2026 ZKWASM Price Prediction: Expert Analysis and Future Market Outlook for Zero-Knowledge WebAssembly Token

Introduction: ZKWASM's Market Position and Investment Value

ZKWASM (ZKWASM), as the first open-source virtual machine enabling zero-knowledge proof generation for WebAssembly, has been making significant strides in the blockchain infrastructure space since its inception. As of February 2026, ZKWASM maintains a market capitalization of approximately $777,183, with a circulating supply of around 120.36 million tokens and a current price of $0.006457. This asset, recognized as a core zk-infrastructure layer for scalable Web3 applications, is playing an increasingly important role in verifiable off-chain computation and modular rollup architecture.

This article will comprehensively analyze ZKWASM's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. ZKWASM Price History Review and Market Status

ZKWASM Historical Price Evolution Trajectory

- 2025: ZKWASM reached a notable price level of $0.17412 on August 21, 2025, representing a significant milestone in its early trading period

- 2026: The token experienced substantial price volatility, declining from the previous high to $0.006154 on February 1, 2026, reflecting broader market correction

ZKWASM Current Market Situation

As of February 4, 2026, ZKWASM is trading at $0.006457, showing a decline of 2.27% over the past 24 hours. The token has recorded a 24-hour trading volume of $13,668.19. Over the past week, ZKWASM has decreased by 10.48%, while the 30-day performance shows a decline of 9.81%.

The market capitalization stands at approximately $777,183, with a circulating supply of 120,362,863.37 ZKWASM tokens, representing 7.85% of the total supply of 1 billion tokens. The fully diluted market cap is calculated at $6,457,000. Within the past 24 hours, the price has fluctuated between a low of $0.006337 and a high of $0.006684.

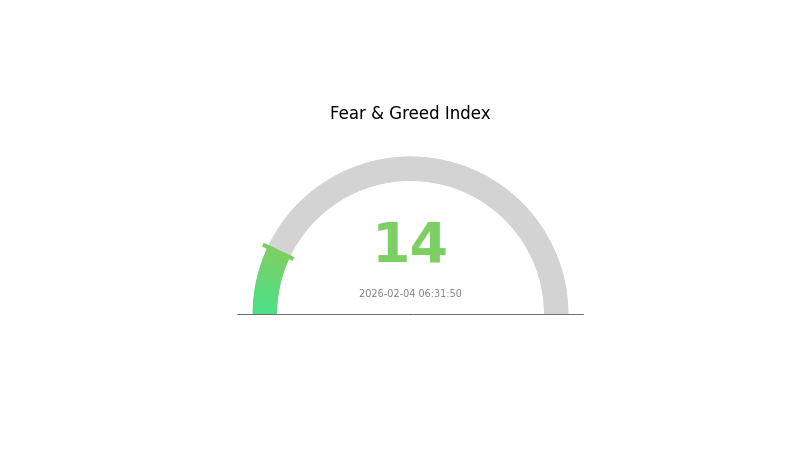

ZKWASM currently holds a market share of 0.00023% in the cryptocurrency market and ranks at position 2691. The token is tracked by 2,181 holders and is listed on 7 exchanges. Market sentiment indicators show a Fear & Greed Index reading of 14, suggesting an "Extreme Fear" condition in the broader market environment.

Click to view current ZKWASM market price

ZKWASM Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The ZKWASM market is currently experiencing extreme fear, with the Fear and Greed Index at 14. This exceptionally low reading signals intense pessimism among investors, reflecting significant market uncertainty and risk aversion. Such extreme fear conditions historically present contrarian opportunities for strategic investors. Market participants should exercise caution while monitoring potential reversal signals. Trading on Gate.com allows you to capitalize on market volatility with comprehensive tools and real-time data during these critical sentiment periods.

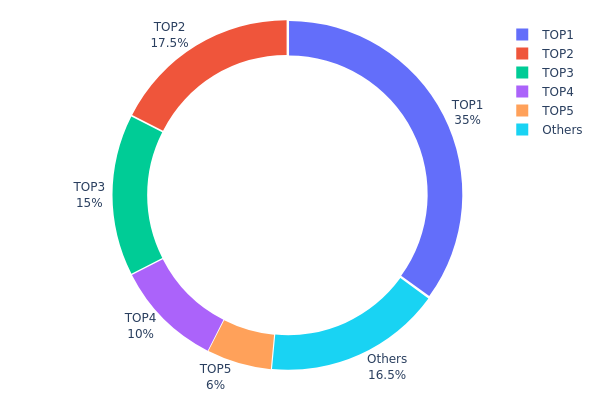

ZKWASM Holdings Distribution

The holdings distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a critical metric for assessing the decentralization level and potential market risks of a cryptocurrency project. By analyzing the proportion of tokens held by top addresses, we can evaluate whether the token supply is dominated by a few large holders (whales) or distributed more evenly across a broader community base.

According to the current data, ZKWASM exhibits a relatively high concentration pattern. The top address alone controls 350,000K tokens, accounting for 35.00% of the total supply, while the top five addresses collectively hold 835,105.56K tokens, representing 83.51% of the circulating supply. This level of concentration suggests that a small number of entities possess significant influence over the token's market dynamics. The remaining 16.49% is distributed among other addresses, indicating limited participation from retail investors or smaller holders.

This concentrated holding structure poses several implications for market stability. First, such distribution increases the risk of price manipulation, as major holders could potentially coordinate to influence market sentiment or execute large-scale sell-offs that trigger cascading liquidations. Second, the high concentration may constrain liquidity during periods of market stress, as a significant portion of the supply remains in the hands of entities that may not actively participate in trading. Third, from a governance perspective, this pattern suggests that decision-making power within the ecosystem may be centralized, potentially conflicting with the decentralization principles that blockchain projects typically advocate.

Click to view the current ZKWASM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfcbd...faa23f | 350000.00K | 35.00% |

| 2 | 0x6450...650799 | 175105.56K | 17.51% |

| 3 | 0xb1ba...56b6e6 | 150000.00K | 15.00% |

| 4 | 0xfdcc...138a14 | 100000.00K | 10.00% |

| 5 | 0x4081...3fda6e | 60000.00K | 6.00% |

| - | Others | 164894.44K | 16.49% |

II. Core Factors Influencing ZKWASM's Future Price

Supply Mechanism

- Supply Mechanism and Scarcity: ZKWASM's price prospects are influenced by its supply mechanism and scarcity characteristics. The token's supply dynamics play a role in determining its market value, though specific tokenomics details require careful evaluation.

- Current Impact: Market demand, adoption trends, and supply-side factors continue to shape ZKWASM's price trajectory. Investors should monitor how supply mechanisms interact with market acceptance to assess potential price movements.

Institutional and Major Holder Dynamics

- Institutional Participation: Institutional involvement represents a key factor in ZKWASM's investment value. The level of institutional engagement can signal confidence in the project's long-term viability and contribute to price stability.

- Mainstream Adoption: The extent of ZKWASM's adoption within the blockchain ecosystem influences its market position. Wider acceptance by developers and enterprises could support positive price development.

Macroeconomic Environment

- Broader Economic Factors: ZKWASM's price outlook is affected by macroeconomic conditions, including monetary policy trends and overall market sentiment. Economic uncertainty and inflation concerns may impact investor behavior toward crypto assets.

- Market Volatility: The cryptocurrency market experiences significant volatility, and ZKWASM is subject to these broader market dynamics. Investors should account for macroeconomic headwinds and tailwinds when evaluating price potential.

Technology Development and Ecosystem Building

- Zero-Knowledge Technology: ZKWASM addresses computational validity and privacy challenges in traditional Web2 environments. The technology's evolution and its complementary role with zkVM solutions could enhance its utility and market appeal.

- Ecosystem Applications: The development of applications leveraging ZKWASM's zero-knowledge scalability solutions may drive adoption. Technical innovation and ecosystem growth remain important factors for long-term price performance.

III. 2026-2031 ZKWASM Price Prediction

2026 Outlook

- Conservative Forecast: $0.00473 - $0.00648

- Neutral Forecast: Around $0.00648

- Optimistic Forecast: Up to $0.00908 (requires favorable market conditions and increased adoption)

2027-2029 Medium-Term Outlook

- Market Stage Expectation: Gradual growth phase with increasing market recognition and potential ecosystem development

- Price Range Forecast:

- 2027: $0.00685 - $0.0105 (approximately 20% increase)

- 2028: $0.00503 - $0.01298 (approximately 41% cumulative growth)

- 2029: $0.00619 - $0.01527 (approximately 71% cumulative growth)

- Key Catalysts: Technology advancement in zero-knowledge proof applications, expanding use cases in decentralized computing, and broader Web3 integration

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.00882 - $0.01316 (assuming steady ecosystem growth and sustained market interest)

- Optimistic Scenario: $0.01422 - $0.01793 (assuming accelerated adoption and strong network effects)

- Transformative Scenario: Potential to reach $0.01793 (under conditions of widespread integration and significant technological breakthroughs)

- 2026-02-04: ZKWASM trading within early-stage valuation range (reflecting current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00908 | 0.00648 | 0.00473 | 0 |

| 2027 | 0.0105 | 0.00778 | 0.00685 | 20 |

| 2028 | 0.01298 | 0.00914 | 0.00503 | 41 |

| 2029 | 0.01527 | 0.01106 | 0.00619 | 71 |

| 2030 | 0.01422 | 0.01316 | 0.00882 | 103 |

| 2031 | 0.01793 | 0.01369 | 0.01164 | 112 |

IV. ZKWASM Professional Investment Strategy and Risk Management

ZKWASM Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors with belief in zero-knowledge proof infrastructure development and modular rollup architecture

- Operational Recommendations:

- Consider accumulating positions during market corrections when price approaches recent support levels

- Monitor progress of the zk-native Launchpad and ecosystem adoption of verifiable dApps

- Utilize Gate Web3 Wallet for secure long-term storage with proper backup of recovery phrases

(II) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Track price movements around key levels, noting recent low at $0.006154 and recent high at $0.006684

- Volume Analysis: Monitor 24-hour trading volume fluctuations to identify potential momentum shifts

- Swing Trading Considerations:

- Pay attention to volatility patterns, as ZKWASM has shown significant price swings with a 1-year decline of 84.23%

- Set appropriate stop-loss orders to manage downside risk in this highly volatile asset

ZKWASM Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 5-8% with active monitoring

(II) Risk Hedging Solutions

- Diversification: Balance ZKWASM holdings with established blockchain infrastructure tokens

- Position Sizing: Scale investments incrementally rather than deploying full capital at once

(III) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active trading and easy access

- Cold Storage Approach: Hardware wallet solutions for long-term holdings exceeding short-term trading needs

- Security Precautions: Never share private keys, enable two-factor authentication, verify contract addresses (0xa8d3dee6671c4fdac4743a1eb1f276eabd4ba302 on BSC) before transactions

V. ZKWASM Potential Risks and Challenges

ZKWASM Market Risks

- High Volatility: The token has experienced an 84.23% decline over one year, indicating substantial price instability

- Low Liquidity: With 24-hour trading volume of approximately $13,668, limited liquidity may result in significant slippage during larger transactions

- Limited Market Penetration: With only 7.85% of tokens in circulation and market cap ranking at 2691, adoption remains in early stages

ZKWASM Regulatory Risks

- Evolving Compliance Landscape: Zero-knowledge proof technologies and privacy-focused solutions may face increased regulatory scrutiny as authorities develop frameworks for privacy-preserving technologies

- Cross-border Operations: As a globally accessible project, ZKWASM may need to navigate varying regulatory requirements across multiple jurisdictions

- Token Classification Uncertainty: Regulatory treatment of utility tokens supporting infrastructure services remains subject to interpretation in many regions

ZKWASM Technical Risks

- Smart Contract Vulnerabilities: As with any blockchain project, potential bugs or exploits in smart contracts could impact token security

- Competition in ZK Space: The zero-knowledge proof sector is becoming increasingly competitive, with multiple projects developing similar solutions

- Adoption Dependency: The token's value proposition relies heavily on successful adoption of the ZKWASM virtual machine and its ecosystem of verifiable dApps

VI. Conclusion and Action Recommendations

ZKWASM Investment Value Assessment

ZKWASM represents an early-stage infrastructure project in the zero-knowledge proof space, positioning itself as the first open-source virtual machine for WebAssembly with ZK proof generation capabilities. The project's backing by notable investors including HashKey Capital, Mirana Ventures, and SevenX indicates institutional confidence in its technical approach. However, the token faces challenges including low circulating supply (7.85% of total), limited market liquidity, and price depreciation. Long-term value proposition depends on successful ecosystem development and adoption of its modular rollup architecture, while short-term risks include market volatility and limited trading depth.

ZKWASM Investment Recommendations

✅ Beginners: Consider minimal allocation after thorough research, focus on understanding zero-knowledge proof technology fundamentals before investing ✅ Experienced Investors: Evaluate as speculative position within diversified crypto portfolio, monitor ecosystem development milestones ✅ Institutional Investors: Assess technical roadmap and competitive positioning within ZK infrastructure landscape, consider pilot allocation with active risk monitoring

ZKWASM Trading Participation Methods

- Spot Trading: Purchase ZKWASM tokens directly on Gate.com with fiat or cryptocurrency

- Dollar-Cost Averaging: Implement systematic investment approach to reduce timing risk in volatile market conditions

- Active Monitoring: Track project developments, partnership announcements, and ecosystem growth metrics to inform investment decisions

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ZKWASM? What are its core technologies and application scenarios?

ZKWASM is a zero-knowledge proof technology based on ZKSNARK circuits that simulates WebAssembly execution, supporting multiple programming languages like C, C++, and Rust. Its core strength lies in enabling privacy-preserving computations on-chain through cryptographic proofs, with applications in confidential transactions, private smart contracts, and cross-chain verification in Web3.

What is the current price and market cap of ZKWASM token?

ZKWASM is currently trading at approximately $0.0072 USD per token, with a market capitalization of around $737,083.52 USD. The 24-hour trading volume stands at $232,212.27 USD. Price data updates in real-time.

What is the ZKWASM token price prediction for 2024 and 2025?

Based on market analysis, ZKWASM was projected to reach approximately $0.24 by end of 2024, with potential growth to $0.42 in 2025. These predictions reflect market trends and technical analysis of the protocol's development and adoption.

What are the advantages of ZKWASM compared to other zero-knowledge proof projects?

ZKWASM natively supports WebAssembly, enabling developers to use mainstream programming languages for efficient development. It simplifies zero-knowledge proof implementation, delivers superior performance, and offers greater flexibility and scalability compared to other solutions.

What is ZKWASM's development roadmap? What are the important milestones ahead?

ZKWASM's roadmap targets mainnet launch by 2025, establishing a decentralized computation environment with expanded WebAssembly support. Key milestones include testnet completion, protocol optimization, and ecosystem expansion for zero-knowledge virtual machine adoption.

What risks should I pay attention to when investing in ZKWASM tokens?

ZKWASM token investments carry market volatility risk, technology risk, and regulatory changes. Assess your financial situation and risk tolerance before investing. Past performance does not guarantee future results.

What are the circulating supply and total supply of ZKWASM tokens?

ZKWASM has a total supply of 1.00B tokens. The circulating supply has not been publicly disclosed. As of February 4, 2026, the fully diluted valuation (FDV) stands at $63.98M.

Where is ZKWASM listed? How is the liquidity?

ZKWASM is listed on major exchanges with growing liquidity. Current trading volume remains moderate, presenting both opportunities and price volatility. Liquidity continues to improve as the project gains adoption and exchange listings expand.

2025 Worthwhile Zero-Knowledge Projects to Watch: The Future of Scalable and Private Blockchains

What is zk-SNARKs? Understanding encryption technology that promotes Web3 privacy

How Zero-Knowledge Proofs are Changing Privacy in Crypto Assets: From ZK-Rollups to Private Transactions

Nillion: Solving the Web3 Data Privacy Dilemma with Blind Computation

Humanity Protocol: Revolutionizing Web3 Identity Verification in 2025

Bedrock Deep Dive: Comprehensive Analysis of Whitepaper, Technical Innovations & Future Roadmap

What is fundamental analysis of crypto projects and how to evaluate whitepaper logic, use cases, and team background in 2026?

Top Cloud Gaming Services

What is tokenomics: token allocation, inflation design, and burning mechanisms explained

VERT vs THETA: A Comprehensive Comparison of Two Leading Vertically-Integrated Technology Platforms

What is Dogecoin's fundamental analysis: key factors driving DOGE's value in 2025-2026?