2026 STRIKE Price Prediction: Comprehensive Market Analysis and Expert Forecasts for the Next Generation of Cryptocurrency Valuations

Introduction: STRIKE's Market Position and Investment Value

StrikeBit AI (STRIKE), as a Modular Agent Protocol (MAP) enabling users to build, expand, and compose intelligent multi-agent systems for scalable collaboration, has been developing since its launch in 2025. As of 2026, STRIKE's market capitalization stands at approximately $1.43 million, with a circulating supply of around 209.9 million tokens, and the price maintains around $0.006816. This asset, positioned as an innovative infrastructure for AI agent collaboration, is playing an increasingly important role in the decentralized AI and Web3 automation sectors.

This article will comprehensively analyze STRIKE's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. STRIKE Price History Review and Market Status

STRIKE Historical Price Evolution Trajectory

- 2025: Token launched on October 1, reaching an all-time high of $0.03015 shortly after its initial listing, demonstrating strong early market reception

- 2025-2026: Price experienced significant correction from its peak, declining approximately 77.4% from the historical high to current levels

- 2026: On January 22, price touched its all-time low at $0.006487, marking the bottom of the correction phase before showing signs of recovery

STRIKE Current Market Situation

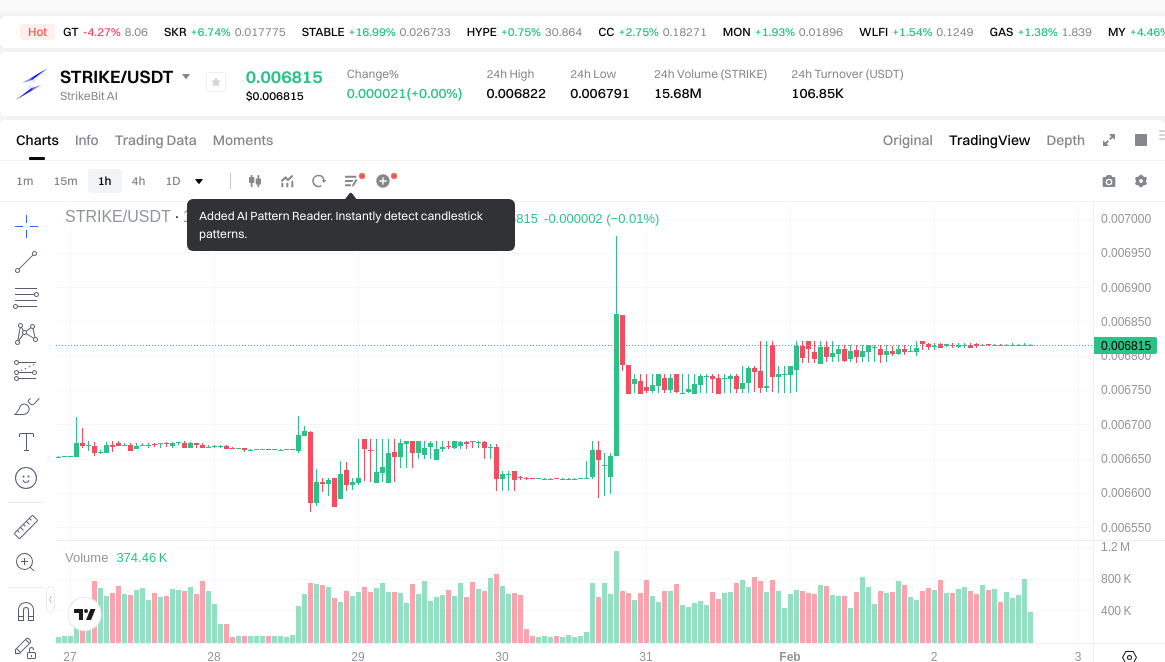

As of February 2, 2026, STRIKE is trading at $0.006816, representing a modest recovery of 5.07% from its all-time low recorded just days earlier. The token demonstrates mixed short-term performance, with a slight 1-hour decline of 0.01% and a 24-hour gain of 0.35%. Over the past week, STRIKE has shown positive momentum with a 2.46% increase, though the 30-day performance reflects a 2.92% decrease.

The current market capitalization stands at approximately $1.43 million, with a circulating supply of 209.9 million tokens out of a maximum supply of 2 billion tokens, resulting in a circulation ratio of 10.5%. The fully diluted market cap reaches $13.63 million. Daily trading volume of $106,347 indicates relatively modest market activity. The token maintains a market dominance of 0.00050% and is currently listed on 4 exchanges, with approximately 3,756 holders participating in the ecosystem.

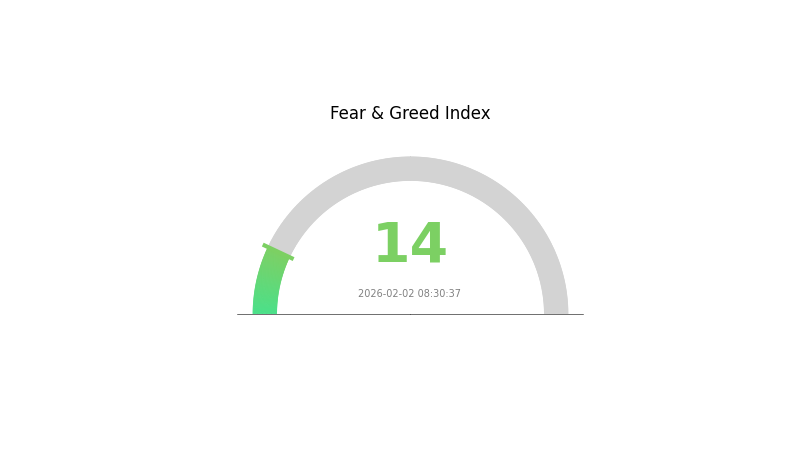

According to market sentiment indicators, the current volatility index sits at 14, suggesting an environment of extreme fear in the broader cryptocurrency market, which may be influencing STRIKE's price action alongside project-specific factors.

Click to view current STRIKE market price

STRIKE Market Sentiment Indicator

02-02-2026 Fear & Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 14. This significantly low sentiment indicator suggests heightened market anxiety and risk aversion among investors. When fear reaches such extreme levels, it typically creates opportunities for contrarian investors to identify potential entry points. However, traders should exercise caution and conduct thorough research before making investment decisions. Market conditions during extreme fear periods often lead to increased volatility. Monitor key support levels and stay informed through reliable market analysis tools available on Gate.com to navigate this challenging market environment effectively.

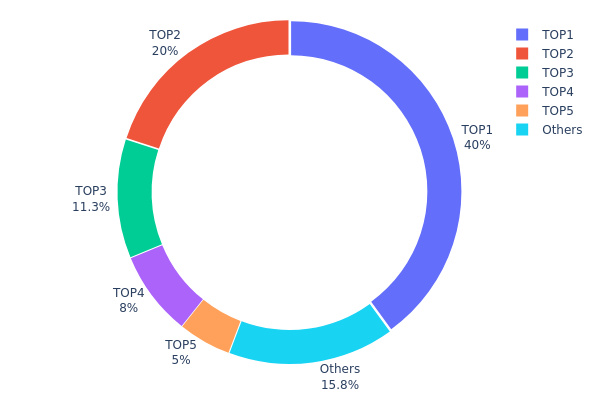

STRIKE Holding Distribution

The holding distribution chart illustrates the allocation of token holdings across different wallet addresses, revealing the concentration level of asset ownership within the network. This metric serves as a crucial indicator of decentralization and potential market control dynamics.

According to the current data, STRIKE exhibits a highly concentrated holding structure. The top holder controls 800,000K tokens, representing 40.00% of the total supply, while the second-largest address holds 400,000K tokens (20.00%). The top five addresses collectively account for 84.25% of the total supply, with only 15.75% distributed among other addresses. This concentration pattern indicates a significant degree of centralization in token ownership.

Such a concentrated holding distribution presents notable implications for market stability and price volatility. The dominance of large holders creates potential vulnerability to significant market movements, as coordinated actions by top addresses could substantially impact liquidity and price discovery mechanisms. Furthermore, this concentration may heighten concerns regarding potential market manipulation and reduce the resilience of the token's market structure. From a decentralization perspective, the current distribution suggests limited community-based governance participation and increased dependency on major stakeholders' decisions.

Click to view current STRIKE Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3153...89821e | 800000.00K | 40.00% |

| 2 | 0xa463...f3371e | 400000.00K | 20.00% |

| 3 | 0x3362...5f032f | 225000.00K | 11.25% |

| 4 | 0xc3d4...994150 | 160000.00K | 8.00% |

| 5 | 0x198f...e634ef | 100000.00K | 5.00% |

| - | Others | 315000.00K | 15.75% |

II. Core Factors Influencing STRIKE's Future Price

Supply Mechanism

- Token Supply Dynamics: The supply mechanism plays a fundamental role in determining STRIKE's value trajectory. Token unlocking schedules and liquidity depth represent key variables that directly affect short-term price movements.

- Historical Patterns: Supply-side factors have historically demonstrated significant influence on price volatility, particularly during major unlock events and liquidity adjustments.

- Current Impact: Investors should carefully evaluate their position sizing based on liquidity conditions and investment horizons, as supply-side pressures may create notable price fluctuations in the near term.

Market Sentiment and Demand Dynamics

- Market Sentiment: The cryptocurrency market exhibits high sensitivity to sentiment shifts. News events, community developments, and social media discourse can trigger rapid price movements in STRIKE.

- Adoption Metrics: User adoption rates and platform engagement levels serve as critical indicators of sustainable demand growth.

- Execution Excellence: Strong technical capabilities alone cannot guarantee success; actual user adoption and effective value capture mechanisms remain essential for long-term price appreciation.

Regulatory Environment

- Regulatory Framework: The regulatory landscape in major cryptocurrency markets significantly influences STRIKE's price performance. Changes in legal clarity and compliance requirements can create both opportunities and risks.

- Policy Developments: Government policies toward digital assets continue to evolve, with potential impacts on market accessibility and institutional participation.

- Compliance Standards: Adherence to regulatory standards may affect STRIKE's listing availability and liquidity across different jurisdictions.

Technical Development and Ecosystem Growth

- Platform Development: Technical progress on the Strike platform and community activity levels directly correlate with STRIKE's fundamental value proposition.

- Network Adoption: The extent of network utilization and ecosystem participation serves as a key indicator of the platform's real-world utility and potential for value accrual.

- Staking and Governance: Staking participation rates and governance engagement reflect community commitment and may influence token velocity and demand patterns.

Macroeconomic Conditions

- Broader Market State: STRIKE's price remains subject to the overall state of the cryptocurrency market, including liquidity conditions and risk appetite among digital asset investors.

- Economic Indicators: Macroeconomic data such as growth rates and inflation trends can indirectly affect cryptocurrency valuations through their impact on risk sentiment and capital flows.

III. 2026-2031 STRIKE Price Forecast

2026 Outlook

- Conservative Forecast: $0.00375 - $0.00682

- Neutral Forecast: Around $0.00682

- Optimistic Forecast: Up to $0.00716 (requires favorable market conditions and increased adoption)

Based on the predictive data, STRIKE is expected to maintain relatively stable price levels in 2026, with the average price hovering around $0.00682. The price range spans from a potential low of $0.00375 to a high of $0.00716, reflecting the current market consolidation phase and gradual development of the project ecosystem.

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual growth phase with increasing market recognition and ecosystem expansion

- Price Range Forecast:

- 2027: $0.00412 - $0.0095 (approximately 2% growth)

- 2028: $0.00577 - $0.01137 (approximately 20% growth)

- 2029: $0.00853 - $0.01177 (approximately 43% growth)

- Key Catalysts: Project development milestones, enhanced market liquidity, and potential partnerships within the crypto ecosystem

During this period, STRIKE is projected to enter a more dynamic growth trajectory, with year-over-year increases becoming more pronounced. The 2028-2029 timeframe appears particularly promising, with cumulative growth potentially reaching over 40% compared to 2026 baseline levels.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00701 - $0.01219 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.01034 - $0.01356 (assuming enhanced ecosystem adoption and favorable regulatory environment)

- Transformative Scenario: Potential to exceed $0.01356 (contingent upon breakthrough technological implementations or major institutional partnerships)

By 2031, the forecast suggests STRIKE could achieve approximately 68% growth compared to 2026 levels, with average prices potentially reaching $0.01149. The upper range projections indicate possible highs of $0.01356, representing significant long-term appreciation potential for early adopters and long-term holders.

As of 2026-02-02, STRIKE demonstrates a forward-looking price trajectory with gradual but consistent growth expectations through 2031, positioning itself within an evolving market landscape.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00716 | 0.00682 | 0.00375 | 0 |

| 2027 | 0.0095 | 0.00699 | 0.00412 | 2 |

| 2028 | 0.01137 | 0.00824 | 0.00577 | 20 |

| 2029 | 0.01177 | 0.00981 | 0.00853 | 43 |

| 2030 | 0.01219 | 0.01079 | 0.00701 | 58 |

| 2031 | 0.01356 | 0.01149 | 0.01034 | 68 |

IV. STRIKE Professional Investment Strategies and Risk Management

STRIKE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to modular agent protocol development and multi-agent AI system infrastructure

- Operational Recommendations:

- Consider accumulating positions gradually during periods of lower volatility to reduce average entry cost

- Monitor project development milestones, particularly updates to the Modular Agent Protocol (MAP) and ecosystem expansion

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings, ensuring private key protection and regular security audits

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Apply 50-day and 200-day moving averages to identify potential trend reversals and momentum shifts in STRIKE price action

- Relative Strength Index (RSI): Monitor overbought (above 70) and oversold (below 30) conditions to time entry and exit points

- Swing Trading Considerations:

- Given STRIKE's relatively small market capitalization of approximately $1.43 million, be aware of potential liquidity constraints during high-volatility periods

- Set disciplined stop-loss levels (typically 5-10% below entry) to manage downside risk in this emerging asset

STRIKE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate no more than 1-2% of cryptocurrency portfolio to STRIKE, given its early-stage nature and market position

- Aggressive Investors: May consider 3-5% allocation as part of a diversified AI and agent protocol sector exposure

- Professional Investors: Can allocate up to 5-10% within specialized thematic portfolios focused on emerging AI infrastructure protocols

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance STRIKE exposure with established layer-1 protocols and stablecoins to reduce concentration risk

- Position Sizing: Implement scaled entry strategies rather than single large positions to average entry price and reduce timing risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet provides convenient access for active trading while maintaining security standards

- Cold Storage Option: For holdings exceeding short-term trading needs, consider hardware wallet solutions with offline key storage

- Security Precautions: Never share private keys or seed phrases, enable two-factor authentication, and regularly verify wallet addresses before transactions

V. STRIKE Potential Risks and Challenges

STRIKE Market Risks

- High Volatility: STRIKE has experienced an 82.37% decline over the past year, demonstrating significant price instability characteristic of low-cap assets

- Limited Liquidity: With 24-hour trading volume of approximately $106,348 and circulation on only 4 exchanges, liquidity constraints may impact execution quality

- Market Capitalization Concerns: Current market cap of $1.43 million represents only 10.5% of fully diluted valuation, indicating substantial future token unlock pressure

STRIKE Regulatory Risks

- AI Protocol Oversight: Evolving regulatory frameworks for AI-based blockchain protocols may introduce compliance requirements affecting project operations

- Token Classification Uncertainty: Regulatory treatment of tokens enabling multi-agent systems remains undefined in many jurisdictions

- Cross-border Considerations: As a BEP-20 token operating within BSC ecosystem, STRIKE faces regulatory scrutiny applicable to both blockchain infrastructure and AI applications

STRIKE Technical Risks

- Smart Contract Vulnerabilities: As with all blockchain protocols, potential undiscovered vulnerabilities in smart contracts could pose security threats

- Protocol Development Risk: The early-stage nature of modular agent protocols introduces execution risk related to roadmap delivery and technical specifications

- Ecosystem Dependency: STRIKE's reliance on BSC infrastructure means network congestion, security issues, or changes to the underlying chain could impact functionality

VI. Conclusion and Action Recommendations

STRIKE Investment Value Assessment

StrikeBit AI presents an emerging opportunity within the modular agent protocol sector, addressing the growing need for scalable multi-agent collaboration systems. The project's innovative approach to building intelligent agent infrastructure positions it within a nascent but potentially significant market segment. However, the token's early-stage status, limited liquidity, substantial year-over-year decline, and relatively small holder base (3,756 holders) indicate considerable uncertainty and risk. The disconnect between current market capitalization and fully diluted valuation suggests potential dilution concerns that warrant careful consideration.

STRIKE Investment Recommendations

✅ Beginners: Avoid or limit exposure to minimal amounts while gaining experience with more established cryptocurrencies. If interested in the AI agent sector, first develop understanding through educational resources and consider larger-cap alternatives ✅ Experienced Investors: Consider small speculative allocation (1-2% of crypto portfolio) only if comfortable with high volatility and potential complete loss. Employ disciplined risk management and avoid emotional decision-making ✅ Institutional Investors: May evaluate STRIKE as part of thematic research into modular agent protocols and AI infrastructure, maintaining appropriate due diligence standards and risk controls consistent with early-stage venture exposure

STRIKE Trading Participation Methods

- Spot Trading: Purchase STRIKE directly on Gate.com and other supported exchanges where the token maintains trading pairs

- Gradual Accumulation: Implement dollar-cost averaging strategies to mitigate timing risk and reduce impact of short-term volatility

- Monitoring and Rebalancing: Regularly review position sizing relative to portfolio risk tolerance and project development progress, adjusting exposure as circumstances evolve

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is STRIKE price(strike price), and what is the difference between it and the current market price?

STRIKE price is the fixed price at which an option holder can buy or sell an underlying asset. Current market price fluctuates based on supply and demand, while STRIKE price remains predetermined until the option expires or is exercised.

How to predict STRIKE price trends in options, what analysis methods are available?

Predict STRIKE price movements through fundamental analysis examining asset value, technical analysis using chart patterns and indicators, volatility assessment measuring price fluctuations, and market sentiment analysis tracking trader positioning. Combine these methods for comprehensive market outlook.

How does choosing different STRIKE prices affect option prices and risks?

Lower strike prices have higher premiums and greater risk exposure, while higher strike prices offer lower premiums with reduced potential gains. Strike selection directly impacts your leverage, break-even point, and profit/loss scenarios.

STRIKE price预测在期权交易策略中有什么实际应用?

STRIKE price预测帮助交易者确定最优行权价格,直接应用于看涨看跌策略、跨式套利和风险对冲。精准预测能提升头寸收益率,优化交易额配置效率。

What is the relationship between STRIKE price, volatility, and time to expiration?

Strike price determines option intrinsic value relative to market price. Higher volatility increases option value as price swings expand profit potential. Longer time to expiration raises option value through increased probability of favorable price movement. Conversely, as expiration approaches, time decay accelerates, reducing option value.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

Why ChatGPT is Likely the Best AI Now?

MomoAI: AI-Powered Social Gaming Revolution on Solana

What Are Network Nodes?

Three Leading Japanese Web3 Tokens

Understanding PoS in Cryptocurrency: A Beginner’s Guide to Proof-of-Stake

Top Crypto Exchanges for Beginners: A Review of Leading Platforms

Top 6 Best Decentralized Exchanges — A Review of Leading DEX Platforms