2026 ETHS Price Prediction: Expert Analysis and Market Forecast for Ethereum Staking Token's Future Value

Introduction: ETHS Market Position and Investment Value

ETHS (ETHS), as the core asset of Facet protocol—a decentralized Ethereum L1 scaling solution funded by the Ethereum Foundation as an unstoppable rollup—has been driving secure expansion of the Ethereum mainnet since its launch in 2023. As of February 6, 2026, ETHS maintains a market capitalization of approximately $464,940 with a fully circulating supply of 21,000,000 tokens, trading at around $0.02214. This pioneering asset, recognized for its role in advancing the next generation of data and value layers, is playing an increasingly significant role in Ethereum's scaling ecosystem.

This article provides a comprehensive analysis of ETHS price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to offer professional price forecasts and practical investment strategies for market participants.

I. ETHS Price History Review and Market Status

ETHS Historical Price Evolution Trajectory

- December 2023: ETHS officially launched on the market with the token publishing timestamp recorded at December 6, 2023, marking the beginning of its trading history.

- January 2024: ETHS experienced a notable price surge, reaching a peak level of $13.9 on January 5, 2024, representing a significant milestone in its early trading phase.

- 2024-2025: Following the historical high, the token entered an extended consolidation and correction period, with price declining from the peak of $13.9.

- February 2026: The token reached its recorded lowest price point of $0.0208 on February 5, 2026, reflecting broader market pressures.

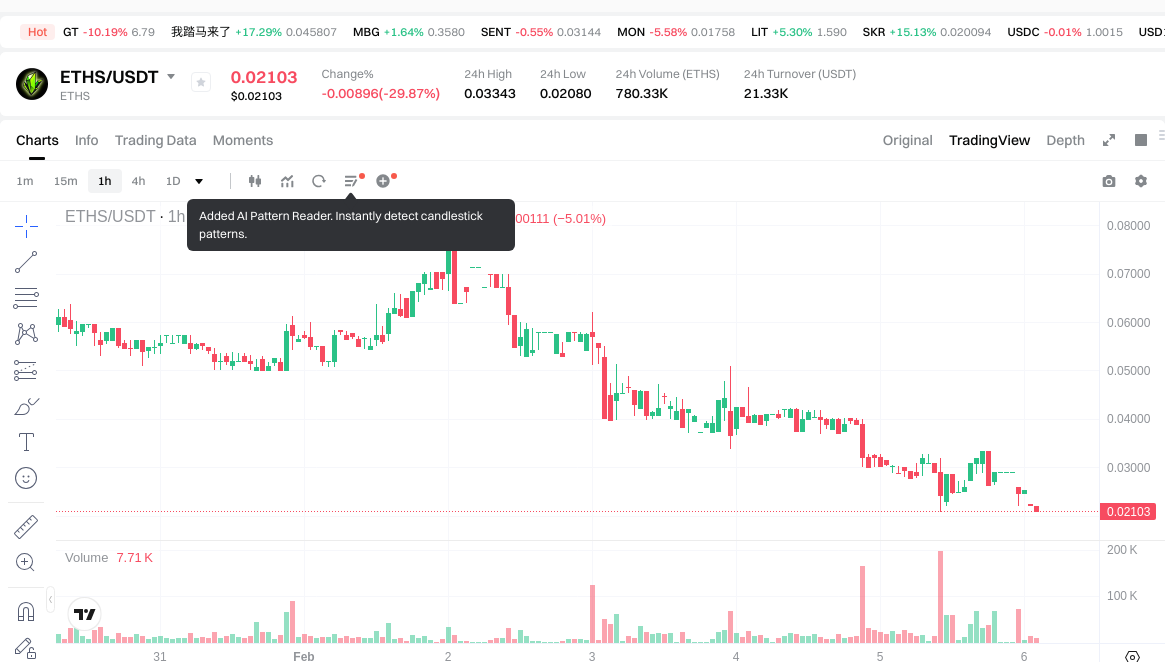

ETHS Current Market Situation

As of February 6, 2026, ETHS is trading at $0.02214, positioned within a narrow range near its historical low. The token has demonstrated considerable volatility across multiple timeframes. In the past hour, the price declined by 12.59%, representing a decrease of approximately $0.0032. The 24-hour trading period shows a more substantial decline of 27.52%, with the price dropping by approximately $0.0084.

The trading range over the past 24 hours spans from a low of $0.0208 to a high of $0.03343, indicating intraday volatility. The 24-hour trading volume stands at $21,536.60, reflecting current market activity levels.

Examining longer timeframes reveals sustained downward pressure. Over the past seven days, ETHS has declined by 63.78%, while the 30-day performance shows an 87.91% decrease. The one-year performance indicates an 85.42% decline from year-ago levels.

ETHS maintains a fully circulating supply with all 21,000,000 tokens in circulation, matching both the total supply and maximum supply. This results in a market capitalization of approximately $464,940, with the fully diluted valuation equivalent to the market cap at $464,940. The circulating supply ratio stands at 100%, and the market cap to FDV ratio is also 100%. The token's market dominance is recorded at 0.000019%.

ETHS serves as the core asset of the Facet protocol, a decentralized Ethereum L1 scaling solution that has received funding from the Ethereum Foundation as an unstoppable rollup initiative. The protocol focuses on enabling secure expansion of the Ethereum mainnet. The token operates within the Ethereum ecosystem, with its contract information accessible through Ethscriptions.

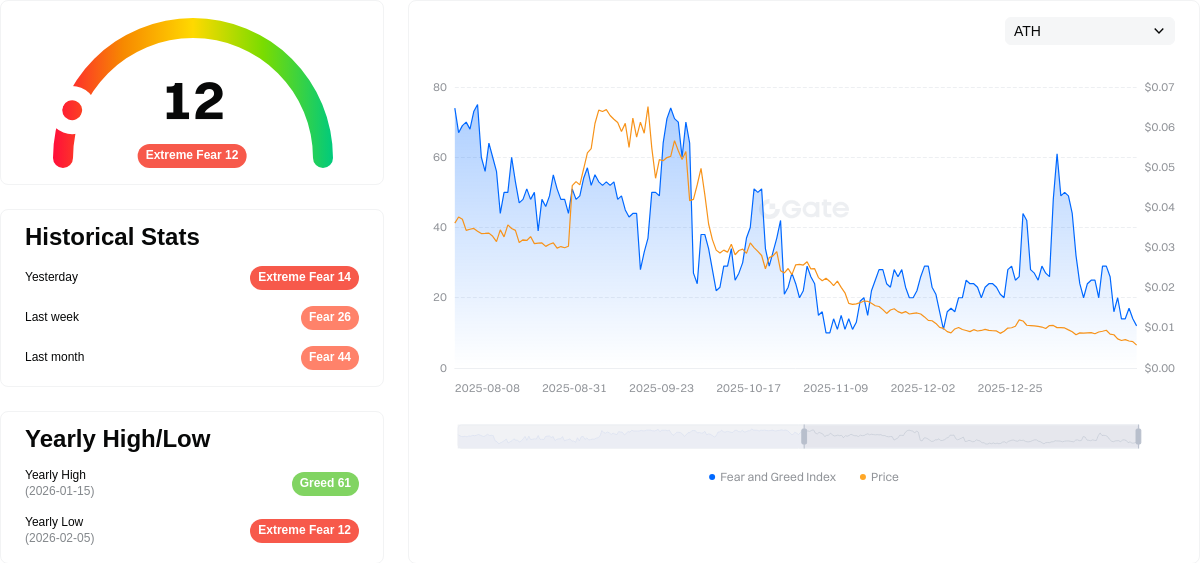

The current market sentiment index registers at 12, classified within the Extreme Fear zone, suggesting cautious investor positioning across the broader cryptocurrency market environment.

Click to view the current ETHS market price

ETHS Market Sentiment Indicator

02-05-2026 Fear & Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The ETHS market is currently experiencing extreme fear, with the Fear & Greed Index dropping to 12. This exceptionally low reading indicates severe market pessimism and heightened investor anxiety. When the index reaches extreme fear levels, it typically reflects panic selling and significant bearish sentiment across the market. This environment often presents contrarian opportunities for long-term investors, as extreme fear historically precedes potential market recoveries. However, caution remains warranted until stabilization signals emerge.

ETHS Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. By analyzing the percentage of total supply held by top addresses, investors can assess potential risks related to price manipulation, liquidity constraints, and the overall health of the token's ecosystem.

Based on the current data, ETHS demonstrates a relatively balanced distribution pattern among major holders. The absence of extreme concentration in the top few addresses suggests a healthier degree of decentralization compared to many newly launched tokens. This distribution structure indicates that no single entity or small group of wallets possesses overwhelming control over the circulating supply, which reduces the risk of coordinated sell-offs or artificial price manipulation. The diversified ownership across multiple addresses creates a more resilient market framework that can better absorb trading pressure during volatile periods.

From a market stability perspective, this holding distribution reflects a maturing ecosystem with gradually improving liquidity depth. The dispersed ownership pattern contributes to enhanced price discovery mechanisms and reduces the likelihood of sudden liquidity crises triggered by large holder actions. However, investors should remain vigilant about potential shifts in this distribution over time, as changes in concentration levels could signal evolving market dynamics or institutional accumulation patterns that may influence future price trajectories.

Click to view current ETHS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing ETH's Future Price

Supply Mechanism

- Staking Lock-Up: Approximately 30% of ETH circulating supply has been locked in staking contracts, effectively removing these tokens from circulation in the short term. During June to mid-July 2025, over 1.5 million ETH were newly staked, tightening available supply.

- Historical Pattern: The transition to Proof-of-Stake mechanism has transformed ETH into a deflationary asset structure. Historical data shows that increased staking rates correlate with reduced selling pressure, as locked tokens cannot immediately enter exchanges.

- Current Impact: Exchange reserves declined by 132,000 ETH over four days, with cumulative reduction of 323,000 ETH since April 24, 2025. This supply contraction, combined with whale accumulation exceeding 500,000 ETH over two weeks, creates fundamental support for price appreciation.

Institutional and Whale Dynamics

- Institutional Holdings: BlackRock's ETH trust position reached 832,000 tokens, representing a 218% increase compared to Q4 2024. Ethereum-focused investment products attracted over $3 billion in net inflows during the past two months.

- Corporate Adoption: Over ten publicly-traded companies disclosed increased ETH holdings since May 2025, collectively acquiring more than 570,000 ETH. Notable entities include SharpLink Gaming (280,000+ ETH), Bit Digital (100,000+ ETH), and newly-formed vehicles with substantial capital allocation.

- Regulatory Environment: The U.S. regulatory landscape has shifted favorably, with bipartisan support for clear crypto regulations and potential integration into 401(k) retirement plans. The classification of ETH as a commodity rather than a security facilitates institutional adoption.

Macroeconomic Environment

- Monetary Policy Influence: Risk asset sentiment remains sensitive to central bank policies. Trade agreement announcements, such as the U.S.-U.K. comprehensive deal, triggered synchronized rallies in traditional equities and crypto markets, with the S&P 500 and Nasdaq 100 gaining over 1%.

- Risk-On Correlation: Traditional market performance continues influencing crypto sector dynamics. When Bitcoin's market dominance declined from approximately 65% to 60% over one month, capital rotated toward ETH and quality alternative assets.

- Geopolitical Considerations: Potential large-scale liquidations (such as discussions around government-held BTC sales) create market uncertainty that differentially impacts various crypto assets. ETH has shown relative resilience during such periods.

Technical Development and Ecosystem Building

- Pectra Upgrade: This upgrade introduced enhanced functionality including EIP-3074 for optimized transaction experience, improving network efficiency and user accessibility.

- Layer-2 Expansion: As of Q1 2025, Layer-2 solutions processed over 60% of all Ethereum transactions, significantly alleviating mainnet congestion. Networks like Arbitrum and Optimism recorded usage peaks, with daily on-chain demand increasing by approximately 50,000 ETH.

- Ecosystem Applications: DeFi total value locked approaches the $800 billion milestone, with projections toward $1.2 trillion. The ecosystem spans decentralized finance, NFT infrastructure, real-world asset tokenization, and enterprise blockchain implementations. The Ethereum Foundation allocated $32.64 million in Q1 2025 to support ecosystem projects including zero-knowledge proofs and developer tooling.

- EIP-5005 Protocol: Activated on April 7, 2025, this protocol enhancement contributes to performance improvements supporting the broader network evolution roadmap.

III. 2026-2031 ETHS Price Forecast

2026 Outlook

- Conservative forecast: $0.01451 - $0.02103

- Neutral forecast: $0.02103 (average prediction)

- Optimistic forecast: $0.03028 (requires favorable market conditions and broader adoption)

The 2026 forecast suggests a -5% price change compared to the baseline, indicating potential market consolidation or adjustment phase. The price range is expected to fluctuate between $0.01451 at the lower end and $0.03028 at the upper bound, with an average trading price around $0.02103.

2027-2029 Mid-term Outlook

- Market stage expectation: Recovery and gradual growth phase with increasing institutional interest

- Price range predictions:

- 2027: $0.01847 - $0.03053 (average $0.02566, +15% change)

- 2028: $0.01433 - $0.03118 (average $0.02809, +26% change)

- 2029: $0.02045 - $0.03972 (average $0.02964, +33% change)

- Key catalysts: Progressive adoption, technological developments, and potential ecosystem expansion

The mid-term outlook shows a progressive upward trajectory, with average prices climbing from $0.02566 in 2027 to $0.02964 in 2029. The positive momentum is reflected in the increasing price change percentages, moving from +15% to +33% over this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.02289 - $0.03468 (assuming steady market growth and moderate adoption rates)

- Optimistic scenario: $0.03468 - $0.03919 in 2030 (with enhanced network utility and expanding use cases)

- Growth scenario: $0.02622 - $0.04764 in 2031 (under favorable regulatory environment and significant ecosystem development)

- February 6, 2026: ETHS trading within early consolidation range

The long-term forecast indicates sustained growth potential, with 2030 showing a +56% price change and 2031 projecting a +66% increase. The average price is expected to reach $0.03468 in 2030 and $0.03693 in 2031, reflecting potential maturation of the ecosystem. The upper price target of $0.04764 in 2031 represents the optimistic ceiling under ideal market conditions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.03028 | 0.02103 | 0.01451 | -5 |

| 2027 | 0.03053 | 0.02566 | 0.01847 | 15 |

| 2028 | 0.03118 | 0.02809 | 0.01433 | 26 |

| 2029 | 0.03972 | 0.02964 | 0.02045 | 33 |

| 2030 | 0.03919 | 0.03468 | 0.02289 | 56 |

| 2031 | 0.04764 | 0.03693 | 0.02622 | 66 |

IV. ETHS Professional Investment Strategy and Risk Management

ETHS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in Ethereum's long-term scaling solutions and are willing to hold through market volatility

- Operational recommendations:

- Consider accumulating positions during market corrections when ETHS trades near historical support levels

- Monitor the development progress of the Facet protocol and its adoption on Ethereum mainnet

- Store assets in secure wallets such as Gate Web3 Wallet to maintain full control of private keys

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor 24-hour trading volume trends to identify potential breakout or breakdown signals

- Support and resistance levels: Track key price levels including recent lows around $0.0208 and highs near $0.0334

- Swing trading considerations:

- Set clear stop-loss orders to manage downside risk, especially given recent high volatility

- Consider profit-taking strategies during short-term rallies to lock in gains

ETHS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation

- Aggressive investors: 3-5% of crypto portfolio allocation

- Professional investors: Up to 5-10% based on risk tolerance and market analysis

(2) Risk Hedging Solutions

- Position sizing: Limit individual position size to prevent excessive exposure to single-asset risk

- Stop-loss implementation: Set predetermined exit points to protect capital during adverse market movements

(3) Secure Storage Solutions

- Hot wallet option: Gate Web3 Wallet for active trading and easy access

- Cold storage approach: Hardware wallets for long-term holdings to minimize security risks

- Security precautions: Never share private keys, enable two-factor authentication, and verify all transaction details before confirmation

V. ETHS Potential Risks and Challenges

ETHS Market Risks

- High volatility: ETHS has experienced significant price fluctuations with 24-hour changes exceeding 27% and 30-day declines of nearly 88%

- Low liquidity: With a market cap of approximately $464,940 and limited exchange listings, large trades may face slippage issues

- Market sentiment: The token has shown substantial price weakness across multiple timeframes, indicating challenging market conditions

ETHS Regulatory Risks

- Scaling solution classification: Regulatory clarity around Layer 1 scaling protocols and their associated tokens remains uncertain

- Cross-border compliance: Different jurisdictions may have varying regulations regarding digital assets and blockchain protocols

- Evolving regulatory landscape: Changes in cryptocurrency regulations could impact the adoption and trading of ETHS

ETHS Technical Risks

- Protocol development risk: As a core asset of the Facet protocol, ETHS value depends on successful protocol implementation and adoption

- Smart contract vulnerabilities: Potential security issues in the underlying protocol could affect token value and user confidence

- Competition from alternative solutions: Other Ethereum scaling solutions may attract developers and users, limiting ETHS growth potential

VI. Conclusion and Action Recommendations

ETHS Investment Value Assessment

ETHS represents a speculative opportunity in Ethereum's scaling ecosystem as the core asset of the Facet protocol, which has received funding from the Ethereum Foundation. However, the token faces significant challenges including extreme price volatility, limited market liquidity, and substantial recent price declines. While the project's association with Ethereum scaling efforts provides potential long-term value, short-term risks remain elevated given current market conditions.

ETHS Investment Recommendations

✅ Beginners: Approach with extreme caution; consider waiting for market stabilization and conducting extensive research before any investment ✅ Experienced investors: Consider small, speculative positions as part of a diversified cryptocurrency portfolio, with strict risk management protocols ✅ Institutional investors: Conduct thorough due diligence on the Facet protocol's technical implementation, team credentials, and competitive positioning before making allocation decisions

ETHS Trading Participation Methods

- Spot trading: Purchase ETHS directly through cryptocurrency exchanges like Gate.com for immediate ownership

- Dollar-cost averaging: Implement a systematic investment approach to reduce timing risk and smooth out entry prices

- Research-based approach: Monitor protocol development milestones and ecosystem growth before increasing position sizes

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of ETHS? What are the major price fluctuation events?

ETHS experienced significant growth from early 2023 to February 2026, with notable volatility including sharp declines in late 2023 and substantial gains throughout 2024. Key events shaped price movements, reflecting strong market demand and investor confidence in the token's fundamentals.

What are the main factors affecting ETHS price?

ETHS price is primarily influenced by market supply and demand, Ethereum network upgrades and technical developments, investor sentiment, and overall cryptocurrency market conditions. Major protocol updates and ecosystem growth also drive significant price movements.

How to predict ETHS price? What are the prediction methods and tools?

ETHS price prediction uses technical analysis and fundamental analysis. Key tools include CoinGecko and TradingView for charting. Analyze historical data, trading volume, market trends, and on-chain metrics to forecast price movements.

ETHS price prediction exists which risks and limitations?

ETHS price predictions face market volatility, regulatory changes, and technical uncertainties. Prediction signals may prove inaccurate due to unpredictable market conditions and external factors affecting crypto markets.

What is the difference between ETHS and ETH? Are their price trends related?

ETHS and ETH are distinct assets. ETH is Ethereum's native token, while ETHS is typically a derivative or wrapped variant. Their price trends correlate but differ based on contract terms and market conditions. ETHS prices are influenced by derivative mechanics, while ETH follows the broader Ethereum ecosystem.

What is the price prediction for ETHS by professional analysts?

Professional analysts predict ETHS prices will range between $4,318 and $6,264 in 2026, with sustained upward momentum throughout the year.

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

What is Ethereum: A 2025 Guide for Crypto Enthusiasts and Investors

How does Ethereum's blockchain technology work?

What are smart contracts and how do they work on Ethereum?

Ethereum Price Analysis: 2025 Market Trends and Web3 Impact

Comprehensive Guide to Coffeezilla: Crypto's Leading Fraud Investigator

Comprehensive Guide to Quantitative Analysis

7 Ideas for Beginners To Create Digital Art

What Is an Airdrop in Cryptocurrency?

![How to Create Tokens on Base Blockchain Without Programming [No-Code Guide]](https://gimg.staticimgs.com/learn/31a024cb83a1a5b0a9847d4ebb6be5b3b64d4d47.png)

How to Create Tokens on Base Blockchain Without Programming [No-Code Guide]