2026 SAVM Price Prediction: Expert Analysis and Market Outlook for the Next Generation Blockchain Token

Introduction: SAVM's Market Position and Investment Value

SatoshiVM (SAVM), as a decentralized Bitcoin ZK Rollup Layer-2 solution compatible with the Ethereum Virtual Machine (EVM) ecosystem, has been developing its unique position in the cryptocurrency landscape since its launch in 2024. As of 2026, SAVM maintains a market capitalization of approximately $216,985, with a circulating supply of around 7.28 million tokens, and the price is positioned at approximately $0.02982. This asset, which serves as a bridge between Bitcoin and EVM ecosystems while utilizing native BTC as gas, is playing an increasingly important role in enhancing Bitcoin scalability and transaction efficiency.

This article will comprehensively analyze SAVM's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SAVM Price History Review and Market Status

SAVM Historical Price Evolution Trajectory

- 2024: Project launch in January 2024 with initial trading activity, price reached its peak level of $13.998 in March

- 2025-2026: Market adjustment period, price experienced significant correction from previous levels

- 2026: Market entered consolidation phase, price touched lower range at $0.02005 in early February

SAVM Current Market Dynamics

As of February 08, 2026, SAVM is trading at $0.02982, showing a 1.56% increase over the past hour. The token has experienced mixed short-term performance with a 6.81% decline over 24 hours and a 12.22% decrease over the past week. The 30-day trend indicates a 43.62% decline, while the yearly performance shows an 89.36% decrease from previous levels.

The 24-hour trading range spans from $0.02556 to $0.03501, with total trading volume reaching $12,621.69. The current market capitalization stands at $216,985.23, representing approximately 0.000024% of the overall crypto market. With a circulating supply of 7,276,500 SAVM tokens out of a maximum supply of 21,000,000, the circulating ratio is 34.65%. The fully diluted market capitalization is calculated at $626,220.

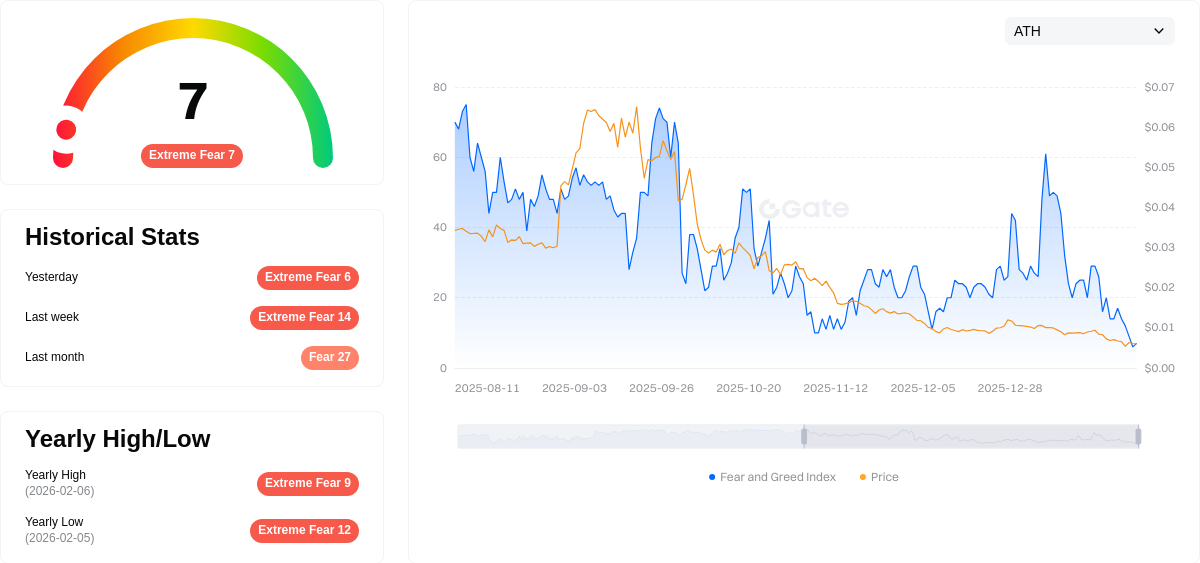

The market sentiment index currently registers at an extreme fear level of 7 on the volatility index, reflecting cautious investor positioning. The token maintains active trading on one exchange platform with a holder base of 11,641 participants.

Click to view current SAVM market price

SAVM Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index plummeting to 7. This represents severe market pessimism as investors flee risky assets amid heightened uncertainty. Such extreme readings historically signal capitulation and potential buying opportunities for contrarian traders. However, caution is warranted as further downside remains possible. Monitor key support levels and risk management protocols closely during this volatile period.

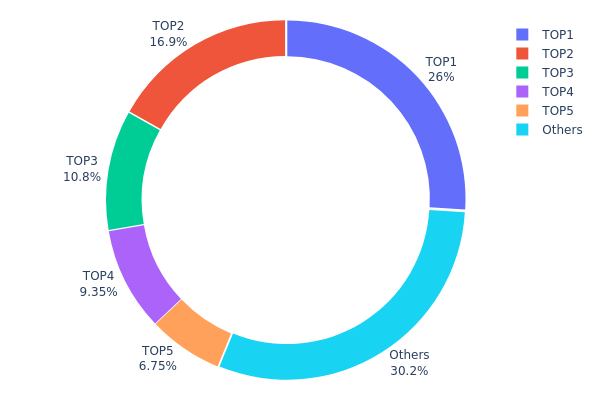

SAVM Holding Distribution

The address holding distribution chart reflects the proportion of tokens held by different wallet addresses within the total circulating supply, serving as a key metric for assessing token concentration and decentralization level. This indicator directly reveals the distribution structure of chip holders on the chain, providing important reference value for evaluating market manipulation risks and price volatility potential.

Based on current data, SAVM exhibits a relatively concentrated holding pattern. The top 5 addresses collectively hold 69.75% of the total supply, with the largest holder controlling 25.95% (3.93 million tokens), the second-largest holding 16.89%, and the third to fifth addresses holding 10.83%, 9.34%, and 6.74% respectively. Such concentration structure indicates that approximately 70% of tokens are concentrated in the hands of a few addresses, while the remaining 30.25% are dispersed among other addresses. This distribution pattern presents typical characteristics of high concentration.

This concentration pattern may bring about dual effects. On one hand, highly concentrated holdings imply that a small number of large holders possess significant market influence. If these addresses engage in concentrated selling behavior, it could trigger substantial price volatility or even market manipulation risks. On the other hand, if these large holders maintain long-term positions and the project team implements transparent lock-up mechanisms, it could provide certain stability for price performance. Currently, the market structure appears relatively fragile, with insufficient degree of decentralization. Investors should closely monitor the on-chain flow patterns of major holders to guard against liquidity risks arising from concentrated selling.

Click to view the current SAVM Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf70a...045408 | 3926.90K | 25.95% |

| 2 | 0xad9e...60f02d | 2555.59K | 16.89% |

| 3 | 0x7ff0...9cc007 | 1640.00K | 10.83% |

| 4 | 0x42cd...c4fdee | 1414.48K | 9.34% |

| 5 | 0xb01e...44d9da | 1020.74K | 6.74% |

| - | Others | 4573.02K | 30.25% |

II. Core Factors Influencing SAVM's Future Price

Market Demand and Adoption Trends

- Market Sentiment: Investor sentiment plays a significant role in price fluctuations, with emotions and confidence levels directly impacting trading behavior and valuation.

- Institutional Participation: The level of engagement from institutional investors influences liquidity and price stability in the market.

- Broader Economic Factors: Macroeconomic trends, including global financial conditions and economic cycles, contribute to overall market dynamics.

Policy and Regulatory Environment

- Regulatory Framework: Policy developments and regulatory clarity across different jurisdictions affect market confidence and adoption rates.

- Compliance Requirements: Evolving compliance standards impact operational frameworks and market accessibility.

Technological Innovation

- Technical Development: Ongoing technological advancements and innovation within the ecosystem contribute to platform capabilities and competitive positioning.

- Network Infrastructure: The underlying technical infrastructure supports scalability and performance characteristics.

Growth Projections

- Annual Growth Rate: Market analysis suggests a potential annual growth rate of approximately 5%, reflecting moderate expansion expectations based on current market conditions and adoption patterns.

- Price Outlook: The price trajectory is expected to be influenced by the interplay of demand dynamics, technological progress, and macroeconomic factors over the coming years.

III. 2026-2031 SAVM Price Predictions

2026 Outlook

- Conservative forecast: $0.01876 - $0.02932

- Neutral forecast: $0.02932 average price level

- Optimistic forecast: up to $0.03049 (contingent on favorable market conditions and ecosystem development)

2027-2029 Outlook

- Market stage expectation: Potential transition into a gradual recovery and growth phase, with price stabilization anticipated as the project matures

- Price range predictions:

- 2027: $0.02901 - $0.03469

- 2028: $0.02035 - $0.03617

- 2029: $0.01883 - $0.03766

- Key catalysts: Enhanced platform adoption, technological upgrades, broader cryptocurrency market sentiment, and increased trading volume on major exchanges like Gate.com

2030-2031 Long-term Outlook

- Baseline scenario: $0.02948 - $0.03918 (assuming steady ecosystem growth and sustained market interest)

- Optimistic scenario: $0.03595 - $0.04132 (driven by successful partnerships, network expansion, and positive regulatory developments)

- Transformative scenario: exceeding $0.04132 (requires exceptional market conditions, widespread adoption, and breakthrough technological implementations)

- 2026-02-08: SAVM price projections suggest a consolidation period with potential for gradual appreciation through 2031, representing an estimated 20-25% cumulative growth trajectory over the five-year forecast horizon

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.03049 | 0.02932 | 0.01876 | -1 |

| 2027 | 0.03469 | 0.02991 | 0.02901 | 0 |

| 2028 | 0.03617 | 0.0323 | 0.02035 | 8 |

| 2029 | 0.03766 | 0.03424 | 0.01883 | 14 |

| 2030 | 0.03918 | 0.03595 | 0.02948 | 20 |

| 2031 | 0.04132 | 0.03757 | 0.01916 | 25 |

IV. SAVM Professional Investment Strategies and Risk Management

SAVM Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts who believe in Bitcoin Layer-2 scaling solutions and the integration between Bitcoin and EVM ecosystems

- Operational Recommendations:

- Consider accumulating positions during periods of market weakness, given the token's substantial decline from its historical high

- Monitor project development milestones and ecosystem growth indicators

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor 50-day and 200-day moving averages to identify potential trend reversals

- Volume Analysis: Track the 24-hour trading volume ($12,621.69) relative to market capitalization to assess liquidity conditions

- Swing Trading Considerations:

- Pay attention to the token's high volatility, as evidenced by recent price fluctuations

- Set appropriate stop-loss levels given the significant price range between recent high ($0.03501) and low ($0.02556)

SAVM Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio

- Aggressive Investors: 3-5% of cryptocurrency portfolio

- Professional Investors: Up to 10% of cryptocurrency portfolio, with active monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance SAVM exposure with other Layer-2 solutions and established cryptocurrencies

- Position Sizing: Limit individual position size to manage downside risk

(III) Secure Storage Solutions

- Gate Web3 Wallet: Recommended for multi-chain asset management and secure storage

- Hardware Wallet Solution: Consider cold storage for larger holdings

- Security Precautions: Always verify contract addresses (0x15e6e0d4ebeac120f9a97e71faa6a0235b85ed12) and enable two-factor authentication

V. SAVM Potential Risks and Challenges

SAVM Market Risks

- High Volatility: The token has experienced an 89.36% decline over the past year, indicating substantial price volatility

- Limited Liquidity: With a 24-hour trading volume of approximately $12,621.69 and relatively low market capitalization, liquidity constraints may impact trading execution

- Low Market Share: SAVM holds only 0.000024% of the cryptocurrency market, suggesting limited market recognition

SAVM Regulatory Risks

- Evolving Regulatory Landscape: Bitcoin Layer-2 solutions may face regulatory scrutiny as authorities develop frameworks for cryptocurrency scaling technologies

- Compliance Requirements: Cross-chain bridge operations between Bitcoin and EVM ecosystems may be subject to varying regulatory requirements across jurisdictions

- Asset Classification: Uncertainty regarding how regulators may classify tokens associated with Bitcoin Layer-2 solutions

SAVM Technical Risks

- ZK Rollup Complexity: The implementation of zero-knowledge rollup technology introduces technical challenges that require ongoing maintenance and security audits

- Bridge Security: Cross-ecosystem bridges present potential vulnerabilities that could be exploited

- Ecosystem Dependency: The project's success is tied to the adoption and development of Bitcoin scaling solutions and EVM compatibility

VI. Conclusion and Action Recommendations

SAVM Investment Value Assessment

SatoshiVM represents an innovative approach to bridging Bitcoin scalability with EVM compatibility through ZK Rollup technology. While the project addresses significant technical challenges in the Bitcoin ecosystem, investors should note the token's substantial price decline and limited market penetration. The low circulating supply ratio (34.65%) suggests potential future token releases that could impact price dynamics. Long-term value proposition depends on successful execution of the technical roadmap and broader adoption of Bitcoin Layer-2 solutions. Short-term risks include continued price volatility, limited liquidity, and market uncertainty.

SAVM Investment Recommendations

✅ Beginners: Approach with caution; consider starting with minimal allocation (less than 1% of portfolio) while learning about Layer-2 technologies and market dynamics ✅ Experienced Investors: Evaluate as a speculative position within a diversified cryptocurrency portfolio, maintaining strict position sizing and risk management protocols ✅ Institutional Investors: Conduct thorough due diligence on technical architecture, team credentials, and ecosystem development before considering strategic allocation

SAVM Trading Participation Methods

- Spot Trading: Available on Gate.com with SAVM trading pairs

- Dollar-Cost Averaging: Consider systematic accumulation strategy to mitigate timing risk

- Portfolio Rebalancing: Regularly adjust position size based on risk tolerance and market conditions

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SAVM token? What are its main uses and value proposition?

SAVM is a governance and utility token that powers its ecosystem platform. It enables platform participation, incentivizes community engagement, and facilitates decentralized governance. The token's value lies in driving protocol development and enhancing user participation efficiency within the network.

How to analyze and predict SAVM price trends? What technical indicators or fundamental factors should be monitored?

Monitor technical indicators like moving averages and RSI, alongside fundamental factors including project development progress, market demand, and trading volume. Analyze on-chain metrics and community sentiment for comprehensive SAVM price forecasting.

What are the main factors affecting SAVM price? How do market sentiment, project progress, and macro environment impact its price?

SAVM price is primarily driven by market sentiment, project milestones, and macroeconomic factors. Investor behavior and industry news create significant price volatility. Macro conditions like inflation rates directly influence its valuation trajectory.

What are the risks and limitations of SAVM price predictions? Why might price predictions be inaccurate?

Price predictions face market volatility and incomplete data risks, causing potential inaccuracy. High leverage contracts and market fragility increase prediction uncertainty. Forecasts rely on historical data, which may not reflect future trends.

How does SAVM's investment potential and risk compare to similar tokens?

SAVM offers moderate investment potential with a fully diluted valuation around $110 million. Compared to other zk-rollups, transaction speed is relatively slower. Main risks include typical cryptocurrency volatility and market uncertainties inherent to the sector.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

Is Ithaca Protocol (ITHACA) a good investment?: A Comprehensive Analysis of Its Technology, Market Position, and Future Potential

Everything You Need to Know About the Ethereum ERC-20 Token Standard

How to Earn Money from Cryptocurrency and Bitcoin?

How to Buy Bitcoin in Russia Using Rubles Without Fees: Essential Tips

Why Open Protocols Are Essential for the Metaverse