2026 ZERC Price Prediction: Expert Analysis and Market Forecast for the Next Generation Digital Asset

Introduction: ZERC's Market Position and Investment Value

zkRace (ZERC), positioned as a pioneering Web3 horse racing game and the world's first zk-rollup-based infrastructure tailored for GameFi, has been developing since its launch in 2024. As of 2026, ZERC maintains a market capitalization of approximately $1.12 million, with a circulating supply of 120 million tokens and a price hovering around $0.0093. This asset, recognized as an innovative GameFi project powered by advanced zero-knowledge rollup technology, is playing an increasingly significant role in the Web3 gaming ecosystem.

This article will comprehensively analyze ZERC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ZERC Price History Review and Market Status

ZERC Historical Price Evolution Trajectory

- May 2024: ZERC reached a peak price of $0.51359, marking a significant milestone in its early trading history

- November 2025: The token experienced substantial downward pressure, touching its lowest recorded price of $0.00881

- 2024-2026: Following broader market dynamics, ZERC witnessed considerable volatility with an 88.5% decline over the annual period

ZERC Current Market Landscape

As of February 03, 2026, ZERC is trading at $0.009333, representing a decline of 0.44% over the past 24 hours. The token has experienced a 1.11% decrease in the past hour and a 4.29% decline over the past week. Over the past 30 days, ZERC has declined by 16.64%.

The 24-hour trading volume stands at $12,678.48, with intraday price fluctuations between $0.0092 and $0.009895. The circulating supply accounts for 100% of the maximum supply at 120,000,000 tokens, resulting in a market capitalization of approximately $1,119,960. The market cap to fully diluted valuation ratio is 100%, indicating complete token circulation.

ZERC currently holds a market ranking of 2441 with a dominance of 0.000040%. The token is held by 1,307 addresses and maintains trading availability on Gate.com. The current market sentiment index registers at 17, indicating extreme fear conditions in the broader cryptocurrency market.

Click to view current ZERC market price

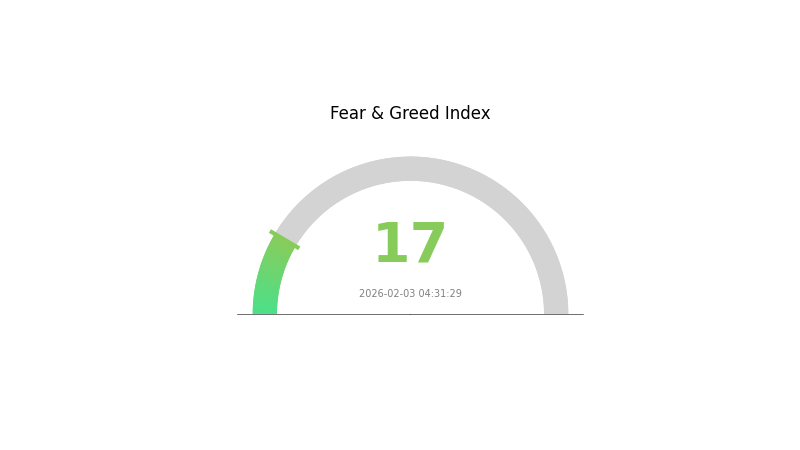

ZERC Market Sentiment Index

2026-02-03 Fear & Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with a fear and greed index of 17. This reading indicates significant market pessimism and investor anxiety. When the index reaches such low levels, it often signals capitulation selling and potential market bottoms. Investors should exercise caution, as extreme fear can present both risks and opportunities. Consider your risk tolerance and investment strategy carefully during periods of heightened market uncertainty. Monitor market developments closely on Gate.com for real-time data and insights.

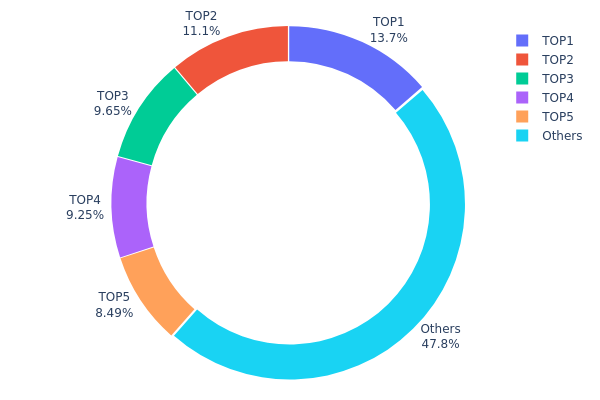

ZERC Holding Distribution

The holding distribution chart visualizes the concentration of ZERC tokens across different wallet addresses, providing crucial insights into the decentralization level and potential market manipulation risks. This metric is essential for assessing the health of token circulation and the balance of power among holders.

Based on the current data, ZERC exhibits a relatively concentrated holding pattern. The top 5 addresses collectively control 52.19% of the total supply, with the largest holder alone possessing 13.68% (16.426 million tokens). The second and third largest addresses hold 11.12% and 9.65% respectively, while the remaining market participants collectively account for 47.81%. This distribution suggests a moderate level of centralization, where major holders retain significant influence over market dynamics.

Such concentration levels present both opportunities and risks for market participants. On one hand, the presence of large holders may indicate institutional confidence or strategic partnerships, potentially providing price stability through long-term commitment. On the other hand, this structure creates vulnerability to coordinated selling pressure or price manipulation if these major addresses decide to liquidate positions simultaneously. The nearly 48% held by smaller addresses does provide some degree of decentralization, preventing complete dominance by a handful of entities. However, investors should remain vigilant about potential volatility stemming from large holder movements and monitor on-chain activities for any significant changes in this distribution pattern.

Click to view current ZERC Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa023...fc947e | 16426.04K | 13.68% |

| 2 | 0xa702...1066e4 | 13345.13K | 11.12% |

| 3 | 0xc394...d34887 | 11580.00K | 9.65% |

| 4 | 0xcffa...290703 | 11104.00K | 9.25% |

| 5 | 0x8730...81be87 | 10190.62K | 8.49% |

| - | Others | 57354.22K | 47.81% |

II. Core Factors Influencing ZERC's Future Price

Supply Mechanism

- Supply and Demand Balance: The price trajectory of ZERC is closely tied to the equilibrium between market supply and available demand. When demand outpaces supply, upward price pressure typically emerges, while oversupply scenarios may lead to price corrections.

- Market Acceptance: The degree of ZERC adoption across various platforms and user bases serves as a fundamental driver. Broader acceptance generally correlates with increased demand, potentially supporting price appreciation.

Institutional and Major Holder Dynamics

- Investor Sentiment: Market confidence plays a direct role in shaping ZERC's price movements. Positive news regarding widespread adoption or significant technological breakthroughs tends to boost investor sentiment, while uncertainty or negative developments may trigger sell-offs.

- Market Perception: The overall perception of ZERC within the cryptocurrency community influences trading behavior and can create momentum in either direction.

Macroeconomic Environment

The provided materials do not contain sufficient information regarding ZERC's specific relationship to macroeconomic factors such as monetary policy, inflation hedging characteristics, or geopolitical influences.

Technical Development and Ecosystem Building

- Technological Progress: Continued technical advancement within the ZERC ecosystem represents a key factor for long-term value proposition. Innovation and improvements to the underlying technology may attract new users and strengthen existing holder confidence.

- Market Dynamics Monitoring: Staying informed about technical developments and broader market trends remains essential for understanding potential price movements. The cryptocurrency market's inherent volatility requires ongoing attention to both fundamental and technical indicators.

III. 2026-2031 ZERC Price Prediction

2026 Outlook

- Conservative Forecast: $0.00763 - $0.00942

- Neutral Forecast: $0.00942

- Optimistic Forecast: $0.0097 (requires favorable market sentiment and increased trading volume)

Mid-term Outlook (2027-2029)

- Market Stage Expectation: ZERC may enter a gradual growth phase with potential volatility as the token establishes market presence and builds community adoption

- Price Range Forecast:

- 2027: $0.00554 - $0.01243

- 2028: $0.00737 - $0.01286

- 2029: $0.00799 - $0.0173

- Key Catalysts: Progressive price appreciation with projected year-over-year growth ranging from 2% to 27%, driven by potential ecosystem development and broader cryptocurrency market trends

Long-term Outlook (2030-2031)

- Baseline Scenario: $0.01038 - $0.01461 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.01514 - $0.02061 (assuming enhanced adoption and favorable regulatory environment)

- Growth Trajectory: Projections indicate potential cumulative growth of 56% by 2030 and 88% by 2031 compared to 2026 baseline levels, reflecting long-term value appreciation potential

- February 3, 2026: ZERC trading within the projected range of $0.00763 - $0.0097 (establishing baseline valuation for future growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0097 | 0.00942 | 0.00763 | 0 |

| 2027 | 0.01243 | 0.00956 | 0.00554 | 2 |

| 2028 | 0.01286 | 0.01099 | 0.00737 | 17 |

| 2029 | 0.0173 | 0.01193 | 0.00799 | 27 |

| 2030 | 0.0206 | 0.01461 | 0.01038 | 56 |

| 2031 | 0.02518 | 0.01761 | 0.01514 | 88 |

IV. ZERC Professional Investment Strategy and Risk Management

ZERC Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: GameFi enthusiasts and Web3 gaming investors seeking exposure to zk-rollup infrastructure

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to mitigate volatility impact, given the token's -88.5% yearly decline

- Monitor zkRace ecosystem developments and gaming platform adoption metrics

- Utilize Gate Web3 Wallet for secure token storage with multi-signature support

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify trend reversals, noting current short-term weakness (-1.11% in 1H, -4.29% in 7D)

- Volume Analysis: Monitor trading volume relative to the $12,678 24-hour baseline to gauge market interest

- Swing Trading Essentials:

- Set stop-loss orders 5-8% below entry points considering recent volatility patterns

- Identify support levels near the $0.0092 24-hour low and resistance near $0.00989 24-hour high

ZERC Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum

- Aggressive Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% allocation with active hedging strategies

(II) Risk Hedging Solutions

- Portfolio Diversification: Distribute investments across multiple GameFi tokens and blockchain gaming sectors

- Position Sizing: Limit single-trade exposure to no more than 2% of total portfolio value

(III) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active trading with instant access and integrated DeFi features

- Cold Storage Solution: Hardware wallet backup for long-term holdings exceeding $1,000 equivalent

- Security Considerations: Enable two-factor authentication, regularly verify contract address (0xf8428A5a99cb452Ea50B6Ea70b052DaA3dF4934F on Ethereum), and never share private keys

V. ZERC Potential Risks and Challenges

ZERC Market Risks

- High Volatility: The token experienced an 88.5% decline over the past year, indicating substantial price instability

- Limited Liquidity: With only $12,678 in 24-hour trading volume and presence on one exchange, liquidity constraints may impact order execution

- Market Capitalization: At approximately $1.12 million market cap with 0.000040% market dominance, the token remains highly speculative

ZERC Regulatory Risks

- Gaming Token Classification: Potential regulatory scrutiny regarding the classification of gaming tokens and in-game asset trading

- Cross-border Compliance: Evolving regulations around blockchain gaming platforms may affect token utility and accessibility

- Securities Law Considerations: Regulatory bodies may evaluate whether gaming tokens constitute securities requiring registration

ZERC Technical Risks

- Smart Contract Vulnerabilities: ERC-20 token dependency on Ethereum network security and potential contract exploits

- Scalability Challenges: While utilizing zk-rollup technology, the platform's ability to handle increased user activity remains untested at scale

- Competition Risk: Emergence of competing Web3 gaming platforms and alternative GameFi infrastructure solutions

VI. Conclusion and Action Recommendations

ZERC Investment Value Assessment

zkRace (ZERC) represents a niche investment in the intersection of Web3 gaming and zk-rollup infrastructure. The token's significant 88.5% yearly decline and limited liquidity present considerable short-term risks, while its positioning as a specialized GameFi infrastructure project offers potential long-term value for investors believing in blockchain gaming adoption. The current market capitalization of $1.12 million and 100% token circulation indicate full supply availability, though low trading volume suggests caution regarding entry and exit capabilities.

ZERC Investment Recommendations

✅ Beginners: Limit exposure to less than 1% of portfolio; focus on learning about GameFi fundamentals before investing; consider paper trading to understand volatility patterns ✅ Experienced Investors: Allocate 2-3% maximum with strict stop-loss discipline; monitor zkRace platform development milestones and user adoption metrics; diversify across multiple GameFi projects ✅ Institutional Investors: Conduct thorough due diligence on zkRace team, technology architecture, and competitive positioning; consider strategic allocation not exceeding 1-2% of gaming/metaverse portfolio sleeve; implement sophisticated risk management protocols

ZERC Trading Participation Methods

- Spot Trading: Purchase ZERC directly through Gate.com with immediate settlement and custody options

- Staking Opportunities: Investigate potential staking programs within the zkRace ecosystem for passive income generation

- Grid Trading: Utilize automated trading strategies on Gate.com to capitalize on price volatility within established ranges

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ZERC? What are its uses and main features?

ZERC is the native token of the zkRace project, designed for trading and incentive mechanisms. It features active trading pairs like ZERC/USDT with significant daily transaction volume, providing users with utility in the zkRace ecosystem for transactions and rewards.

What is the current price of ZERC? What are the all-time high and all-time low prices?

ZERC's current price varies by market conditions. The all-time high reached $8.24, while the all-time low was $0.00902. Check real-time prices for the latest market data.

What is the 2024 ZERC price prediction? What do professional analysts think?

2024 ZERC price prediction shows significant decline reflecting market pressure. Professional analysts project the price could drop to $0.00881 by end of 2025, representing approximately 98.29% decline from peak levels due to GameFi sector weakness.

What are the main factors affecting ZERC price fluctuations?

ZERC price is primarily influenced by market sentiment, regulatory policies, trading volume, technology developments, and investor confidence. Market demand, macroeconomic trends, and competitive dynamics also play significant roles in price movements.

How to analyze ZERC price trends? What technical analysis indicators can be referenced?

Analyze ZERC using moving averages, RSI, MACD, and Bollinger Bands. Monitor trading volume, support/resistance levels, and market sentiment. Track on-chain metrics and compare price action across timeframes for comprehensive trend analysis.

What are the advantages and disadvantages of ZERC compared to similar tokens like ETH and SOL?

ZERC offers niche specialized features with lower market saturation, but lacks the extensive ecosystem, proven security infrastructure, and higher trading volumes that ETH and SOL command. ETH and SOL remain more established for DeFi and development adoption.

What are the main risks of investing in ZERC and how to mitigate them?

ZERC faces market volatility and liquidity risks. Mitigate by diversifying your portfolio, investing only what you can afford to lose, conducting thorough research, and using dollar-cost averaging for gradual entry into positions.

What is ZERC's long-term development prospect? What is the project team and technology roadmap?

ZERC is built on zkSync, delivering fast and secure transactions. The project focuses on NFT horse racing gaming. The team plans to expand gaming features and develop a comprehensive NFT marketplace ecosystem.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

The 7 Best Metaverse Games to Play in Recent Years

NBLU vs THETA: A Comprehensive Comparison of Two Emerging Blockchain Technologies and Their Impact on the Decentralized Finance Ecosystem

NIBI vs LINK: A Comprehensive Comparison of Two Leading Blockchain Infrastructure Protocols

IRIS vs RUNE: A Comprehensive Comparison of Two Leading Blockchain Ecosystems

Cryptocurrency Tax Calculation Methods and Recommended Tools