2026 ISK Price Prediction: Expert Analysis and Market Forecast for Iceland's Currency

Introduction: ISK's Market Position and Investment Value

ISKRA Token (ISK), as a blockchain gaming hub platform token connecting players and game studios, has been developing its gaming ecosystem since its launch in 2022. As of 2026, ISK maintains a market capitalization of approximately $473,857, with a circulating supply of around 498.8 million tokens, and the price hovering at $0.00095. This asset, positioned as a "blockchain gaming ecosystem enabler," is playing an increasingly important role in the Web3 gaming and GameFi sectors.

This article will comprehensively analyze ISK's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ISK Price History Review and Market Status

ISK Historical Price Evolution Trajectory

- 2022: ISK reached a significant price level during its early trading period, with the token recording a price of $0.619073 on September 29, 2022

- 2023-2025: The token experienced a prolonged downward trend as part of broader market cycles, reflecting adjustments in the blockchain gaming sector

- 2026: Price continued to decline, reaching a new low of $0.00094359 on February 5, 2026

ISK Current Market Situation

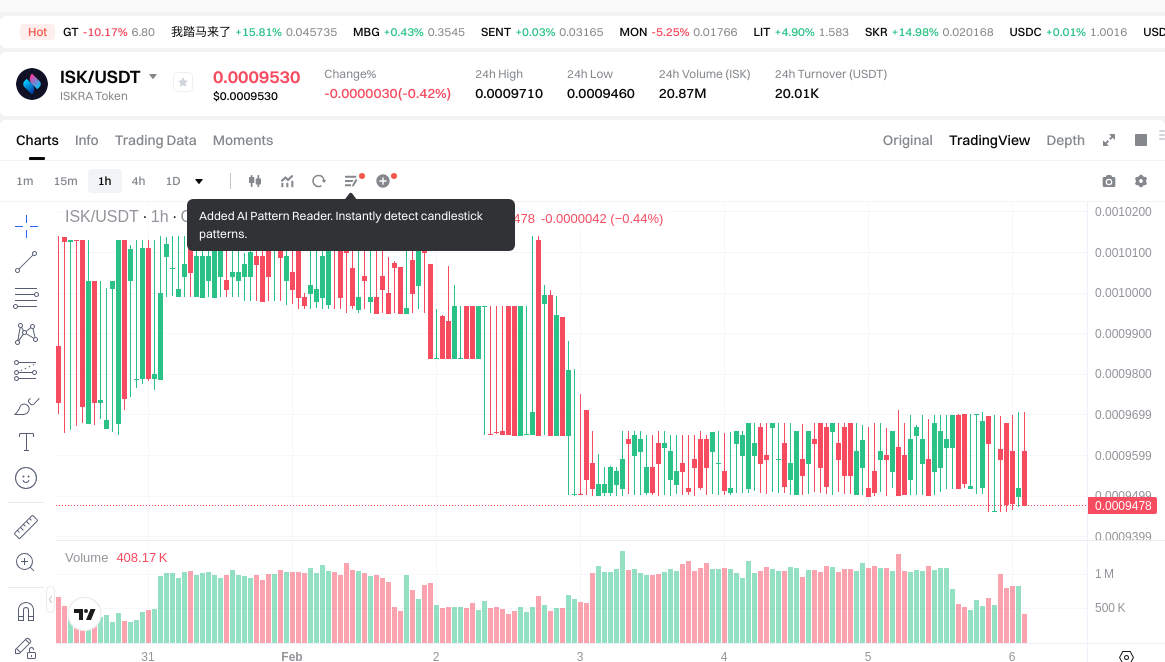

As of February 6, 2026, ISK is trading at $0.00095, showing a downward movement across multiple timeframes. Over the past hour, the token has declined by 0.94%, while the 24-hour period reflects a 1.4% decrease. The weekly performance shows a 3.21% drop, with the monthly decline reaching 16.08%. The annual performance indicates a substantial 93.4% decrease from previous levels.

The 24-hour trading range spans from $0.000946 to $0.000971, with trading volume reaching $20,056.70. The token's market capitalization stands at $473,857.07, with a circulating supply of 498,796,910.74 ISK tokens, representing approximately 49.88% of the total supply of 996,852,899.71 tokens. The maximum supply is capped at 1,000,000,000 tokens. The fully diluted market cap is valued at $947,010.25.

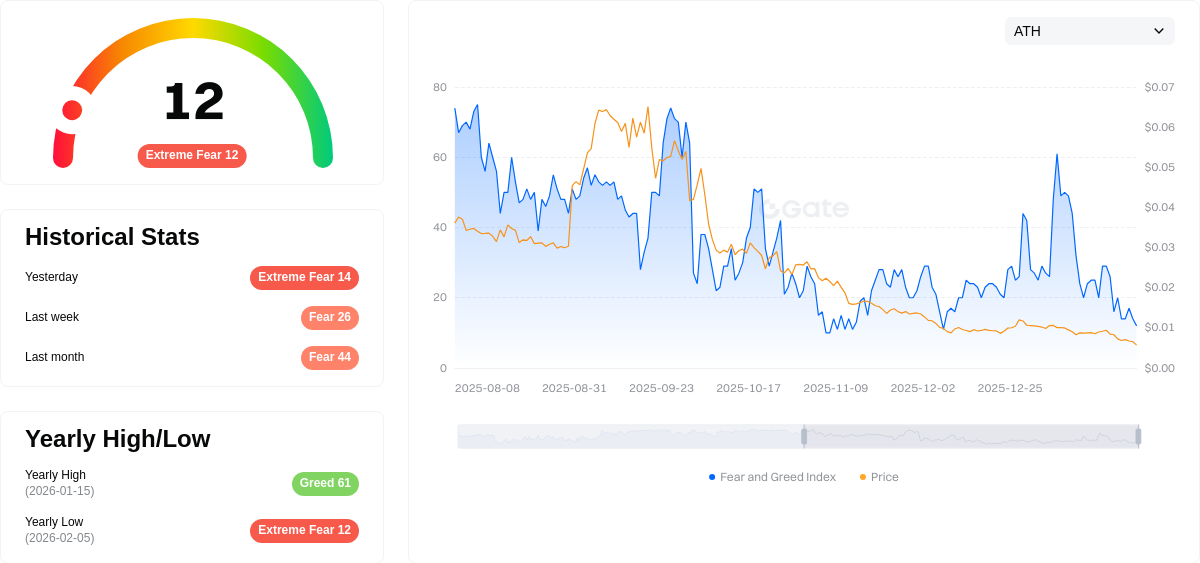

ISK currently holds a market share of 0.000039% and ranks at position 3055 in the market. The token has 267 holders and is available for trading on 3 exchanges. The current market sentiment indicator shows a reading of 12, classified as extreme fear, reflecting cautious investor attitudes.

Click to view current ISK market price

ISK Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 12. This significantly low reading indicates heightened market anxiety and pessimistic sentiment among investors. Such extreme fear conditions often create significant opportunities for contrarian investors, as assets may be oversold. However, caution remains essential, as further downside risks could materialize. Market participants should carefully assess their risk tolerance and investment strategies during this volatile period at Gate.com.

ISK Holding Distribution

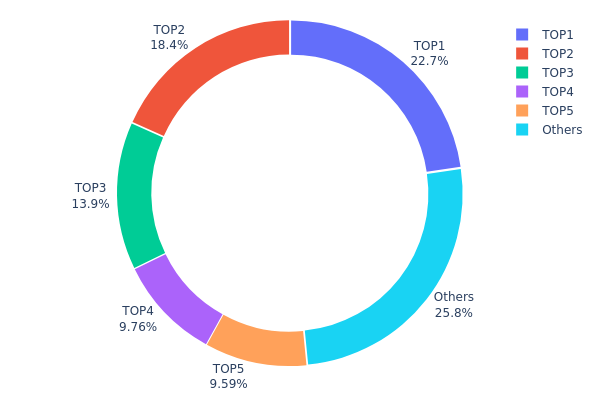

The holding distribution chart illustrates the concentration of ISK tokens across different wallet addresses, providing insights into how token supply is allocated among holders. This metric serves as a crucial indicator of decentralization and potential market manipulation risks within the ISK ecosystem.

Based on current on-chain data, ISK exhibits a moderately concentrated holding structure. The top five addresses collectively control approximately 74.21% of the total supply, with the largest holder possessing 22.66% (209,058.68K tokens), followed by the second-largest at 18.35% (169,267.74K tokens). The remaining holders, categorized as "Others," account for only 25.79% of the total distribution. This concentration level suggests that a relatively small number of entities maintain substantial influence over ISK's circulating supply.

Such concentration patterns carry significant implications for market dynamics. The dominance of top holders may contribute to reduced liquidity depth and increased vulnerability to large-scale sell pressure. If major holders decide to liquidate positions simultaneously, the market could experience acute volatility due to insufficient buy-side depth to absorb such volume. Furthermore, this distribution structure potentially enables coordinated price movements, as a small coalition of major holders could theoretically influence market direction through strategic trading actions.

From a structural perspective, ISK's current holding distribution reflects a developing stage of decentralization. While not alarmingly centralized compared to some emerging tokens, the 74% concentration among top five addresses indicates room for improvement in achieving broader token distribution. This structure may impact long-term ecosystem stability, as the project's resilience could be tested if major holders alter their positions. Market participants should monitor whether this concentration decreases over time as the token matures, which would signal healthier market development and reduced systemic risk.

Click to view current ISK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1b9e...078e54 | 209058.68K | 22.66% |

| 2 | 0x2046...85bc02 | 169267.74K | 18.35% |

| 3 | 0x9576...80bb3c | 127832.28K | 13.86% |

| 4 | 0x0d32...184584 | 90000.00K | 9.75% |

| 5 | 0xa962...49cbeb | 88457.76K | 9.59% |

| - | Others | 237617.35K | 25.79% |

II. Core Factors Influencing ISK's Future Price

Supply and Demand Dynamics

- Mining Production: Mining production remains the primary supply source, maintaining relative stability with annual output fluctuating between 2,000-3,500 tons. Historical patterns show that mining production responds slowly to price changes due to the lengthy development cycle from discovery to production, typically spanning several decades.

- Recycling Rates: Recycling accounts for approximately 25% of total annual supply, with volumes ranging from 1,100-1,700 tons. Historical data indicates a correlation coefficient of 0.65 between recycling volumes and price levels during 2010-2019. Economic and financial crises tend to accelerate recycling activity as holders liquidate assets for cash.

- Investment Demand: Investment demand comprises physical bars and coins (averaging around 1,600 tons annually), central bank purchases (approximately 500 tons per year), and ETF holdings. ETF demand demonstrates high correlation (0.73) with concurrent price movements but shows limited predictive value for future price trends.

Market Sentiment and Economic Stability

- Monetary Policy Impact: Central bank policies and interest rate decisions influence asset allocation preferences and currency valuations, affecting relative attractiveness compared to other investment vehicles.

- Economic Conditions: During periods of heightened economic instability, mean reversion to intrinsic value accelerates, driven by economic and political event shocks. Financial crises historically boost demand as investors seek quality liquid assets.

- Liquidity Factors: Idiosyncratic liquidity risk continues to impact trading behavior and price formation in investment markets, with liquidity premiums varying across different market conditions.

Global Financial Conditions

- Cross-Border Effects: International capital flows and foreign exchange market dynamics create interconnections through balance sheet channels, potentially amplifying price volatility during market stress periods.

- Risk Premium Considerations: Time-varying risk premiums and volatility patterns affect investor positioning and portfolio allocation decisions across global markets.

- Volatility Asymmetry: Price movements exhibit asymmetric responses to positive versus negative information shocks, with downside volatility typically exceeding upside volatility during stress periods.

III. 2026-2031 ISK Price Predictions

2026 Outlook

- Conservative prediction: $0.00088

- Neutral prediction: $0.00095

- Optimistic prediction: $0.00125

2027-2029 Outlook

- Market stage expectation: ISK may enter a gradual growth phase with moderate volatility as the market matures and adoption potentially increases

- Price range predictions:

- 2027: $0.00074 - $0.00144 (average $0.0011)

- 2028: $0.00107 - $0.00142 (average $0.00127)

- 2029: $0.00102 - $0.00166 (average $0.00135)

- Key catalysts: Progressive market development with price changes ranging from 15% to 41% year-over-year could reflect evolving ecosystem dynamics

2030-2031 Long-term Outlook

- Baseline scenario: $0.00093 - $0.00150 (assuming steady market conditions)

- Optimistic scenario: $0.00150 - $0.00218 (assuming favorable market sentiment and increased adoption)

- Transformation scenario: $0.00132 - $0.00193 by 2031 (reflecting potential 93% cumulative growth under sustained positive conditions)

- February 6, 2026: ISK trading within projected 2026 range

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00125 | 0.00095 | 0.00088 | 0 |

| 2027 | 0.00144 | 0.0011 | 0.00074 | 15 |

| 2028 | 0.00142 | 0.00127 | 0.00107 | 33 |

| 2029 | 0.00166 | 0.00135 | 0.00102 | 41 |

| 2030 | 0.00218 | 0.0015 | 0.00093 | 57 |

| 2031 | 0.00193 | 0.00184 | 0.00132 | 93 |

IV. ISK Professional Investment Strategies and Risk Management

ISK Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Blockchain gaming enthusiasts and believers in the GameFi ecosystem

- Operational Recommendations:

- Consider accumulating positions during market downturns, given ISK's current price of $0.00095 is near its historical low of $0.00094359

- Monitor Iskra platform development milestones, including new game launches and community growth metrics

- Storage Solution: Utilize Gate Web3 Wallet for secure self-custody, supporting Base network where ISK is deployed

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range between $0.000946 and $0.000971 for short-term trading opportunities

- Volume Analysis: Track the $20,056.70 daily trading volume to gauge market liquidity and interest

- Swing Trading Considerations:

- Pay attention to the token's recent volatility, including the 1.4% decline in 24 hours and 3.21% decrease over 7 days

- Set stop-loss orders to manage downside risk, particularly given the 93.4% decline over the past year

ISK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active monitoring and diversification across multiple blockchain gaming tokens

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance ISK exposure with established cryptocurrencies and other GameFi sector tokens

- Position Sizing: Scale investments based on market cap ($473,857) and circulating supply (498.8 million tokens, representing 49.88% of max supply)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and platform interaction on Base network

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding trading needs

- Security Considerations: Verify contract address (0xd85EFF20288ca72eA9eEcFFb428F89EE5066CA5C on Base) before transactions, enable two-factor authentication, and never share private keys

V. ISK Potential Risks and Challenges

ISK Market Risks

- Low Liquidity: With only $20,056.70 in 24-hour trading volume and 267 holders, the token faces significant liquidity constraints that may impact execution of larger orders

- Price Volatility: The token has experienced substantial volatility, declining 93.4% over the past year from its all-time high of $0.619073 in September 2022

- Limited Exchange Availability: Currently listed on only 3 exchanges, which may restrict trading options and price discovery mechanisms

ISK Regulatory Risks

- Gaming Token Classification: Regulatory uncertainty surrounding blockchain gaming tokens and their classification across different jurisdictions

- NFT and Virtual Asset Regulations: Evolving regulatory frameworks for in-game assets and NFT trading may impact Iskra's platform operations

- Cross-Border Compliance: The platform's global nature may face challenges with varying regulatory requirements across different regions

ISK Technical Risks

- Smart Contract Dependencies: The token operates on Base network, and any vulnerabilities or network issues could affect functionality

- Platform Development Risk: Success depends on Iskra's ability to attract quality game studios and maintain an engaged player community

- Market Cap Concentration: With a relatively small market cap of $473,857 and market share of 0.000039%, the token is susceptible to significant price movements from individual transactions

VI. Conclusion and Action Recommendations

ISK Investment Value Assessment

ISKRA Token presents an opportunity within the blockchain gaming sector, serving as the utility token for a platform connecting gamers and game studios. However, the investment carries substantial risk, evidenced by the 93.4% decline from its all-time high and current trading near historical lows. The token's long-term value proposition depends on Iskra's ability to execute its vision of becoming a thriving blockchain gaming hub, attract quality game projects through its Launchpad, and grow its user community. Short-term risks include low liquidity, limited exchange availability, and ongoing market volatility in both the broader crypto market and GameFi sector.

ISK Investment Recommendations

✅ Beginners: Exercise extreme caution. If interested in blockchain gaming exposure, start with minimal allocation (under 1% of crypto portfolio) and thoroughly research the Iskra platform and its ecosystem development before investing

✅ Experienced Investors: Consider ISK as a speculative position within a diversified GameFi portfolio. Monitor platform metrics including new game launches, user growth, and trading volume trends. Implement strict position sizing and stop-loss strategies

✅ Institutional Investors: Conduct comprehensive due diligence on Iskra's business model, team, partnerships, and competitive positioning within the blockchain gaming landscape. Assess liquidity constraints for larger positions and potential impact on price execution

ISK Trading Participation Methods

- Spot Trading: Purchase ISK tokens directly on Gate.com and other supporting exchanges with available trading pairs

- Platform Participation: Engage with the Iskra ecosystem by exploring blockchain games, joining community activities, and utilizing the platform's Launchpad for new game project opportunities

- Wallet Storage: Transfer tokens to Gate Web3 Wallet for secure self-custody and direct interaction with Base network applications

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What are the main factors affecting ISK(Icelandic Króna)price predictions?

ISK price is primarily influenced by Iceland's economic health, monetary policy decisions, interest rate changes, international trade flows, market sentiment, and geopolitical factors affecting Nordic economies.

How to use technical analysis methods to predict future price trends of ISK?

Analyze historical price data and candlestick charts to identify trends. Use tools like moving averages, RSI, and support/resistance levels. Monitor trading volume changes and chart patterns to determine entry and exit points for ISK price movements.

What is the long-term appreciation or depreciation trend of ISK relative to the Euro or US Dollar?

ISK shows a long-term depreciation trend against both the Euro and US Dollar. Over the past year, the USD/ISK exchange rate has fluctuated significantly, with ISK depreciating approximately 12.35% against the US Dollar, indicating continued weakness in the Icelandic currency.

2024-2025年ISK价格预测的经济学家观点如何?

Economists predict ISK will experience moderate appreciation in 2024-2025, driven by Iceland's stable energy sector and tourism recovery. Market sentiment remains cautiously optimistic, though external factors like global interest rate trends warrant monitoring. Experts recommend steady portfolio positioning to capture potential gains.

What is the relationship between ISK price fluctuations and Iceland's economic indicators such as inflation rate and interest rate?

ISK price is directly influenced by Iceland's inflation and interest rates. Higher inflation or lower rates typically weaken ISK, while rising rates support currency strength. These macroeconomic indicators significantly impact ISK market performance.

How should people planning to visit Iceland or trade ISK utilize price prediction information to make decisions?

Monitor real-time ISK price trends and market sentiment to time your trades or currency exchanges effectively. Use price predictions to identify optimal entry points, anticipate market movements, and maximize value when converting to or from ISK based on forecasted trends.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Comprehensive Guide to Coffeezilla: Crypto's Leading Fraud Investigator

Comprehensive Guide to Quantitative Analysis

7 Ideas for Beginners To Create Digital Art

What Is an Airdrop in Cryptocurrency?

![How to Create Tokens on Base Blockchain Without Programming [No-Code Guide]](https://gimg.staticimgs.com/learn/31a024cb83a1a5b0a9847d4ebb6be5b3b64d4d47.png)

How to Create Tokens on Base Blockchain Without Programming [No-Code Guide]