2026 PRAI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: PRAI's Market Position and Investment Value

Privasea AI (PRAI), positioned as a decentralized confidential AI infrastructure utilizing Fully Homomorphic Encryption (FHE), has emerged as an innovative player in the DePIN (Decentralized Physical Infrastructure Network) sector. Since its launch in 2025, the project has focused on enabling secure computation on encrypted data for both Web2 and Web3 applications. As of February 4, 2026, PRAI maintains a market capitalization of approximately $709,174, with a circulating supply of around 206 million tokens and a current price hovering near $0.003442. This asset, which bridges privacy-preserving AI technology with blockchain infrastructure, is playing an increasingly important role in sectors such as healthcare, finance, and digital identity verification.

This article provides a comprehensive analysis of PRAI's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to offer professional price forecasts and practical investment strategies for investors.

I. PRAI Price Historical Review and Market Status

PRAI Historical Price Evolution Trajectory

- 2025: Token officially launched on May 14, price experienced significant volatility with early trading activity

- 2026: Market entered correction phase, price declined from previous levels to current range

PRAI Current Market Status

As of February 04, 2026, PRAI is trading at $0.003442, representing a 24-hour decline of 4.81%. The token's trading volume over the past 24 hours reached $23,396.56, indicating moderate market activity.

The token's short-term performance shows downward pressure, with a 1-hour decline of 1.26% and a 7-day decrease of 23.35%. The 30-day performance mirrors this trend with a 23.18% decline. Over the past year, PRAI has experienced a substantial decrease of 97.86% from its initial trading levels.

The 24-hour price range spans from $0.003317 to $0.0037, with the token currently holding above its recorded low of $0.003317, which was marked on February 04, 2026.

PRAI's circulating supply stands at 206,035,500 tokens, representing 20.6% of the maximum supply of 1,000,000,000 tokens. The current market capitalization is approximately $709,174, with a fully diluted valuation of $3,442,000. The token maintains a market dominance of 0.00012%.

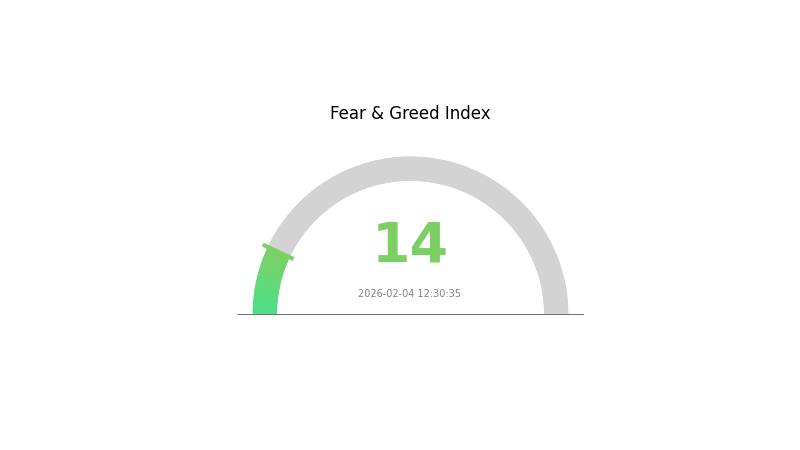

The crypto market sentiment index currently registers at 14, indicating an "Extreme Fear" level, which may be influencing broader market dynamics including PRAI's performance.

PRAI is available for trading on 13 exchanges and has attracted 29,062 holders. The token operates on the BSC (BEP-20) standard with the contract address 0x899357e54c2c4b014ea50a9a7bf140ba6df2ec73.

Click to view current PRAI market price

PRAI Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 14. This exceptionally low sentiment indicates severe market pessimism and panic among investors. Such extreme readings historically present significant opportunities for contrarian traders and long-term investors. When fear reaches these levels, asset valuations often become deeply discounted. Market participants should exercise caution while considering their risk tolerance and investment strategy. Monitor this indicator closely as extreme sentiment can signal potential turning points in the market cycle.

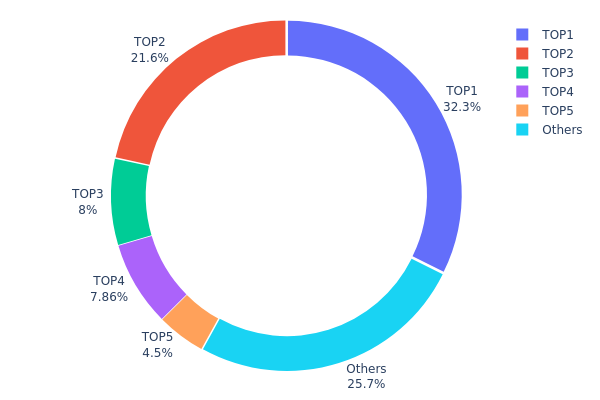

PRAI Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different addresses on the blockchain, serving as a crucial indicator of market structure and decentralization. According to the latest data, PRAI exhibits a highly concentrated distribution pattern, with the top five addresses collectively controlling 74.27% of the total token supply. Specifically, the largest address holds 323.2 million tokens (32.32%), while the second-largest address controls 215.95 million tokens (21.59%). This concentration level significantly exceeds the healthy threshold typically observed in mature cryptocurrency projects, indicating substantial centralization risk.

Such extreme concentration poses several market implications. First, the dominant positions held by the top two addresses create significant price manipulation potential, as large-scale selling pressure from either could trigger substantial market volatility. Second, this distribution pattern suggests limited circulation among retail participants, with only 25.73% of tokens distributed across other addresses. This structural imbalance may impede organic price discovery mechanisms and reduce market resilience during stress periods. The presence of an 8% holder in the third position (80 million tokens) further reinforces the oligopolistic market structure.

From a decentralization perspective, PRAI's current holding distribution reflects weak on-chain structural stability. The heavy reliance on a few major holders contradicts the foundational principles of decentralized networks and exposes the project to governance risks. While such concentration patterns are not uncommon during early-stage token launches or following initial distribution events, sustained centralization over time typically correlates with reduced community engagement and higher susceptibility to coordinated selling events that could destabilize market confidence.

Click to view current PRAI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7e71...1f687d | 323200.00K | 32.32% |

| 2 | 0xf2d0...66d26d | 215950.00K | 21.59% |

| 3 | 0xb41f...dc723f | 80000.00K | 8.00% |

| 4 | 0xcfc6...8941bf | 78631.50K | 7.86% |

| 5 | 0x73d8...4946db | 45045.64K | 4.50% |

| - | Others | 257172.86K | 25.73% |

II. Core Factors Influencing PRAI's Future Price

Supply Mechanism

- Annual Growth Rate: The price outlook for Privasea AI is influenced by market demand, adoption trends, institutional participation, and broader economic factors. With an estimated annual growth rate of 5%, future price movements may reflect gradual supply expansion and increasing market acceptance.

- Historical Patterns: Changes in supply dynamics have historically impacted price stability, with controlled growth rates supporting sustained market confidence.

- Current Impact: The projected 5% annual growth rate suggests moderate supply expansion, which may help balance demand pressures while maintaining price stability.

Institutional and Major Holder Dynamics

- Institutional Participation: Institutional engagement is recognized as a key factor affecting PRAI's price trajectory, though specific institutional holdings were not detailed in available materials.

- Corporate Adoption: Information regarding notable companies adopting PRAI was not provided in the reference materials.

- National Policies: No specific national-level policies directly related to PRAI were mentioned in the available data.

Macroeconomic Environment

- Monetary Policy Impact: Broader economic factors, including central bank policies and economic conditions, are expected to influence PRAI's price performance.

- Inflation Hedge Attributes: The overall economic environment, including inflation dynamics, may affect investor sentiment toward PRAI.

- Geopolitical Factors: International market conditions and geopolitical developments could indirectly impact PRAI's price outlook.

Technology Development and Ecosystem Building

- Market Demand and Adoption: Technology adoption trends represent a core driver of PRAI's future price movements, with increasing usage potentially supporting upward price momentum.

- Investor Sentiment: Market sentiment and investor confidence directly influence PRAI's price direction, with positive market expectations contributing to price stability.

- Ecosystem Applications: Information regarding specific DApps or ecosystem projects built on PRAI was not available in the provided materials.

III. 2026-2031 PRAI Price Forecast

2026 Outlook

- Conservative Prediction: $0.00273 - $0.00345

- Neutral Prediction: $0.00345 (average market scenario)

- Optimistic Prediction: $0.00421 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual growth phase with moderate volatility, as the project continues to establish its market presence and expand its user base

- Price Range Forecast:

- 2027: $0.00261 - $0.00433, with an average price around $0.00383, representing an 11% potential increase from 2026

- 2028: $0.00339 - $0.00588, with an average price around $0.00408, showing an 18% potential growth trajectory

- 2029: $0.00483 - $0.00543, with an average price around $0.00498, indicating a 44% potential increase from the 2026 baseline

- Key Catalysts: Technology development milestones, strategic partnerships, broader market acceptance of AI-related crypto projects, and overall cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00271 - $0.00593 (assuming steady project development and moderate market conditions)

- Optimistic Scenario: $0.00520 - $0.00696 by 2031 (assuming successful ecosystem expansion and strong market momentum), representing up to a 61% potential increase from 2026 levels

- Transformative Scenario: Prices could reach the upper range of $0.00696 by 2031 (under highly favorable conditions including significant technological breakthroughs, widespread adoption, and bullish crypto market cycles)

- February 4, 2026: PRAI trading within the predicted range of $0.00273 - $0.00421 (early stage of the forecast period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00421 | 0.00345 | 0.00273 | 0 |

| 2027 | 0.00433 | 0.00383 | 0.00261 | 11 |

| 2028 | 0.00588 | 0.00408 | 0.00339 | 18 |

| 2029 | 0.00543 | 0.00498 | 0.00483 | 44 |

| 2030 | 0.00593 | 0.0052 | 0.00271 | 51 |

| 2031 | 0.00696 | 0.00557 | 0.00406 | 61 |

IV. PRAI Professional Investment Strategy and Risk Management

PRAI Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in the development potential of decentralized confidential AI infrastructure and privacy-preserving computing technology

- Operational Recommendations:

- Establish positions in batches during market pullbacks to reduce average cost

- Set clear investment objectives and holding periods, avoiding emotional trading due to short-term price fluctuations

- Use Gate Web3 Wallet for secure storage of PRAI tokens to ensure asset security

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Systems: Observe the relationship between short-term (7-day) and long-term (30-day) moving averages to capture trend reversal opportunities

- Volume Analysis: Combined with price movements to determine the strength of market trends and potential reversal signals

- Key Points for Swing Trading:

- Pay attention to news related to the development of AI and privacy computing sectors for trading opportunities

- Set reasonable stop-loss levels to control single-trade risk exposure

PRAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate no more than 3% of total portfolio

- Aggressive Investors: Allocate 5-10% of total portfolio

- Professional Investors: Adjust allocation flexibly based on market conditions and project progress, but should not exceed 15%

(2) Risk Hedging Solutions

- Diversified Investment: Combine PRAI with other assets in different sectors to reduce the impact of single project risks

- Phased Position Reduction: Gradually take profits when significant gains occur to lock in returns and reduce risk exposure

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Use Gate Web3 Wallet for convenient trading and daily management

- Cold Storage Solution: For large holdings, consider transferring to hardware wallets for long-term secure storage

- Security Precautions: Regularly backup private keys and mnemonic phrases, avoid storing them on internet-connected devices, and be vigilant against phishing attacks and fraud

V. PRAI Potential Risks and Challenges

PRAI Market Risks

- High Price Volatility: PRAI has experienced a 97.86% decline over the past year, showing significant price volatility that may lead to substantial short-term losses

- Low Market Capitalization: With a market cap of approximately $709,000 and ranking 2757, the token faces liquidity risks and susceptibility to market manipulation

- Limited Trading Volume: 24-hour trading volume of only $23,396 indicates low market activity, which may result in difficulties in buying or selling at desired prices

PRAI Regulatory Risks

- AI Technology Regulation: Governments worldwide are strengthening regulations on AI technology, which may impact the development of decentralized AI projects

- Cryptocurrency Compliance Requirements: Evolving regulatory policies in various countries for cryptocurrency projects may create compliance challenges

- Data Privacy Regulations: Although the project focuses on privacy protection, interpretation and enforcement of relevant laws across different jurisdictions may pose operational risks

PRAI Technical Risks

- FHE Technology Complexity: Fully Homomorphic Encryption is still an emerging technology with potential implementation challenges and performance bottlenecks

- Project Development Progress: As a relatively new project, there may be delays or technical difficulties in roadmap execution

- Smart Contract Security: BSC-based tokens face potential smart contract vulnerabilities and security risks requiring continuous monitoring

VI. Conclusion and Action Recommendations

PRAI Investment Value Assessment

PRAI represents an innovative attempt in the decentralized confidential AI infrastructure space, utilizing Fully Homomorphic Encryption technology to provide privacy-preserving AI computing solutions. The project addresses data security concerns in sensitive sectors such as healthcare, finance, and digital identity. However, given the token's significant historical price decline, small market capitalization, and low trading volume, investors face considerable market and liquidity risks in the short term. Long-term value depends on the project team's ability to execute its roadmap and gain market adoption.

PRAI Investment Recommendations

✅ Beginners: Exercise extreme caution, consider waiting for the project to mature and demonstrate clearer market validation before participating with minimal capital ✅ Experienced Investors: May allocate small speculative positions while closely monitoring project development progress and sector trends, maintaining strict risk control ✅ Institutional Investors: Conduct thorough due diligence on the project's technical architecture, team background, and commercialization prospects, considering participation only if aligned with portfolio strategy

PRAI Trading Participation Methods

- Spot Trading: Purchase PRAI through Gate.com spot market, suitable for investors seeking long-term holding

- Regular Investment: Establish positions through regular fixed-amount purchases to smooth out volatility and reduce timing risks

- Portfolio Approach: Include PRAI as part of a diversified portfolio alongside other AI and DePIN sector tokens to spread risk

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of PRAI tokens?

PRAI has shown early-stage price discovery since launch. Starting from initial listing, the token reached $0.00346 USD as of February 2026. Price movements reflect market adoption of Privasea AI's privacy computing solutions and broader crypto market sentiment.

What are the main factors affecting PRAI price?

PRAI price is primarily influenced by market demand, trading volume, investor sentiment, and overall cryptocurrency market trends. Price fluctuations are significant, with historical highs of $0.1615 and lows of $0.003338.

How to conduct PRAI price prediction analysis?

PRAI price prediction utilizes growth percentages and market indicators for future value estimation. The model integrates RSI and MACD for dynamic forecasts. As of February 4, 2026, PRAI is projected to reach $0.006852 by 2040, reflecting approximately 97.99% growth potential.

PRAI与其他同类代币相比价格优势在哪里?

PRAI maintains exceptional price stability with fluctuations below 4% using advanced algorithms. This superior stability mechanism outperforms competitor stablecoins, offering investors reliable value preservation and lower volatility risk in volatile crypto markets.

What risks should be noted in PRAI price prediction?

PRAI price prediction involves market volatility risk, regulatory uncertainty, and technological development risks. Crypto investments carry inherent high risk requiring careful decision-making and thorough risk assessment before investing.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Comprehensive Guide to Phil Konieczny's Cryptocurrency Investment Strategy and Philosophy

What is Raydium: A Complete Overview of the DEX on Solana Blockchain

Six Cryptocurrency Tokens With Total Growth Exceeding 1,000x

When will the Dogecoin ETF receive approval?

Can you mine Bitcoin from home?