2026 RECT Price Prediction: Expert Analysis and Market Outlook for Rectified Token's Future Value

Introduction: RECT's Market Position and Investment Value

ReflectionAI (RECT), as a decentralized platform designed for AI model collaboration, has been facilitating the sharing, acquisition, and trading of AI models since its launch in October 2024. As of February 2026, RECT maintains a market capitalization of approximately $196,959, with a circulating supply of around 587 million tokens, and the price holding at approximately $0.0003355. This asset, known as a "Web3-powered AI model marketplace token," is playing an increasingly important role in the decentralized AI ecosystem and privacy-focused digital collaboration spaces.

This article will comprehensively analyze RECT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. RECT Price History Review and Market Status

RECT Historical Price Evolution

- October 2024: RECT launched on Gate.com at an initial price of $0.1, marking its entry into the cryptocurrency market

- January 2025: The token experienced significant volatility, reaching a peak of $1.1331 on January 20, representing an increase of over 1,033% from its launch price

- February 2026: Following the January peak, RECT declined substantially, dropping to a historical low of $0.0003333 on February 7, reflecting a correction of over 99% from its all-time high

RECT Current Market Status

As of February 8, 2026, RECT is trading at $0.0003355, showing a slight recovery from its recent low. The token demonstrates limited price movement in the short term, with a 24-hour decline of 0.11% and a 1-hour decline of 0.55%. Over the past week, RECT has decreased by 6.21%, while the 30-day performance shows an 8.21% decline.

The current market capitalization stands at approximately $196,959, with a 24-hour trading volume of $13,019.89. The circulating supply represents 58.71% of the total supply, with 587,061,292 tokens in circulation out of a maximum supply of 1 billion tokens. The token maintains a holder base of 44,257 addresses, indicating continued community interest despite recent price challenges.

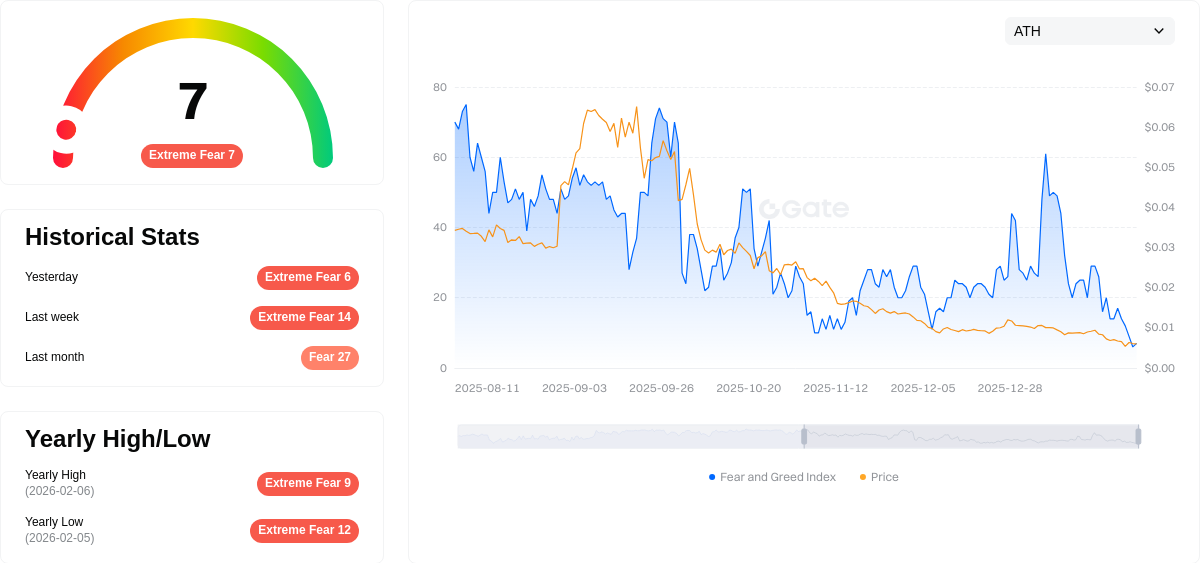

RECT's market dominance is minimal at 0.000013%, reflecting its position as a smaller market cap token. The fully diluted market cap is calculated at $335,500, with the market cap to FDV ratio at 58.71%. The cryptocurrency market sentiment index currently reads 7, indicating an "Extreme Fear" environment, which may be influencing RECT's trading patterns.

Click to view current RECT market price

RECT Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with a sentiment index of 7. This significant level of pessimism typically indicates that panic selling has intensified across the market. When the index reaches such extreme lows, it often represents a potential contrarian opportunity for long-term investors, as excessive fear can create attractive entry points. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely and manage risk appropriately during this period of heightened uncertainty.

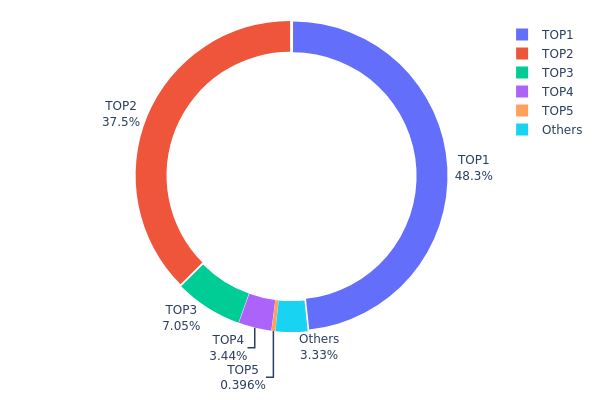

RECT Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, providing insights into the decentralization level and potential market control risks. By examining the percentage of total supply held by top addresses, analysts can assess whether a token exhibits excessive centralization or maintains a healthier distributed structure.

Based on the current data, RECT demonstrates a highly concentrated holding pattern. The top holder controls 48.32% of the total supply (483,274.33K tokens), while the second-largest address holds 37.45% (374,545.51K tokens). Combined, these two addresses account for approximately 85.77% of the entire token supply. The third through fifth positions hold 7.05%, 3.44%, and 0.39% respectively, with all remaining addresses collectively representing only 3.35% of the supply. This extreme concentration creates significant structural vulnerabilities within the RECT ecosystem.

Such a centralized distribution pattern presents considerable market risks. The dominance of the top two holders grants them substantial influence over price movements and liquidity conditions. Any significant sell pressure from these major holders could trigger dramatic price volatility, while their trading decisions may disproportionately impact market sentiment. Furthermore, this concentration level raises concerns about potential price manipulation and limits the token's decentralization credentials. The minimal participation from smaller holders (only 3.35% distributed among others) suggests limited community engagement and increased dependency on a small number of entities for market stability.

Click to view current RECT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6c25...e9b39c | 483274.33K | 48.32% |

| 2 | 0x0000...000001 | 374545.51K | 37.45% |

| 3 | 0x0d07...b492fe | 70511.45K | 7.05% |

| 4 | 0x6d7a...3c714a | 34434.00K | 3.44% |

| 5 | 0x0374...ec3ddc | 3959.20K | 0.39% |

| - | Others | 33275.50K | 3.35% |

II. Core Factors Influencing RECT's Future Price

Supply and Demand Dynamics

-

Market Behavior Analysis: Technical analysis theory suggests that "the market reflects everything" - all factors affecting price, whether economic, political, or psychological, are already reflected in price through supply and demand relationships. For RECT, market participants consider various influencing factors when making trading decisions, making market trading behavior itself a key indicator.

-

Price Trend Movement: Price trends constitute the most fundamental and core factor in technical analysis. According to the principles of market dynamics, trends tend to continue until reversal signals appear. RECT's price, while fluctuating up and down, ultimately moves in a certain direction, following patterns similar to Newton's law of inertia.

-

Volume and Position Analysis: Trading volume serves as an important sentiment indicator. When RECT rises with large trading volume, it indicates strong market enthusiasm and greater intensity and urgency for the upward movement. Conversely, upward pressure would be much lighter. Position volume similarly reflects market sentiment - increasing positions indicate capital inflow into the market, while decreasing positions suggest capital outflow.

Macroeconomic Environment

-

Economic Policy Impact: Macroeconomic factors play a crucial role in price fluctuations. Policy adjustments such as monetary policy changes, GDP data, interest rate modifications, and employment figures all influence market sentiment, thereby causing price volatility. Loose monetary policy may promote price increases, while tight policy could suppress market prices.

-

International Economic Factors: The overall international economic situation also impacts price trends. Factors beyond import prices, including export prices and other international economic elements, collectively affect market performance.

-

Inflation Expectations: Output gap and inflation expectations are key components influencing future price risk. Risk and uncertainty factors are primary considerations affecting capital flows, so reducing risk and uncertainty should help minimize negative impacts on the market.

Technical Analysis Indicators

-

Trend Lines and Moving Averages: Trend lines in upward markets connect two or more rising lows, while in downward markets they connect two or more declining highs. These trend lines constrain future price movements, serving support and resistance functions. Moving average analysis helps identify market trends and discover reversal signals.

-

Golden Ratio and Retracement Levels: In trending markets, retracement or rebound magnitudes have several key numerical values worth noting, particularly one-third and two-thirds levels. The golden ratio numbers 0.382 and 0.618 are also commonly referenced. These levels help traders assess whether movements constitute retracements or trend reversals.

-

Volume-Price Relationship: In uptrends, when prices rise alongside increasing positions, it indicates continuous new trader entry with buying pressure overwhelming selling pressure, constituting a bullish signal. Conversely, if prices rise while positions decline, it suggests upward momentum mainly comes from short covering, representing a bearish signal.

Market Sentiment and Investor Behavior

-

Psychological Factors: The concept that "history repeats itself" stems from human psychological considerations. Investment behavior essentially pursues profit, a motivation unchanged across time. Under this psychological state, human trading behavior tends toward certain patterns, leading to historical repetition. Therefore, past price movement patterns may continuously recur in the future.

-

Capital Flow Direction: Capital flow determines short-term market trends, while market sentiment (such as investor confidence and risk-aversion sentiment) also influences trading behavior, thereby intensifying market volatility. When market risk-aversion sentiment rises and capital flows out, market prices may weaken.

-

Trading Volume Changes: Trading volume variations provide assistance in judging market conditions. However, specific analysis is required for specific situations, avoiding mechanical application. For instance, as time progresses and traders actively close near-term contracts to avoid delivery and transfer to later contracts, near-term contract positions naturally decline while far-term contract positions increase.

III. 2026-2031 RECT Price Prediction

2026 Outlook

- Conservative prediction: $0.00028

- Neutral prediction: $0.00034

- Optimistic prediction: $0.00047 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: RECT may experience gradual growth momentum as the cryptocurrency market enters a potential recovery phase, with increasing adoption and ecosystem development potentially supporting price appreciation.

- Price range prediction:

- 2027: $0.00025 - $0.00054

- 2028: $0.00035 - $0.00066

- 2029: $0.00054 - $0.00059

- Key catalysts: Market sentiment improvement, technological upgrades, expanding use cases, and broader cryptocurrency adoption could serve as primary drivers for price growth during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00055 - $0.00058 (assuming steady market development and maintained project fundamentals)

- Optimistic scenario: $0.00064 - $0.00070 (assuming accelerated ecosystem growth and favorable regulatory environment)

- Transformative scenario: $0.00079 (under exceptionally favorable conditions including widespread adoption and significant technological breakthroughs)

- 2026-02-08: RECT trading within the predicted range of $0.00028 - $0.00047 (baseline market conditions)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00047 | 0.00034 | 0.00028 | 0 |

| 2027 | 0.00054 | 0.0004 | 0.00025 | 19 |

| 2028 | 0.00066 | 0.00047 | 0.00035 | 40 |

| 2029 | 0.00059 | 0.00056 | 0.00054 | 68 |

| 2030 | 0.0007 | 0.00058 | 0.00055 | 71 |

| 2031 | 0.00079 | 0.00064 | 0.00047 | 90 |

IV. RECT Professional Investment Strategies and Risk Management

RECT Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to decentralized AI model collaboration ecosystems with a long-term perspective

- Operational Recommendations:

- Consider accumulating positions during periods of relative price stability or market corrections

- Monitor the platform's development progress, including user adoption metrics and model marketplace activity

- Storage Solution: Utilize Gate Web3 Wallet for secure storage, supporting BSC network tokens with multi-layer security features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently around $13,019) relative to market cap to identify liquidity patterns

- Support and Resistance Levels: Track recent price ranges between $0.0003333 and $0.0003536 to identify potential entry and exit points

- Swing Trading Considerations:

- Given the token's volatility profile (down 99.96% from ATH), establish strict stop-loss parameters

- Consider the relatively low liquidity and market cap when sizing positions to minimize slippage risk

RECT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation

- Aggressive Investors: 2-3% of crypto portfolio allocation

- Professional Investors: May consider up to 5% with appropriate hedging strategies and deep due diligence

(II) Risk Hedging Approaches

- Position Sizing: Limit individual position exposure to account for the token's high volatility and limited exchange availability (currently listed on 1 exchange)

- Diversification: Balance RECT holdings with more established AI and blockchain infrastructure tokens to mitigate sector-specific risks

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet, offering user-friendly interface with BSC network support for active traders

- Cold Storage Approach: For long-term holdings, consider transferring to hardware wallet solutions compatible with BEP20 tokens

- Security Considerations: Always verify contract address (0xb42E1E0165140321DB20eF46A2e9a240D60284b6) before transactions, enable two-factor authentication, and never share private keys

V. RECT Potential Risks and Challenges

RECT Market Risks

- Extreme Volatility: The token has experienced a 99.96% decline from its ATH of $1.1331 in January 2025 to current levels around $0.0003355, indicating significant price instability

- Limited Liquidity: With 24-hour trading volume of approximately $13,019 and listing on only 1 exchange, the token faces potential liquidity constraints that may impact execution quality

- Market Cap Pressure: The current market cap of approximately $196,959 represents a relatively small market presence with dominance of only 0.000013%, suggesting vulnerability to broader market movements

RECT Regulatory Risks

- AI Model Trading Compliance: Decentralized AI model marketplaces may face evolving regulatory scrutiny regarding intellectual property rights, data privacy, and model accountability standards

- Smart Contract Regulation: Web3-based incentive mechanisms may encounter regulatory uncertainty as jurisdictions develop frameworks for decentralized finance and tokenized ecosystems

- Cross-border Operations: The platform's global nature of AI model sharing and trading may present challenges in navigating diverse regulatory environments across different jurisdictions

RECT Technical Risks

- Smart Contract Vulnerabilities: As with any Web3 platform, there exists inherent risk of potential smart contract exploits or bugs that could impact user funds or platform functionality

- Scalability Challenges: As an AI model collaboration platform on BSC, the project may face technical challenges in scaling to accommodate growing user bases and complex model transactions

- Platform Adoption Risk: The success of the ecosystem depends on achieving critical mass of both model creators and consumers, which remains uncertain given current market conditions

VI. Conclusion and Action Recommendations

RECT Investment Value Assessment

ReflectionAI presents an innovative approach to decentralized AI model collaboration, addressing the growing market need for transparent, privacy-focused AI development ecosystems. The platform's Web3 smart contract-backed incentive mechanism offers a compelling value proposition for fostering user engagement and fair contribution recognition. However, the token faces considerable challenges, including dramatic price depreciation from ATH, limited exchange availability, and nascent ecosystem development stage. The long-term value proposition depends heavily on the platform's ability to attract and retain a critical mass of AI developers and users, while navigating technical scalability and regulatory uncertainties. Short-term risks remain elevated due to significant volatility, limited liquidity, and broader market conditions affecting micro-cap cryptocurrencies.

RECT Investment Recommendations

✅ Newcomers: Approach with extreme caution given the token's volatility profile and limited liquidity. If interested, limit exposure to a minimal portion of your overall crypto portfolio (under 1%) and prioritize education about the project's fundamentals before committing capital. ✅ Experienced Investors: Consider RECT as a high-risk, speculative position within a diversified AI-focused crypto portfolio. Implement strict risk management protocols including position sizing limits and stop-loss disciplines, while monitoring platform development milestones. ✅ Institutional Investors: Conduct comprehensive due diligence on the platform's technology architecture, team credentials, and competitive positioning. Given current liquidity constraints, evaluate whether the investment aligns with portfolio mandates and consider engaging directly with project stakeholders for deeper insights.

RECT Trading Participation Methods

- Spot Trading on Gate.com: Access RECT/USDT trading pairs with competitive fees and user-friendly interface for direct token acquisition

- Dollar-Cost Averaging: Implement systematic purchase strategies to mitigate timing risk, particularly suitable given the token's volatility characteristics

- Gate Web3 Wallet Integration: Utilize Gate Web3 Wallet for seamless storage and potential participation in future platform features or staking mechanisms

Cryptocurrency investment carries extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is RECT token? What are its main uses and characteristics?

RECT token powers the Reflection AI ecosystem, designed to incentivize participation and contribution. Its main purpose is driving ecosystem collaboration and AI model trading. Key features include AI-based reflection mechanisms and community-driven governance.

What are the main factors affecting RECT price?

RECT price is primarily influenced by market supply and demand, trading volume, project development progress, community sentiment, and overall cryptocurrency market conditions.

What is the historical price performance of RECT? What were the past price trends?

RECT has demonstrated significant volatility throughout its history, experiencing multiple cycles of growth and decline. The cryptocurrency has shown notable price fluctuations with periods of sharp increases followed by corrections. Trading volume has varied considerably across different market conditions. Past trends indicate both bullish and bearish phases, reflecting broader market dynamics and investor sentiment shifts in the crypto sector.

What are the risks to pay attention to when investing in RECT tokens?

RECT token investments carry market volatility risk, regulatory uncertainty, and liquidity risk. Conduct thorough research and assess your risk tolerance before investing.

What advantages or disadvantages does RECT have compared to similar tokens?

RECT offers faster transaction speeds and lower fees than many competitors, but has lower market recognition. Its technological innovation and community support may lag behind mainstream tokens, though it presents growth potential in emerging markets.

What are RECT's future development prospects and price predictions?

RECT shows strong bullish potential with conservative 2026-2027 price targets of $0.00021-$0.00065. Market fundamentals and adoption trends suggest upward momentum. Long-term growth depends on ecosystem expansion and trading volume increases.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Blockchain Developer Salaries: What Web3 Developers Are Paid

Revolut Quiz Answers: Complete Guide to Earning Free Cryptocurrency

Best Non-Custodial Wallets: Top Choices

Comprehensive Guide to Moving Averages

Six Cryptocurrencies That Have Achieved Over 1,000x Total Growth