2026 SUDO Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: SUDO's Market Position and Investment Value

Sudoswap (SUDO), as a governance token for a concentrated liquidity AMM protocol designed for NFTs, has been carving out its niche in the decentralized finance ecosystem since its launch. As of 2026, SUDO maintains a market capitalization of approximately $338,577, with a circulating supply of around 25.4 million tokens, and the price hovering near $0.0133. This asset, positioned as a governance mechanism for NFT liquidity solutions, is playing an increasingly relevant role in the NFT trading infrastructure space.

This article will comprehensively analyze SUDO's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SUDO Price History Review and Market Status

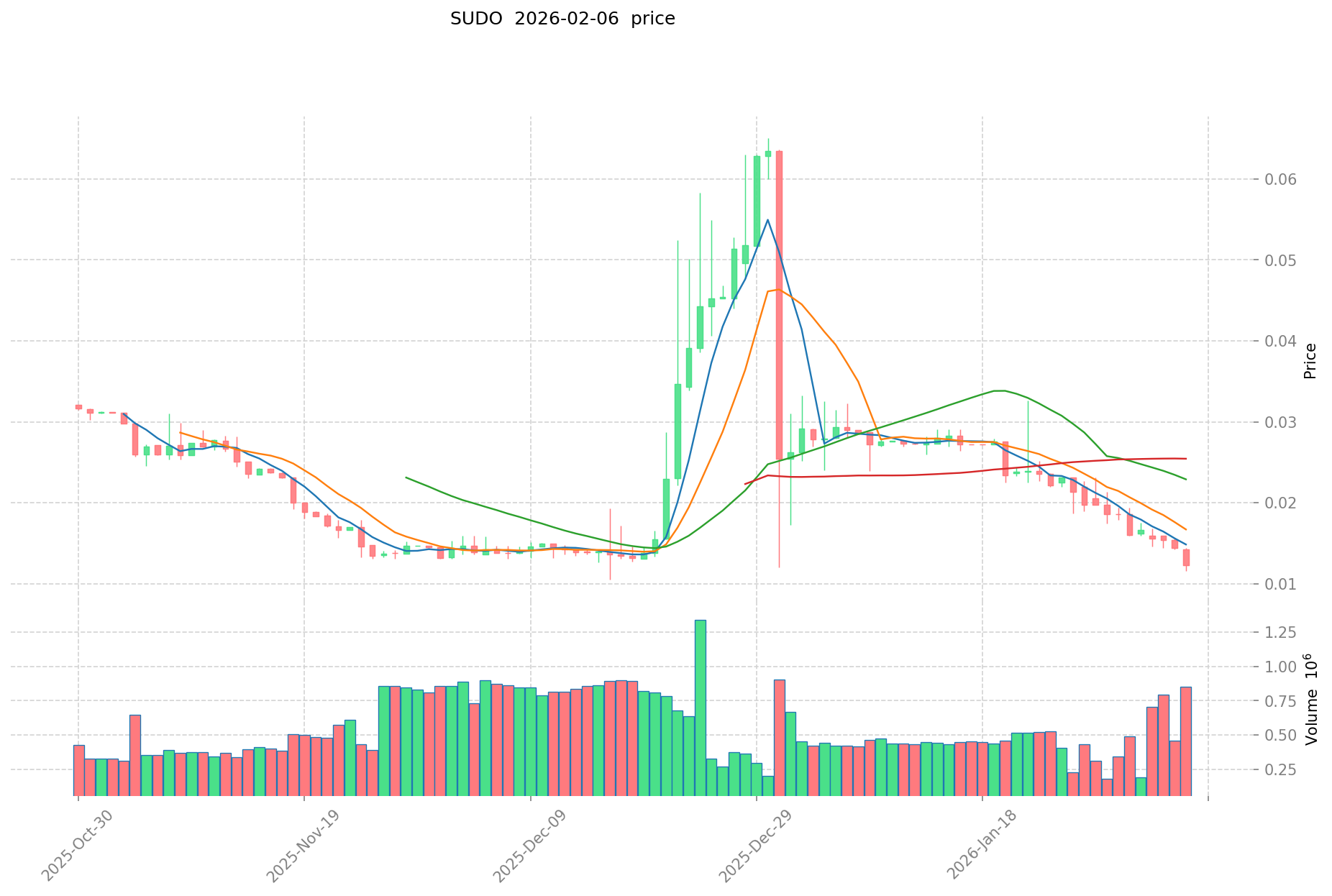

SUDO Historical Price Evolution Trajectory

- 2023: On February 19, SUDO reached a historical price level of $4.16, representing a significant milestone in the token's early trading history.

- 2026: On January 1, the token experienced notable downward pressure, with prices declining to $0.01122368.

SUDO Current Market Dynamics

As of February 7, 2026, SUDO is trading at $0.01333, showing mixed short-term performance indicators. The token has demonstrated a 5.86% increase over the past hour and a 4.87% gain in the last 24 hours, with trading volumes reaching $11,427.52 during this period.

However, broader timeframe analysis reveals more challenging market conditions. The 7-day performance shows a decline of 27.16%, while the 30-day trajectory indicates a 50.77% decrease. The annual perspective presents an 85.74% reduction from previous levels.

The token's market capitalization stands at $338,577.10, with a circulating supply of 25,399,632.77 SUDO tokens, representing approximately 42.33% of the total supply of 58,056,418.77 tokens. The fully diluted market valuation is calculated at $773,892.06, based on a maximum supply of 60,000,000 tokens.

The 24-hour price range has fluctuated between $0.01161 and $0.0141, reflecting ongoing market volatility. With 2,424 token holders and a market dominance of 0.000030%, SUDO maintains a presence within the broader cryptocurrency ecosystem.

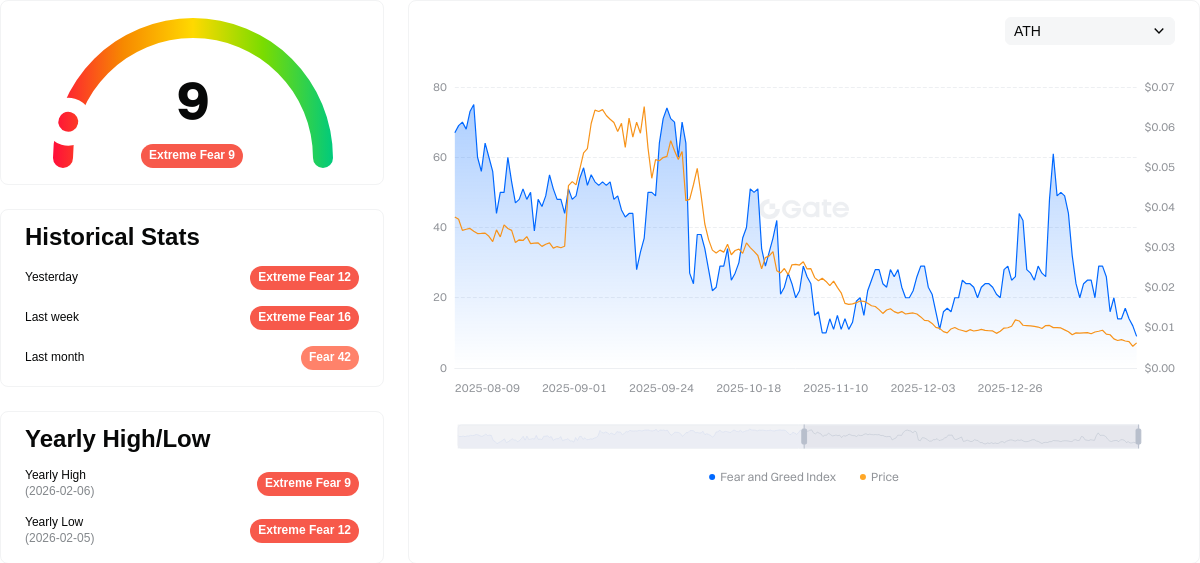

The current market sentiment index registers at 9, indicating an extreme fear environment across the cryptocurrency markets.

Click to view the current SUDO market price

SUDO Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting a critical low of 9. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, risk assets typically face selling pressure as participants reassess their positions. However, historically, extreme fear levels have often preceded significant market recovery opportunities. Investors should remain vigilant while considering potential entry points for long-term positions at depressed valuations on Gate.com.

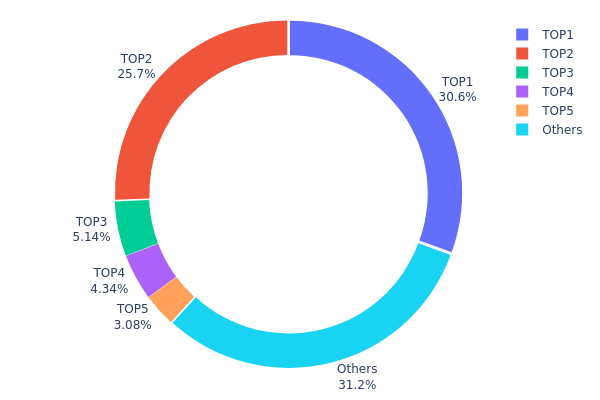

SUDO Holding Distribution

The holding distribution chart reveals the allocation of SUDO tokens across different wallet addresses, providing critical insights into the token's decentralization level and potential market manipulation risks. According to the latest on-chain data, the top 5 addresses collectively control approximately 68.77% of the total SUDO supply, indicating a highly concentrated holding structure. Specifically, the largest holder (0xca41...07a251) possesses 30.59% of total tokens, while the second-largest address (0x6853...b7eeb0) holds 25.65%. This concentration pattern suggests that a small number of entities maintain substantial control over SUDO's circulating supply.

Such a concentrated distribution structure carries significant implications for market stability and price volatility. When major holders control over two-thirds of the token supply, they possess considerable influence over market dynamics, including the ability to impact prices through large-scale transactions or coordinated actions. The remaining 31.23% held by other addresses indicates limited distribution among retail participants, which may constrain organic market development and liquidity depth. This asymmetric distribution could amplify price fluctuations during periods of significant buying or selling pressure from top holders.

From a decentralization perspective, SUDO's current holding structure exhibits characteristics of centralized control, which diverges from the fundamental principles of distributed blockchain networks. While concentrated holdings may facilitate coordinated development and governance in early project stages, they simultaneously introduce systemic risks related to market manipulation and single-point dependencies. The relatively low percentage held by smaller addresses (31.23%) suggests limited community participation, which may affect long-term ecosystem sustainability and token value stability.

Click to view current SUDO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xca41...07a251 | 17764.29K | 30.59% |

| 2 | 0x6853...b7eeb0 | 14892.50K | 25.65% |

| 3 | 0xa023...fc947e | 2981.90K | 5.13% |

| 4 | 0xcffa...290703 | 2518.31K | 4.33% |

| 5 | 0x75d4...6d346f | 1786.16K | 3.07% |

| - | Others | 18113.27K | 31.23% |

II. Core Factors Influencing SUDO's Future Price

Supply Mechanism

- Fixed Supply Cap: SUDO features a capped total supply, which may generate scarcity effects as demand grows, potentially driving price appreciation.

- Historical Pattern: Crypto assets with limited supply have historically experienced upward price pressure when demand remains stable or increases.

- Current Impact: The fixed supply mechanism positions SUDO to benefit from increased adoption, as token availability constraints could amplify price movements during periods of heightened market interest.

Institutional and Whale Dynamics

While specific institutional holdings and corporate adoption details are limited in available materials, monitoring large holder activities and tracking any future institutional engagement will be essential for assessing SUDO's price trajectory.

Macroeconomic Environment

- Monetary Policy Impact: Broader cryptocurrency market trends, influenced by central bank policies and liquidity conditions, affect SUDO's performance alongside other digital assets.

- Market Sentiment: The overall sentiment in cryptocurrency markets, driven by investor optimism or concerns about digital asset prospects, plays a significant role in SUDO's price dynamics.

- Regulatory Developments: Evolving regulatory frameworks and compliance requirements across jurisdictions represent key uncertainties that could impact SUDO's market position.

Technological Development and Ecosystem Building

- Community Engagement: Active community participation and governance mechanisms contribute to SUDO's long-term sustainability and adoption potential.

- Technological Advancements: Ongoing protocol improvements and technical innovations within SUDO's infrastructure may enhance its utility and attractiveness to users.

- Ecosystem Applications: The development and expansion of applications, services, and use cases built around SUDO will directly influence demand for the token and support its value proposition in the broader crypto landscape.

III. 2026-2031 SUDO Price Forecast

2026 Outlook

- Conservative prediction: $0.00693 - $0.01333

- Neutral prediction: $0.01333

- Optimistic prediction: $0.01826 (subject to favorable market conditions)

Mid-term 2027-2029 Outlook

- Market stage expectation: During this period, SUDO may experience gradual growth as the cryptocurrency market matures and adoption increases. The token could benefit from broader institutional interest and technological developments within its ecosystem.

- Price range predictions:

- 2027: $0.01232 - $0.02306 (approximately 18% increase from 2026)

- 2028: $0.01263 - $0.02312 (approximately 45% increase from 2026)

- 2029: $0.01808 - $0.03064 (approximately 59% increase from 2026)

- Key catalysts: Market adoption expansion, potential protocol upgrades, and increasing utility within decentralized finance applications could serve as primary drivers for price appreciation.

Long-term 2030-2031 Outlook

- Baseline scenario: $0.01739 - $0.02596 in 2030 (assuming steady market conditions and continued project development)

- Optimistic scenario: $0.01611 - $0.03444 by 2031 (contingent upon significant ecosystem growth and favorable regulatory developments)

- Transformative scenario: Potential to reach upper ranges if SUDO achieves widespread adoption and integration across multiple blockchain platforms

- February 7, 2026: SUDO trading within initial price discovery phase as the market establishes valuation benchmarks

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01826 | 0.01333 | 0.00693 | 0 |

| 2027 | 0.02306 | 0.0158 | 0.01232 | 18 |

| 2028 | 0.02312 | 0.01943 | 0.01263 | 45 |

| 2029 | 0.03064 | 0.02127 | 0.01808 | 59 |

| 2030 | 0.02959 | 0.02596 | 0.01739 | 94 |

| 2031 | 0.03444 | 0.02777 | 0.01611 | 108 |

IV. SUDO Professional Investment Strategy and Risk Management

SUDO Investment Methodology

(I) Long-Term Holding Strategy

- Suitable for: Investors who believe in NFT market infrastructure development and are willing to tolerate high volatility

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to mitigate entry price risk, avoiding lump-sum purchases during periods of high volatility

- Monitor protocol governance developments and NFT market adoption metrics to assess long-term value proposition

- Storage Solution: Use Gate Web3 Wallet for secure self-custody with multi-signature protection enabled

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Profile Analysis: Monitor 24-hour trading volume relative to historical averages; current volume of $11,427 suggests limited liquidity requiring cautious position sizing

- Support and Resistance Levels: Track key price levels including recent 24-hour range ($0.01161-$0.0141) and all-time low ($0.01122368) as potential support zones

- Swing Trading Considerations:

- Utilize stop-loss orders given the token's high volatility (4.87% daily change, -27.16% weekly decline)

- Factor in low liquidity when planning entry and exit points to minimize slippage impact

SUDO Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 0-1% of crypto portfolio allocation

- Aggressive Investors: 2-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active hedging strategies

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance SUDO exposure with established NFT marketplace tokens and broader crypto assets

- Position Sizing Based on Market Cap: Given the relatively small market cap of $338,577, limit position size to prevent illiquidity issues during exits

(III) Secure Storage Solutions

- Non-Custodial Wallet Recommendation: Gate Web3 Wallet with hardware wallet integration for enhanced security

- Multi-Signature Setup: For holdings above $10,000 equivalent, implement multi-signature arrangements

- Security Precautions: Never share private keys, verify contract addresses (0x3446dd70b2d52a6bf4a5a192d9b0a161295ab7f9 on Ethereum), and be vigilant against phishing attempts

V. SUDO Potential Risks and Challenges

SUDO Market Risks

- Liquidity Risk: With only $11,427 in 24-hour trading volume and availability on limited exchanges, entering or exiting large positions may significantly impact price

- Volatility Risk: The token demonstrates extreme price swings, with a -85.74% decline over one year and -50.77% over 30 days, indicating substantial downside potential

- NFT Market Correlation: As an NFT-focused protocol token, SUDO's value is closely tied to NFT market sentiment, which has experienced declining activity

SUDO Regulatory Risks

- NFT Regulatory Uncertainty: Evolving global regulations regarding NFTs could impact protocol usage and token utility

- DeFi Compliance Requirements: Increasing regulatory scrutiny on decentralized finance protocols may introduce operational constraints

- Governance Token Classification: Potential regulatory treatment of governance tokens could affect SUDO's legal status in various jurisdictions

SUDO Technical Risks

- Smart Contract Risk: As an AMM protocol for NFTs, vulnerabilities in smart contracts could lead to fund losses or protocol exploitation

- Competition Risk: Established NFT marketplaces and emerging concentrated liquidity solutions may reduce Sudoswap's market share

- Limited Adoption: With 2,424 holders and low trading activity, the protocol faces challenges in achieving network effects necessary for sustainable growth

VI. Conclusion and Action Recommendations

SUDO Investment Value Assessment

SUDO represents a specialized governance token for NFT concentrated liquidity infrastructure. While the protocol addresses technical needs in the NFT trading ecosystem, the token faces significant headwinds including severely limited liquidity, substantial price depreciation (-85.74% annually), and challenging market conditions for NFT-related assets. The small market capitalization of approximately $338,577 and circulating supply of only 42.33% of total supply suggest both early-stage opportunity and considerable dilution risk. Long-term value depends heavily on NFT market recovery and protocol adoption, while short-term risks include continued volatility and liquidity constraints.

SUDO Investment Recommendations

✅ Beginners: Exercise extreme caution; consider avoiding investment until demonstrable protocol traction and improved liquidity emerge. If interested, limit exposure to less than 0.5% of total crypto portfolio ✅ Experienced Investors: May consider small speculative allocation (1-3% of crypto portfolio) with strict risk management, viewing it as a high-risk/high-reward NFT infrastructure play ✅ Institutional Investors: Conduct thorough due diligence on protocol mechanics, team background, and competitive positioning before committing capital; consider strategic investment contingent on clear adoption milestones

SUDO Trading Participation Methods

- Spot Trading on Gate.com: Execute trades on Gate.com where SUDO is listed, utilizing limit orders to manage entry prices in low-liquidity conditions

- Gate Web3 Wallet Integration: Utilize Gate Web3 Wallet for secure self-custody and potential participation in protocol governance activities

- Dollar-Cost Averaging Approach: For long-term believers, implement systematic small purchases over extended periods to smooth entry price volatility

Cryptocurrency investments carry extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their individual risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SUDO token and what are its practical uses?

SUDO is the native token of SudoSwap, used for paying trading fees and incentivizing platform participants. It enables decentralized trading and liquidity mining, with active trading pairs on Uniswap V2.

What is SUDO's historical price performance, including its all-time high and all-time low?

SUDO reached an all-time high of HK$29.184626 on February 20, 2023, and an all-time low of HK$0.09004 on December 31, 2025. The token has experienced significant volatility throughout its trading history.

What is the 2024 SUDO price prediction, and how do professional analysts view it?

2024 SUDO price predictions were not officially released. Professional analysts have focused on 2025 forecasts instead, analyzing growth potential based on historical trends, market dynamics, and ecosystem development for upcoming years.

What are the main factors affecting SUDO price?

SUDO price is primarily influenced by market demand, NFT market trends, Sudoswap platform activity, and token supply. The platform's custom bonding curve mechanism also plays a significant role in price determination.

What advantages does SUDO have compared to other Layer 2 or public chain tokens?

SUDO offers superior transaction speed and lower fees than competing Layer 2 solutions, combined with enhanced security and scalability. Its efficient architecture enables faster processing and broader adoption potential.

What are the main risks of investing in SUDO?

Main risks include market volatility, price manipulation, regulatory uncertainty, and technical security issues. NFT market demand fluctuations and liquidity concerns also pose potential challenges to SUDO investments.

What is the SUDO project's development roadmap and what major plans does it have for the future?

SUDO project plans to continuously optimize core functionality, focusing on performance enhancement and user experience improvements to enable broader application scenarios and strengthen ecosystem development.

What are SUDO's circulating supply and total supply, and is there inflation risk?

SUDO features a fixed total supply with no additional token minting planned. The circulating supply details are available in official documentation. With a capped supply mechanism, inflation risk is minimal, making SUDO a deflationary asset with strong long-term value potential.

How to conduct technical analysis of SUDO to predict price movements?

Analyze SUDO's price charts using moving averages, RSI, and MACD indicators. Monitor trading volume trends, support/resistance levels, and candlestick patterns. Track on-chain metrics and market sentiment for comprehensive technical forecasting.

How is SUDO's trading volume and liquidity on major exchanges?

SUDO maintains moderate trading volume and liquidity across major platforms, with active participation in decentralized NFT trading protocols. The token demonstrates consistent market engagement and reasonable trading depth for price discovery.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Can quantum computers break Bitcoin?

What is MEPAD: A Comprehensive Guide to Mobile Electronic Personal Assistant Devices

What is FRAG: A Comprehensive Guide to Fragment Shaders and Real-Time Graphics Rendering

What is CRE: A Comprehensive Guide to Commercial Real Estate Investment and Market Analysis

What is CATGPT: A Comprehensive Guide to AI-Powered Conversational Technology