2026 GATA Price Prediction: Expert Analysis and Market Forecast for Gata Token's Future Value

Introduction: GATA's Market Position and Investment Value

GATA (GATA), as a decentralized AI infrastructure project, has been building advanced AI inference and training technologies since its launch in 2025. As of 2026, GATA maintains a market capitalization of approximately $983,185, with a circulating supply of around 245 million tokens, and the price remains at approximately $0.004013. This asset, characterized as "decentralized AI computing infrastructure," is playing an increasingly significant role in enabling large-scale AI models to collaborate efficiently across globally distributed GPUs.

This article will comprehensively analyze GATA's price trends from 2026 to 2031, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price forecasts and practical investment strategies.

I. GATA Price History Review and Market Status

GATA Historical Price Evolution Trajectory

- 2025: GATA launched on Gate.com on January 4, 2025, reaching an all-time high of $0.09911 on September 24, 2025

- 2026: Market entered correction phase, with price declining to an all-time low of $0.003927 on February 2, 2026, representing a significant contraction from the peak

GATA Current Market Dynamics

As of February 3, 2026, GATA is trading at $0.004013, showing a decline of 2.85% over the past 24 hours. The token has experienced notable volatility in recent periods, with a 10.78% decrease over the past 7 days and a 39.98% decline over the past 30 days. Over the past year, the price has decreased by 97.33% from its historical peak.

The current 24-hour trading volume stands at $13,011.04, with the price fluctuating between $0.003927 and $0.004256 during this period. GATA maintains a market capitalization of approximately $983,185, with a circulating supply of 245,000,000 tokens out of a maximum supply of 1,000,000,000 tokens, representing 24.5% of the total supply in circulation. The fully diluted market cap is $4,013,000.

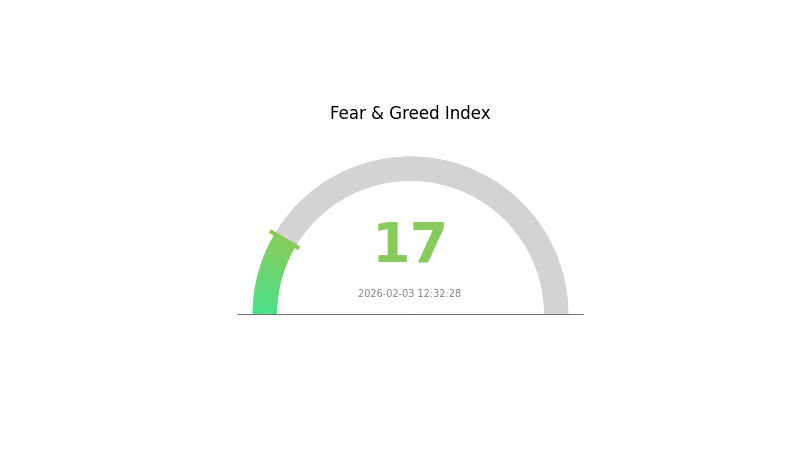

The token is deployed on the BSC (BNP20) network and currently has 4,619 holders. Market sentiment indicators suggest heightened caution, with the market fear index at 17, indicating an "Extreme Fear" environment. GATA's market share stands at 0.00014% of the overall cryptocurrency market.

Click to view current GATA market price

GATA Market Sentiment Index

02-03-2026 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This indicates significant market pessimism and heightened risk aversion among investors. When the index reaches such low levels, it typically signals excessive selling pressure and panic-driven decisions. Historically, extreme fear periods have often preceded market reversals and presented buying opportunities for long-term investors. However, traders should remain cautious and conduct thorough analysis before making investment decisions during such volatile market conditions.

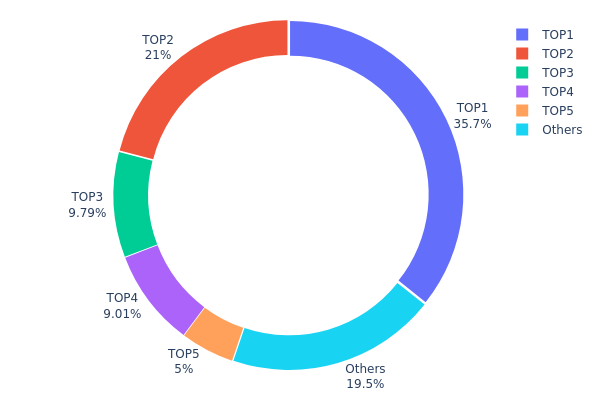

GATA Holding Distribution

The holding distribution chart reveals the allocation of tokens across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. By analyzing the concentration of holdings among top addresses, we can assess potential risks related to price manipulation, liquidity constraints, and overall network health.

Based on the current data, GATA exhibits a relatively high concentration pattern. The top address holds 357 million tokens, accounting for 35.70% of the total supply, while the second-largest address controls 21.00%. Combined, the top five addresses hold approximately 80.49% of the circulating supply, with only 19.51% distributed among other market participants. This concentrated structure indicates that a small number of entities possess significant influence over the token's market dynamics.

Such high concentration poses several implications for market behavior. The dominance of large holders increases the potential for coordinated selling pressure or strategic accumulation, which could lead to heightened volatility during price movements. Additionally, the limited distribution among smaller addresses suggests lower retail participation and reduced liquidity depth. From a decentralization perspective, GATA's current holding pattern reflects a centralized governance structure, where key decisions and market movements may be heavily influenced by a few major stakeholders. This concentration level warrants close monitoring, particularly during periods of market stress or major token unlock events.

Click to view current GATA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7a38...f2acbb | 357000.00K | 35.70% |

| 2 | 0x0c5d...ba9853 | 210000.00K | 21.00% |

| 3 | 0xfa84...4e77d1 | 97908.33K | 9.79% |

| 4 | 0x5a77...b430d7 | 90091.67K | 9.00% |

| 5 | 0x663d...2b7833 | 50000.00K | 5.00% |

| - | Others | 195000.00K | 19.51% |

II. Core Factors Influencing GATA's Future Price

Supply and Demand Dynamics

- Market Supply-Demand Balance: The fundamental relationship between supply and demand serves as a primary driver of GATA's price movements. When market demand exceeds available supply, upward price pressure typically emerges, while excess supply relative to demand tends to create downward pressure.

- Supply Chain Stability: The stability and efficiency of GATA's supply chain infrastructure plays a significant role in price determination. Disruptions or improvements in supply chain operations can create volatility or stability in market pricing.

- Production Costs: Manufacturing and operational costs directly influence the baseline pricing structure. Changes in production efficiency, raw material costs, or operational expenses can shift the price floor and ceiling for GATA.

Market Competition and Technological Progress

- Competitive Landscape: The intensity of market competition and the emergence of alternative solutions impact GATA's market positioning and pricing power. Increased competition may compress margins, while market leadership can support premium pricing.

- Technological Advancement: Innovation and technological improvements can enhance value proposition and utility. Successful implementation of new technologies may justify higher valuations, while failure to keep pace with industry developments could negatively affect price expectations.

- Market Adoption: The rate and extent of market adoption influences both demand patterns and long-term price sustainability. Broader acceptance typically correlates with increased stability and potential for appreciation.

Macroeconomic Environment

- Economic Conditions: Overall macroeconomic health, including factors such as economic growth rates, employment levels, and consumer confidence, creates the broader context within which GATA operates. Strong economic fundamentals generally support positive price trends.

- Policy and Regulatory Environment: Government policies, regulatory changes, and institutional frameworks can significantly impact market dynamics. Supportive policies may enhance growth prospects, while restrictive measures could constrain development.

- Market Sentiment: Investor confidence and market psychology play important roles in short to medium-term price movements. Shifts in sentiment, whether driven by news, events, or broader market trends, can create substantial price volatility independent of fundamental factors.

III. 2026-2031 GATA Price Forecast

2026 Outlook

- Conservative Forecast: $0.00365 - $0.00401

- Neutral Forecast: Around $0.00401

- Optimistic Forecast: Up to $0.00546 (requires favorable market conditions and increased trading activity)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with potential consolidation periods as the token seeks to establish a stable trading range and expand its user base

- Price Range Forecast:

- 2027: $0.00365 - $0.00597 (approximately 18% potential growth)

- 2028: $0.00337 - $0.00669 (approximately 33% potential growth)

- 2029: $0.00494 - $0.00626 (approximately 50% cumulative growth trajectory)

- Key Catalysts: Market adoption rates, technological developments in the underlying ecosystem, regulatory clarity in key jurisdictions, and overall cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00375 - $0.00614 (assuming steady market conditions and moderate adoption)

- Optimistic Scenario: $0.00614 - $0.00774 (assuming enhanced utility, strategic partnerships, and favorable market dynamics)

- Transformative Scenario: Approaching $0.00774 (requires breakthrough adoption, significant ecosystem expansion, and sustained bullish crypto market conditions)

- 2031-02-03: GATA may potentially reach $0.00694 average price level (representing approximately 72% growth from 2026 baseline, contingent on market conditions)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00546 | 0.00401 | 0.00365 | 0 |

| 2027 | 0.00597 | 0.00474 | 0.00365 | 18 |

| 2028 | 0.00669 | 0.00535 | 0.00337 | 33 |

| 2029 | 0.00626 | 0.00602 | 0.00494 | 50 |

| 2030 | 0.00774 | 0.00614 | 0.00375 | 53 |

| 2031 | 0.00756 | 0.00694 | 0.00472 | 72 |

IV. GATA Professional Investment Strategy and Risk Management

GATA Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Investors who believe in the long-term potential of decentralized AI infrastructure and are willing to tolerate high volatility

- Operational recommendations:

- Consider accumulating positions during market downturns, as GATA has declined approximately 97.33% from its all-time high of $0.09911

- Monitor developments in decentralized AI inference and training technologies to assess project progress

- Utilize Gate Web3 Wallet for secure storage of GATA tokens on the BSC chain

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Current price around $0.004013 is near the all-time low of $0.003927, which may act as support

- Volume Analysis: Monitor the 24-hour trading volume of approximately $13,011 to gauge market interest

- Swing trading considerations:

- Watch for price movements within the 24-hour range of $0.003927 to $0.004256

- Consider the recent negative momentum (-2.85% in 24H, -10.78% in 7D, -39.98% in 30D) when planning entry and exit points

GATA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Active investors: 3-5% of crypto portfolio

- Professional investors: Up to 10% of crypto portfolio, with careful position sizing

(2) Risk Hedging Solutions

- Portfolio diversification: Spread investments across multiple projects in the AI and infrastructure sectors

- Position scaling: Use dollar-cost averaging to mitigate timing risk in this volatile asset

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for convenient trading and staking

- Cold storage solution: Consider hardware wallets for long-term holdings to minimize security risks

- Security precautions: Always verify contract address (0x46ee3bfc281d59009ccd06f1dd6abdbfcd82ffc3 on BSC), enable two-factor authentication, and never share private keys

V. GATA Potential Risks and Challenges

GATA Market Risks

- High volatility: GATA has experienced a 97.33% decline over the past year, demonstrating extreme price volatility

- Limited liquidity: With a 24-hour trading volume of approximately $13,011 and market cap of $983,185, liquidity may be constrained

- Low market capitalization: The small market cap increases susceptibility to large price swings from relatively small trades

GATA Regulatory Risks

- AI technology regulation: Evolving regulatory frameworks for AI technologies may impact decentralized AI projects

- Cryptocurrency compliance: Changes in cryptocurrency regulations across different jurisdictions could affect trading and adoption

- Token classification: Uncertainty around whether GATA might be classified as a security in various jurisdictions

GATA Technical Risks

- Project execution: As the project builds decentralized AI inference and training technologies, technical challenges may arise in delivering on roadmap promises

- Network scalability: Ensuring efficient collaboration of AI models across globally distributed GPUs presents significant technical hurdles

- Competition: The decentralized AI infrastructure space is increasingly competitive, with numerous projects vying for market share

VI. Conclusion and Action Recommendations

GATA Investment Value Assessment

GATA operates in the promising intersection of artificial intelligence and decentralized infrastructure, which represents a potentially significant long-term opportunity. However, the token's performance shows substantial weakness, with a 97.33% decline from its all-time high and current trading near historical lows. The project's success depends heavily on execution of its technical roadmap and adoption of its decentralized AI infrastructure. While the long-term vision of enabling large-scale AI models to collaborate across distributed GPUs is compelling, short-term risks remain elevated due to market volatility, limited liquidity, and the early-stage nature of the project.

GATA Investment Recommendations

✅ Beginners: Given the high risk profile and significant volatility, new investors should approach GATA with extreme caution. If considering investment, allocate no more than 1-2% of your crypto portfolio and only invest amounts you can afford to lose entirely.

✅ Experienced investors: Consider GATA as a speculative position within a diversified crypto portfolio. Monitor project developments closely and use technical analysis to identify potential entry points near support levels. Maintain strict position limits of 3-5% of your crypto holdings.

✅ Institutional investors: Conduct thorough due diligence on the project's technology, team, and competitive positioning. Consider GATA as part of a broader thesis on decentralized AI infrastructure, with appropriate risk management and hedging strategies in place.

GATA Trading Participation Methods

- Spot trading: Purchase GATA directly on Gate.com and other exchanges where it is listed

- Dollar-cost averaging: Accumulate positions gradually over time to mitigate timing risk in this volatile market

- Secure storage: Use Gate Web3 Wallet for active trading positions or transfer to cold storage for long-term holdings

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is GATA? What are its uses?

GATA is a distributed AI inference and training technology project that enables large-scale AI models to work efficiently across global GPU resources. It aims to optimize AI model construction and deployment through decentralized computing power coordination.

GATA的历史价格走势如何?

GATA价格在2026年1月呈现波动态势。1月2日价格为¥0.04971,1月5日下跌至¥0.04775。整体表现相对稳定,交易额保持活跃。建议查看完整历史数据了解更详细走势。

What is the GATA price prediction for 2024?

Based on market analysis, GATA's 2024 price prediction was approximately $0.007809. Projections indicated potential growth toward $0.04457 by 2030, representing significant long-term upside potential for investors.

What are the risks of investing in GATA?

GATA carries significant volatility risk with extreme price fluctuations and potential 92.97% annual declines. Limited liquidity with low trading volume may impact large transactions. Crypto assets are inherently high-risk and prices can change rapidly.

What are the advantages of GATA compared to similar tokens?

GATA offers superior liquidity and trading volume with strong market recognition. Its robust community support builds investor confidence, while innovative technology sets it apart competitively in the market.

What are GATA's future development prospects and application scenarios?

GATA accelerates AI development through decentralized models, enabling open AI and returning value to the majority. Its applications span shared AI resources across various sectors, with strong potential for widespread adoption and ecosystem expansion in the decentralized AI infrastructure space.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

LBLOCK vs STX: A Comprehensive Comparison of Two Leading Blockchain Tokens in the DeFi Ecosystem

The 7 Best Metaverse Games to Play in Recent Years

NBLU vs THETA: A Comprehensive Comparison of Two Emerging Blockchain Technologies and Their Impact on the Decentralized Finance Ecosystem

NIBI vs LINK: A Comprehensive Comparison of Two Leading Blockchain Infrastructure Protocols

IRIS vs RUNE: A Comprehensive Comparison of Two Leading Blockchain Ecosystems