2026 VGX Price Prediction: Expert Analysis and Market Forecast for Voyager Token's Future Value

Introduction: VGX's Market Position and Investment Value

VGX Token (VGX), positioned as a cross-platform and cross-chain token focused on the gaming space, has been developing since its launch in 2017. As of 2026, VGX maintains a market capitalization of approximately $436,000, with a circulating supply of around 916.55 million tokens, and its price stands at approximately $0.0004757. This gaming-oriented digital asset is playing an increasingly important role in integrating rewards and ownership mechanisms across various gaming platforms and blockchain ecosystems.

This article will comprehensively analyze VGX's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. VGX Price History Review and Market Status

VGX Historical Price Evolution Trajectory

- 2018: VGX reached a peak during the cryptocurrency market cycle, with price touching $12.54 in January

- 2018-2025: The token experienced a prolonged downtrend alongside broader market corrections, with price declining from historical highs

- 2026: Price recorded a new low level in January, dropping to $0.000379

VGX Current Market Situation

As of February 6, 2026, VGX is trading at $0.0004757, representing a significant decline from its historical peak. The token has experienced notable volatility in recent trading periods, with the 24-hour price range between $0.0004317 and $0.0005579.

The market capitalization stands at approximately $436,001, with a circulating supply of 916.55 million VGX tokens, representing 91.65% of the maximum supply of 1 billion tokens. Daily trading volume has reached $36,051, indicating moderate market activity.

Short-term price movements show downward pressure, with a 10.47% decrease over the past 24 hours and an 8.17% decline over the past week. However, the 30-day performance indicates a 7.5% increase, suggesting some recovery attempts. The one-year performance reflects a substantial decline of 94.31%.

The VGX token maintains a presence across 5 exchanges and has approximately 7,980 token holders. The market capitalization to fully diluted valuation ratio stands at 91.65%, indicating that most of the token supply is already in circulation. Current market dominance is minimal at 0.000018% of the total cryptocurrency market.

Click to view current VGX market price

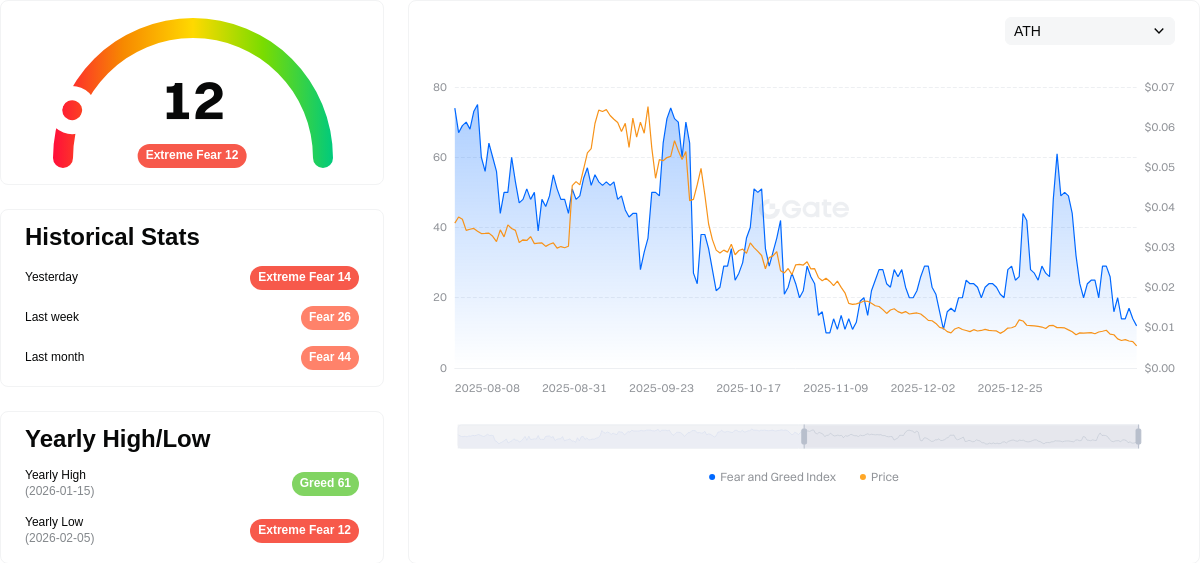

VGX Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index dropping to 12. This indicates severe market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often signals potential buying opportunities for contrarian investors. Market volatility tends to spike during periods of extreme fear, creating both risks and opportunities. Traders should exercise caution while monitoring market fundamentals and maintaining proper risk management strategies during this uncertain period.

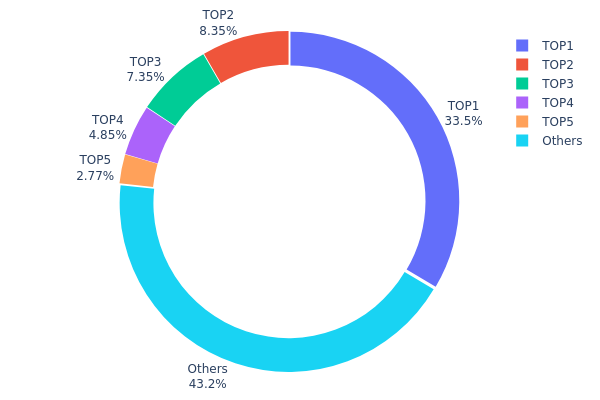

VGX Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, providing insights into the degree of decentralization and potential market control risks. By analyzing the distribution pattern, investors can assess whether a significant portion of the token supply is concentrated in the hands of a few large holders, which may impact price stability and trading dynamics.

According to the current data, VGX exhibits a moderately high concentration level. The top holder controls approximately 33.51% of the total supply with 335.26 million tokens, while the top 5 addresses collectively hold 57.80% of the circulating supply. Notably, the second-largest address (0x0000...00dead) represents a burn address holding 8.34%, which effectively reduces the actual circulating supply. When excluding the burn address, the remaining top 4 addresses control 49.46% of the supply, indicating significant concentration among major stakeholders.

This concentration pattern suggests potential risks for market volatility and price manipulation. Large holders possess considerable influence over price movements through coordinated buying or selling activities. The 43.2% held by other addresses provides some degree of decentralization, yet the dominant position of top holders means that major liquidations or strategic accumulations could trigger substantial price fluctuations. From a structural perspective, this distribution reflects a semi-centralized ecosystem where institutional participants and early investors maintain substantial control, potentially limiting the token's resistance to coordinated market actions and reducing overall on-chain stability.

Click to view current VGX Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 335257.81K | 33.51% |

| 2 | 0x0000...00dead | 83495.60K | 8.34% |

| 3 | 0x3cc9...aecf18 | 73505.99K | 7.34% |

| 4 | 0x9642...2f5d4e | 48465.79K | 4.84% |

| 5 | 0x4c0d...f78e40 | 27753.53K | 2.77% |

| - | Others | 431747.10K | 43.2% |

II. Core Factors Influencing VGX's Future Price

Supply Mechanism

- Token Economics Structure: VGX operates under a defined supply framework that influences its market dynamics. The token's circulation is affected by various distribution mechanisms and strategic releases that impact overall availability.

- Historical Patterns: Past supply adjustments have demonstrated correlation with price movements, where controlled distribution phases have been associated with market stability periods.

- Current Impact: Ongoing supply dynamics continue to shape market expectations, with circulation metrics serving as a reference point for traders assessing potential value trajectories.

Market Sentiment and Trading Activity

Market sentiment represents a significant driver of VGX price movements. Overall cryptocurrency market conditions, trading volumes, and investor confidence levels create the foundational context for price action. When broader market sentiment turns positive, increased trading activity typically follows, potentially supporting upward price momentum.

User adoption trends play an equally important role in determining VGX's market position. As platform engagement expands and more users integrate VGX into their trading activities, demand-side pressures can influence price discovery mechanisms.

Macroeconomic Environment

- Global Economic Conditions: Broader macroeconomic factors, including interest rate policies and inflation expectations, create an external context that affects cryptocurrency valuations. Changes in traditional financial markets often correlate with shifts in digital asset sentiment.

- Regulatory Developments: Evolving regulatory frameworks across different jurisdictions can impact market accessibility and institutional participation levels. Policy clarity tends to support more stable trading environments.

- Market Volatility Factors: External events, including geopolitical developments and systemic financial market changes, contribute to overall volatility patterns that affect VGX alongside other digital assets.

Technology Development and Platform Evolution

Technological advancements within the platform ecosystem represent another key consideration. System improvements, security enhancements, and feature expansions can influence user confidence and platform competitiveness. The ongoing development of platform infrastructure and service offerings contributes to the overall value proposition for VGX holders.

Platform utility and use case expansion provide additional context for long-term value assessment. As the ecosystem develops new functionalities and strengthens existing services, the fundamental basis for token demand may evolve accordingly.

III. 2026-2031 VGX Price Prediction

2026 Outlook

- Conservative Prediction: $0.00044 - $0.00048

- Neutral Prediction: $0.00048 (average scenario)

- Optimistic Prediction: $0.00054 (requires favorable market conditions and increased platform adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: VGX may experience a gradual recovery phase with moderate volatility as the crypto market continues to mature and regulatory frameworks become clearer.

- Price Range Predictions:

- 2027: $0.00038 - $0.00063

- 2028: $0.00041 - $0.00058

- 2029: $0.00035 - $0.00061

- Key Catalysts: Platform ecosystem development, strategic partnerships, and broader adoption of VGX utility features within the Voyager ecosystem could serve as primary price drivers during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00039 - $0.00059 (assuming steady platform growth and stable market conditions)

- Optimistic Scenario: $0.00067 - $0.00086 (contingent upon significant platform expansion and increased trading volume)

- Transformational Scenario: Potential to reach $0.00086 by 2031 (requires exceptional market conditions, major technological breakthroughs, and widespread institutional adoption)

- February 6, 2026: VGX trading within the $0.00044 - $0.00054 range (early consolidation phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00054 | 0.00048 | 0.00044 | 0 |

| 2027 | 0.00063 | 0.00051 | 0.00038 | 6 |

| 2028 | 0.00058 | 0.00057 | 0.00041 | 19 |

| 2029 | 0.00061 | 0.00058 | 0.00035 | 21 |

| 2030 | 0.00085 | 0.00059 | 0.00039 | 24 |

| 2031 | 0.00086 | 0.00072 | 0.00067 | 51 |

IV. VGX Professional Investment Strategy and Risk Management

VGX Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors seeking gaming sector exposure with high risk tolerance

- Operational Recommendations:

- Allocate only a small portion of portfolio given the token's high volatility (94.31% decline over 1 year)

- Monitor integration progress with gaming platforms and partnerships announced by VGX Foundation

- Storage solution: Utilize Gate Web3 Wallet for secure asset management with cross-chain compatibility

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track short-term trends given recent 10.47% 24-hour decline and 8.17% weekly decline

- Volume Analysis: Monitor the current 24-hour trading volume of approximately 36,051 tokens against historical patterns

- Swing Trading Points:

- Consider the 24-hour price range between 0.0004317 and 0.0005579 for entry and exit levels

- Exercise caution during low liquidity periods, as VGX trades on only 5 exchanges

VGX Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Maximum 1-2% of crypto portfolio allocation

- Aggressive Investors: Maximum 3-5% of crypto portfolio allocation

- Professional Investors: Maximum 5-8% with active hedging strategies

(II) Risk Hedging Solutions

- Position Sizing: Limit exposure given the token's market cap of approximately 436,000 and ranking at 3108

- Diversification: Balance VGX holdings with established gaming and metaverse tokens

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and cross-platform access

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding trading needs

- Security Precautions: Verify contract address (0x3c4b6e6e1ea3d4863700d7f76b36b7f3d3f13e3d on Ethereum) before transactions to avoid scams

V. VGX Potential Risks and Challenges

VGX Market Risks

- Extreme Volatility: Price declined 94.31% over the past year, indicating substantial market instability

- Low Liquidity: Trading on only 5 exchanges with relatively modest 24-hour volume may result in price slippage

- Market Capitalization: With a market cap of approximately 436,000, the token remains highly speculative

VGX Regulatory Risks

- Gaming Token Classification: Evolving regulations regarding gaming tokens and in-game assets across jurisdictions

- Cross-chain Operations: Regulatory uncertainty surrounding multi-chain token operations and interoperability

- Platform Partnerships: Dependency on regulatory compliance of partner gaming platforms and companies

VGX Technical Risks

- Smart Contract Security: Ethereum-based token requires ongoing monitoring for potential vulnerabilities

- Cross-chain Integration: Technical challenges in maintaining functionality across multiple blockchain networks

- Holder Concentration: With approximately 7,980 holders, large holder movements could significantly impact price

VI. Conclusion and Action Recommendations

VGX Investment Value Assessment

VGX token presents a high-risk, speculative opportunity in the gaming and cross-chain space. While the VGX Foundation's vision of creating a unified token for gaming rewards across multiple platforms addresses a genuine market need, the token's significant price decline (94.31% over one year) and relatively low market position (ranked 3108) suggest substantial challenges. The circulating supply represents 91.65% of maximum supply, indicating limited future dilution concerns. However, limited exchange listings and modest trading volume present liquidity concerns for investors.

VGX Investment Recommendations

✅ Beginners: Avoid or allocate minimal speculative funds (less than 1% of portfolio) only after thorough research and understanding of gaming token dynamics

✅ Experienced Investors: Consider small position sizing (1-3% of crypto portfolio) with strict stop-loss orders, focusing on VGX Foundation partnership announcements and gaming platform integrations

✅ Institutional Investors: Approach with caution; evaluate VGX within broader gaming sector allocation with comprehensive due diligence on Foundation operations and cross-chain technical implementation

VGX Trading Participation Methods

- Spot Trading: Available on Gate.com and 4 other exchanges; verify liquidity before placing large orders

- Dollar-Cost Averaging: Gradual accumulation strategy to mitigate timing risk given high volatility

- Partnership Monitoring: Track VGX Foundation announcements regarding gaming platform integrations and cross-chain expansions for informed decision-making

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is VGX (Voyager Token) and what are its main uses?

VGX is the native token of Voyager exchange, primarily used for trading fee discounts and platform rewards. Holders benefit from reduced trading fees and exclusive incentives within the ecosystem.

What are the main factors affecting VGX price?

VGX price is primarily influenced by market demand, trading volume, project development progress, competitive landscape, and overall cryptocurrency market trends and sentiment.

What is the VGX price forecast for the future?

VGX price predictions for 2026 suggest potential fluctuations between 0.511 USD and 2.378 USD. The lowest prediction stands at 0.203 USD. Future price movements depend on market dynamics and adoption trends.

What are the main risks of investing in VGX?

VGX investment risks include market volatility, regulatory changes, technology adoption uncertainty, and competition in the crypto sector. Price fluctuations can be significant, and liquidity may vary. Always conduct thorough research before investing.

What are the advantages and disadvantages of VGX compared to other cryptocurrencies?

VGX offers practical utility and ecosystem integration, providing real-world use cases. However, it faces lower market liquidity and limited mainstream adoption compared to major cryptocurrencies, presenting higher volatility risk in a competitive market.

What is Voyager platform's development outlook and how will it affect VGX price?

Voyager's platform expansion and market competitiveness directly impact VGX value. Stronger user growth and enhanced market position can drive VGX price appreciation. Market conditions remain a key influence factor.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

What are smart contracts and what problems do they address

What Is Web3: Why Do We Need the Third Generation of the Internet

What is the FIO Protocol? Is FIO a good investment?

Hot vs. cold crypto wallets — which is right for you?

APR vs. APY in Crypto Assets: An In-Depth Guide to Their Key Differences