2026 BUCK Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: BUCK's Market Position and Investment Value

GME Mascot (BUCK), as GameStop's official mascot token, has emerged as a distinctive presence in the meme cryptocurrency sector since its launch in November 2024. As of February 6, 2026, BUCK maintains a market capitalization of approximately $406,497, with a circulating supply of 999,993,000 tokens and a current price hovering around $0.0004065. This Solana-based asset, characterized by its connection to the iconic GameStop brand, has attracted over 11,304 holders within its relatively short existence.

This article will comprehensively analyze BUCK's price trajectory from 2026 to 2031, examining historical patterns, market supply-demand dynamics, ecosystem developments, and broader macroeconomic factors. Through professional price forecasting and practical investment strategies, we aim to provide investors with valuable insights for navigating this emerging digital asset's potential opportunities and risks in the evolving cryptocurrency landscape.

I. BUCK Price History Review and Market Status

BUCK Historical Price Evolution Trajectory

- November 2024: Token launched on November 14, 2024, with initial trading activity on Gate.com platform

- November 2024: Price reached a peak of $0.05859 on November 21, 2024, representing the all-time high since launch

- 2025-2026: Market entered a correction phase, with price declining from the November 2024 peak through early 2026

BUCK Current Market Situation

As of February 6, 2026, BUCK is trading at $0.0004065, marking an all-time low since its launch. The token has experienced significant downward pressure across multiple timeframes, with a 26.56% decline over the past 24 hours. The weekly performance shows a 41.26% decrease, while the monthly decline reaches 50.06%. Over the past year, BUCK has decreased by 59.03% from previous levels.

The 24-hour trading range spans from $0.000361 to $0.0006162, with a trading volume of approximately $14,379. The market capitalization stands at $406,497, with a fully diluted valuation matching this figure due to the complete circulation of all 999,993,000 tokens. The token maintains a market dominance of 0.000017% and is held by 11,304 addresses on the Solana blockchain.

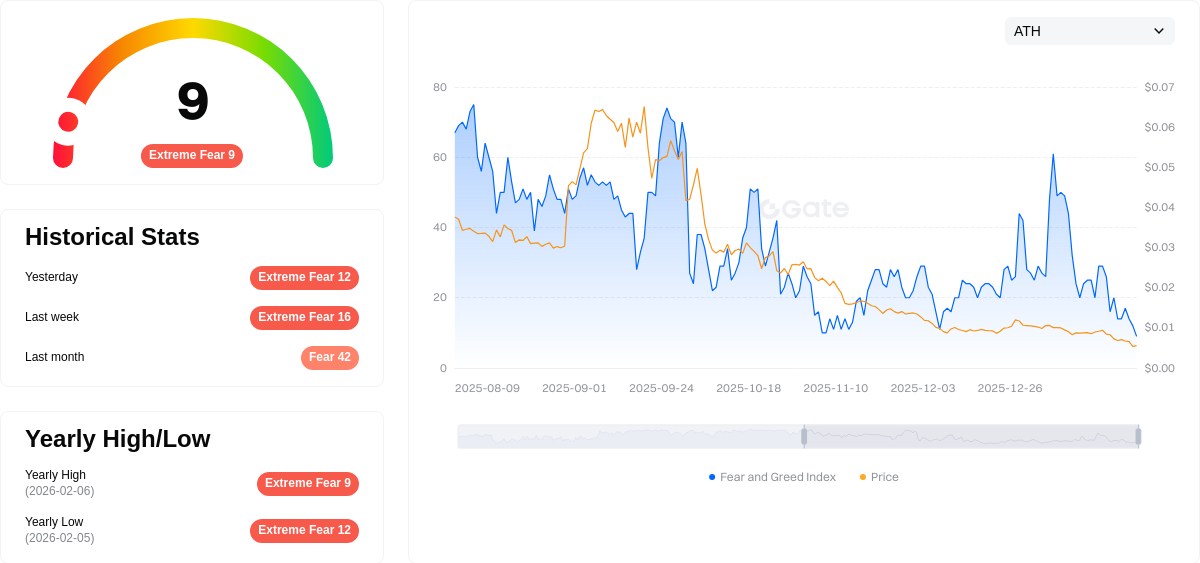

The current market sentiment indicator shows a reading of 9, classified as "Extreme Fear," reflecting heightened caution among market participants. Despite the challenging market conditions, BUCK maintains its position as the official mascot token of GameStop, with its contract address deployed on the Solana network.

Click to view current BUCK market price

BUCK Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 9. Such low sentiment typically indicates significant market pessimism and capitulation, often creating potential buying opportunities for contrarian investors. When fear reaches extreme levels, asset prices may be oversold, suggesting a possible market reversal. However, investors should exercise caution and conduct thorough research before making trading decisions. Monitor market developments closely and consider your risk tolerance when positioning during periods of extreme fear.

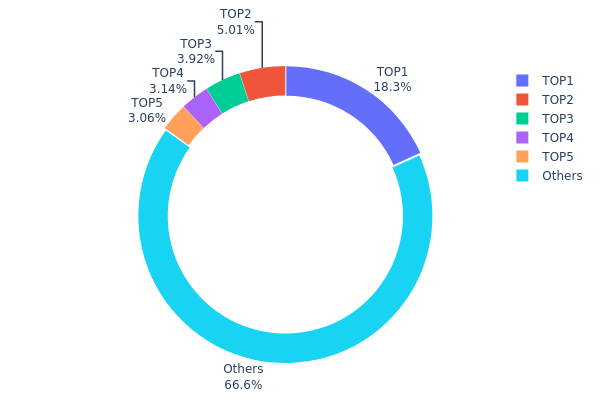

BUCK Holding Distribution

The holding distribution chart displays the concentration of token holdings across different address tiers, serving as a key indicator of decentralization and potential market manipulation risks. By analyzing the percentage of total supply held by top addresses versus smaller holders, investors can assess whether a token's ownership structure presents systemic vulnerabilities or healthy distribution patterns.

Current data reveals significant concentration in BUCK's holding structure, with the top address controlling 18.25% of the total supply (182,556.81K BUCK), followed by the second-largest holder at 5.00% (50,050.00K BUCK). The top five addresses collectively account for 33.36% of circulating supply, while the remaining 66.64% is distributed among other participants. This concentration level falls within a moderate risk zone, where the largest holder possesses substantial influence over price discovery and liquidity dynamics, yet the majority of tokens remain distributed across the broader ecosystem.

The current distribution structure indicates potential volatility risks stemming from concentrated holdings. The 18.25% controlled by the leading address creates vulnerability to single-actor sell pressure, which could trigger cascading liquidations or rapid price movements during market stress. However, the fact that two-thirds of supply resides outside top-five addresses suggests adequate base-layer distribution to absorb moderate selling activity. From a market manipulation perspective, coordinated action among top holders could theoretically influence price trends, though the relatively fragmented nature of the remaining 66.64% provides some countervailing market forces.

Click to view current BUCK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 182556.81K | 18.25% |

| 2 | AJF3kX...CKU3WT | 50050.00K | 5.00% |

| 3 | 4KEpJP...UE7JEa | 39147.11K | 3.91% |

| 4 | D5jx4w...e1nw8p | 31409.40K | 3.14% |

| 5 | HEY8Wt...ygfHzD | 30609.00K | 3.06% |

| - | Others | 666076.43K | 66.64% |

II. Core Factors Influencing BUCK's Future Price

Supply Mechanism

- Savings Coin Model: BUCK is positioned as a "Savings Coin" rather than a traditional stablecoin, designed to provide passive yield on USD-denominated crypto assets for non-US users. This unique positioning differentiates its supply dynamics from conventional stablecoins.

- Yield Generation: The token's core feature of offering passive returns to holders may create sustained demand, as users seek income-generating alternatives in the crypto space.

- Current Impact: As Buck Labs launched BUCK in early January 2026, the token's supply mechanism is still in its early implementation phase, with its long-term effects on price stability yet to be fully observed.

Institutional and Market Dynamics

- Market Sentiment: Current cryptocurrency market sentiment remains subdued, with the Fear and Greed Index at 23, indicating "extreme fear." This cautious market environment typically does not favor risk assets and may impact BUCK's initial adoption rate.

- Crypto Market Structure: The broader cryptocurrency market capitalization stands at approximately $3.09 trillion, with BTC dominating at 58.43% market share. Stablecoin market cap reached $307.5 billion, showing modest growth of 0.18% over seven days.

- Regulatory Environment: Global regulatory developments, particularly concerning stablecoins and savings-oriented crypto products, will significantly influence BUCK's operational framework and market acceptance.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate decisions remain a key factor. As of January 2026, the probability of a 25 basis point rate cut stands at 12.6%, while the likelihood of maintaining current rates is 87.4%, suggesting a cautious approach to monetary easing.

- Employment Data: US unemployment rate for December came in at 4.4%, below the expected 4.5%, indicating relatively stable labor market conditions that may influence broader market sentiment.

- Inflation Dynamics: As a USD-denominated savings instrument, BUCK's attractiveness is closely tied to real yield expectations and inflation trends, making it sensitive to global price stability developments.

Technology Development and Ecosystem Building

- Passive Yield Infrastructure: BUCK's technological foundation focuses on creating sustainable passive income mechanisms for USD-denominated crypto holdings, representing an innovative approach in the savings-oriented crypto product space.

- Non-US Market Focus: The strategic targeting of non-US users positions BUCK within specific regulatory frameworks and market segments, potentially affecting its adoption trajectory and ecosystem partnerships.

- Market Integration: As a newly launched token in January 2026, BUCK's integration into existing DeFi protocols, exchanges, and wallet infrastructure will be crucial for its ecosystem growth and price discovery mechanisms.

III. 2026-2031 BUCK Price Prediction

2026 Outlook

- Conservative forecast: $0.00033 - $0.00043

- Neutral forecast: $0.00043 (average market conditions)

- Optimistic forecast: $0.00058 (requires favorable market sentiment and increased adoption)

2027-2029 Mid-term Outlook

- Market stage expectation: Gradual growth phase with potential volatility as the project develops its ecosystem and expands user base

- Price range predictions:

- 2027: $0.00029 - $0.00064

- 2028: $0.00033 - $0.00072

- 2029: $0.00047 - $0.00069

- Key catalysts: Platform development milestones, partnerships expansion, and broader crypto market recovery cycles

2030-2031 Long-term Outlook

- Baseline scenario: $0.00049 - $0.00081 (assuming steady ecosystem growth and maintained market interest)

- Optimistic scenario: $0.00067 - $0.00078 (requires successful protocol upgrades and increased DeFi integration)

- Transformative scenario: Potential to reach upper price ranges if BUCK achieves significant adoption breakthroughs and benefits from favorable regulatory developments

- February 6, 2026: BUCK trading analysis shows early-stage price discovery with projected annual growth of 6%

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00058 | 0.00043 | 0.00033 | 6 |

| 2027 | 0.00064 | 0.00051 | 0.00029 | 24 |

| 2028 | 0.00072 | 0.00057 | 0.00033 | 41 |

| 2029 | 0.00069 | 0.00065 | 0.00047 | 59 |

| 2030 | 0.00081 | 0.00067 | 0.00049 | 64 |

| 2031 | 0.00078 | 0.00074 | 0.00047 | 82 |

IV. BUCK Professional Investment Strategies and Risk Management

BUCK Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and long-term crypto market outlook

- Operational recommendations:

- Given BUCK's significant price volatility (down 59.03% year-over-year), consider dollar-cost averaging to reduce timing risk

- Monitor GameStop's strategic developments and community engagement metrics as key indicators

- Secure storage solution: Gate Web3 Wallet provides multi-layer security features for long-term asset custody

(II) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Current 24-hour trading volume of $14,379 indicates limited liquidity, requiring careful position sizing

- Support/resistance levels: Recent trading range between $0.000361 (ATL) and $0.0006162 (24h high) provides reference points

- Swing trading considerations:

- High volatility (down 26.56% in 24 hours) presents both opportunities and risks for short-term traders

- Low market cap of approximately $406,497 suggests susceptibility to price manipulation

BUCK Risk Management Framework

(I) Asset Allocation Principles

- Conservative investors: Maximum 1-2% of crypto portfolio allocation

- Aggressive investors: Maximum 3-5% of crypto portfolio allocation

- Professional investors: Position sizing based on risk-adjusted return models and liquidity constraints

(II) Risk Hedging Solutions

- Portfolio diversification: Balance BUCK exposure with established cryptocurrencies and stablecoins

- Position limits: Set strict stop-loss orders given the token's high volatility profile

(III) Secure Storage Solutions

- Hot wallet option: Gate Web3 Wallet for active trading with multi-signature protection

- Cold storage approach: Hardware wallet solutions for long-term holdings exceeding immediate trading needs

- Security precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (FLqmVrv6cp7icjobpRMQJMEyjF3kF84QmC4HXpySpump on Solana)

V. BUCK Potential Risks and Challenges

BUCK Market Risks

- Extreme volatility: Price declined 41.26% over 7 days and 50.06% over 30 days, indicating unstable market conditions

- Limited liquidity: With only $14,379 in 24-hour volume and single exchange listing, large trades may face significant slippage

- Concentration risk: 100% circulating supply (999,993,000 BUCK) may limit scarcity value compared to tokens with vesting schedules

BUCK Regulatory Risks

- Meme token classification: Regulatory authorities may subject mascot-based tokens to enhanced scrutiny or restrictions

- Securities law considerations: Potential classification changes could impact trading availability and compliance requirements

- Brand association risks: Regulatory actions targeting GameStop or mascot-based tokens could affect BUCK's market perception

BUCK Technical Risks

- Smart contract vulnerabilities: As a Solana-based token, dependent on underlying blockchain security and potential contract exploits

- Network dependency: Solana network outages or congestion could impact BUCK trading and transfer capabilities

- Single blockchain exposure: No cross-chain deployment limits ecosystem diversity and introduces platform-specific risks

VI. Conclusion and Action Recommendations

BUCK Investment Value Assessment

BUCK represents a high-risk, speculative asset tied to GameStop's brand recognition and community engagement. With a small market cap of approximately $406,497 and ranking at #3,174, the token demonstrates limited institutional adoption and significant downside momentum. The 59.03% year-over-year decline and recent 26.56% daily drop suggest substantial market headwinds. While the 11,304 holder base indicates some community support, the single exchange listing and low trading volume present liquidity concerns. Long-term value depends heavily on GameStop's ability to leverage its mascot for brand engagement and BUCK's capacity to develop utility beyond meme status.

BUCK Investment Recommendations

✅ Beginners: Avoid or allocate no more than 0.5% of crypto portfolio; prioritize education on meme token dynamics and practice with small amounts ✅ Experienced investors: Consider speculative positions not exceeding 2-3% of crypto portfolio with strict stop-loss parameters; monitor social sentiment and GameStop corporate developments ✅ Institutional investors: Assess alignment with investment mandates and risk thresholds; current liquidity profile may not support significant position sizes without market impact

BUCK Trading Participation Methods

- Spot trading: Available on Gate.com with BUCK/USDT pair for direct purchase and sale

- Dollar-cost averaging: Implement systematic small purchases to mitigate timing risk in volatile markets

- Community monitoring: Follow official X account (@buckthebunny) and track on-chain metrics via Solana Explorer for holder activity and transaction patterns

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BUCK? What are its uses and value?

BUCK is a cryptocurrency token with a total supply of 1 billion. It serves as a digital asset within its ecosystem, offering utility and value through market trading and potential future applications. Its price fluctuates based on market demand and project developments.

What is BUCK's historical price trend? What factors influence its price fluctuations?

BUCK's price has been shaped by market sentiment, trading volume, and technological development. Price fluctuations are primarily driven by overall market trends and user adoption rates.

What is the BUCK price prediction for 2024-2025? How do analysts view it?

BUCK price prediction for 2024-2025 remains uncertain with current market showing strong selling signals. Technical analysis indicates bearish momentum across multiple timeframes, suggesting cautious market sentiment toward BUCK token valuation.

What are the main risks of investing in BUCK?

Main risks include USD exchange rate fluctuations and interest rate changes. These risks may impact returns, but can be mitigated through portfolio diversification and dollar-cost averaging strategies.

What is the difference between BUCK and other stablecoins like USDT and USDC?

BUCK differs from USDT and USDC primarily through its unique backing mechanism and issuing entity. While USDT and USDC are fiat-backed, BUCK may utilize different collateralization methods, offering distinct risk profiles and utility within Web3 ecosystems.

What is the liquidity and market depth of BUCK?

BUCK maintains deep liquidity and robust trading volume, enabling smooth execution of large transactions. The platform provides proof of reserves for transparency. Strong market depth ensures reliable pricing and stable market conditions for traders.

Where can I trade BUCK?

BUCK is primarily traded on major cryptocurrency exchanges. You can trade BUCK on platforms that support it. Check the official BUCK website or use crypto tracking platforms to find current exchange listings and real-time trading volumes for the most up-to-date information.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

Top 12 Leading Decentralized Exchanges

New NISA vs. Bitcoin: A Comparison of Benefits and Drawbacks

Inverted Hammer Candlestick Pattern: A Comprehensive Guide

How Liquidity Provider Tokens Work

What Is Staking? How to Earn Passive Income with Staking