2026 SENSO Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: SENSO's Market Position and Investment Value

Sensorium (SENSO) serves as a utility token powering a global social VR media platform, launched in 2020 to facilitate immersive entertainment experiences within the Sensorium Galaxy virtual world. As of February 8, 2026, SENSO maintains a market capitalization of approximately $210,385, with a circulating supply of around 70.27 million tokens, and a price hovering near $0.002994. This asset, recognized as a bridge between virtual reality entertainment and blockchain technology, is playing an increasingly relevant role in the convergence of VR experiences and decentralized digital economies.

This article will comprehensively analyze SENSO's price trajectory from 2026 through 2031, integrating historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SENSO Price History Review and Current Market Status

SENSO Historical Price Evolution Trajectory

- 2021: SENSO reached a notable peak of $3.28 on November 21, marking a significant milestone in its trading history, with substantial upward momentum driven by market enthusiasm for VR and metaverse concepts.

- 2025: The token experienced considerable volatility, with price movements reflecting broader market corrections and sector adjustments in the virtual reality space.

- 2025-2026: Market cycles brought SENSO from earlier elevated levels to a low of $0.000012 on August 28, 2025, representing a significant decline as market sentiment shifted and trading activity adjusted.

SENSO Current Market Status

As of February 8, 2026, SENSO is trading at $0.002994, showing a 24-hour price change of 0.43% with an intraday high of $0.002999 and low of $0.002981. The token's 24-hour trading volume stands at $14,017.05, while its market capitalization is approximately $210,385.77.

The circulating supply of SENSO is 70,269,127 tokens, representing 1.19% of the total supply of 715,280,000 tokens. The fully diluted market capitalization is $2,141,548.32, and the token holds a market dominance of 0.000085%.

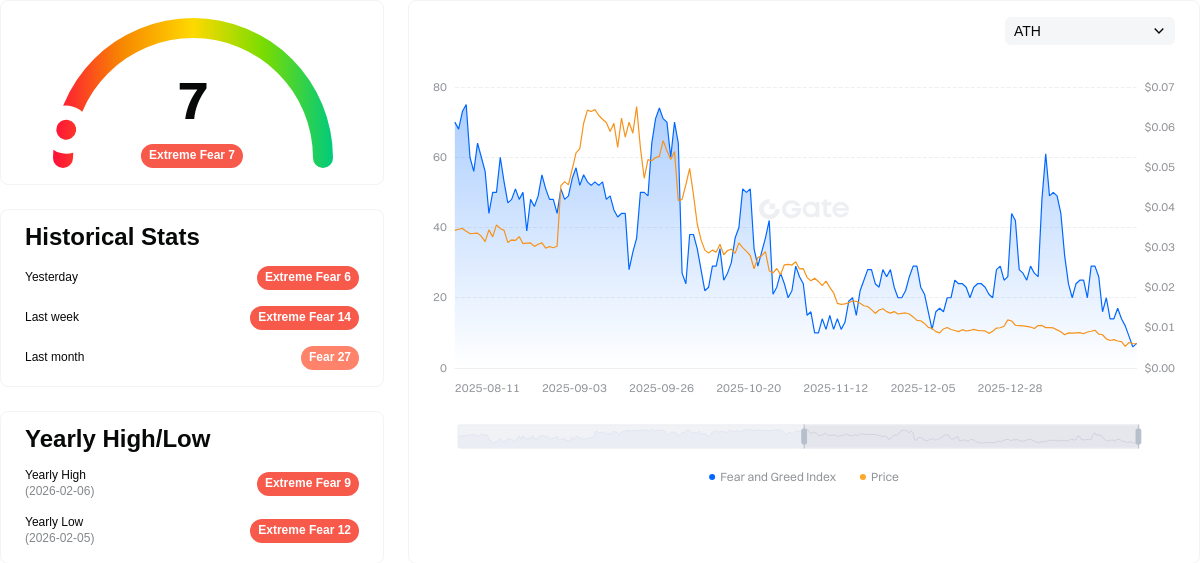

Over different time periods, SENSO has shown varied performance: a 1-hour change of -0.16%, a 7-day decline of -4.27%, a 30-day decrease of -3.42%, and a 1-year drop of -82.34%. The current market sentiment index reflects an extreme fear level with a VIX score of 7.

The token is available for trading on Gate.com and maintains a holder base of 3,571 addresses. SENSO operates as an ERC-20 token on the Ethereum blockchain, with its contract address verified at 0xC19B6A4Ac7C7Cc24459F08984Bbd09664af17bD1.

Click to view current SENSO market price

SENSO Market Sentiment Index

02-08-2026 Fear and Greed Index: 7(Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the SENSO index plummeting to 7, signaling severe market pessimism. This exceptionally low reading suggests investors are highly risk-averse, with widespread concerns dominating sentiment. Such extreme fear levels historically present contrarian opportunities, as panic-driven selloffs often create buying positions for long-term investors. Market participants should exercise caution while remaining aware that extreme fear episodes typically precede market reversals. Monitor key support levels closely and consider your risk tolerance carefully during this volatile period.

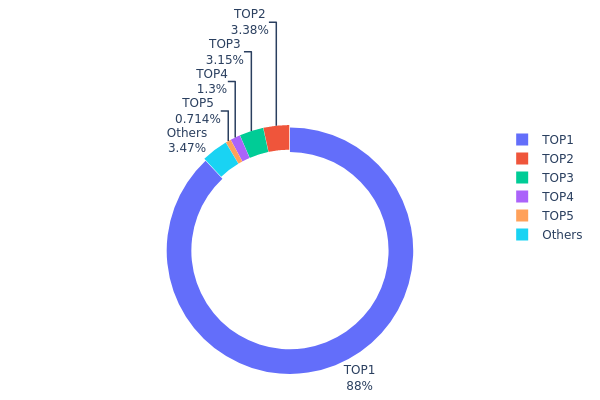

SENSO Holdings Distribution

According to the holdings distribution data, SENSO exhibits an extremely high concentration characteristic. The top-ranked address holds 5.205 billion tokens, accounting for 87.99% of the total supply, demonstrating an exceptionally centralized token structure. The second through fifth addresses hold 200 million, 186.396 million, 76.6848 million, and 42.2074 million tokens respectively, with holdings percentages of 3.38%, 3.15%, 1.29%, and 0.71%. The remaining addresses collectively hold only 204.9918 million tokens, representing 3.48% of the total supply.

This highly concentrated distribution pattern indicates that SENSO's on-chain structure is significantly dominated by a single major holder. Such an extreme concentration level poses substantial risks to market stability, as the top address possesses sufficient token volume to potentially influence market prices and liquidity through large-scale selling actions. Meanwhile, the relatively small holdings of other addresses suggest limited market participation breadth, which may result in insufficient trading depth and increased price volatility sensitivity.

From a decentralization perspective, SENSO's current holdings distribution deviates considerably from the ideal decentralized model. The market structure is highly dependent on the behavior of the largest holder, and any potential transfer or trading activity from this address could trigger significant market fluctuations. This concentration characteristic also reflects that the project may still be in its early development stage, or that a substantial portion of tokens remains under project team or early investor control, requiring close attention to subsequent unlocking schedules and circulation dynamics.

Click to view current SENSO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000001 | 5205000.00K | 87.99% |

| 2 | 0x9c2f...d400fb | 200000.00K | 3.38% |

| 3 | 0x45c3...bf38c9 | 186396.00K | 3.15% |

| 4 | 0xbc68...ce2172 | 76684.80K | 1.29% |

| 5 | 0x8c77...9726c3 | 42207.40K | 0.71% |

| - | Others | 204991.80K | 3.48% |

II. Core Factors Influencing SENSO's Future Price

Supply Mechanism

- Fixed Total Supply: SENSO operates with a capped token supply, creating potential scarcity value as adoption increases.

- Historical Pattern: Previous supply dynamics have shown correlation between limited circulation and price stability during market volatility.

- Current Impact: The controlled supply structure may support price appreciation as the metaverse ecosystem expands and demand for SENSO tokens grows.

Institutional and Major Holder Dynamics

- Institutional Holdings: Market data indicates growing interest from specialized digital asset funds focused on metaverse and virtual reality sectors.

- Enterprise Adoption: The Sensorium platform continues to attract partnerships within the entertainment and virtual experience industries, driving utility demand.

- Regulatory Landscape: The evolving regulatory framework for digital assets may influence institutional participation and market accessibility.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policy shifts and interest rate trajectories influence risk appetite for digital assets, affecting SENSO's valuation dynamics.

- Inflation Hedge Characteristics: As a technology-focused digital asset, SENSO's performance correlation with traditional inflation hedges remains limited compared to broader crypto markets.

- Geopolitical Factors: Global economic uncertainties and digital asset regulatory developments across jurisdictions may create both risks and opportunities for SENSO adoption.

Technology Development and Ecosystem Building

- Metaverse Integration: SENSO's deep connection with metaverse infrastructure presents significant potential for value appreciation as virtual reality applications mature and expand.

- VR/AR Technology Advancement: Continued development in virtual reality and augmented reality technologies enhances the utility proposition of SENSO within the Sensorium ecosystem.

- Ecosystem Applications: The platform's focus on immersive entertainment experiences, including virtual concerts and social interactions, drives practical use cases that may support long-term token demand and market performance.

III. 2026-2031 SENSO Price Prediction

2026 Outlook

- Conservative Forecast: $0.0021 - $0.003

- Neutral Forecast: Around $0.003

- Optimistic Forecast: Up to $0.00366 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual growth phase with moderate volatility, potentially influenced by broader crypto market trends and platform development progress

- Price Range Forecast:

- 2027: $0.00183 - $0.00363, with an average around $0.00333

- 2028: $0.00212 - $0.00383, with an average around $0.00348

- 2029: $0.00281 - $0.00453, with an average around $0.00365

- Key Catalysts: Platform ecosystem expansion, user base growth, strategic partnerships, and overall metaverse sector momentum

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00376 - $0.00487 by 2030 (assuming steady ecosystem development and stable market conditions)

- Optimistic Scenario: $0.00403 - $0.00641 by 2031 (assuming accelerated adoption, successful platform upgrades, and positive regulatory environment)

- Transformational Scenario: Potential to exceed $0.00641 (requires breakthrough partnerships, mass market adoption, and exceptional market conditions)

- 2026-02-08: SENSO trading within the predicted range of $0.0021 - $0.00366 (early stage of projected growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00366 | 0.003 | 0.0021 | 0 |

| 2027 | 0.00363 | 0.00333 | 0.00183 | 11 |

| 2028 | 0.00383 | 0.00348 | 0.00212 | 16 |

| 2029 | 0.00453 | 0.00365 | 0.00281 | 21 |

| 2030 | 0.00487 | 0.00409 | 0.00376 | 36 |

| 2031 | 0.00641 | 0.00448 | 0.00403 | 49 |

IV. SENSO Professional Investment Strategies and Risk Management

SENSO Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Investors believing in VR/metaverse sector development and seeking long-term exposure to Sensorium Galaxy ecosystem

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry point risk given SENSO's high volatility (-82.34% over 1 year)

- Monitor Sensorium Galaxy platform development milestones and user adoption metrics

- Store assets in secure wallets like Gate Web3 Wallet for enhanced security control

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use short-term (7-day) and medium-term (30-day) moving averages to identify trend reversals; note recent 7-day decline of -4.27%

- Volume Analysis: Monitor 24-hour trading volume ($14,017) relative to market cap ($210,386) to assess liquidity conditions

- Swing Trading Points:

- Identify support levels near recent 24-hour low ($0.002981) and resistance at 24-hour high ($0.002999)

- Consider taking partial profits during short-term rallies given the narrow 24-hour range

SENSO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Aggressive Investors: 2-3% of crypto portfolio

- Professional Investors: Up to 5% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine SENSO with established cryptocurrencies and other metaverse/VR tokens to reduce concentration risk

- Position Sizing: Limit individual position to account for SENSO's low market dominance (0.000085%) and limited exchange availability (1 exchange)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking participation

- Cold Storage Solution: Hardware wallets for long-term holdings exceeding $1,000 equivalent

- Security Precautions: Verify contract address (0xC19B6A4Ac7C7Cc24459F08984Bbd09664af17bD1) on Etherscan before any transactions; enable two-factor authentication

V. SENSO Potential Risks and Challenges

SENSO Market Risks

- High Volatility: 82.34% decline over the past year indicates significant price instability and potential for further downside

- Limited Liquidity: Trading on only 1 exchange with 24-hour volume of $14,017 may result in slippage during larger transactions

- Low Market Capitalization: $210,386 market cap ranks SENSO at #3882, exposing investors to elevated manipulation and delisting risks

SENSO Regulatory Risks

- VR/Metaverse Sector Uncertainty: Evolving regulations around virtual worlds, digital assets, and user-generated content may impact platform operations

- Token Classification: Potential regulatory scrutiny regarding SENSO's utility status within the Sensorium ecosystem

- Cross-Border Compliance: Global VR platform operations may face varying jurisdictional requirements affecting token utility

SENSO Technical Risks

- Smart Contract Vulnerabilities: ERC-20 token infrastructure requires ongoing security audits to prevent exploits

- Platform Dependency: SENSO value tied directly to Sensorium Galaxy's development success and user adoption rates

- Competition Risk: Established metaverse platforms and emerging VR competitors may limit Sensorium's market share growth

VI. Conclusion and Action Recommendations

SENSO Investment Value Assessment

SENSO represents a high-risk, speculative investment in the VR entertainment and metaverse sector. The token's significant 82.34% annual decline, limited liquidity (1 exchange), and low market dominance (0.000085%) suggest substantial volatility risks. Long-term value depends heavily on Sensorium Galaxy's ability to execute its VR social platform vision, attract users, and differentiate from competitors. Short-term risks include continued price pressure, liquidity constraints, and broader crypto market sentiment.

SENSO Investment Recommendations

✅ Beginners: Avoid or limit exposure to micro-cap allocation (< 0.5% of portfolio); prioritize education about VR/metaverse sector before investing ✅ Experienced Investors: Consider small speculative position (1-2% of portfolio) with strict stop-loss discipline; monitor platform development progress ✅ Institutional Investors: Conduct thorough due diligence on Sensorium's technology, partnerships, and competitive positioning before considering position

SENSO Trading Participation Methods

- Spot Trading: Purchase SENSO through Gate.com for direct exposure to price movements

- Dollar-Cost Averaging: Implement systematic purchasing schedule to reduce timing risk in volatile conditions

- Platform Participation: Engage with Sensorium Galaxy ecosystem to understand token utility and platform development firsthand

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of SENSO token? What are the highest and lowest prices in the past year?

SENSO has demonstrated strong market performance with notable volatility. Over the past year, the token reached highs around $0.85 and lows near $0.15, reflecting dynamic market sentiment and adoption growth in the web3 ecosystem.

What are the main factors affecting SENSO price?

SENSO price is primarily influenced by supply and demand dynamics, Sensorium Galaxy platform technological advancement, entertainment industry partnerships, overall crypto market trends, and macroeconomic conditions.

SENSO项目的基本面和技术发展进展如何?

SENSO自2020年上市以来在虚拟现实娱乐领域表现突出。截至2025年,市值达219,872美元,流通量约70,269,127枚。项目在元宇宙领域持续推进技术发展,具有良好的发展前景。

What are professional analysts' predictions for SENSO's future price?

Professional analysts predict SENSO's price will be influenced by market demand, technological development, and adoption trends. Future price movements depend on tokenomics, market sentiment, and broader crypto market conditions. Specific predictions vary, so monitoring market dynamics is essential.

What are the risks to be aware of when investing in SENSO tokens?

SENSO token investment carries high market volatility risk. Prices fluctuate significantly based on market conditions. Investors should conduct thorough research, understand market dynamics, and make independent investment decisions while bearing their own risks.

What are SENSO's advantages or disadvantages compared to similar competitive projects?

SENSO offers superior sensor precision and data stability with robust technology infrastructure. However, it faces higher implementation costs. Competitors may have lower prices but typically lack SENSO's reliability and accuracy standards in data provision.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Is Ithaca Protocol (ITHACA) a good investment?: A Comprehensive Analysis of Its Technology, Market Position, and Future Potential

Everything You Need to Know About the Ethereum ERC-20 Token Standard

How to Earn Money from Cryptocurrency and Bitcoin?

How to Buy Bitcoin in Russia Using Rubles Without Fees: Essential Tips

Why Open Protocols Are Essential for the Metaverse