2026 HAPPY Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: HAPPY's Market Position and Investment Value

HappyCat (HAPPY), a meme-inspired cryptocurrency rooted in viral internet culture, has captured market attention since its launch in November 2024. As of February 3, 2026, HAPPY maintains a market capitalization of approximately $983,290, with a circulating supply of 3.33 billion tokens and a current price of around $0.000295. This Solana-based asset, drawing inspiration from the popular "Happy Happy Happy Cat" viral video that first emerged in 2015, has built a community of over 105,000 holders despite experiencing considerable price volatility since its all-time high of $0.04723 in November 2024.

This article provides a comprehensive analysis of HAPPY's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for both existing holders and potential investors.

I. HAPPY Price History Review and Market Status

HAPPY Historical Price Evolution Trajectory

- 2015: The original Happy Happy Happy Cat video first appeared, marking the beginning of the meme's viral spread

- November 2024: HAPPY token launched on November 7, 2024, with a publish price of $0.02718, reaching an all-time high of $0.04723 on November 16, 2024

- 2025-2026: Price experienced significant correction, declining by approximately 89.87% over the past year, dropping from historical peak to current levels around $0.000295

HAPPY Current Market Situation

As of February 3, 2026, HAPPY is trading at $0.000295, showing a modest intraday increase of 0.5% over the past 24 hours. The token has demonstrated some short-term volatility, with a 1-hour price gain of 1.41%, while facing broader downward pressure evidenced by a 7-day decline of 21.43% and a 30-day decrease of 38.49%.

The 24-hour trading range has fluctuated between a low of $0.000288 and a high of $0.0003148, with total trading volume reaching $14,954.88. The token recently touched its all-time low of $0.000288 on February 2, 2026, representing a significant 99.37% decline from its all-time high of $0.04723 recorded on November 16, 2024.

HAPPY maintains a fully diluted market capitalization of approximately $983,290, with a total and circulating supply of 3,333,186,743 tokens, indicating 100% of tokens are currently in circulation. The token ranks #2519 by market cap, holding a 0.000035% market dominance. With a holder count of 105,589, the token has established a notable community presence.

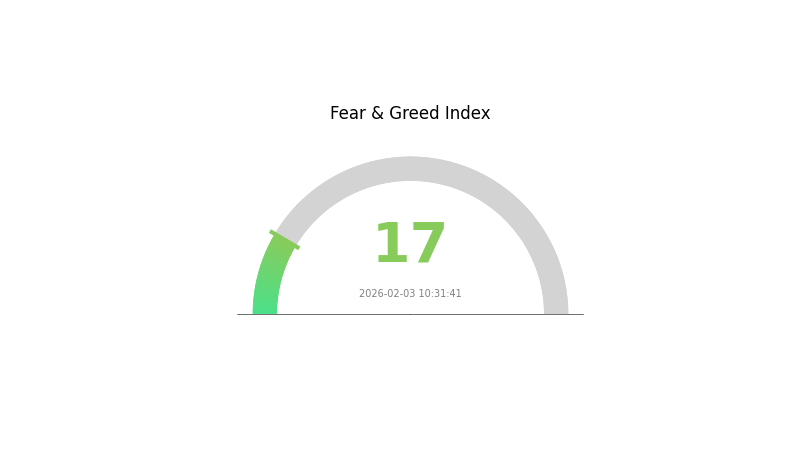

The current market sentiment index stands at 17, indicating extreme fear in the broader cryptocurrency market, which may be influencing HAPPY's price performance alongside other digital assets.

Click to view current HAPPY market price

HAPPY Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This exceptionally low reading reflects significant market pessimism and investor anxiety. During periods of extreme fear, opportunities often emerge for contrarian investors seeking long-term positions at discounted prices. Market volatility remains elevated, and sentiment suggests heightened risk aversion among traders. Such extreme conditions historically precede potential market reversals, making it a critical time for careful portfolio management and strategic decision-making on Gate.com.

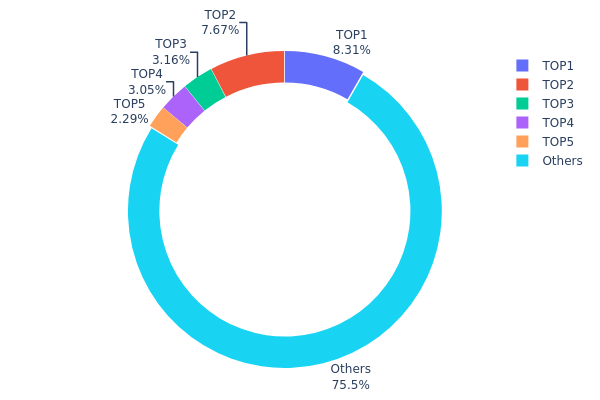

HAPPY Holdings Distribution

The holdings distribution chart reveals the concentration level of token ownership across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. By analyzing the percentage of supply held by top addresses versus smaller holders, investors can assess whether a token's price movements might be subject to whale influence or if ownership is broadly distributed across the community.

Based on the current data, HAPPY demonstrates a moderately concentrated ownership structure. The top 5 addresses collectively control 24.45% of the total supply, with the largest single holder possessing 8.31% (276,993.83K tokens) and the second-largest holding 7.66% (255,518.20K tokens). While this concentration level suggests the presence of significant whale positions, the remaining 75.55% distributed among other addresses indicates a reasonably diverse holder base. This distribution pattern falls within a balanced range—not excessively centralized like some meme tokens where top holders control over 50%, yet showing enough major stakeholder presence to potentially influence short-term price action.

From a market structure perspective, this distribution carries both stabilizing and volatility-inducing elements. The substantial "Others" category (75.55%) suggests adequate retail participation and liquidity depth, which typically supports organic price discovery and reduces susceptibility to single-entity manipulation. However, the top two addresses collectively holding over 15% of supply present potential liquidity risks—coordinated selling from these positions could trigger significant downward pressure. The current structure reflects a token that has achieved moderate community adoption while maintaining early investor or treasury positions, characteristic of projects in their growth phase. This balance generally supports market stability during normal conditions but warrants monitoring for large wallet movements that could signal upcoming volatility.

Click to view the current HAPPY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 276993.83K | 8.31% |

| 2 | 2Ejnns...z2Ps3e | 255518.20K | 7.66% |

| 3 | u6PJ8D...ynXq2w | 105291.46K | 3.15% |

| 4 | CXejtJ...zoEVtH | 101656.06K | 3.05% |

| 5 | 4QXXp1...zGaYB3 | 76266.96K | 2.28% |

| - | Others | 2516964.79K | 75.55% |

II. Core Factors Influencing HAPPY's Future Price

Market Demand and Economic Factors

-

Market Demand Dynamics: The future price trajectory of HAPPY is significantly influenced by overall market demand patterns. Consumer behavior and adoption rates play a crucial role in determining price movements, as increased interest and usage typically correlate with upward price pressure.

-

Economic Environment: Broader economic factors serve as key determinants for HAPPY's valuation. Macroeconomic conditions, including inflation trends and monetary policy adjustments, can create either favorable or challenging environments for cryptocurrency assets.

Production and Supply Considerations

-

Production Cost Structure: Production costs represent a fundamental factor in HAPPY's price formation. Changes in operational expenses, network maintenance costs, and infrastructure requirements can directly impact the token's economic viability and market valuation.

-

Supply Chain Stability: The stability of supply chain operations plays an essential role in price determination. Disruptions or improvements in supply chain efficiency can lead to corresponding price adjustments as market participants factor in availability and distribution capabilities.

Regulatory and Technological Development

-

Regulatory Changes: Regulatory developments remain critical determinants of HAPPY's price outlook. Evolving compliance requirements, legal frameworks, and governmental policies toward digital assets can substantially affect market sentiment and institutional participation.

-

Technological Advancements: Continuous technological progress influences HAPPY's competitive position and utility. Innovations in blockchain technology, network upgrades, and enhanced functionality can contribute to improved market perception and adoption rates, potentially supporting price appreciation over time.

III. 2026-2031 HAPPY Price Prediction

2026 Outlook

- Conservative prediction: $0.00022 - $0.00029

- Neutral prediction: $0.00029

- Optimistic prediction: $0.0003 (requires favorable market conditions)

Based on the forecast data, HAPPY is expected to experience a slight decline in 2026, with the price potentially ranging between $0.00022 and $0.0003. The average price is projected to stabilize around $0.00029, indicating a consolidation phase as the token seeks to establish a stronger market foundation.

2027-2029 Outlook

- Market stage expectation: Gradual recovery and stabilization phase

- Price range predictions:

- 2027: $0.00017 - $0.00031

- 2028: $0.00023 - $0.00037

- 2029: $0.00028 - $0.0004

- Key catalysts: Market sentiment improvement, potential ecosystem development, and broader cryptocurrency market trends

During this mid-term period, HAPPY is projected to show modest growth momentum. The 2027 forecast suggests continued consolidation with an average price of $0.0003, followed by a slight uptick in 2028 with an average of $0.0003 and a potential high of $0.00037. By 2029, the token may demonstrate more substantial growth with an average price of $0.00034, representing approximately 14% growth from the previous period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00034 - $0.00048 (assuming steady market conditions)

- Optimistic scenario: $0.00042 - $0.00056 (assuming enhanced ecosystem adoption)

- Transformative scenario: Up to $0.00056 (requiring exceptional market conditions and widespread adoption)

Looking further ahead, HAPPY shows potential for more significant appreciation. The 2030 projection indicates an average price of $0.00037 with a potential high of $0.00048, representing approximately 24% growth. By 2031, the long-term forecast suggests the token could reach an average price of $0.00042, with optimistic scenarios pointing to $0.00056, which would represent roughly 43% growth. However, investors should note the wider price range in 2031, with a low of $0.00022, indicating increased volatility and market uncertainty in longer-term projections.

- 2026-02-03: HAPPY price predictions suggest cautious optimism with potential for gradual appreciation over the five-year forecast period

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0003 | 0.00029 | 0.00022 | -1 |

| 2027 | 0.00031 | 0.0003 | 0.00017 | 0 |

| 2028 | 0.00037 | 0.0003 | 0.00023 | 2 |

| 2029 | 0.0004 | 0.00034 | 0.00028 | 14 |

| 2030 | 0.00048 | 0.00037 | 0.00034 | 24 |

| 2031 | 0.00056 | 0.00042 | 0.00022 | 43 |

IV. HAPPY Professional Investment Strategy and Risk Management

HAPPY Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors seeking exposure to meme token ecosystem with high risk tolerance

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry timing risk given HAPPY's high volatility

- Monitor community engagement metrics on social platforms as key value indicators

- Storage Solution: Gate Web3 Wallet offers secure custody for SOL-based tokens with integrated risk management features

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track 24-hour trading volume patterns; current volume at $14,954.88 indicates liquidity levels for entry/exit planning

- Support/Resistance Levels: Monitor the 24-hour low of $0.000288 as potential support and $0.0003148 as resistance

- Swing Trading Considerations:

- HAPPY shows significant short-term volatility with -21.43% weekly change, creating potential swing opportunities

- Set strict stop-loss orders given the token's 89.87% decline from publication price

HAPPY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Maximum 0.5-1% of crypto portfolio allocation

- Aggressive Investors: Up to 3-5% allocation with active monitoring

- Professional Investors: Position sizing based on comprehensive risk-adjusted portfolio models

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance meme token exposure with established cryptocurrencies

- Stablecoin Reserves: Maintain liquid stablecoin positions for opportunistic rebalancing

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet provides multi-layer security for SOL ecosystem tokens

- Security Considerations: Enable two-factor authentication, verify contract addresses (HAPPYwgFcjEJDzRtfWE6tiHE9zGdzpNky2FvjPHsvvGZ), and maintain private key backups in secure offline storage

V. HAPPY Potential Risks and Challenges

HAPPY Market Risks

- Extreme Volatility: HAPPY has declined 89.87% year-over-year, demonstrating significant downside risk potential

- Limited Liquidity: Trading volume of $14,954.88 may result in slippage during larger transactions

- Market Capitalization Risk: With a market cap of approximately $983,290, HAPPY is susceptible to manipulation and sudden price swings

HAPPY Regulatory Risks

- Meme Token Classification: Evolving regulatory frameworks may impact trading availability and compliance requirements

- Platform Listing Risk: Changes in exchange policies could affect accessibility across trading platforms

- Tax Treatment Uncertainty: Investors should consult tax professionals regarding reporting obligations for meme token transactions

HAPPY Technical Risks

- Smart Contract Dependency: Token functionality relies on Solana blockchain infrastructure stability

- Community-Driven Value: Price heavily influenced by social media trends and community sentiment rather than fundamental utility

- Viral Content Lifecycle: Token's association with 2015 viral video may face relevance challenges affecting long-term sustainability

VI. Conclusion and Action Recommendations

HAPPY Investment Value Assessment

HAPPY represents a high-risk, community-driven meme token within the Solana ecosystem. While its cultural connection to viral internet content provides short-term engagement potential, the token's 89.87% decline from its publication price and limited market capitalization of $983,290 underscore substantial volatility risks. The current holder base of 105,589 demonstrates some community participation, though investors should recognize that meme tokens typically lack fundamental utility and derive value primarily from social sentiment.

HAPPY Investment Recommendations

✅ Beginners: Avoid allocation or limit exposure to less than 1% of total portfolio; prioritize established cryptocurrencies for initial market experience

✅ Experienced Investors: Consider micro-allocation (1-3%) only if already holding diversified crypto portfolio; implement strict stop-loss protocols

✅ Institutional Investors: Generally unsuitable for institutional mandates due to limited liquidity, high volatility, and absence of fundamental value drivers

HAPPY Trading Participation Methods

- Spot Trading: Execute direct purchases through Gate.com with immediate settlement on Solana blockchain

- Limit Orders: Place strategic buy orders near support levels to optimize entry pricing amid volatility

- Risk Management Integration: Utilize portfolio tracking tools to monitor HAPPY allocation against overall risk parameters

Cryptocurrency investment carries extreme risks. This article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is HAPPY token? What are its uses and value?

HAPPY is a meme coin designed to spread joy in the crypto world. It serves as a medium for trading and community rewards. Its value fluctuates with market dynamics, driven by community engagement and trading volume.

How to predict the future price of HAPPY tokens? What are the analysis methods?

Predict HAPPY price using technical analysis(examining historical price trends and trading volume)and fundamental analysis(evaluating project value, adoption rate, and market demand). Combine both methods for comprehensive forecasting.

What are the main risks of investing in HAPPY tokens? How should I evaluate them?

Main risks include market volatility, regulatory uncertainty, and intense crypto competition. Evaluate by assessing the project's technology foundation, team expertise, trading volume, and market sentiment to make informed decisions.

What are the advantages and disadvantages of HAPPY token compared to other mainstream cryptocurrencies?

HAPPY token offers fast transaction speeds and low fees, with strong community support. However, it faces lower market liquidity and brand recognition compared to established cryptocurrencies, requiring continued ecosystem development for mainstream adoption.

What is the market outlook for HAPPY token in 2024-2025?

HAPPY token shows promising growth potential driven by strong community support and technological innovations. With expanding NFT market adoption and increasing utility, HAPPY is positioned for significant appreciation during this period.

What are the main factors affecting HAPPY token price?

HAPPY token price is primarily influenced by supply and demand dynamics, market sentiment, and adoption rates. Positive developments and increased usage drive prices up, while negative news or reduced interest can cause declines. Trading volume and overall market conditions also play significant roles.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Investigating the True Identity of Bitcoin Founder Satoshi Nakamoto

How to Participate in Cryptocurrency Airdrops and Essential Security Measures

Top 7 Hardware Picks for Cryptocurrency Mining

What Does DYOR Mean in Crypto?

What Is a Cryptocurrency Airdrop: Where to Find Them and How to Profit