2026 BUCK Price Prediction: Comprehensive Market Analysis and Future Outlook for Decentralized Stablecoin Growth

Introduction: BUCK's Market Position and Investment Value

GME Mascot (BUCK), as the official mascot token of GameStop operating on the Solana blockchain, has emerged in the crypto market since its launch in 2024. As of February 2026, BUCK maintains a market capitalization of approximately $553,496 with a fully circulating supply of 999,993,000 tokens, trading at around $0.0005535. This meme-inspired digital asset represents a unique intersection of retail gaming culture and decentralized finance.

This article will comprehensively analyze BUCK's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies. With over 11,000 holders and deployment on the Solana network, BUCK presents a case study in community-driven token economics and the evolving landscape of branded cryptocurrency assets.

I. BUCK Price History Review and Current Market Status

BUCK Historical Price Evolution Trajectory

- 2024: BUCK launched in November 2024, reaching an all-time high of $0.05859 on November 21, 2024, shortly after its debut on the market

- 2025-2026: The token experienced a significant price decline, dropping from its peak to an all-time low of $0.0004522 on February 4, 2026, representing a substantial correction from its launch period

BUCK Current Market Situation

As of February 5, 2026, BUCK is trading at $0.0005535, showing a recovery of 0.22% over the past hour and 9.97% increase in the last 24 hours. The token's 24-hour trading range spans from $0.0004522 to $0.0007506, with a total trading volume of $13,292.01.

The market capitalization stands at approximately $553,496, with a fully diluted market cap matching this figure as all 999,993,000 tokens are in circulation, representing 100% of the total supply. BUCK maintains a market dominance of 0.000021% within the broader cryptocurrency ecosystem.

Over recent periods, BUCK has experienced notable price fluctuations, declining 34.12% over the past week, 27.26% over the past month, and 50.58% over the past year. The token currently holds 11,299 holders and is deployed on the Solana blockchain with the contract address FLqmVrv6cp7icjobpRMQJMEyjF3kF84QmC4HXpySpump.

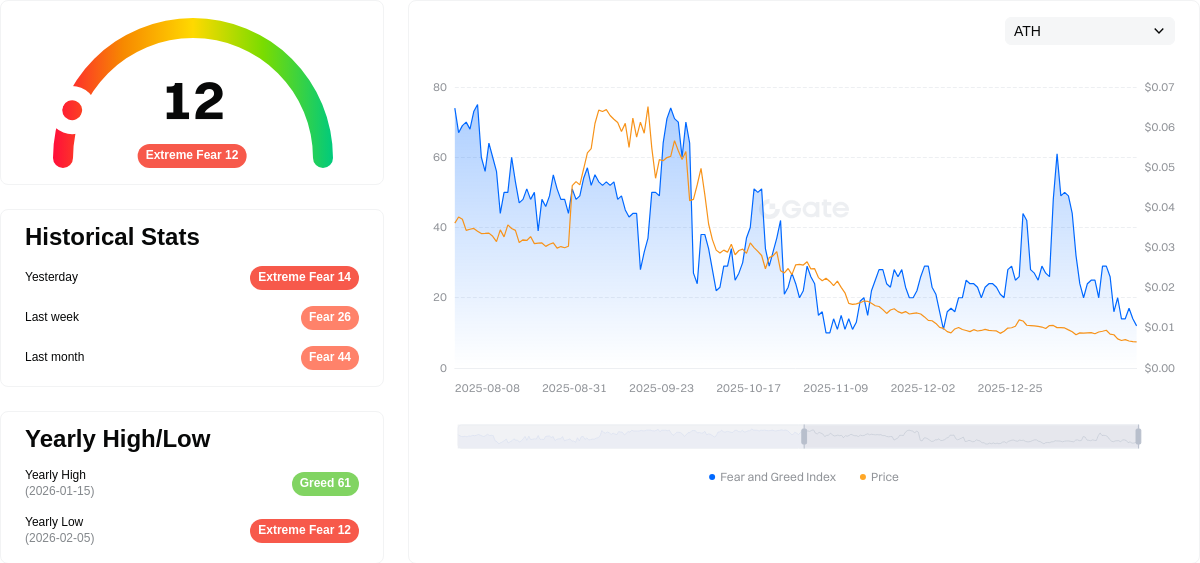

The current market sentiment indicator registers at 12 on the VIX scale, reflecting an "Extreme Fear" environment in the cryptocurrency market.

Click to view current BUCK market price

BUCK Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The BUCK market is currently experiencing extreme fear, with the Fear and Greed Index standing at 12. This exceptionally low reading indicates intense market pessimism and risk aversion among investors. When the index reaches such extreme levels, it often signals potential oversold conditions and may present contrarian opportunities for long-term investors. However, caution remains warranted as market volatility could persist. Traders should maintain disciplined risk management strategies and avoid emotional decision-making during periods of extreme fear.

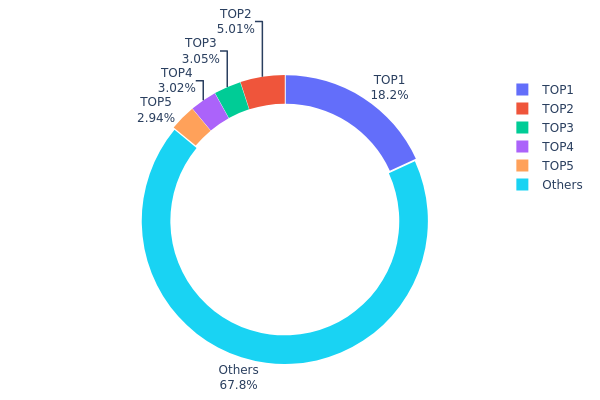

BUCK Holding Distribution

The holding distribution chart provides a comprehensive view of how BUCK tokens are allocated across different wallet addresses on the blockchain. This metric serves as a crucial indicator of market structure, revealing the degree of token concentration among major holders and the overall distribution pattern across the ecosystem. By analyzing the top holders and their respective percentages, investors can assess the level of decentralization and potential market manipulation risks.

Based on the current data, BUCK exhibits a moderate concentration pattern with the top five addresses collectively holding approximately 32.16% of the total supply. The largest single holder controls 181.64 million tokens, representing 18.16% of the circulating supply, which indicates a significant but not overwhelming concentration. The subsequent top holders maintain relatively balanced positions ranging from 2.94% to 5.00%, suggesting a distributed power structure among major stakeholders. Notably, the "Others" category comprises 67.84% of total holdings, demonstrating that the majority of BUCK tokens are dispersed across a broad base of smaller addresses.

This distribution structure presents both opportunities and considerations for market participants. The relatively high percentage held by smaller addresses (67.84%) indicates a healthy level of retail participation and community engagement, which generally supports price stability and organic growth. However, the presence of a dominant holder with 18.16% of supply introduces potential volatility risks, as large-scale movements from this address could significantly impact market liquidity and price action. The current structure suggests a maturing ecosystem with established whale positions while maintaining sufficient decentralization to support sustainable long-term development.

Click to view the current BUCK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 181636.32K | 18.16% |

| 2 | AJF3kX...CKU3WT | 50050.00K | 5.00% |

| 3 | 9kwuhM...AKZxJE | 30517.91K | 3.05% |

| 4 | HEY8Wt...ygfHzD | 30174.00K | 3.01% |

| 5 | D5jx4w...e1nw8p | 29399.59K | 2.94% |

| - | Others | 678071.37K | 67.84% |

II. Core Factors Influencing BUCK's Future Price

Supply Mechanism

- Load Demand Dynamics: BUCK converters require careful consideration of load requirements during application to ensure performance and reliability under varying conditions. The efficiency and stability of power conversion directly impact market demand.

- Historical Pattern: Semiconductor industry cycles have historically shown that recovery phases drive increased demand for power management components. Past recovery periods have corresponded with price appreciation for related technologies.

- Current Impact: The anticipated semiconductor industry recovery presents a favorable environment. As manufacturing activity increases and technology advancement continues, demand for efficient power conversion solutions is expected to strengthen.

Institutional and Major Stakeholder Dynamics

- Market Positioning: BUCK technology represents a critical component in automotive electronics and industrial applications, sectors experiencing ongoing transformation and growth.

- Technology Adoption: Development in power management technology continues to attract attention from manufacturers seeking enhanced efficiency and thermal management capabilities.

- Industry Development: The electronics component market faces structural differentiation, with automotive and industrial sectors showing varied recovery patterns that may influence demand trajectories.

Macroeconomic Environment

- Economic Factors: Global economic uncertainty and geopolitical dynamics present mixed signals for technology sectors. While some regions face headwinds, overall market fundamentals suggest moderate growth potential.

- Market Conditions: Import cost pressures remain subdued, with controlled commodity and component prices supporting stable input costs for manufacturers.

- Industry Outlook: Despite cautious expectations for automotive and industrial electronics markets, ongoing technological innovation and efficiency requirements provide underlying support for power management solutions.

Technology Development and Ecosystem Building

- Technical Innovation: Advancements in electromagnetic compatibility, thermal management, and conversion efficiency continue to enhance BUCK converter capabilities, addressing evolving performance requirements.

- Application Expansion: Growing adoption in automotive electronic products and industrial equipment demonstrates the technology's versatility and expanding use cases across multiple sectors.

- Market Evolution: The electronic components industry shows structural changes, with specialized applications and advanced manufacturing techniques creating differentiated demand patterns that may benefit established technologies.

III. 2026-2031 BUCK Price Forecast

2026 Outlook

- Conservative Forecast: $0.00046 - $0.00055

- Neutral Forecast: $0.00055 (average market conditions)

- Optimistic Forecast: $0.00058 (requires sustained market momentum and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: BUCK may enter a gradual growth phase with expanding use cases and broader market recognition

- Price Range Forecast:

- 2027: $0.00048 - $0.00083

- 2028: $0.00038 - $0.00097

- 2029: $0.00050 - $0.00103

- Key Catalysts: Enhanced ecosystem integration, potential partnerships, and improved market liquidity could drive price appreciation during this period

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00085 - $0.00113 (assuming steady ecosystem development and moderate market conditions)

- Optimistic Scenario: $0.00103 - $0.00154 (assuming accelerated adoption and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper range of $0.00154 by 2031 (requires breakthrough developments in utility and mainstream adoption)

- 2026-02-05: BUCK trading within early-stage price discovery phase with projected average of $0.00055 for the year

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00058 | 0.00055 | 0.00046 | 0 |

| 2027 | 0.00083 | 0.00057 | 0.00048 | 2 |

| 2028 | 0.00097 | 0.0007 | 0.00038 | 26 |

| 2029 | 0.00103 | 0.00084 | 0.0005 | 51 |

| 2030 | 0.00113 | 0.00093 | 0.00085 | 68 |

| 2031 | 0.00154 | 0.00103 | 0.0007 | 86 |

IV. BUCK Professional Investment Strategy and Risk Management

BUCK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and understanding of meme token volatility

- Operational recommendations:

- Consider dollar-cost averaging to mitigate entry timing risk given BUCK's price volatility

- Monitor GME Mascot project developments and community engagement metrics

- Implement predetermined exit strategies based on portfolio allocation goals

- Storage solution: Use Gate Web3 Wallet for secure storage with multi-layer security features

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor the 24-hour trading volume of $13,292 to identify liquidity patterns and potential breakout signals

- Support and resistance levels: Track the 24-hour range between $0.0004522 and $0.0007506 for entry and exit points

- Swing trading considerations:

- Be cautious of high volatility, with 24-hour fluctuations exceeding 9.97%

- Set stop-loss orders to protect against sudden downward movements, especially given the 34.12% decline over the past 7 days

BUCK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5-1% of crypto portfolio allocation

- Aggressive investors: 2-5% of crypto portfolio allocation

- Professional investors: Up to 10% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio diversification: Combine BUCK with stablecoins and established cryptocurrencies to reduce concentration risk

- Position sizing: Limit exposure based on the token's low market cap of $553,496 and high volatility characteristics

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading and convenient access to Solana-based tokens

- Cold storage solution: For long-term holdings, consider transferring assets to hardware solutions after initial trading period

- Security precautions: Never share private keys, enable two-factor authentication, and regularly verify contract addresses (FLqmVrv6cp7icjobpRMQJMEyjF3kF84QmC4HXpySpump) before transactions

V. BUCK Potential Risks and Challenges

BUCK Market Risks

- High volatility: BUCK has experienced significant price fluctuations, with a 50.58% decline over the past year and 34.12% drop in the last 7 days

- Limited liquidity: With a market cap of approximately $553,496 and ranking of 2957, BUCK may face liquidity constraints during periods of market stress

- Meme token characteristics: As the GameStop mascot token, BUCK's value is largely sentiment-driven and may not have fundamental backing

BUCK Regulatory Risks

- Meme token scrutiny: Regulators may increase oversight of meme-based cryptocurrencies, potentially affecting trading and accessibility

- GameStop association: Any regulatory actions or negative developments related to GameStop could indirectly impact BUCK's perception

- Platform listing risk: Limited exchange availability (currently on 1 exchange) could affect accessibility if regulatory restrictions increase

BUCK Technical Risks

- Smart contract vulnerabilities: As a Solana-based token, BUCK is subject to potential smart contract risks inherent in blockchain platforms

- Network dependency: Performance and security are tied to the Solana network's stability and uptime

- Limited holder base: With approximately 11,299 holders, the token may be susceptible to price manipulation by large holders

VI. Conclusion and Action Recommendations

BUCK Investment Value Assessment

BUCK represents a high-risk, speculative investment opportunity tied to the GameStop brand and meme culture. While the token has shown short-term price recovery of 9.97% in 24 hours, longer-term performance indicates significant challenges, with declines of 34.12% over 7 days and 50.58% over one year. The token's low market cap, limited exchange availability, and meme-driven nature suggest it is suitable only for investors with high risk tolerance who understand the speculative nature of such assets. The complete circulating supply (100% of max supply) eliminates inflation concerns, but the small holder base and limited liquidity present substantial risks.

BUCK Investment Recommendations

✅ Beginners: Avoid BUCK until gaining more experience with cryptocurrency markets; if interested, allocate no more than 0.5% of portfolio and use Gate.com's educational resources to understand meme token dynamics ✅ Experienced investors: Consider BUCK only as a small speculative position (1-3% of portfolio) with clearly defined exit strategies and strict stop-loss parameters ✅ Institutional investors: BUCK's low liquidity and market cap make it unsuitable for most institutional portfolios; only consider for specialized meme token strategies with appropriate risk controls

BUCK Trading Participation Methods

- Spot trading: Purchase BUCK directly on Gate.com using the Solana network with competitive trading fees

- Dollar-cost averaging: Implement systematic purchases to reduce timing risk in volatile market conditions

- Active monitoring: Track BUCK's performance metrics and GME Mascot community developments through Gate.com's analytics tools and verified contract address on Solana Explorer

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BUCK token? What are its use cases and value proposition?

BUCK is a meme token designed to leverage viral characteristics and attract users and investors. It functions as a digital currency for transactions and a collectible asset, appealing to both crypto enthusiasts and general users seeking engagement and community participation.

What is the historical price performance of BUCK? What are the past price trends?

BUCK declined 0.10% in 24 hours and 1.10% over 7 days. All-time high: BTC0.00001394, all-time low: BTC0.00001017. Current price is 4.60% below peak and 3.80% above lowest point.

What are the main factors affecting BUCK price?

BUCK price is primarily driven by GameStop adoption and ecosystem development, overall cryptocurrency market sentiment, macroeconomic conditions, and BUCK application potential. Trading volume and investor interest also play significant roles in price movements.

What price will BUCK reach in 2024? How do experts view it?

BUCK is a stablecoin designed to maintain a price of approximately US$1.00. As of February 2026, BUCK trades at US$0.9993, consistent with its stablecoin mechanism. Expert consensus supports BUCK maintaining its US$1.00 peg through its protocol design.

What are the differences between BUCK and similar stablecoins like USDC and USDT?

BUCK distinguishes itself through enhanced protocol design and decentralized governance mechanisms. Unlike USDC's centralized control and USDT's opacity concerns, BUCK offers greater transparency, algorithmic stability, and community-driven decision-making, positioning it as a next-generation stablecoin alternative.

What are the risks of investing in BUCK? What should I pay attention to?

BUCK investment involves centralization risks and low market liquidity, leading to high price volatility. Monitor token distribution and trading volume carefully before investing.

What is the liquidity and trading volume of BUCK? Where can I buy it?

BUCK maintains strong liquidity and trading volume across multiple platforms. The stablecoin is widely available for purchase and actively traded, enabling seamless daily transactions and various financial activities with high accessibility.

What is BUCK project's roadmap and future plans?

BUCK plans to launch AI autonomous driving 2.0 in 2025 and advance intelligent vehicle technology targeting L3 autonomous driving certification. Future expansion includes broader smart vehicle applications and market penetration globally.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

GORK vs OP: The Ultimate Comparison of Two Competing Protocols in Modern Technology

How to use MACD, RSI, and KDJ indicators to identify crypto trading signals

TMAI vs ICP: Comparing Two Leading Internet Computer Protocol Solutions for Decentralized Applications

What is token economy model: Complete guide to token distribution, inflation design, and governance mechanisms in 2026

What is Kaspa (KAS) market overview: $0.03083 price, $37.1M trading volume, and 269B circulating supply in 2026?