2026 MOTHER Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: MOTHER's Market Position and Investment Value

MOTHER IGGY (MOTHER), as a meme coin operating on the Solana blockchain, has established its presence in the cryptocurrency market since its launch in 2024. As of February 2026, MOTHER maintains a market capitalization of approximately $1.35 million, with a circulating supply of around 965.35 million tokens, and the price hovering around $0.0014. This Solana-based meme asset represents an emerging category within the broader crypto ecosystem, attracting attention from a community of over 25,000 holders.

This article will comprehensively analyze MOTHER's price trajectory from 2026 to 2031, examining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. MOTHER Price History Review and Market Status

MOTHER Historical Price Evolution Trajectory

- 2024: MOTHER token was launched in May 2024 with an initial price of $0.0184, experiencing significant volatility in its early trading phase

- 2024: In June 2024, the token reached a notable price level of $0.2266 on June 12th, marking a substantial increase from its launch price

- 2024-2026: Following the peak in mid-2024, the price entered a prolonged correction phase, declining from the June high of $0.2266 to $0.00122 by January 2026

MOTHER Current Market Situation

As of February 2, 2026, MOTHER is trading at $0.0014, representing a modest recovery from its recent low point. The token has shown a slight positive movement of 0.07% over the past 24 hours and 0.71% in the last hour, though it remains under pressure with a 26.41% decline over the past 7 days.

The market capitalization stands at approximately $1.35 million, with a circulating supply of 965.35 million tokens representing 97.51% of the maximum supply of 989.99 million tokens. The 24-hour trading volume is $15,074.19, indicating relatively modest market activity.

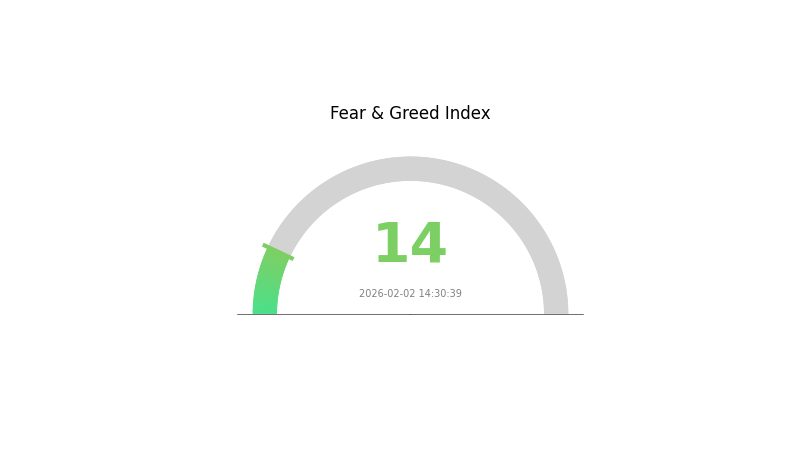

The token's fully diluted market cap is $1.39 million, closely aligned with its current market capitalization due to the high circulation ratio. With 25,266 holders and availability on 4 exchanges, MOTHER maintains a presence in the market despite the challenging price environment. The current market sentiment indicator shows a reading of 14, reflecting extreme fear conditions in the broader cryptocurrency market.

Click to view the current MOTHER market price

MOTHER Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 14. This exceptionally low reading indicates intense market pessimism and panic selling among investors. Such extreme fear often presents contrarian opportunities, as historical data suggests markets tend to recover following periods of maximum fear. Investors should exercise caution while monitoring for potential entry points. Risk management remains critical during high volatility periods. Consider diversifying your portfolio and avoiding emotional trading decisions during market downturns.

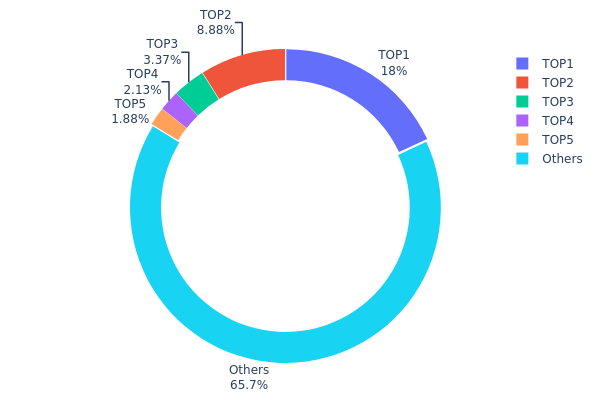

MOTHER Token Holding Distribution

The token holding distribution chart reflects the allocation of MOTHER tokens across different wallet addresses, serving as a crucial indicator of decentralization and potential market manipulation risks. According to the latest on-chain data, the top holder controls approximately 174.24 million tokens, accounting for 18.04% of the total supply, while the second-largest address holds 85.75 million tokens (8.88%). The top five addresses collectively hold 331.12 million tokens, representing 34.27% of the total supply, with the remaining 634.23 million tokens (65.73%) distributed among other addresses.

This distribution pattern reveals moderate concentration characteristics in MOTHER's holding structure. While the top holder's 18.04% stake represents a significant concentration, it remains below the concerning threshold of 30-40% typically associated with severe centralization risks. The relatively even distribution among the top five holders, with no single entity controlling more than 20%, suggests a more balanced governance structure compared to many newly launched tokens. However, the fact that the top five addresses control over one-third of the circulating supply still poses potential risks for coordinated selling pressure or market manipulation activities.

From a market structure perspective, this holding distribution indicates a relatively healthy degree of decentralization, which could contribute to improved liquidity and reduced volatility risks. The 65.73% token allocation among numerous smaller addresses demonstrates meaningful community participation and broader token distribution. This pattern typically correlates with more stable price action and reduced susceptibility to single-entity manipulation, though investors should remain vigilant regarding potential coordinated actions by major holders during periods of market stress.

Click to view current MOTHER Token Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 174237.98K | 18.04% |

| 2 | DMe3dd...x4vGH3 | 85746.05K | 8.88% |

| 3 | Cw32Ny...YLwZeh | 32509.75K | 3.36% |

| 4 | C57RBa...B6uu1B | 20514.74K | 2.12% |

| 5 | 5PAhQi...cnPRj5 | 18110.83K | 1.87% |

| - | Others | 634231.31K | 65.73% |

II. Core Factors Influencing MOTHER's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Employment data serves as a significant catalyst for market direction. Weak employment reports could reverse the strengthening trend of the US dollar, potentially triggering renewed buying interest in the market.

- Inflation Hedging Attributes: Despite short-term selling pressure, the core appeal as a safe-haven asset remains intact, with geopolitical uncertainties and macroeconomic factors continuing to support potential rebounds.

- Geopolitical Factors: Geopolitical uncertainties represent a key driver for market movements. Global political instability continues to influence investor sentiment and asset allocation decisions.

III. 2026-2031 MOTHER Price Prediction

2026 Outlook

- Conservative forecast: $0.00079 - $0.00140

- Neutral forecast: $0.00140 (average price level)

- Optimistic forecast: $0.00156 (requires favorable market conditions and increased trading volume)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with moderate volatility, as the token seeks to establish stronger market presence and community engagement

- Price range forecast:

- 2027: $0.00078 - $0.00219

- 2028: $0.00173 - $0.00193

- 2029: $0.00166 - $0.00263

- Key catalysts: Enhanced adoption rates, potential ecosystem developments, and broader cryptocurrency market trends could serve as primary drivers for price appreciation during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00178 - $0.00226 (assuming steady market conditions and consistent project development)

- Optimistic scenario: $0.00260 - $0.00293 (contingent on significant technological advancements and increased mainstream adoption)

- Transformational scenario: $0.00384 (requires exceptional market conditions, major partnership announcements, and substantial ecosystem expansion)

- February 2, 2026: MOTHER trading within early prediction parameters, establishing foundation for potential multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00156 | 0.0014 | 0.00079 | 0 |

| 2027 | 0.00219 | 0.00148 | 0.00078 | 5 |

| 2028 | 0.00193 | 0.00184 | 0.00173 | 31 |

| 2029 | 0.00263 | 0.00188 | 0.00166 | 34 |

| 2030 | 0.00293 | 0.00226 | 0.00178 | 61 |

| 2031 | 0.00384 | 0.0026 | 0.00215 | 85 |

IV. MOTHER Professional Investment Strategy and Risk Management

MOTHER Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Investors with high risk tolerance and understanding of meme coin volatility

- Operation Recommendations:

- Consider dollar-cost averaging (DCA) approach to mitigate entry timing risk

- Monitor Solana ecosystem developments and meme coin market sentiment shifts

- Implement strict position sizing, limiting MOTHER allocation to speculative portfolio portion

- Storage Solution: Utilize Gate Web3 Wallet for secure, self-custodial storage with Solana network compatibility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Profile Analysis: Track the 24H trading volume ($15,074) against historical patterns to identify liquidity zones

- Support/Resistance Levels: Monitor the 24H range ($0.001284-$0.001438) and historical low ($0.00122) as key technical levels

- Swing Trading Key Points:

- Given high volatility (-26.41% over 7 days), establish predetermined profit-taking and stop-loss levels

- Monitor holder count (25,266) trends as indicator of community engagement shifts

MOTHER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of total crypto portfolio

- Aggressive Investors: 2-5% of total crypto portfolio

- Professional Traders: Up to 5-10% with active risk management protocols

(2) Risk Hedging Solutions

- Diversification Strategy: Balance MOTHER exposure with major crypto assets (BTC, ETH) and other Solana ecosystem tokens

- Position Sizing with Volatility Adjustment: Scale positions inversely to recent volatility metrics (current 7D: -26.41%)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking access

- Security Best Practices: Enable two-factor authentication, verify contract address (3S8qX1MsMqRbiwKg2cQyx7nis1oHMgaCuc9c4VfvVdPN) before transactions, avoid sharing private keys

V. MOTHER Potential Risks and Challenges

MOTHER Market Risks

- Meme Coin Volatility: Historical data shows 85.72% decline from peak, indicating susceptibility to sentiment-driven price swings

- Limited Exchange Availability: Currently listed on 4 exchanges, potentially constraining liquidity during high-volatility periods

- Market Cap Concentration: With $1.35M market capitalization, MOTHER remains vulnerable to whale movements and low market depth

MOTHER Regulatory Risks

- Evolving Meme Token Regulations: Increasing global scrutiny on speculative tokens may impact accessibility and trading conditions

- Platform Compliance Requirements: Potential delisting risks if regulatory frameworks tighten for meme-category assets

- Tax Reporting Obligations: Varied jurisdictional treatment of meme coins may create compliance complexity for investors

MOTHER Technical Risks

- Solana Network Dependencies: Performance subject to Solana blockchain congestion and potential network outages

- Smart Contract Risk: Token contract (3S8qX1MsMqRbiwKg2cQyx7nis1oHMgaCuc9c4VfvVdPN) vulnerabilities could expose holders to technical exploits

- Liquidity Risk: Circulating supply of 965.35M tokens (97.51% of max supply) may experience slippage during large transactions

VI. Conclusion and Action Recommendations

MOTHER Investment Value Assessment

MOTHER represents a high-risk, speculative meme token within the Solana ecosystem. The token has experienced significant volatility, declining 85.72% from its all-time high of $0.2266 reached in June 2024. Current market conditions show 26.41% weekly decline and limited exchange presence, suggesting cautious approach. Long-term value proposition depends heavily on sustained community engagement (currently 25,266 holders) and broader meme coin market trends. Short-term risks include continued price depreciation, low liquidity environment, and meme cycle volatility.

MOTHER Investment Recommendations

✅ Beginners: Consider avoiding or limiting exposure to under 1% of total portfolio; prioritize education on meme token mechanics before participation ✅ Experienced Investors: Allocate 1-3% for tactical trading opportunities; implement strict stop-losses given recent downtrend (-26.41% 7D) ✅ Institutional Investors: Exercise caution due to limited liquidity ($15,074 24H volume) and high volatility profile; suitable only for speculative allocation strategies

MOTHER Trading Participation Methods

- Spot Trading: Access MOTHER/USDT pairs on Gate.com with competitive trading fees and advanced order types

- Wallet Integration: Utilize Gate Web3 Wallet for direct Solana DEX access and self-custodial management

- Portfolio Tracking: Monitor real-time price movements, holder trends, and market sentiment indicators through Gate.com analytics tools

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MOTHER token and what are its practical use cases?

MOTHER is a cryptocurrency token designed to power decentralized applications and blockchain ecosystems. Its practical use cases include governance participation, transaction facilitation, platform rewards, and community incentive mechanisms within its network ecosystem.

What is MOTHER's historical price performance and what is the percentage change over the past year?

MOTHER reached an all-time high of $0.24055675 and a low of $0.002996825. Over the past year, the price has declined by over 98%, reflecting significant market volatility in this cryptocurrency.

What are professional analysts' predictions for MOTHER's future price?

Professional analysts project MOTHER's price will experience significant growth in the coming years. Most analysts maintain an optimistic outlook, citing strong fundamentals and increasing market adoption. However, specific price targets vary among analysts based on different market scenarios and technical indicators.

What are the main factors affecting MOTHER price?

MOTHER price is primarily influenced by market supply and demand dynamics, trading volume, community adoption, tokenomics, and broader cryptocurrency market sentiment. Regulatory developments and macroeconomic conditions also play significant roles in price movements.

What risks should I pay attention to when investing in MOTHER tokens?

MOTHER token investments carry market volatility risk with potential value depreciation. Assess your financial capacity and risk tolerance carefully. Market uncertainty and regulatory changes may also impact returns. Conduct thorough research before investing.

What are the advantages and disadvantages of MOTHER compared to similar tokens?

MOTHER offers rapid token acquisition with substantial rewards earned in approximately 15 minutes. However, alternative tokens may provide more diversified reward mechanisms and extended earning cycles, offering different strategic benefits for long-term holders.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

What Are Nodes?

Best Crypto Credit Cards in Recent Years

7 Essential Indicators for Beginner Traders

Top 9 AI Tools for Exchange Trading: Software and Trading Bots

What is mobile mining, and can you make money with it?