2026 LVVA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: LVVA's Market Position and Investment Value

Levva Protocol Token (LVVA) serves as an innovative crypto asset in the decentralized custody protocol sector, having launched in early 2025. Since its inception, the token has established itself within the keychain aggregation infrastructure space. As of February 2026, LVVA maintains a market capitalization of approximately $965,625, with a circulating supply of around 1.25 billion tokens, and trades at approximately $0.0007725. This asset, designed to facilitate modular permissionless custody solutions, is playing an increasingly relevant role in the key management and application connectivity ecosystem.

This article will comprehensively analyze LVVA's price trajectory from 2026 through 2031, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasting and practical investment strategies.

I. LVVA Price History Review and Market Status

LVVA Historical Price Evolution Trajectory

- 2025: Token launched in January, price reached 0.016799 in mid-March representing the highest level since inception

- 2026: Market entered correction phase in early February, price declined to 0.0007078 marking a significant retracement from previous highs

LVVA Current Market Dynamics

As of February 03, 2026, LVVA is trading at 0.0007725, showing a 7.42% increase over the past 24 hours with trading volume reaching 51,881.57. The token has experienced volatility across different timeframes, with a 1.40% gain in the last hour, while facing a 21.24% decline over the past 7 days and a 48.1% decrease over the 30-day period.

The current market capitalization stands at 965,625 with 1,250,000,000 tokens in circulation out of a total supply of 2,000,000,000, representing a 62.5% circulation ratio. The fully diluted market cap is valued at 1,545,000. The token's market share currently represents 0.000056% of the overall cryptocurrency market.

LVVA maintains a presence across 6 exchanges and has attracted 2,005 holders. The current market sentiment index indicates a reading of 1, reflecting cautious positioning among market participants. The token operates on the ERC-20 standard and is deployed on the Ethereum network at contract address 0x6243558a24cc6116abe751f27e6d7ede50abfc76.

Click to view current LVVA market price

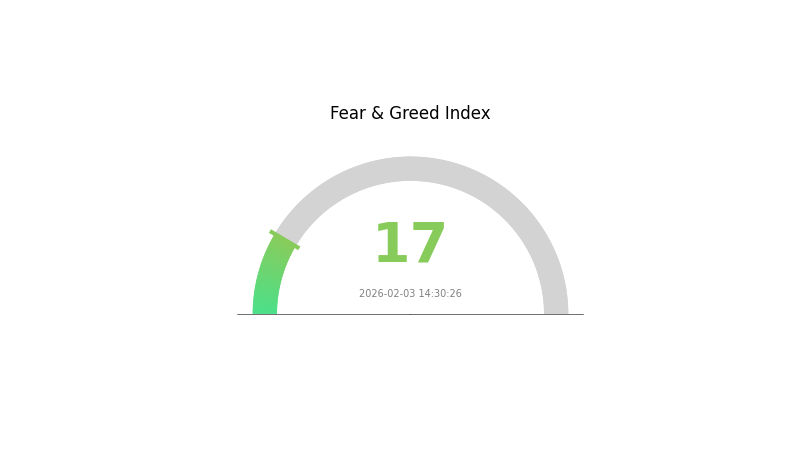

LVVA Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 17. This historically low reading suggests significant market pessimism and widespread investor anxiety. During such periods, risk-averse investors may consider defensive strategies, while contrarian traders might see potential buying opportunities. Market volatility is likely elevated, and investors should exercise caution with position sizing. Monitor key support levels and market catalysts closely, as extreme fear conditions often precede potential market reversals or consolidation phases.

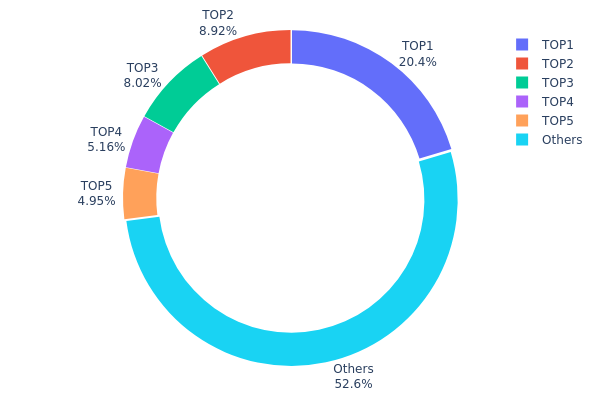

LVVA Holding Distribution

The holding distribution chart represents the allocation of token holdings across different wallet addresses, providing insights into the concentration of asset ownership within the network. This metric is crucial for evaluating decentralization levels and identifying potential risks associated with concentrated holdings that could impact market dynamics.

According to the current data, LVVA exhibits a moderately concentrated holding structure. The top address controls 324,084.75K tokens, representing 20.38% of the total supply, while the top five addresses collectively hold 754,120.32K tokens, accounting for 47.40% of the circulating supply. The remaining 52.6% is distributed among other addresses. This distribution pattern indicates that while there is a notable concentration among major holders, the token maintains a reasonable degree of dispersion across the broader holder base.

This holding concentration level presents both opportunities and risks. On one hand, the presence of large holders suggests strong conviction from institutional or strategic investors, which can provide price stability during volatile market conditions. On the other hand, the significant holdings concentrated in the top addresses create potential vulnerabilities to price manipulation and increased volatility should these major holders decide to liquidate their positions. The 52.6% held by smaller addresses demonstrates some level of community participation, but the combined influence of the top five addresses remains substantial enough to impact market sentiment and liquidity dynamics significantly.

Click to view current LVVA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa023...fc947e | 324084.75K | 20.38% |

| 2 | 0x6d1f...9e230e | 141783.58K | 8.91% |

| 3 | 0xcffa...290703 | 127523.66K | 8.01% |

| 4 | 0x9642...2f5d4e | 81979.12K | 5.15% |

| 5 | 0x2014...27cbd7 | 78749.21K | 4.95% |

| - | Others | 835975.84K | 52.6% |

II. Core Factors Influencing LVVA's Future Price

Market Sentiment and News Impact

- Investor Confidence: Market sentiment plays a direct role in LVVA price movements. Positive news regarding widespread adoption or significant technological breakthroughs tends to drive price increases.

- News Sensitivity: The cryptocurrency market exhibits high sensitivity to news events. Global news, supply-demand dynamics, and market activity continuously influence LVVA's price, potentially causing fluctuations within seconds, particularly during periods of high volatility.

- Market Psychology: Investor emotions and confidence directly affect LVVA's trading patterns and price trajectory.

Regulatory Environment and Legal Clarity

- Government Oversight: The regulatory environment in major cryptocurrency markets plays a crucial role in LVVA's market performance.

- Legal Framework: Clarity in regulatory policies and legal frameworks significantly impacts investor confidence and market stability.

- Compliance Requirements: Changes in regulatory requirements across different jurisdictions may influence LVVA's accessibility and adoption rates.

Supply and Demand Dynamics

- Market Activity: Continuous fluctuations in supply and demand relationships affect LVVA's exchange rates against various fiat currencies.

- Trading Volume: Market activity levels contribute to price volatility, with higher trading volumes often correlating with increased price movement.

- Liquidity Factors: The availability of LVVA across trading platforms influences price stability and market depth.

III. 2026-2031 LVVA Price Prediction

2026 Outlook

- Conservative prediction: $0.00059 - $0.00077

- Neutral prediction: $0.00077 average price level

- Optimistic prediction: $0.00082 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token may experience a gradual recovery phase with moderate volatility, as indicated by projected price fluctuations ranging from 2% to 27% year-over-year changes.

- Price range predictions:

- 2027: $0.00046 - $0.00113

- 2028: $0.00049 - $0.00101

- 2029: $0.00092 - $0.00131

- Key catalysts: Market adoption momentum and ecosystem development could drive price appreciation, with 2029 potentially showing a 27% change compared to the previous period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00069 - $0.00115 (assuming steady market growth and maintained project fundamentals)

- Optimistic scenario: $0.00134 - $0.00155 (assuming accelerated adoption and favorable regulatory environment)

- Transformational scenario: Potential to reach $0.00155 by 2031 (contingent upon significant ecosystem expansion and sustained market momentum with a projected 73% change)

- February 3, 2026: LVVA trading within $0.00059 - $0.00082 range (early-stage market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00082 | 0.00077 | 0.00059 | 0 |

| 2027 | 0.00113 | 0.00079 | 0.00046 | 2 |

| 2028 | 0.00101 | 0.00096 | 0.00049 | 24 |

| 2029 | 0.00131 | 0.00098 | 0.00092 | 27 |

| 2030 | 0.00153 | 0.00115 | 0.00069 | 48 |

| 2031 | 0.00155 | 0.00134 | 0.00094 | 73 |

IV. LVVA Professional Investment Strategies and Risk Management

LVVA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts interested in decentralized custody solutions and keychain aggregation technology

- Operational Recommendations:

- Consider accumulating positions during market corrections, given the token's 48.1% decline over the past 30 days

- Monitor protocol development milestones and adoption metrics within the Open Custody Protocol ecosystem

- Implement secure storage through Gate Web3 Wallet to maintain control of private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $51,881 to identify liquidity trends and potential breakout signals

- Support and Resistance Levels: Track the recent low of $0.0007078 and 24-hour high of $0.0007975 to establish trading ranges

- Swing Trading Key Points:

- Given the 7-day decline of 21.24%, consider short-term rebounds within the established trading range

- Set stop-loss orders below the all-time low of $0.0007078 to manage downside risk

LVVA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation, focusing on established crypto assets with LVVA as a minor speculative position

- Aggressive Investors: 5-10% allocation, with recognition of the token's volatility and early-stage nature

- Professional Investors: Up to 15% allocation, with active monitoring of protocol development and market conditions

(2) Risk Hedging Solutions

- Diversification Approach: Balance LVVA holdings with other DeFi infrastructure tokens to reduce concentration risk

- Position Sizing Strategy: Scale into positions gradually rather than deploying capital all at once, given the 48.1% monthly decline

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet provides convenient access for active traders while maintaining custody of ERC-20 tokens

- Hardware Wallet Solution: For long-term holdings, consider transferring LVVA tokens to hardware storage for enhanced security

- Security Considerations: Always verify contract address (0x6243558a24cc6116abe751f27e6d7ede50abfc76) before transactions and be cautious of phishing attempts

V. LVVA Potential Risks and Challenges

LVVA Market Risks

- High Volatility: The token has experienced a decline from its all-time high of $0.016799 to current levels around $0.0007725, representing a substantial drawdown

- Limited Liquidity: With a 24-hour trading volume of approximately $51,881 and listing on 6 exchanges, liquidity constraints may impact larger trades

- Market Cap Dynamics: With a circulating market cap of $965,625 and ranking at 2532, the token has limited market presence and may face challenges in attracting institutional capital

LVVA Regulatory Risks

- Custody Protocol Scrutiny: As regulations around digital asset custody evolve globally, protocols facilitating keychain aggregation may face increased compliance requirements

- Cross-jurisdictional Compliance: The permissionless nature of the Open Custody Protocol may encounter regulatory challenges in jurisdictions with strict custody licensing frameworks

- Token Classification Uncertainty: Regulatory clarity regarding utility tokens associated with custody infrastructure remains evolving across different markets

LVVA Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token deployed on Ethereum, LVVA is subject to potential smart contract bugs or exploits within the protocol

- Protocol Integration Complexity: The keychain aggregation mechanism involves coordination across multiple key management protocols, creating potential technical failure points

- Network Dependency: LVVA operations rely on Ethereum network performance, exposing holders to potential congestion, high gas fees, or network-level issues

VI. Conclusion and Action Recommendations

LVVA Investment Value Assessment

LVVA represents an emerging approach to solving keychain aggregation challenges in the decentralized custody space. The protocol's innovative relayer mechanism addresses a genuine infrastructure need within the Web3 ecosystem. However, the token currently faces considerable headwinds, including a 48.1% monthly price decline, limited market capitalization of approximately $965,625, and relatively constrained liquidity. The circulating supply of 1.25 billion tokens represents 62.5% of the maximum supply of 2 billion tokens, suggesting moderate tokenomics inflation risk. While the long-term value proposition centers on adoption of the Open Custody Protocol's keychain aggregation technology, short-term risks include continued price volatility, limited exchange listings, and the need for broader market validation of the protocol's utility.

LVVA Investment Recommendations

✅ Beginners: Allocate no more than 1-2% of crypto portfolio to LVVA, prioritize education on custody solutions and DeFi infrastructure, and utilize Gate Web3 Wallet for secure storage ✅ Experienced Investors: Consider LVVA as a speculative position within a diversified DeFi infrastructure portfolio, monitor protocol adoption metrics, and employ risk management through position sizing and stop-loss orders ✅ Institutional Investors: Conduct thorough due diligence on the Open Custody Protocol's technical architecture and market fit, assess liquidity constraints relative to position size requirements, and evaluate regulatory implications for custody-related tokens

LVVA Trading Participation Methods

- Spot Trading: Purchase LVVA directly through Gate.com and other supporting exchanges with ERC-20 token compatibility

- Dollar-Cost Averaging: Implement systematic purchase plans to smooth out price volatility, particularly given recent market weakness

- Staking and Protocol Participation: Explore opportunities to engage with the Open Custody Protocol ecosystem through available participation mechanisms

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

LVVA的历史价格表现如何?

LVVA has demonstrated strong momentum in recent trading periods, with consistent volume growth and positive price trajectory. The token shows healthy market interest and trading activity, positioning it favorably among emerging digital assets in the cryptocurrency market.

What is the price prediction for LVVA in the next month/year?

LVVA is expected to experience significant growth in the long term, driven by increasing market adoption and protocol development. Short-term prices may fluctuate due to market volatility, while the one-year outlook suggests potential upside as the ecosystem matures and user base expands.

What are the main factors affecting LVVA price?

LVVA price is primarily influenced by market sentiment and news, regulatory environment and policy changes, trading volume and liquidity, overall crypto market trends, and technological developments of the protocol.

What are the advantages of LVVA compared to other mainstream cryptocurrencies?

LVVA offers faster transaction speed and lower fees tailored for creative industry digital asset management. It excels in scalability and user experience compared to other mainstream cryptocurrencies.

What is LVVA's market liquidity and trading volume like?

LVVA demonstrates strong market liquidity and high trading volume. The token attracts significant trading activity from investors, with robust liquidity across major trading pairs, ensuring efficient price discovery and smooth transactions for traders.

What are the risks to pay attention to when investing in LVVA?

LVVA investment carries market volatility, regulatory uncertainty, and technical security risks. Price fluctuations and potential network vulnerabilities require careful consideration.

What is LVVA's technical foundation and team background?

LVVA is built on AI-driven DeFi portfolio management technology. The core team comprises experts with backgrounds in fintech and artificial intelligence, dedicated to creating innovative financial solutions for decentralized finance.

Where can LVVA be traded?

LVVA is available for trading on major cryptocurrency exchanges. The token supports LVVA/USDT trading pairs, allowing users to buy and sell with ease. Check the official LVVA website or major exchange platforms for current trading availability and real-time pricing information.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How to Trade Cryptocurrency: A Step-by-Step Guide

Top 6 AI-Driven Cryptocurrencies: Which Tokens Can You Buy in Japan and How to Purchase Them

Bitcoin Halving Overview | Has the Price Cycle Run Its Course?

Top 5 Cryptocurrency Trading Platforms!

Understanding PoS in Cryptocurrency: A Beginner’s Guide to Proof-of-Stake