2026 TEVA Price Prediction: Expert Analysis and Market Forecast for Teva Pharmaceutical Industries Stock

Introduction: TEVA's Market Position and Investment Value

Tevaera (TEVA), as a UX-first gaming ecosystem powered by ZK Stack and AI technology, has been making significant strides in the Web3 gaming sector since its launch in December 2024. As of February 2026, TEVA maintains a market capitalization of approximately $949,830, with a circulating supply of around 840.56 million tokens, and the price hovering around $0.00113. This asset, recognized as a community-driven gaming platform with over one million Soulbound Gamers, is playing an increasingly important role in redefining the blockchain gaming landscape through multi-genre Web3 games and innovative gaming agents.

This article will comprehensively analyze TEVA's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TEVA Price History Review and Market Status

TEVA Historical Price Evolution Trajectory

- 2025: Token launch on Gate.com with an initial price of $0.015, reaching an all-time high of $0.075043 on January 3, 2025

- 2026: Market correction phase, price declined significantly from the ATH, reaching an all-time low of $0.001013 on February 2, 2026

TEVA Current Market Situation

As of February 3, 2026, TEVA is trading at $0.001130, showing a 1.15% increase over the past 24 hours and a 2.27% gain in the last hour. The 24-hour trading range spans from $0.001031 to $0.001205, with a total trading volume of $13,396.17.

The token currently holds a market capitalization of approximately $949,830, ranking 2544 in the overall cryptocurrency market. With a circulating supply of 840.56 million TEVA tokens out of a maximum supply of 4 billion, the circulating ratio stands at 21.01%. The fully diluted market cap is calculated at $4.52 million.

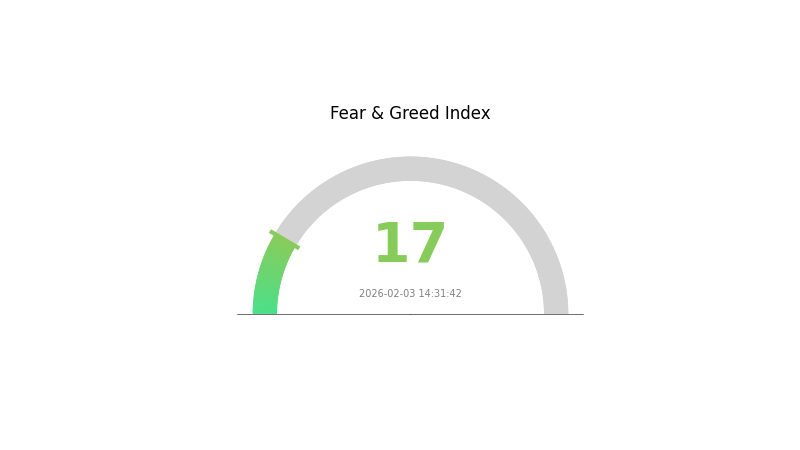

Over longer time frames, TEVA has experienced considerable volatility, declining 22.56% over the past week, 54.63% over the past month, and 92.78% over the past year. The current price represents a 98.49% decrease from its all-time high of $0.075043 recorded on January 3, 2025. The Gate.com Fear and Greed Index currently shows a reading of 17, indicating extreme fear in the market sentiment.

TEVA has a holder base of 71,219 addresses and is listed on 3 exchanges. The token operates on the Base blockchain, with its contract address verified at 0x00309d634d11541b857f927be91ad2f0bd78894c.

Click to view the current TEVA market price

TEVA Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching 17. This exceptionally low reading indicates significant pessimism and risk aversion among investors. Market participants are displaying heightened caution, with selling pressure dominating trading activity. Such extreme fear conditions historically present potential opportunities for contrarian investors, as sentiment-driven sell-offs often create accumulation points. However, traders should exercise prudence and conduct thorough research before making investment decisions. Monitor market developments closely as sentiment indicators can shift rapidly based on macroeconomic factors and regulatory news.

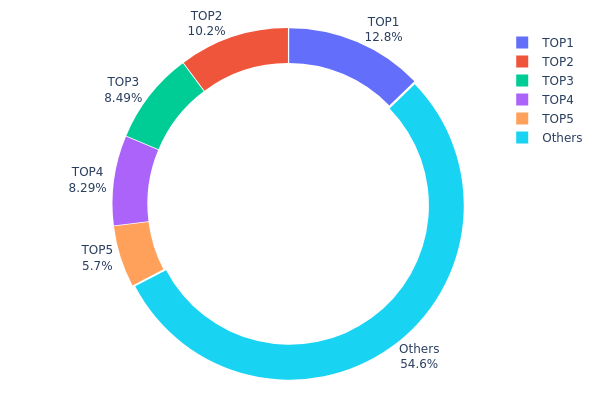

TEVA Holdings Distribution

The holdings distribution chart reflects the concentration of token ownership across different addresses on the blockchain, serving as a crucial indicator for assessing market structure and potential centralization risks. By analyzing the distribution pattern of TEVA tokens among top holders and broader market participants, investors can evaluate the degree of decentralization and identify potential vulnerabilities in the token's ecosystem.

Based on the current data, TEVA exhibits a moderately concentrated holdings structure. The top holder controls approximately 12.75% of the total supply (107,220.76K tokens), while the top five addresses collectively account for 45.42% of the circulating supply. This concentration level, though notable, falls within a relatively reasonable range compared to many emerging crypto assets. The "Others" category represents 54.58% of holdings, indicating that more than half of the tokens are distributed among smaller addresses and the broader community. This distribution pattern suggests a balance between institutional or whale positions and retail participation.

From a market dynamics perspective, this concentration level presents both opportunities and risks. The substantial holdings by top addresses could introduce elevated price volatility, as significant sell pressure from any major holder may impact market stability. However, the fact that no single address controls an overwhelming majority (over 20-30%) mitigates extreme manipulation concerns. The current structure indicates a developing ecosystem where early investors or strategic partners maintain meaningful positions while allowing for reasonable market liquidity and community participation. This distribution pattern reflects a transitional phase in TEVA's market maturity, where on-chain governance remains somewhat centralized but shows potential for broader decentralization as the project evolves.

Click to view current TEVA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x18b0...281e9f | 107220.76K | 12.75% |

| 2 | 0x0d07...b492fe | 85793.58K | 10.20% |

| 3 | 0x69be...6ee5e0 | 71359.12K | 8.49% |

| 4 | 0xd3e0...20cd97 | 69646.67K | 8.28% |

| 5 | 0xb733...086a18 | 47917.39K | 5.70% |

| - | Others | 458446.25K | 54.58% |

II. Core Factors Influencing TEVA's Future Price

Supply Mechanism

- Patent Disputes and Generic Competition: TEVA operates in the pharmaceutical sector where patent expirations and generic drug competition significantly impact pricing power. The company's revenue stream faces pressure from patent disputes and competitive dynamics in the generic pharmaceutical market.

- Historical Pattern: Stock price movements have historically been influenced by patent litigation outcomes and competitive pricing pressures. Market trends show that generic pharmaceutical companies experience distinct volatility patterns tied to regulatory decisions and patent timelines.

- Current Impact: Ongoing patent disputes continue to create uncertainty in revenue projections. Competitive pressures from other generic manufacturers may compress margins and affect near-term price performance.

Institutional and Major Holder Dynamics

- Institutional Holdings: Institutional ownership stands at 57.49%, representing a decrease of 11.15% compared to the previous quarter. The largest institutional holder is Larry Robbins, holding 16.69 million shares (1.46% of total shares), with a recent increase of 12.91% in holdings.

- Analyst Ratings: Multiple analysts have issued buy ratings within the past month, with target price projections averaging $29.50, with a high of $35.00 and a low of $18.07.

- Market Positioning: TEVA ranks 38th out of 159 companies in the pharmaceutical industry based on valuation metrics, indicating a relatively reasonable valuation within its sector.

Macroeconomic Environment

- Monetary Policy Impact: The pharmaceutical sector, categorized as a domestic demand-oriented industry, maintains a neutral sensitivity to US dollar fluctuations. Current dollar index positioning suggests moderate currency-related headwinds or tailwinds for international operations.

- Healthcare Sector Resilience: Within periods of economic uncertainty, the healthcare sector has demonstrated relative stability. Notable investors including Warren Buffett and Seth Klarman have maintained or increased positions in healthcare stocks, suggesting institutional confidence in the sector's defensive characteristics.

- Regional Market Dynamics: TEVA operates through three primary segments: North America, Europe, and International Markets. European healthcare stocks have shown improved earnings expectations, with the sector projected to deliver solid quarterly growth.

Financial Health and Operational Efficiency

- Revenue Performance: Most recent quarterly revenue reached $4.71 billion, representing an 11.40% year-over-year increase. Net profit demonstrated significant improvement with a 321.20% year-over-year increase.

- Financial Stability: The company received a financial score of 8.25 out of 10, ranking 78th out of 159 in the pharmaceutical industry. Operational efficiency metrics indicate strong management execution despite sector challenges.

- Valuation Metrics: Current P/E ratio stands at 26.85. Price momentum scoring reached 9.55 out of 10, ranking 6th out of 159 in the pharmaceutical industry, suggesting strong technical positioning.

- Trading Range: The stock currently trades between resistance at $34.18 and support at $31.21, presenting potential range-bound trading opportunities for tactical investors.

Risk Factors

- Volatility Profile: The stock exhibits a beta of 0.70, indicating lower volatility relative to broader market indices. During market advances, TEVA typically underperforms the index, while during declines it experiences smaller drawdowns.

- Debt Management: Moderate financial leverage requires careful monitoring. Investors should consider the company's debt servicing capacity amid ongoing operational pressures.

- Regulatory Pressures: The pharmaceutical industry faces persistent regulatory headwinds that may impact pricing flexibility and profitability. Ongoing scrutiny of drug pricing policies represents a structural challenge for the sector.

- Market Sentiment: Despite strong fundamental metrics, the stock remains susceptible to sector-wide sentiment shifts and pharmaceutical industry-specific concerns regarding pricing power and competitive dynamics.

III. 2026-2031 TEVA Price Forecast

2026 Outlook

- Conservative prediction: $0.00097 - $0.00109

- Neutral prediction: $0.00109 average price level

- Optimistic prediction: $0.00129 (requiring favorable market conditions and broader adoption)

Based on the forecast data, TEVA may experience a slight decline of approximately 3% in 2026, with prices expected to range between $0.00097 and $0.00129. The average trading price is projected around $0.00109, suggesting a period of consolidation as the token establishes its market position.

2027-2029 Outlook

- Market stage expectation: Recovery and gradual growth phase with increasing momentum

- Price range predictions:

- 2027: $0.00095 - $0.00165, with potential 5% growth

- 2028: $0.00101 - $0.00187, with estimated 25% increase

- 2029: $0.00132 - $0.00216, with projected 45% appreciation

- Key catalysts: Market maturation, expanded utility adoption, and improved token economics

The mid-term outlook suggests a progressive recovery trajectory, with 2027 marking a potential turning point as the token demonstrates positive growth. By 2028-2029, TEVA could enter an accelerated growth phase, with year-over-year increases becoming more substantial as the project gains traction.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00148 - $0.00207 (assuming steady ecosystem development and maintained market interest)

- Optimistic scenario: $0.00187 - $0.00284 (with enhanced platform features and increased user engagement)

- Transformative scenario: Prices potentially reaching $0.00284 (under conditions of significant technological breakthroughs and widespread adoption)

The long-term forecast indicates sustained growth potential through 2031, with cumulative increases of 68% by 2030 and 75% by 2031 compared to baseline levels. These projections suggest TEVA could establish a more stable market presence, though actual performance will depend on broader cryptocurrency market conditions, regulatory developments, and the project's ability to deliver on its roadmap.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00129 | 0.00109 | 0.00097 | -3 |

| 2027 | 0.00165 | 0.00119 | 0.00095 | 5 |

| 2028 | 0.00187 | 0.00142 | 0.00101 | 25 |

| 2029 | 0.00216 | 0.00165 | 0.00132 | 45 |

| 2030 | 0.00207 | 0.0019 | 0.00148 | 68 |

| 2031 | 0.00284 | 0.00199 | 0.00187 | 75 |

IV. TEVA Professional Investment Strategy and Risk Management

TEVA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of Web3 gaming ecosystems and ZK Stack technology

- Operational Recommendations:

- Consider accumulating TEVA during market dips, given the current price of $0.00113 represents a significant discount from higher levels

- Monitor the project's gaming ecosystem development and community growth, particularly the expansion beyond the current 1 million Soulbound Gamers

- Storage Solution: Use Gate Web3 Wallet for secure long-term storage with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $13,396.17 to identify liquidity patterns and potential breakout signals

- Support and Resistance Levels: Track the 24-hour range between $0.001031 (low) and $0.001205 (high) to identify short-term trading opportunities

- Swing Trading Points:

- Consider the recent 22.56% decline over 7 days as potential entry zones for contrarian positions

- Set stop-loss orders below the all-time low of $0.001013 (recorded on February 2, 2026) to manage downside risk

TEVA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio allocation

- Aggressive Investors: 5-10% of cryptocurrency portfolio allocation

- Professional Investors: Up to 15% with active hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Balance TEVA holdings with established gaming tokens and layer-2 scaling solutions

- Position Sizing: Given the 92.78% decline over one year, implement gradual position building rather than lump-sum investments

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with convenient access to Gate.com exchange

- Cold Storage Solution: Hardware wallet storage for long-term holdings exceeding investment comfort levels

- Security Precautions: Enable two-factor authentication, regularly update security settings, and never share private keys or seed phrases

V. TEVA Potential Risks and Challenges

TEVA Market Risks

- High Volatility: The token has experienced a 92.78% decline over one year, indicating extreme price volatility that may not suit risk-averse investors

- Limited Liquidity: With only 3 exchanges listing TEVA and a 24-hour trading volume of $13,396.17, liquidity constraints may impact large position entries or exits

- Market Capitalization Concerns: The current market cap of approximately $949,830 represents only 21.01% of the fully diluted valuation, suggesting significant token unlock risk

TEVA Regulatory Risks

- Gaming Token Classification: Evolving regulatory frameworks for blockchain gaming tokens may impact TEVA's utility and trading accessibility

- Cross-border Gaming Regulations: Multi-genre Web3 games face varying regulatory standards across jurisdictions, potentially affecting adoption

- Token Utility Compliance: Changes in securities regulations regarding gaming utility tokens could affect TEVA's classification and trading status

TEVA Technical Risks

- ZK Stack Dependency: The project's reliance on ZK Stack technology exposes it to potential technical vulnerabilities or development delays in the underlying infrastructure

- Smart Contract Risks: As a Base network token (contract address: 0x00309d634d11541b857f927be91ad2f0bd78894c), TEVA faces standard smart contract security risks

- Ecosystem Development Risk: The success of TEVA depends heavily on the continued development and adoption of the Tevaera gaming ecosystem and Teva Chain

VI. Conclusion and Action Recommendations

TEVA Investment Value Assessment

TEVA represents a high-risk, high-potential opportunity within the Web3 gaming sector. The project's focus on user experience, backed by ZK Stack and AI technology, addresses real pain points in blockchain gaming. With over 1 million Soulbound Gamers and 71,219 token holders, the community foundation shows promise. However, the significant price decline of 92.78% over one year and the low market cap of $949,830 indicate substantial volatility and execution risks. The token's current price of $0.00113, far below its all-time high of $0.075043, presents both opportunity and caution. Long-term value depends on successful ecosystem development, gaming adoption, and the broader recovery of the Web3 gaming sector.

TEVA Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio) and focus on learning about the project's gaming ecosystem development before increasing exposure ✅ Experienced Investors: Consider dollar-cost averaging strategy with 3-5% allocation, monitoring key milestones such as Teva Chain launches and new game releases ✅ Institutional Investors: Conduct thorough due diligence on the ZK Stack infrastructure and gaming roadmap, with allocation decisions based on risk-adjusted portfolio strategies

TEVA Trading Participation Methods

- Spot Trading: Trade TEVA directly on Gate.com with access to real-time market data and liquidity

- Portfolio Integration: Use Gate Web3 Wallet to integrate TEVA holdings with broader DeFi and gaming ecosystem participation

- Community Engagement: Monitor project developments through official channels (website: tevaera.com, Twitter: @tevaera) to stay informed about ecosystem updates

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TEVA Pharmaceutical and what is its main business?

Teva Pharmaceutical is an Israeli pharmaceutical company specializing in generic and branded drugs. It operates across North America, Europe, and international markets, serving patients worldwide with diverse medication portfolios.

How to predict future price trends of TEVA stock?

Predict TEVA price movements using technical analysis, market trends, and key support/resistance levels. By 2031, TEVA may reach $36.78. Monitor trading volume, chart patterns, and market sentiment for accurate forecasting.

What are the main risk factors for TEVA stock?

TEVA's primary risks include litigation and regulatory challenges, patent expiration, and generic drug competition. These factors may impact profitability and market position.

What are TEVA's competitive advantages compared to other pharmaceutical companies?

Teva's competitive advantages include strong generic drug technology platforms, high-barrier generic products, significant market share in inhalation and oral medications, and strategic acquisitions enhancing operational capabilities.

TEVA股票的历史表现和股息政策如何?

Teva股票2015年创下历史新高至每股72美元。公司定期派发股息,当前季度股息为每股$0.34。2026年股票表现保持稳定,持续维持分红政策。

What are the key factors affecting TEVA stock price?

TEVA stock price is influenced by Federal Reserve interest rate decisions, employment data, inflation levels, and institutional investor trading activity. Company financial performance and earnings reports are also critical factors driving price movements.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

How to Trade Cryptocurrency: A Step-by-Step Guide

Top 6 AI-Driven Cryptocurrencies: Which Tokens Can You Buy in Japan and How to Purchase Them

Bitcoin Halving Overview | Has the Price Cycle Run Its Course?

Top 5 Cryptocurrency Trading Platforms!

Understanding PoS in Cryptocurrency: A Beginner’s Guide to Proof-of-Stake