Is Liquidity Coming Back? How Should the Market Read These Steps?

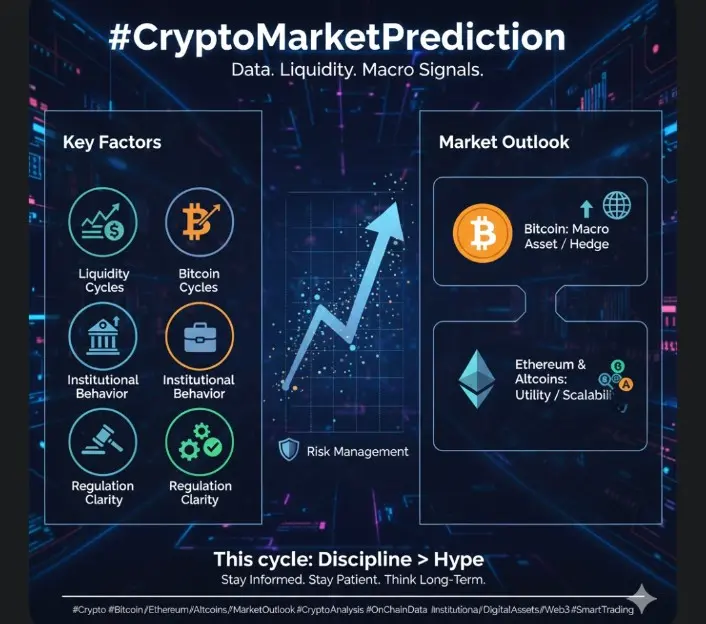

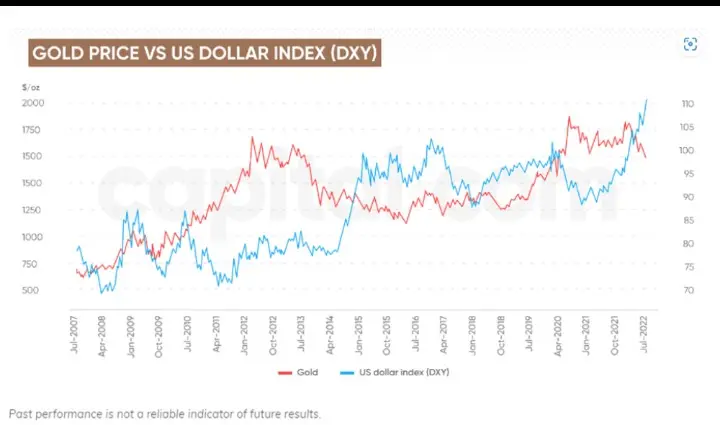

Recently, the liquidity measures taken by central banks are once again at the top of the agenda. Short-term funding and repurchase operations create temporary relief in the banking system, while we see risk appetite in financial markets being tested again. Such moves initially create the perception that "money is entering the market," which can lead to rapid price reactions in risky assets, especially cryptocurrencies.

However, historical data clearly shows that an increase in liquidity does not always create a lasting upward tr

Recently, the liquidity measures taken by central banks are once again at the top of the agenda. Short-term funding and repurchase operations create temporary relief in the banking system, while we see risk appetite in financial markets being tested again. Such moves initially create the perception that "money is entering the market," which can lead to rapid price reactions in risky assets, especially cryptocurrencies.

However, historical data clearly shows that an increase in liquidity does not always create a lasting upward tr

BTC0,61%