2026 SPEC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SPEC's Market Position and Investment Value

Spectral (SPEC), positioned as an innovative onchain autonomous agent platform that converts natural language into Solidity code, has been making strides in the Web3 ecosystem since its launch in 2024. As of 2026, SPEC has a market capitalization of approximately $1.42 million, with a circulating supply of around 9 million tokens, and its price maintains at approximately $0.16. This asset, described as a manifestation of the Agent Economy in Web3, is playing an increasingly significant role in enabling individuals and enterprises to generate production-grade smart contracts, arbitrage agents, NFTs, and rollups.

This article will comprehensively analyze SPEC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SPEC Price History Review and Market Status

SPEC Historical Price Evolution Trajectory

- 2024: Token launch in May with initial price at $2.3, reaching peak of $18.673 in November during market enthusiasm period

- 2025-2026: Market correction phase, price declining from previous high levels

- 2026: January experienced significant volatility, recording lowest price point at $0.073 on January 21

SPEC Current Market Situation

As of February 2, 2026, SPEC is trading at $0.15727, showing notable short-term volatility. Over the past 24 hours, the token experienced a price decline of 28.29%, with trading activity reaching $177,191.47 in volume. The 24-hour price range fluctuated between $0.14947 and $0.22377, indicating considerable intraday movement.

From a weekly perspective, SPEC demonstrated a recovery pattern with a 103.69% increase over the past 7 days. The 30-day performance shows a gain of 20.59%, suggesting some stabilization after recent lows. However, the 1-year performance reflects a decline of 96.33% from earlier price levels.

The current market capitalization stands at approximately $1.42 million, with a circulating supply of 9 million tokens representing 9% of the maximum supply of 100 million tokens. The fully diluted market cap is calculated at $15.73 million. SPEC holds a market dominance of 0.00058% and is currently listed on 7 exchanges, with a holder base of 6,308 addresses.

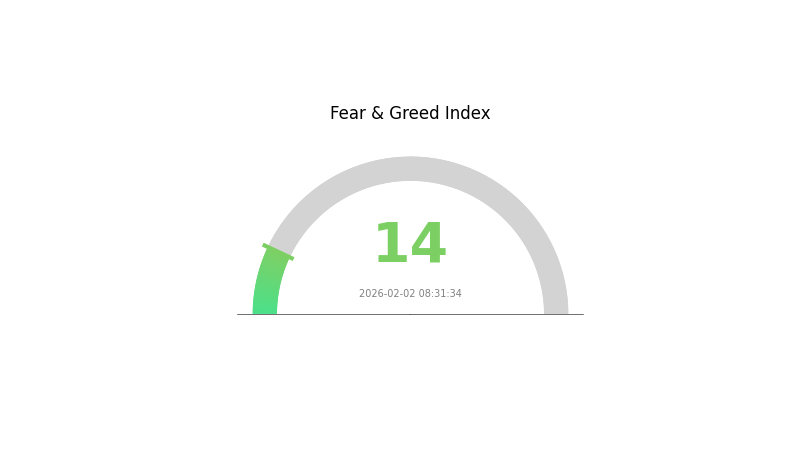

The token operates on the Ethereum blockchain following the ERC-20 standard, with the contract address verified on Etherscan. Market sentiment indicators suggest a cautious environment, with the current fear and greed index at 14, reflecting extreme fear conditions in the broader cryptocurrency market.

Click to view current SPEC market price

SPEC Market Sentiment Index

2026-02-02 Fear & Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 14. This exceptionally low sentiment indicates significant market pessimism and heightened anxiety among investors. Such extreme fear levels often present contrarian opportunities, as historical patterns suggest markets tend to recover from these depths. Traders should exercise caution while monitoring for potential entry points, as extreme sentiment readings can signal either capitulation or the formation of market bottoms. Risk management remains essential during periods of high volatility and fear-driven price movements.

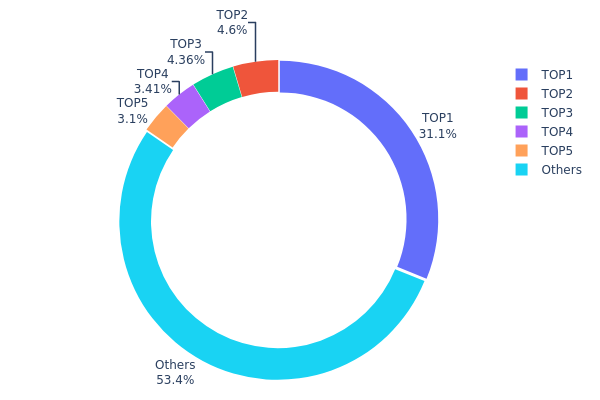

SPEC Holdings Distribution

The holdings distribution chart provides a clear view of how SPEC tokens are allocated across different wallet addresses on the blockchain. This metric serves as a crucial indicator of token concentration and reveals the degree of decentralization within the network. By analyzing the distribution pattern, we can assess potential risks related to market manipulation, price volatility, and overall ecosystem health.

According to the current data, SPEC exhibits a relatively high concentration pattern with the top holder controlling 31.14% of the total supply (31,148.85K tokens). The top five addresses collectively hold 46.58% of all tokens in circulation, while the remaining 53.42% is distributed among other participants. This concentration level suggests a moderate centralization risk, where a limited number of large holders possess significant influence over market dynamics.

The current distribution structure presents both opportunities and concerns for market participants. On one hand, the presence of substantial holders may indicate strong conviction from early investors or strategic partners, potentially providing price stability during market downturns. On the other hand, the concentration of nearly half the supply among five addresses creates vulnerability to sudden price movements if these major holders decide to liquidate their positions. The 53.42% distribution among smaller holders does provide some cushion against complete centralization, suggesting a growing community base that could help balance the influence of larger stakeholders over time.

Click to view current SPEC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x42bd...1596a1 | 31148.85K | 31.14% |

| 2 | 0x7c01...b21056 | 4595.02K | 4.59% |

| 3 | 0x1b82...31dc9f | 4358.92K | 4.35% |

| 4 | 0x39ea...331bec | 3406.34K | 3.40% |

| 5 | 0xb7b9...f752b7 | 3100.89K | 3.10% |

| - | Others | 53389.98K | 53.42% |

II. Core Factors Influencing SPEC's Future Price

Market Demand and Adoption Trends

- Market Demand Dynamics: The price outlook for Spectral is significantly influenced by market demand patterns. As adoption expands and more users integrate SPEC into their portfolios, demand pressures may contribute to price appreciation.

- Adoption Trajectory: The growth in user base and platform adoption serves as a fundamental driver for SPEC's value proposition. Increased utilization across various use cases can create sustained demand momentum.

- Institutional Participation: The level of institutional involvement plays a crucial role in price formation. Greater institutional engagement typically brings enhanced liquidity and price stability to the token ecosystem.

Macroeconomic Environment

- Economic Factors Impact: Broader economic conditions, including inflation rates, monetary policy directions, and global liquidity conditions, exert influence on cryptocurrency valuations including SPEC.

- Market Sentiment: Overall sentiment in financial markets and risk appetite among investors can affect capital flows into digital assets, thereby impacting SPEC's price trajectory.

- Growth Projections: Based on market analysis suggesting an annual growth rate of approximately 5%, SPEC may experience gradual price appreciation in the coming years, contingent on favorable market conditions and sustained adoption trends.

III. 2026-2031 SPEC Price Forecast

2026 Outlook

- Conservative forecast: $0.11389 - $0.13495

- Neutral forecast: $0.15601

- Optimistic forecast: $0.17473 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: SPEC may enter a gradual growth phase as the project matures and expands its ecosystem. The token could experience moderate volatility while establishing key partnerships and technical developments.

- Price range forecast:

- 2027: $0.10253 - $0.24144

- 2028: $0.15052 - $0.22171

- 2029: $0.20406 - $0.24232

- Key catalysts: Technology upgrades, ecosystem expansion, growing user adoption, and broader market recovery could serve as primary drivers for price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.13646 - $0.25246 (assuming steady project development and moderate market conditions)

- Optimistic scenario: $0.22744 - $0.31433 (contingent on successful implementation of major milestones and favorable regulatory environment)

- Transformative scenario: Above $0.31433 (requires exceptional market conditions, widespread adoption, and breakthrough technological achievements)

- 2026-02-02: SPEC is positioned at the early stage of its forecast period, with potential for systematic growth over the next five years based on projected market dynamics.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.17473 | 0.15601 | 0.11389 | 0 |

| 2027 | 0.24144 | 0.16537 | 0.10253 | 5 |

| 2028 | 0.22171 | 0.20341 | 0.15052 | 29 |

| 2029 | 0.24232 | 0.21256 | 0.20406 | 35 |

| 2030 | 0.25246 | 0.22744 | 0.13646 | 44 |

| 2031 | 0.31433 | 0.23995 | 0.21355 | 52 |

IV. SPEC Professional Investment Strategy and Risk Management

SPEC Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Crypto enthusiasts interested in AI-driven blockchain infrastructure and Web3 autonomous agent technology

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to build positions gradually, given SPEC's high volatility (24H change: -28.29%)

- Monitor project development milestones related to natural language to Solidity code conversion capabilities

- Store assets in secure wallets like Gate Web3 Wallet for long-term holding

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Current 24H trading volume stands at $177,191, indicating moderate liquidity levels requiring careful position sizing

- Price Range Monitoring: Track the 24H range between $0.14947-$0.22377 to identify optimal entry and exit points

- Swing Trading Considerations:

- The 7-day price increase of 103.69% suggests significant volatility, presenting both opportunities and risks

- Set stop-loss orders to manage downside risk, particularly given the 96.33% decline from launch price over the past year

SPEC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active risk monitoring

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance SPEC holdings with established cryptocurrencies and stablecoins

- Position Sizing: Limit individual trade exposure to no more than 2-3% of total portfolio value

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and convenient access

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding $10,000

- Security Precautions: Enable two-factor authentication, regularly update security settings, and never share private keys or seed phrases

V. SPEC Potential Risks and Challenges

SPEC Market Risks

- High Volatility: SPEC has experienced a 96.33% decline from its all-time high of $18.673 (November 2024) to current levels, demonstrating extreme price fluctuations

- Limited Liquidity: With a market cap of approximately $1.42 million and daily trading volume of $177,191, liquidity constraints may impact large trades

- Low Market Dominance: SPEC represents only 0.00058% of the total crypto market, indicating limited market adoption and higher susceptibility to market sentiment shifts

SPEC Regulatory Risks

- AI Compliance Uncertainty: As regulations around AI-generated smart contracts evolve, Spectral's core technology may face future compliance requirements

- Securities Classification: Autonomous agent tokens may attract regulatory scrutiny regarding their classification and trading restrictions

- Cross-border Regulatory Variations: Different jurisdictions may impose varying rules on AI-driven blockchain applications, affecting global adoption

SPEC Technical Risks

- Smart Contract Security: As a platform generating Solidity code, any vulnerabilities in generated contracts could impact user confidence and adoption

- Technology Maturity: The natural language to code conversion technology is relatively nascent, requiring continued development and testing

- Competitive Landscape: Emerging AI and blockchain integration projects may offer similar or superior solutions, affecting SPEC's market position

VI. Conclusion and Action Recommendations

SPEC Investment Value Assessment

SPEC presents an intriguing investment opportunity in the AI-driven blockchain infrastructure space, particularly for investors interested in autonomous agent technology and natural language smart contract generation. The project's focus on converting natural language into Solidity code addresses a genuine market need for accessible blockchain development tools. However, the token faces significant challenges, including a 96.33% decline from its all-time high, limited liquidity with a $1.42 million market cap, and only 9% of tokens currently circulating. The recent 7-day price surge of 103.69% demonstrates potential volatility-driven opportunities, but also underscores substantial risk. With only 6,308 holders and availability on 7 exchanges, SPEC remains a speculative asset suitable primarily for risk-tolerant investors with strong conviction in the Agent Economy thesis.

SPEC Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) to gain exposure while limiting downside risk. Use Gate.com's spot trading platform to make small, gradual purchases and store assets in Gate Web3 Wallet.

✅ Experienced Investors: Consider a 2-4% allocation with active monitoring of project developments and price action. Implement strict stop-loss orders and take partial profits during volatility spikes like the recent 103.69% weekly gain.

✅ Institutional Investors: Conduct thorough due diligence on Spectral's technology roadmap and team before committing capital. Consider strategic allocation up to 3-5% with hedging strategies and regular rebalancing based on market conditions and project milestones.

SPEC Trading Participation Methods

- Spot Trading: Purchase SPEC directly on Gate.com using USDT or other trading pairs for straightforward exposure

- Dollar-Cost Averaging: Set up regular purchase schedules to mitigate timing risk and smooth out entry prices over time

- Limit Orders: Use limit orders to buy during price dips near support levels (e.g., near the 24H low of $0.14947) and sell near resistance levels

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SPEC token and what are its main uses?

SPEC is an ERC-20 token within the Spectral ecosystem. Its primary uses include governance, allowing token holders to vote on platform updates and influence network development decisions.

What are the main factors affecting SPEC price?

SPEC price is primarily influenced by market sentiment and news events, government regulatory policies and legal clarity, trading volume and market liquidity, overall crypto market trends, and investor adoption rates.

How to predict SPEC's future price trend?

Analyze real-time price data, market trends, and transaction volume to forecast SPEC price movements. Combine technical analysis tools with market dynamics and supply-demand relationships for accurate predictions.

SPEC价格预测中存在哪些风险和局限性?

SPEC价格预测存在显著稀释风险,因大部分代币仍被锁定,高流通供应可能导致价格下跌。市场需求不确定性和交易额波动增加了预测复杂性。

Compared to similar projects, what is SPEC's price potential?

SPEC demonstrates significant market cap growth potential with strong fundamentals. Currently trading 99.32% below historical highs, it offers substantial upside opportunity for early adopters seeking exposure to similar utility-driven projects.

How has SPEC's historical price performance been, and are there any patterns to follow?

SPEC shows volatile price movements with no clear fixed pattern, but exhibits an overall upward trend. Price fluctuations are driven by supply-demand dynamics and technical developments. Data analysis helps identify emerging trends.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Are Network Nodes?

Three Leading Japanese Web3 Tokens

Understanding PoS in Cryptocurrency: A Beginner’s Guide to Proof-of-Stake

Top Crypto Exchanges for Beginners: A Review of Leading Platforms

Top 6 Best Decentralized Exchanges — A Review of Leading DEX Platforms