2026 PDEX Price Prediction: Expert Analysis and Market Forecast for Polkadex Token's Future Value

Introduction: PDEX Market Position and Investment Value

Polkadex (PDEX), positioned as an open-source decentralized trading platform built on the Substrate blockchain framework, has been evolving since its launch in 2021. By 2026, PDEX maintains a market capitalization of approximately $198,286, with a circulating supply of around 7.46 million tokens and a current price hovering near $0.02658. This asset, known for its "order book-based DEX with centralized exchange user experience," is playing an increasingly important role in the decentralized finance trading infrastructure space.

This article will comprehensively analyze PDEX's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PDEX Price History Review and Market Status

PDEX Historical Price Evolution Trajectory

- 2021: PDEX reached its all-time high of $39.38 on May 16, marking a significant milestone in its early trading history

- 2026: The token experienced substantial downward pressure, with price declining to its all-time low of $0.01842911 on February 4

PDEX Current Market Status

As of February 8, 2026, PDEX is trading at $0.02658, showing mixed short-term performance across different timeframes. Over the past hour, the token has gained 0.0029%, with a modest increase of approximately $0.00000077. Within the 24-hour period, PDEX has declined by 10.26%, corresponding to a decrease of about $0.00304.

Looking at the weekly perspective, PDEX has demonstrated a recovery with a 5.27% increase over the past 7 days, adding approximately $0.00133 to its value. However, the broader trend remains challenging, with the token down 31.75% over the past 30 days and showing a significant 79.79% decline over the one-year period.

The 24-hour trading range has been between $0.02556 and $0.02962, indicating moderate intraday volatility. Trading volume for the period stands at $8,039.36, with the current market capitalization at $198,286.80. The circulating supply represents 7,460,000 PDEX tokens out of a maximum supply of 20,000,000, resulting in a circulation ratio of 37.3%. The fully diluted market cap matches the current market capitalization at $198,286.80, reflecting the relationship between circulating and total supply.

Polkadex currently ranks #3966 in the cryptocurrency market, with a market dominance of 0.0000078%. The project has attracted 4,258 token holders and is listed on 2 exchanges, including Gate.com.

Click to check the current PDEX market price

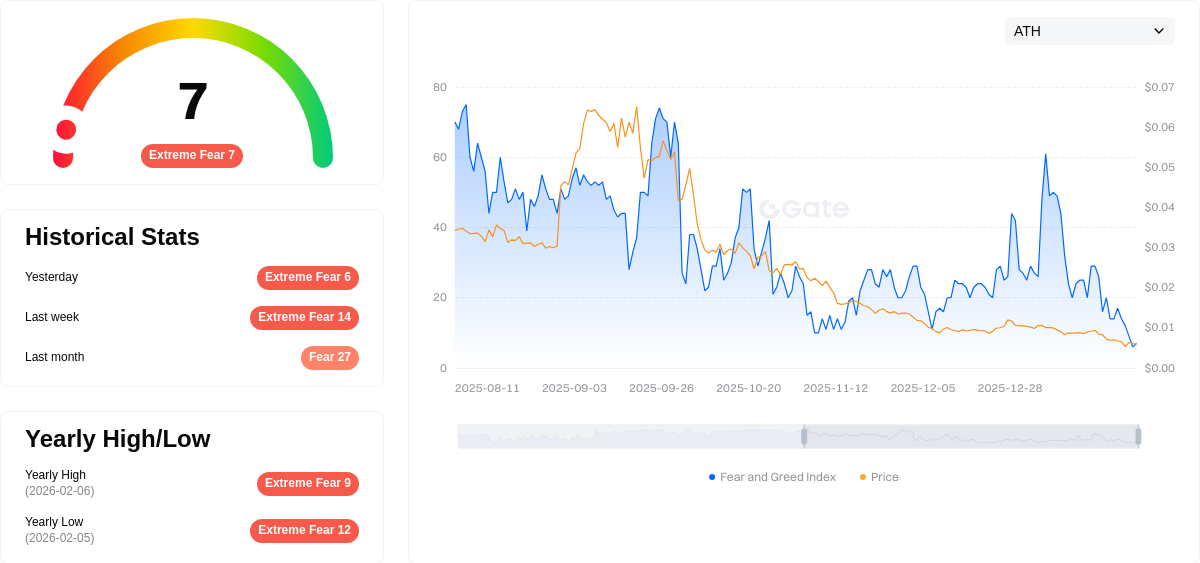

PDEX Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching 7. This indicates strong bearish sentiment and significant risk aversion among investors. Market participants are showing heightened caution, with selling pressure potentially outweighing buying interest. Such extreme fear conditions often create opportunities for contrarian investors, as panic-driven price declines may present attractive entry points for long-term participants. However, traders should remain vigilant regarding market volatility during this period of intense negative sentiment.

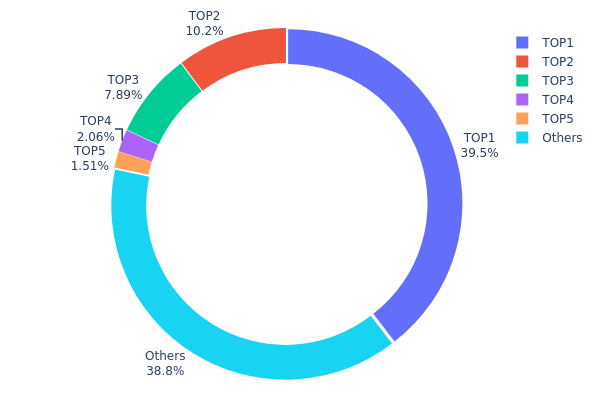

PDEX Holding Distribution

The holding distribution chart illustrates the allocation of PDEX tokens across different wallet addresses, providing insights into the concentration level and decentralization characteristics of token ownership. By analyzing the distribution pattern among top holders and the broader community, this metric serves as a crucial indicator for assessing market structure stability and potential manipulation risks.

Based on the current data, PDEX exhibits a moderately concentrated holding structure. The top address controls approximately 39.54% of the total supply with 1.242 million tokens, while the top 5 addresses collectively hold 61.2% of the circulating supply. The remaining 38.8% is distributed among other addresses, suggesting a relatively limited level of decentralization. This concentration pattern indicates that a small number of major holders possess significant influence over market dynamics, which could potentially amplify price volatility during large-scale trading activities or coordinated selling pressure.

The current holding distribution presents both opportunities and considerations for market participants. On one hand, the substantial holdings by top addresses may reflect strong confidence from early investors or institutional participants, potentially providing price support during market downturns. On the other hand, the concentration risk cannot be overlooked, as coordinated actions by major holders could trigger significant price movements and increase market uncertainty. The distribution structure suggests that PDEX is still in a relatively early stage of ecosystem development, where broader token distribution and enhanced decentralization remain important goals for long-term sustainability and market maturity.

Click to view current PDEX Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3737...373737 | 1242.40K | 39.54% |

| 2 | 0x30f1...4561ad | 321.23K | 10.22% |

| 3 | 0xbb36...03b65d | 247.86K | 7.88% |

| 4 | 0x0d07...b492fe | 64.65K | 2.05% |

| 5 | 0xaa3e...708eae | 47.50K | 1.51% |

| - | Others | 1218.18K | 38.8% |

II. Core Factors Influencing PDEX Future Price

Market Sentiment and Adoption

- Investor Confidence: Market sentiment and investor confidence have a direct impact on PDEX price movements. Positive news regarding widespread adoption or significant technological breakthroughs in PDEX tends to boost price momentum.

- Adoption Rate: The rate at which PDEX is being adopted plays a crucial role in determining its future value trajectory. Increased usage and integration into various platforms can contribute to upward price pressure.

Regulatory Environment

- Regulatory Changes: Shifts in regulatory frameworks across different jurisdictions can significantly affect PDEX price dynamics. Clear and favorable regulations may encourage institutional participation and broader market acceptance.

- Policy Developments: Government and regulatory bodies' trade, fiscal, financial, and foreign exchange control programs and policies can influence price volatility and market stability.

Macroeconomic Environment

- Interest Rates: Changes in interest rates can impact the attractiveness of cryptocurrency investments relative to traditional assets, thereby affecting PDEX demand and pricing.

- Supply and Demand Dynamics: Fundamental shifts in supply-demand relationships remain key drivers of price fluctuations in the cryptocurrency market.

External Market Conditions

- Overall Crypto Market Trends: The broader cryptocurrency market's fundamental trends and overall sentiment can influence PDEX performance, as correlations with major digital assets often exist.

- External Factors: Various external factors beyond direct control, including macroeconomic conditions and global market sentiment, can impact PDEX's actual performance and valuation.

III. 2026-2031 PDEX Price Forecast

2026 Outlook

- Conservative estimate: $0.01462 - $0.02658

- Neutral estimate: $0.02658

- Optimistic estimate: $0.03695 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market phase expectation: The token may enter a gradual growth phase as the project matures and expands its user base

- Price range forecast:

- 2027: $0.01969 - $0.04193

- 2028: $0.02727 - $0.05121

- 2029: $0.04139 - $0.06516

- Key catalysts: Platform development progress, partnership announcements, and broader cryptocurrency market trends could serve as primary drivers for price appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.02839 - $0.07589 (assuming steady ecosystem development and stable market conditions)

- Optimistic scenario: $0.05546 - $0.0796 (contingent upon significant technological breakthroughs and mainstream adoption)

- Transformative scenario: Values approaching or exceeding $0.0796 (requiring exceptional market conditions, widespread institutional adoption, and substantial ecosystem expansion)

- February 8, 2026: PDEX trading at current levels (early stage of predicted growth cycle)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.03695 | 0.02658 | 0.01462 | 0 |

| 2027 | 0.04193 | 0.03176 | 0.01969 | 19 |

| 2028 | 0.05121 | 0.03685 | 0.02727 | 38 |

| 2029 | 0.06516 | 0.04403 | 0.04139 | 65 |

| 2030 | 0.07589 | 0.0546 | 0.02839 | 105 |

| 2031 | 0.0796 | 0.06524 | 0.05546 | 145 |

IV. PDEX Professional Investment Strategy and Risk Management

PDEX Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Investors who believe in the development potential of decentralized exchange infrastructure and are willing to hold for the long term

- Operational Recommendations:

- Consider accumulating positions when market sentiment is relatively low, avoiding chasing high prices

- Pay attention to the project's technical development progress and ecosystem construction dynamics

- Storage Solution: It is recommended to use Gate Web3 Wallet for secure custody, regularly back up private keys and mnemonic phrases

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average System: Use the 20-day and 50-day moving averages to identify medium to long-term trends

- Volume Analysis: Observe the relationship between volume and price changes to determine the reliability of market movements

- Key Points for Swing Trading:

- Set reasonable stop-loss levels, it is recommended to control single loss within 5-10%

- Pay attention to the daily price volatility range (historical 24H range reference: $0.02556 - $0.02962)

PDEX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Suggested allocation not exceeding 1-2% of total assets

- Aggressive Investors: Suggested allocation 3-5% of total assets

- Professional Investors: Can flexibly adjust allocation ratio based on market conditions and personal risk preference

(2) Risk Hedging Solutions

- Diversification Strategy: Do not concentrate funds in a single asset, diversify investment across different types of crypto assets

- Regular Rebalancing: Periodically review and adjust portfolio based on market changes

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet, convenient for daily trading and management

- Cold Storage Solution: For large holdings, consider using hardware wallets for offline storage

- Security Precautions: Never share private keys or mnemonic phrases, beware of phishing websites and scam links, enable two-factor authentication

V. PDEX Potential Risks and Challenges

PDEX Market Risks

- High Price Volatility: PDEX has experienced significant price fluctuations historically, with 24H volatility reaching over 10%, and 30-day decline of 31.75%

- Low Liquidity Risk: With a 24-hour trading volume of approximately $8,039, relatively low market liquidity may lead to difficulty executing large orders

- Market Capitalization Risk: With a current market cap of approximately $198,287 and ranking around 3966, it belongs to small-cap assets with higher investment risk

PDEX Regulatory Risks

- Uncertainty in Crypto Asset Regulation: Global regulatory policies for crypto assets are constantly evolving, which may impact PDEX's operations

- Compliance Pressure: Decentralized trading platforms may face compliance review requirements in certain jurisdictions

- Policy Change Risk: Adjustments in national policies regarding crypto assets may affect PDEX's market performance

PDEX Technical Risks

- Smart Contract Vulnerabilities: As a decentralized trading platform, any smart contract loopholes may lead to asset security issues

- Network Security Risk: Potential security threats such as DDoS attacks and hacking attempts

- Technical Upgrade Risk: Project development progress may not meet expectations, affecting ecosystem growth

VI. Conclusion and Action Recommendations

PDEX Investment Value Assessment

PDEX, as a decentralized trading platform based on Substrate framework, aims to provide users with a centralized exchange-like experience through order book functionality. However, the project currently faces significant market challenges. The price is far below its historical high, market capitalization is relatively small, and liquidity is limited. From a long-term perspective, the success of the project depends on the advancement of its technology development, ecosystem expansion, and user growth. From a short-term perspective, investors need to be highly vigilant about price volatility and liquidity risks.

PDEX Investment Recommendations

✅ Beginners: It is recommended to maintain a cautious attitude, start with a small allocation if interested, and avoid investing funds that cannot afford to be lost ✅ Experienced Investors: Can consider moderate allocation, but need to closely monitor project progress and market dynamics, and set strict stop-loss strategies ✅ Institutional Investors: It is recommended to conduct thorough due diligence, evaluate the project's technical strength, team background, and market prospects before making investment decisions

PDEX Trading Participation Methods

- Spot Trading: Purchase and hold PDEX tokens through Gate.com and other exchanges that support the asset

- Regular Investment Plan: Diversify investment risks by establishing fixed periodic purchase plans

- Risk Management: Always maintain reasonable position control, avoid over-concentration of funds, and set appropriate stop-loss and take-profit levels

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance, and it is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PDEX? What are its uses and functions?

PDEX is a leading manufacturer of powered surgical instruments designed for medical device manufacturers. It provides advanced technology solutions that enhance surgical precision, improve operational efficiency, and deliver innovative tools for the healthcare industry.

How to conduct PDEX price prediction? What analysis methods are available?

PDEX price prediction uses technical and fundamental analysis. Technical methods include moving averages, RSI, and trend analysis. Fundamental analysis examines market demand, trading volume, and ecosystem development. Combine multiple indicators for accurate forecasting.

What is PDEX's historical price trend? What are the main factors affecting its price?

PDEX has experienced significant price fluctuations in 2026, primarily driven by market sentiment and investor confidence. Key factors include adoption announcements, technical developments, trading volume, and broader cryptocurrency market trends. Positive news typically drives price appreciation.

What are the risks of investing in PDEX? What should I pay attention to?

PDEX investment carries market volatility risks and potential losses. Key considerations include price fluctuations, market conditions, and personal risk tolerance. Always conduct thorough research before investing and only invest capital you can afford to lose.

What are the differences and advantages of PDEX compared to other DeFi tokens?

PDEX features an automatic burning mechanism that regulates token supply through decentralization, maintaining market stability. Unlike other DeFi tokens, PDEX controls inflation via self-destruction mechanisms, ensuring sustainable tokenomics and long-term value preservation.

Where can I buy and trade PDEX?

PDEX can be traded on major centralized exchanges. The most active trading pair is PDEX/USDT with significant daily trading volume, offering good liquidity for both buying and trading PDEX tokens.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

7 Ways To Survive the Crypto Bear Market

Blockchain Developer Salaries: What Web3 Developers Are Paid

Revolut Quiz Answers: Complete Guide to Earning Free Cryptocurrency

Best Non-Custodial Wallets: Top Choices

Comprehensive Guide to Moving Averages