2026 UNA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: UNA's Market Position and Investment Value

Unagi (UNA), as a web3 gaming ecosystem token serving as a universal gateway across multiple gaming platforms, has been operating since its launch in 2024. As of 2026, UNA holds a market capitalization of approximately $723,411, with a circulating supply of around 129.57 million tokens, and its price hovers around $0.005583. This asset, positioned as a "cross-game utility token," is playing an increasingly significant role in the web3 gaming sector, providing seamless experiences across various genres including Ultimate Champions and Persona.

This article will comprehensively analyze UNA's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. UNA Price History Review and Market Status

UNA Historical Price Evolution Trajectory

- 2024: UNA token launched in June with an initial offering price of $0.05, reaching a peak of $0.17245 on June 12, 2024, representing significant early-stage growth momentum.

- 2024-2025: Following the initial peak, the token entered a consolidation phase with gradual price adjustments as the gaming ecosystem continued development.

- 2026: Market conditions shifted, with the price declining to $0.005563 on February 4, 2026, reflecting broader market dynamics and ecosystem maturation phases.

UNA Current Market Situation

As of February 4, 2026, UNA is trading at $0.005583, with a 24-hour trading volume of $18,931.63. The token has experienced notable volatility across different timeframes: a 0.13% decrease over the past hour, a 5.69% decline in the last 24 hours, and an 11.3% drop over the past week. The 30-day performance shows a 46.29% decrease, while the year-over-year metric indicates an 88.36% decline.

The current market capitalization stands at approximately $723,411, with a circulating supply of 129,574,008 UNA tokens out of a maximum supply of 1,000,000,000 tokens, representing a circulation ratio of approximately 12.96%. The fully diluted market cap is calculated at $5,583,000. The market cap to fully diluted valuation ratio of 12.96% suggests a significant portion of tokens remains to enter circulation.

UNA maintains a market dominance of 0.00020% and holds a ranking of 2747 among digital assets. The 24-hour price range has fluctuated between $0.005563 and $0.005979. The token is deployed on the Base blockchain network, with the contract address verified at 0x24569d33653c404f90aF10A2b98d6E0030D3d267. Current holder count stands at 45,955 addresses, indicating a developing community base across the gaming ecosystem.

Click to view current UNA market price

UNA Market Sentiment Indicator

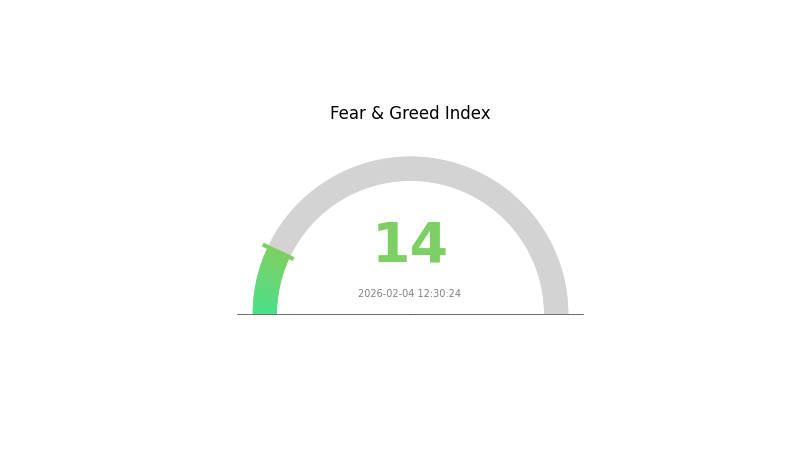

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 14. This exceptionally low sentiment suggests that investors are highly pessimistic about market conditions. Extreme fear typically presents contrarian trading opportunities, as markets often recover from such oversold conditions. Experienced traders monitor these extreme readings carefully, as they can indicate potential reversal points. However, caution is warranted as severe fear may persist longer than expected. Consider taking a measured approach to portfolio positioning during such volatile periods.

UNA Holding Distribution

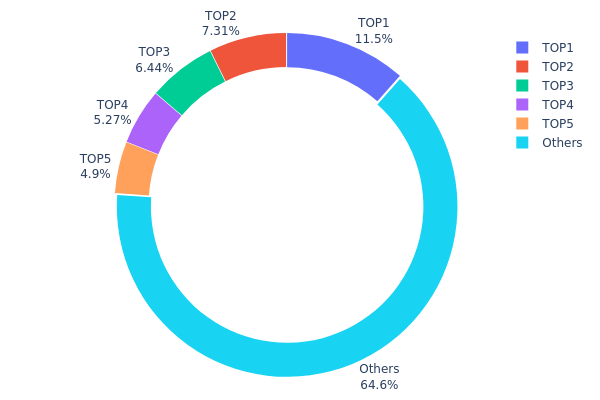

The holding distribution chart reveals how UNA tokens are allocated across different wallet addresses, serving as a critical indicator of token centralization and market structure. This metric helps assess whether token control is concentrated among a few large holders or distributed more evenly across the community, which directly impacts market stability and manipulation risk.

Based on current data, UNA demonstrates a moderately concentrated holding pattern. The top five addresses collectively control 35.41% of total supply, with the largest holder maintaining 11.52% (16.10M tokens). The remaining 64.59% is distributed among other addresses, suggesting a relatively balanced ecosystem compared to highly centralized projects where top holders might control over 50% of supply.

This distribution structure presents both opportunities and risks. The 11.52% concentration in the largest address remains below critical manipulation thresholds but warrants monitoring. The substantial 64.59% held by smaller addresses indicates healthy community participation and reduces single-point-of-failure risks. However, the top five holders' combined 35.41% stake could still influence short-term price movements through coordinated actions. This configuration suggests UNA maintains reasonable decentralization while retaining sufficient liquidity concentration for market efficiency.

Click to view current UNA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x18b0...281e9f | 16102.41K | 11.52% |

| 2 | 0x01c1...44c6e6 | 10209.10K | 7.30% |

| 3 | 0x8bbc...75fd50 | 8997.83K | 6.44% |

| 4 | 0x0d07...b492fe | 7361.01K | 5.26% |

| 5 | 0x69be...6ee5e0 | 6844.02K | 4.89% |

| - | Others | 90166.36K | 64.59% |

II. Core Factors Influencing UNA's Future Price

Supply Mechanism

- Token Supply Structure: UNA's supply mechanism plays a fundamental role in determining its market value. The token distribution model and release schedule directly affect market circulation and potential price movements.

- Historical Impact: Supply-side dynamics have consistently demonstrated significant influence on UNA's price trajectory. Changes in token circulation have historically correlated with market valuation adjustments.

- Current Impact: The ongoing supply mechanism continues to be a critical factor in shaping UNA's price expectations. Market participants closely monitor supply-side developments as a key indicator of future value potential.

Market Demand Dynamics

- Web3 Gaming Ecosystem Position: UNA holds a strategic position within the web3 gaming ecosystem, which serves as a primary driver of demand. The token's utility and adoption within gaming applications contribute to sustained market interest.

- Ecosystem Growth: The expansion of UNA's underlying ecosystem directly influences demand patterns. As the platform develops and attracts more users, token demand may experience corresponding growth.

- Market Participation: Investor sentiment and trading activity reflect the broader demand landscape for UNA. Market dynamics continue to evolve based on ecosystem developments and user adoption rates.

Risk Considerations and Market Dynamics

- Investment Risk Profile: Investors should carefully evaluate market volatility and potential risks associated with UNA. The cryptocurrency market's inherent uncertainty requires thorough due diligence and risk assessment.

- Market Monitoring: Ongoing observation of market trends, ecosystem developments, and trading patterns remains essential for understanding UNA's price behavior. Regular assessment of market conditions helps investors make informed decisions.

- Growth Potential: While UNA demonstrates growth potential within the web3 gaming sector, price movements depend on multiple interconnected factors including ecosystem expansion, user adoption, and overall market conditions.

III. 2026-2031 UNA Price Prediction

2026 Outlook

- Conservative Prediction: $0.00285 - $0.00558

- Neutral Prediction: Around $0.00558

- Optimistic Prediction: Up to $0.0067 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: Progressive growth phase with gradual price appreciation, supported by potential ecosystem development and broader market recovery

- Price Range Predictions:

- 2027: $0.00491 - $0.00719 (approximately 10% increase from 2026)

- 2028: $0.00366 - $0.00766 (approximately 19% cumulative growth)

- 2029: $0.00401 - $0.01003 (approximately 28% cumulative increase)

- Key Catalysts: Enhanced token utility, potential partnerships, and general cryptocurrency market momentum

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00765 - $0.01083 (assuming steady ecosystem development and maintained market interest)

- Optimistic Scenario: $0.0086 - $0.01389 (with accelerated adoption and favorable regulatory environment)

- Transformative Scenario: Potential to reach $0.01389 by 2031 (under conditions of significant network growth and sustained bullish market cycles, representing approximately 73% growth from baseline)

- 2026-02-04: UNA trading within projected range of $0.00285 - $0.0067 (early-stage valuation phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0067 | 0.00558 | 0.00285 | 0 |

| 2027 | 0.00719 | 0.00614 | 0.00491 | 10 |

| 2028 | 0.00766 | 0.00666 | 0.00366 | 19 |

| 2029 | 0.01003 | 0.00716 | 0.00401 | 28 |

| 2030 | 0.01083 | 0.0086 | 0.00765 | 53 |

| 2031 | 0.01389 | 0.00971 | 0.00767 | 73 |

IV. UNA Professional Investment Strategy and Risk Management

UNA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term blockchain gaming enthusiasts and ecosystem believers who believe in the development potential of web3 gaming

- Operational recommendations:

- Consider accumulating positions during market corrections when UNA price shows significant decline from historical levels

- Monitor the development progress of Unagi's gaming ecosystem, including updates to Ultimate Champions, Persona, and newly announced game titles

- Utilize Gate Web3 Wallet for secure storage, enabling convenient participation in future ecosystem activities while maintaining asset security

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor the relationship between UNA's 24-hour trading volume (currently around $18,900) and price movements to identify potential trend reversals

- Support and resistance levels: Track key price levels, with attention to the current low of $0.005563 as potential support

- Swing trading considerations:

- Given UNA's relatively high volatility (24H change: -5.69%, 7D: -11.3%), traders may consider shorter-term position management

- Set stop-loss orders at reasonable levels below entry points to manage downside risk in this volatile gaming token sector

UNA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: May allocate up to 10% with active management and hedging strategies

(2) Risk Hedging Solutions

- Diversification approach: Combine UNA holdings with other established gaming tokens and Layer-2 ecosystem assets to reduce single-project exposure

- Position sizing discipline: Implement dollar-cost averaging during accumulation phases rather than concentrated purchases

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading and ecosystem participation

- Multi-signature solution: For larger holdings, consider implementing multi-signature security protocols

- Security considerations: Never share private keys, enable two-factor authentication, verify all contract addresses on Base network (0x24569d33653c404f90aF10A2b98d6E0030D3d267) before transactions

V. UNA Potential Risks and Challenges

UNA Market Risks

- High volatility profile: UNA has experienced substantial price fluctuations, with a 46.29% decline over 30 days and 88.36% decrease over one year, indicating significant market risk

- Limited liquidity: With only 2 exchanges listing UNA and 24-hour trading volume of approximately $18,900, liquidity constraints may impact ability to enter or exit positions at desired prices

- Market cap considerations: Current market cap of approximately $723,000 and market dominance of 0.0002% reflects early-stage project status with associated risks

UNA Regulatory Risks

- Gaming token classification: Potential regulatory uncertainty regarding classification of gaming ecosystem tokens and their treatment under securities laws in various jurisdictions

- Cross-border compliance: As a web3 gaming platform operating globally, UNA may face varying regulatory requirements across different markets

- Evolving regulatory landscape: Changes in cryptocurrency and gaming regulations could impact UNA's operational flexibility and market accessibility

UNA Technical Risks

- Smart contract vulnerabilities: Base network contract (0x24569d33653c404f90aF10A2b98d6E0030D3d267) requires ongoing security audits to prevent potential exploits

- Ecosystem development execution: Success depends on timely delivery and user adoption of Ultimate Champions, Persona, and future game releases

- Network dependency: As UNA operates on the Base network, any technical issues or congestion on the underlying blockchain could affect token functionality

VI. Conclusion and Action Recommendations

UNA Investment Value Assessment

UNA represents an early-stage opportunity in the web3 gaming ecosystem, offering exposure to multiple game titles through a single unified token. The project's vision of creating an interconnected gaming environment across various genres shows innovation potential. However, investors should carefully weigh this long-term vision against current market realities: significant price depreciation from all-time high of $0.17245, limited exchange availability (2 platforms), and modest trading volume. The token's current circulating supply of approximately 129.57 million (12.96% of maximum supply) suggests potential for future token releases that could impact price dynamics. While the ecosystem approach has merit, execution risk remains substantial given the competitive web3 gaming landscape.

UNA Investment Recommendations

✅ Beginners: Consider allocating only small exploratory amounts (no more than 1-2% of crypto portfolio) and focus on understanding the gaming ecosystem before increasing exposure. Prioritize learning about Base network operations and web3 gaming fundamentals.

✅ Experienced investors: May consider strategic position building during market weakness if convinced of the gaming ecosystem's long-term potential. Implement strict position sizing discipline and monitor development milestones for Ultimate Champions and Persona releases.

✅ Institutional investors: Conduct thorough due diligence on team background, tokenomics sustainability, and competitive positioning. Consider direct engagement with project development team for deeper insights before committing significant capital.

UNA Trading Participation Methods

- Spot trading: Available on Gate.com and one other exchange, allowing direct purchase and sale of UNA tokens

- Gate Web3 Wallet integration: Enables secure self-custody while maintaining flexibility for ecosystem participation and potential future gaming utility

- Research-driven approach: Before trading, review Unagi's official communications at unagi.games and monitor social channels for ecosystem updates that may impact token value

Cryptocurrency investment carries extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of UNA token and how has its historical price trend been?

UNA token is currently trading at $0 USD with a market cap of $0 USD. The historical price trend shows significant market volatility due to continuous 24/7 cryptocurrency market movements. For real-time pricing data and detailed historical charts, please visit the official price tracking page.

What are the main factors affecting UNA price?

UNA price is primarily influenced by market demand, trading volume, overall crypto market sentiment, project developments, regulatory news, and macroeconomic conditions. Community engagement and strategic partnerships also play significant roles in price movements.

2024年UNA价格预测会如何发展?

UNA在2024年6月达到高点0.17245美元,10月回调至0.00649美元。2025年受利好因素驱动,预计价格有望逐步恢复上升,市场需密切关注基本面与交易额变化趋势。

What are the advantages of UNA tokens compared to other cryptocurrencies?

UNA tokens offer specialized utility focused on rewards and incentive mechanisms within specific ecosystems. Built on established blockchain infrastructure, UNA provides flexible application scenarios with streamlined functionality tailored for targeted use cases, distinguishing it from general-purpose cryptocurrencies.

What are the risks to note when investing in UNA tokens?

UNA token investments carry price volatility risks that may result in principal loss. Market conditions are unpredictable, and investors bear full responsibility for their investment decisions. Returns cannot be guaranteed.

What is the liquidity and trading volume of UNA token?

UNA token maintains modest liquidity with a 24-hour trading volume of approximately ¥1,777,930 CNY. The token demonstrates steady market activity with current price at ¥0.04169 CNY as of February 2026.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

What is GAIN: Understanding the Generative Adversarial Interaction Network and Its Applications in Modern AI

What is MDX: A Comprehensive Guide to Markdown with JSX Integration

What is XELS: A Comprehensive Guide to Understanding This Innovative Ecosystem

What is SHM: A Comprehensive Guide to Simple Harmonic Motion and Its Real-World Applications

2026 GAIN Price Prediction: Expert Analysis and Market Outlook for the Next Bull Cycle