Resultados da pesquisa de "SAY"

mercado de previsão pensamento: quando a probabilidade substitui o medo, podemos ser verdadeiramente livres

Título original: Quando um pai usa o mercado de previsão para aliviar a ansiedade parental

Autor original: Polyfactual

Fonte original:

Reprodução: Daisy, Mars Finance

Na manhã da terça-feira passada, eu estava na fila de entrega e recolha da escola primária, apoiando-me na mochila do meu filho, paralisado. O fim de semana que passou trouxe mais um tiroteio na escola que ocupou as manchetes.

Quando ele correu animadamente para dentro do prédio da escola, senti aquela familiar sensação de aperto no peito - uma sensação angustiante, como se, à medida que eles se tornassem mais independentes neste mundo hostil, qualquer coisa pudesse acontecer.

Enquanto dirigia para o trabalho, ouvi um audiolivro longo: "Say Nothing", um registro histórico sobre o conflito da Irlanda do Norte - uma luta anticolonial que durou trinta anos, de 1969 até o final da década de 1990.

MarsBitNews·2025-10-15 13:26

Cripto Slide Spurs $1B Leverage Flush, But It's a Healthy Pullback, Analysts Say

Os preços do Cripto caíram após um relatório de inflação PPI elevado, sinalizando um retrocesso normal dentro de uma tendência em alta. Os analistas enfatizam que esta consolidação saudável se segue a um rally significativo. Os riscos de mercado incluem a sobrevalorização e dados económicos que afetam a perspetiva da Reserva Federal.

YahooFinance·2025-08-14 20:17

SUI Eyes $3.40 Breakout, Analysts Say $4.00 Sell Wall Is the Next Key Level to Watch

SUI está de olho em uma quebra acima de $3,40, com analistas mirando $4,00 como resistência. Indicadores técnicos e métricas na cadeia apoiam essa perspectiva em alta, com suporte chave em $2,83 e aumento de endereços ativos.

CryptoFrontNews·2025-06-10 08:02

Michael Saylor: O protocolo Bitcoin pode enfrentar ameaças de Computação Quântica através de atualizações de software para lidar com riscos potenciais.

Techub News informou que, segundo a CoinDesk, o fundador da Strategy, Michael Saylor, recentemente minimizou a ameaça da Computação Quântica ao Bitcoin em uma entrevista, acreditando que, quando a ameaça se tornar iminente, o protocolo do Bitcoin poderá enfrentar riscos potenciais através de atualizações de software. Ele afirmou: "Isso é principalmente uma tática de marketing das pessoas que querem te vender o próximo Token de conceito quântico. O Google e a Microsoft não vão vender computadores que podem quebrar a encriptação moderna, porque isso destruiria o Google e a Microsoft - também destruiria o governo dos EUA e o sistema bancário."

Atualmente, já existem várias propostas estudando como fazer com que o Bitcoin Prova de Trabalho (PoW) resista a ataques quânticos, incluindo hardware de encriptação quântica desenvolvido por startups como a BTQ. Um desenvolvedor de Bitcoin já submeteu uma proposta de melhoria (BIP), sugerindo a migração dos endereços de carteira para endereços seguros contra quântica através de um hard fork. Say

BTC-0,14%

TechubNews·2025-06-09 01:08

CoinVoice latest news, according to Fox Business reporter Charles Gasparino, Wall Street executives say that the White House is preparing to reach trade agreements with India, Japan, South Korea, and Australia, with tariff levels expected to be similar to those with the UK, around 10%. However, trade policies with China are a different matter.

CoinVoice·2025-05-08 20:39

Cardano signals em alta breakout to $1.50, while market strategists say Mutuum Finance is primed for a 32x alta repentina

O post Cardano signals em alta breakout para $1.50, enquanto os estrategistas de mercado dizem que a Mutuum Finance está preparada para um aumento repentino de 32x apareceu primeiro em Invezz

BitcoinInsider·2025-03-18 02:24

Hedera Eyes $0.25 as Experts Say HBAR has 90% Upside

O mercado de criptomoedas mostra sinais de sentimento positivo, especialmente para ativos como Hedera (HBAR) com conversas sobre ganhos potenciais. Especialistas preveem um aumento de 90% para HBAR, atingindo $0.25. Discussões sobre um ETF HBAR e uma alta projetada de $0.46 contribuem para a perspectiva otimista.

CryptosHeadlines·2025-03-07 02:46

Altcoin to Hit $20 by 2027, Analysts Say Whales Behind LINK’s Breakout & TON’s Path to Recovery!

O setor de criptomoedas continua a ser animado, caracterizado por mudanças frequentes e inesperadas. Tentativas recentes de iniciar uma fuga do Chainlink têm encontrado obstáculos, contudo compras substanciais por baleias indicam que ultrapassar a marca dos $20 poderá em breve tornar-se uma realidade. Simultaneamente, Toncoin's

CryptoFrontNews·2025-03-03 11:16

Baleias do Bitcoin estão a mover os seus ativos, dizem os especialistas, que os estão a alocar para ADA, RBLK, DOGE

Bitcoin

BlockchainNews·2025-01-29 11:34

Em 2025, o ETH Workshop ainda será "resgatado"?

Autor: Mu Mu

Lu Xun never said, 'No matter what sins you committed in your past life, holding Ethereum counts as paying off.' This round of Ethereum holders didn't expect Ethereum to perform so poorly, ranking at the bottom among mainstream projects. However, it is too early to draw conclusions now, as the bull market seems to be far from over. If we say that the adoption of Bitcoin has just begun, then Crypto and Web3 are still in their early stages. Can Ethereum 'save' itself by 2025? What 'events' and 'breakthroughs' are worth looking forward to?

Fluxo de entrada de ETF de caixa

Os ETFs de Ethereum têm sido aprovados para negociação nos EUA por um tempo agora, em comparação com os ETFs de Bitcoin.

DeepFlowTech·2025-01-17 09:51

Will Dogecoin Ascensão to an all-time high after Trump's inauguration? Influencers say picture 'almost

Influenciadores especulam um possível aumento no preço do Dogecoin após a posse de Trump na próxima semana, citando padrões históricos de aumento de preço após eventos de posse no passado. No ano passado, o DOGE subiu quase 1.100% uma semana após a posse de Joe Biden.

CompassInvestments·2025-01-15 09:19

SUI Explodes, But Experts Say These Altcoins Could Be the Next to Surge With 25,000% Gains

Após a dramática Ascensão da SUI, o foco muda para outras criptomoedas preparadas para um crescimento significativo. Especialistas de mercado estão identificando altcoins que podem estar à beira de surtos sem precedentes, potencialmente oferecendo retornos tão altos quanto 25.000%. Esses ativos digitais emergentes poderiam apresentar

BitcoincomNews·2025-01-07 15:00

Um Juiz Federal Acaba de Dar uma Tareia na SEC. Eis o que Significa. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

Gary Gensler's 'final public remarks' before stepping down, what did he say about cryptocurrency?

O presidente da Comissão do Mercado de Valores Mobiliários dos Estados Unidos, Gary Gensler, falou sobre a execução eficaz das leis de valores mobiliários em seu último discurso público, enfatizando como um mercado bem regulamentado pode estabelecer confiança e criar um ambiente propício ao sucesso econômico. Ele explicou a necessidade de implementar essas 'regras da estrada' e mencionou como atualizar e fortalecer as regras para reduzir o risco, aumentar a escala do mercado de capitais e a profundidade. Gensler também destacou a contribuição das leis de valores mobiliários para o sucesso econômico do país, tanto para investidores quanto para emissores. Ele também mencionou os princípios fundamentais das leis de valores mobiliários em relação ao mercado de ações, governança corporativa, divulgação de informações, entre outros aspectos.

動區BlockTempo·2024-11-17 05:07

Goldman Sachs e Morgan Stanley compraram mais de 600 milhões de dólares em PontoBTCETF no segundo trimestre

Goldman Sachs and Morgan Stanley collectively purchased over $600 million BTCETF in the second quarter, joining the ranks of Cobertura Fund and financial advisors. Most of the ETFs purchased by Goldman Sachs reflect its holdings of nearly 7 million shares of iShares Bitcoin Trust, valued at approximately $238 million, while Morgan Stanley purchased shares of BlackRock's iSharesBTCETF, holding 5.5 million shares valued at $188 million. Although the latest regulatory filings indicate a potential increase in institutional investors, ETF issuers and analysts say that these products have been mainly driven by individual investors so far.

BTC-0,14%

金色财经_·2024-08-15 03:10

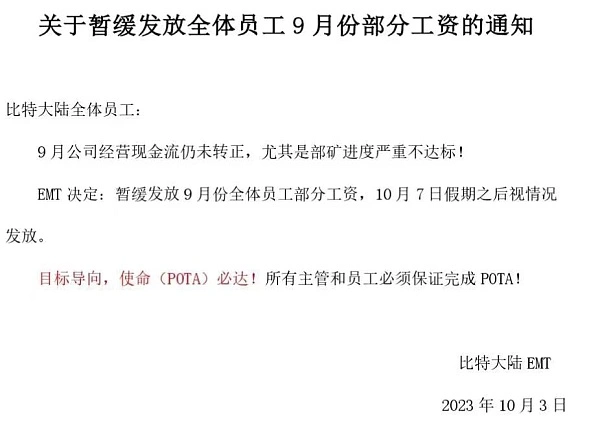

O negócio de máquinas de mineração é difícil de fazer Bitmain parou de pagar salários

A Bitmain, que está em silêncio há muito tempo, causou discussões acaloradas no círculo por causa de um anúncio de atraso na folha de pagamento, sob o mercado de baixa, a Bitmain, que já esteve sob os holofotes, não será capaz de suportar o fluxo de caixa?

De acordo com o relatório Wu Say Blockchain, vários funcionários internos da Bitmain confirmaram que a Bitmain emitiu um aviso: o fluxo de caixa operacional da empresa em setembro não se tornou positivo, especialmente o progresso da mina (referindo-se à máquina de mineração estacionada na mina) não está seriamente de acordo com o padrão, a EMT decidiu suspender o pagamento de parte do salário de todos os funcionários em setembro, e pagá-lo de acordo com a situação após o feriado em 7 de outubro. Vários empregados revelaram que todos os salários de desempenho dos empregados em setembro foram todos deduzidos, e seus salários básicos também foram deduzidos pela metade, e os salários deduzidos não sabiam quando seriam pagos. Até 8 de outubro, os funcionários não recebiam salários não pagos e o bônus de fim de ano de 2022 não foi pago.

A Bitmain já monopolizou mais de setenta por cento da participação de mercado global da máquina de mineração de bitcoin, e então porque os dois fundadores Wu Jihan e Zhan Ketuan competiram pelo controle do...

金色财经_·2023-10-11 13:37

Carregar mais