2026 ZYRA Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: ZYRA's Market Position and Investment Value

Bitcoin ZK (ZYRA), positioned as a Bitcoin Layer 2 scaling network built on zero-knowledge proof (ZK-Rollup) technology, has been actively developing its ecosystem since its launch in 2025. The project aims to expand Bitcoin mainnet capabilities by enabling low-cost, high-throughput smart contracts and transactions while maintaining the security and decentralization characteristics of Bitcoin. As of February 2026, ZYRA maintains a market capitalization of approximately $573,600, with a fully circulating supply of 1 billion tokens and a current trading price around $0.0005736. This governance-focused asset, serving as the native token of the BitcoinZK network, is playing an increasingly important role in the Bitcoin Layer 2 ecosystem development.

This article will comprehensively analyze ZYRA's price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic environments to provide investors with professional price forecasts and practical investment strategies.

I. ZYRA Price History Review and Market Status

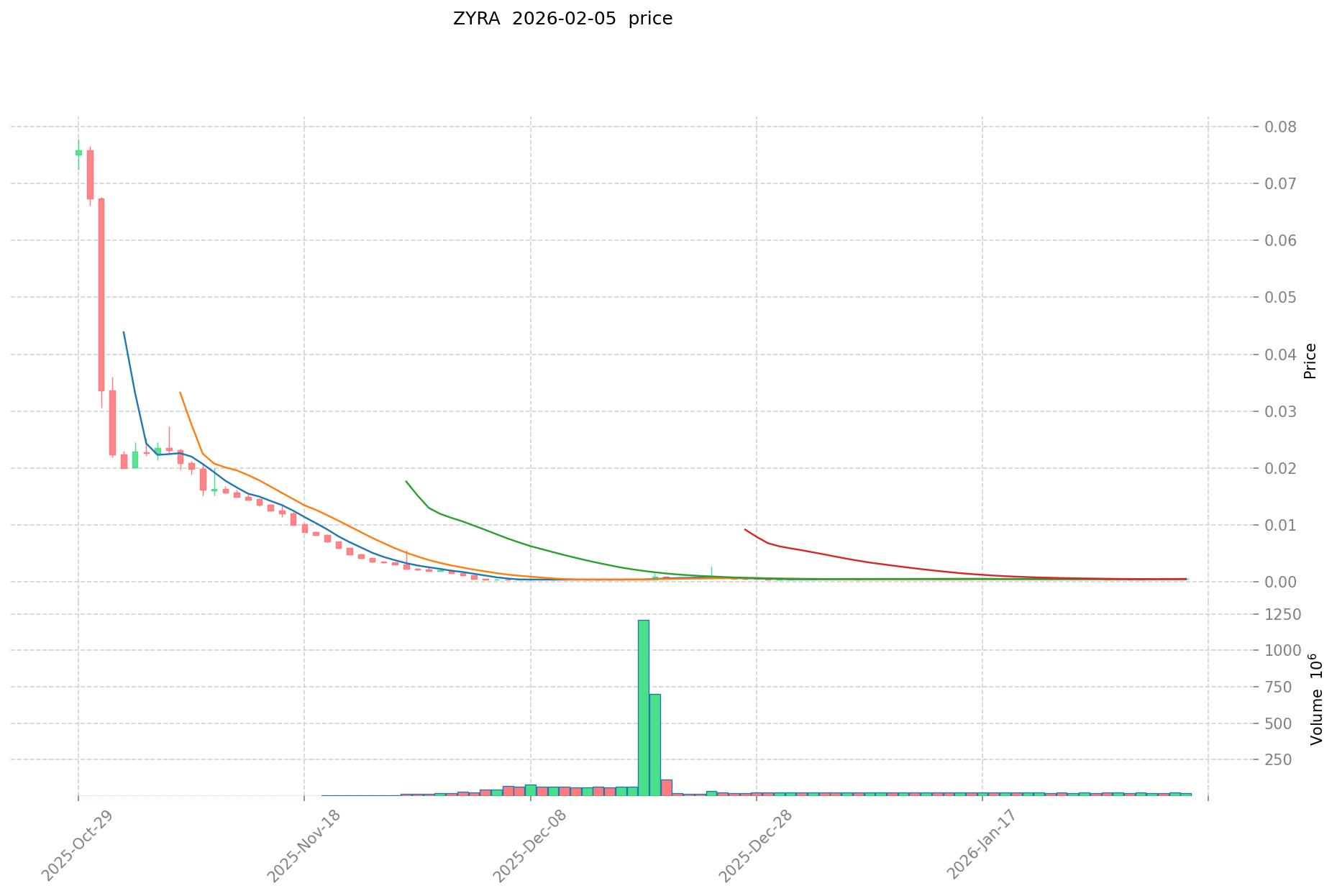

ZYRA Historical Price Evolution Trajectory

- 2025: ZYRA was officially launched on January 3, 2025, entering the cryptocurrency market as the native governance token of the BitcoinZK network.

- September 2025: The token experienced significant growth, reaching a peak price of 0.17 USD on September 11, 2025.

- December 2025: Market conditions led to a correction phase, with ZYRA declining to its recorded low of 0.0004 USD on December 5, 2025.

ZYRA Current Market Dynamics

As of February 5, 2026, ZYRA is trading at 0.0005736 USD. The token has demonstrated short-term volatility with a 1-hour price decrease of 0.21%, while showing positive momentum over longer timeframes with a 24-hour increase of 2.91%, a 7-day gain of 14.54%, and a 30-day appreciation of 12.94%.

The 24-hour trading volume stands at 12,367.58 USD, with the price fluctuating between a high of 0.0005945 USD and a low of 0.0005562 USD during this period. ZYRA maintains a circulating supply of 1,000,000,000 tokens, which represents 100% of its total and maximum supply, resulting in a market capitalization of 573,600 USD. The fully diluted market cap matches the current market cap at 573,600 USD, indicating complete token circulation.

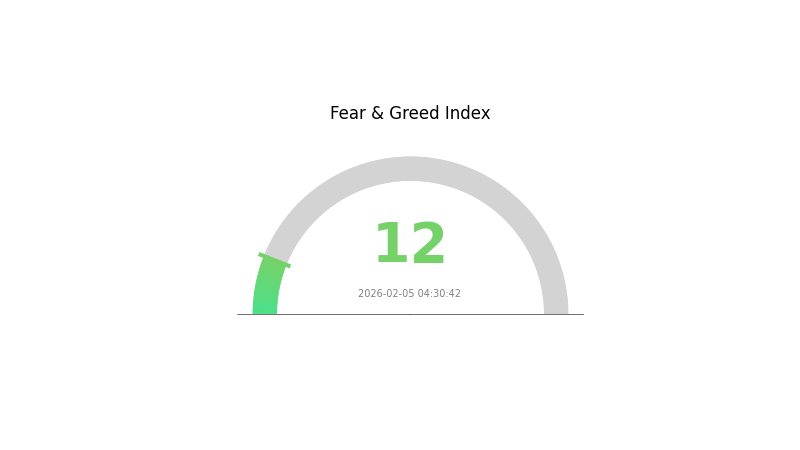

The token currently holds a market ranking of 2926, with a market dominance of 0.000022%. ZYRA is supported by a holder base of 23,507 addresses and is listed on 1 exchange. The current market sentiment index registers at 12, reflecting an extreme fear condition in the broader cryptocurrency market.

Click to check the current ZYRA market price

ZYRA Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching only 12 points. This exceptionally low reading indicates significant market pessimism and heightened investor anxiety. During periods of extreme fear, market participants often exhibit risk-averse behavior, leading to increased selling pressure and depressed asset valuations. Historically, such extreme sentiment levels have presented contrarian opportunities for long-term investors, as markets typically recover from oversold conditions. However, investors should exercise caution and conduct thorough research before making investment decisions during such volatile periods.

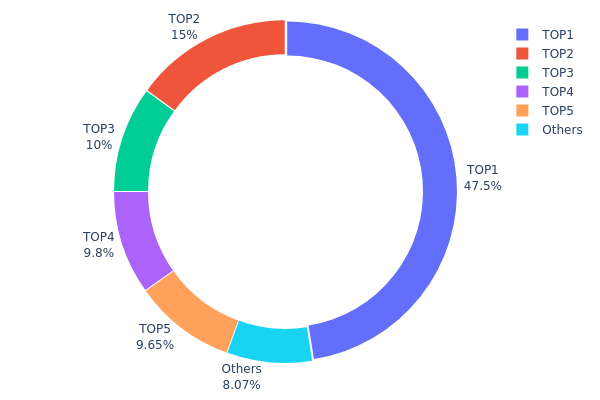

ZYRA Token Holding Distribution

The token holding distribution chart reveals the allocation of ZYRA tokens across different wallet addresses, serving as a critical indicator of decentralization and market structure. According to the latest on-chain data, the top five addresses collectively control 822,304.14K ZYRA tokens, representing 82.23% of the total supply. This concentration pattern suggests a highly centralized holding structure that warrants careful examination.

The dominant holder at address 0x7fcc...a3433c commands 474,772.66K tokens (47.47%), constituting nearly half of the entire circulating supply. When combined with the second and third largest holders controlling 15.00% and 10.00% respectively, the top three addresses alone account for 72.47% of all tokens. Such extreme concentration creates significant structural risks, as price movements could be heavily influenced by the trading decisions of these major holders. The remaining addresses outside the top five hold merely 8.08%, indicating limited distribution among retail participants and a shallow market depth.

From a market stability perspective, this centralized distribution pattern increases vulnerability to price manipulation and introduces elevated volatility risks. Large holders possess sufficient market power to execute significant price swings through coordinated buying or selling activities. Additionally, the limited token circulation among smaller holders suggests weak organic trading activity and potentially fragile liquidity conditions. This concentration structure indicates that ZYRA's on-chain ecosystem remains in an early developmental stage, with decentralization yet to be meaningfully achieved across the broader holder base.

Click to view current ZYRA Token Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7fcc...a3433c | 474772.66K | 47.47% |

| 2 | 0x15e1...44b427 | 150000.00K | 15.00% |

| 3 | 0x6e73...1ad5d9 | 100000.00K | 10.00% |

| 4 | 0x21d0...6e52cb | 98004.25K | 9.80% |

| 5 | 0xa8dd...673a5e | 96527.23K | 9.65% |

| - | Others | 80695.86K | 8.08% |

II. Core Factors Influencing ZYRA's Future Price

Market Volatility and Sentiment

- High Volatility Characteristic: The cryptocurrency market is known for its significant price fluctuations, and ZYRA's price trajectory may be influenced by overall market sentiment and investor behavior patterns.

- Historical Pattern: Digital asset prices have historically shown sensitivity to broader market movements, with sentiment shifts often preceding directional changes.

- Current Impact: Market participants should monitor sentiment indicators, as ZYRA's valuation may reflect general risk appetite in the crypto space.

Institutional Capital Flows

- Institutional Participation: The flow of institutional capital into cryptocurrency markets has become an increasingly important factor in price formation.

- Market Balance: Institutional fund movements may provide stabilization effects, potentially moderating short-term price volatility.

- Structural Evolution: The gradual integration of institutional investors suggests a maturation process in the asset class, which may influence long-term price dynamics.

Policy and Regulatory Environment

- Government Decision-Making: Policy decisions at various governmental levels may affect market conditions and investor confidence.

- Regulatory Framework: The evolving regulatory landscape continues to shape market structure and participation patterns.

- Policy Uncertainty: Market participants remain attentive to potential regulatory developments that could impact trading conditions.

Macroeconomic Context

- Economic Conditions: Broader economic factors, including inflation trends and monetary policy directions, may influence investment flows into digital assets.

- Market Structure: The relationship between traditional financial markets and cryptocurrency valuations continues to evolve.

- External Factors: International developments and geopolitical considerations may contribute to market dynamics.

III. 2026-2031 ZYRA Price Prediction

2026 Outlook

- Conservative prediction: $0.00046 - $0.00057

- Neutral prediction: $0.00057 (average market scenario)

- Optimistic prediction: $0.00064 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase with potential expansion in user base and ecosystem development

- Price range prediction:

- 2027: $0.0005 - $0.00087

- 2028: $0.0006 - $0.00086

- 2029: $0.00054 - $0.00107

- Key catalysts: Market sentiment shifts, technological improvements, and broader crypto market recovery trends could serve as primary drivers

2030-2031 Long-term Outlook

- Baseline scenario: $0.00075 - $0.00094 (assuming steady market development and sustained project momentum)

- Optimistic scenario: $0.00094 - $0.00112 (assuming enhanced market penetration and favorable regulatory environment)

- Transformational scenario: Approaching $0.00112 (requires exceptional adoption rates and breakthrough developments in the project ecosystem)

- February 5, 2026: ZYRA is in early prediction phase with projected average price around $0.00057

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00064 | 0.00057 | 0.00046 | 0 |

| 2027 | 0.00087 | 0.00061 | 0.0005 | 5 |

| 2028 | 0.00086 | 0.00074 | 0.0006 | 28 |

| 2029 | 0.00107 | 0.0008 | 0.00054 | 39 |

| 2030 | 0.00097 | 0.00094 | 0.00075 | 63 |

| 2031 | 0.00112 | 0.00096 | 0.00063 | 66 |

IV. ZYRA Professional Investment Strategy and Risk Management

ZYRA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in Bitcoin Layer 2 scaling solutions and ZK-Rollup technology development

- Operational Recommendations:

- Consider accumulating positions when market sentiment is neutral or bearish, as ZYRA has shown recovery potential with a 14.54% increase over 7 days

- Monitor the development progress of the BitcoinZK network and governance proposals that may impact token utility

- Storage Solution: Utilize Gate Web3 Wallet for secure storage of ZYRA tokens, ensuring private key control and supporting BSC network compatibility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $12,367.58 to identify liquidity patterns and potential breakout opportunities

- Price Range Trading: Focus on the recent 24-hour range between $0.0005562 (low) and $0.0005945 (high) to identify support and resistance levels

- Swing Trading Key Points:

- Watch for momentum shifts as ZYRA has demonstrated short-term volatility with a 2.91% increase in 24 hours

- Consider the token's 30-day performance of 12.94% when evaluating medium-term trading positions

ZYRA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio allocation, given the token's early stage and market cap rank of 2926

- Aggressive Investors: 5-10% allocation for those seeking exposure to Bitcoin Layer 2 governance tokens

- Professional Investors: Up to 15% allocation with active position management and stop-loss protocols

(2) Risk Hedging Solutions

- Diversification Strategy: Balance ZYRA holdings with exposure to established Layer 1 assets to offset governance token volatility

- Position Sizing: Implement scaled entry and exit strategies based on the token's price movements and network development milestones

(3) Secure Storage Solutions

- Recommended Non-Custodial Wallet: Gate Web3 Wallet, which supports BSC network tokens and provides enhanced security features

- Multi-Signature Solution: For larger holdings, consider implementing multi-signature wallet solutions compatible with BSC

- Security Precautions: Always verify contract addresses (0x0d8c844716bcd981d9b6d3f2ccf5364129086c96 for BSC), never share private keys, and enable all available security features

V. ZYRA Potential Risks and Challenges

ZYRA Market Risks

- Limited Liquidity: With a total market cap of approximately $573,600 and ranking at 2926, ZYRA exhibits relatively low liquidity, which may result in significant price slippage during large transactions

- High Volatility: The token has experienced substantial price fluctuations, having reached a high of $0.17 and a low of $0.0004, indicating potential for significant price swings

- Market Dominance: With a market dominance of only 0.000022%, ZYRA represents a minor position in the overall cryptocurrency market, making it susceptible to broader market movements

ZYRA Regulatory Risks

- Governance Token Classification: Regulatory frameworks for governance tokens remain uncertain in many jurisdictions, potentially affecting ZYRA's operational model and value proposition

- Layer 2 Protocol Oversight: As regulations around Bitcoin Layer 2 solutions evolve, BitcoinZK network operations may face compliance requirements that could impact token functionality

- Cross-border Trading Restrictions: Changes in cryptocurrency trading regulations across different regions may affect ZYRA's accessibility and liquidity

ZYRA Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, ZYRA is subject to potential smart contract exploits or vulnerabilities within the BitcoinZK protocol

- Network Development Risks: The success of ZYRA is closely tied to the development and adoption of the BitcoinZK network, and any delays or technical challenges may impact token value

- Interoperability Challenges: Integration with Bitcoin mainnet and maintaining security while achieving scalability through ZK-Rollup technology presents ongoing technical challenges

VI. Conclusion and Action Recommendations

ZYRA Investment Value Assessment

ZYRA represents a governance token for the BitcoinZK Layer 2 network, targeting Bitcoin scalability through ZK-Rollup technology. The token has demonstrated positive momentum with gains of 14.54% over 7 days and 12.94% over 30 days. However, investors should consider the early-stage nature of the project, limited liquidity, and the token's significant price history ranging from $0.0004 to $0.17. The long-term value proposition depends on the successful development and adoption of the BitcoinZK network, while short-term risks include market volatility, regulatory uncertainty, and technical execution challenges.

ZYRA Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio) to gain exposure while learning about Layer 2 governance mechanisms. Focus on understanding the project fundamentals before increasing position size ✅ Experienced Investors: Consider a moderate allocation (3-5%) with active monitoring of network development milestones and governance proposals. Implement systematic entry strategies during market corrections ✅ Institutional Investors: Conduct thorough due diligence on the BitcoinZK protocol, assess governance token mechanics, and consider strategic positions aligned with Layer 2 scaling thesis, while maintaining comprehensive risk management protocols

ZYRA Trading Participation Methods

- Spot Trading: Execute spot purchases on Gate.com, monitoring the 24-hour price range and volume patterns for optimal entry points

- Dollar-Cost Averaging: Implement systematic purchase strategies to mitigate timing risk, particularly suitable given the token's volatility profile

- Secure Storage: Transfer holdings to Gate Web3 Wallet after purchase to maintain custody control and participate in potential governance activities

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ZYRA token and what are its uses and value?

ZYRA is the native token of Bitcoin ZK protocol with fixed supply of 1 billion. It incentivizes miners and supports network operations. Deflationary mechanisms enhance scarcity and increase long-term value potential.

What is the price prediction for ZYRA in 2024? What are the main factors affecting the price?

ZYRA price prediction for 2024 is estimated between $0.45-$0.75, influenced by market demand, blockchain adoption, tokenomics, and regulatory environment. Supply-demand dynamics, transaction volume, and ecosystem development are key price drivers.

What are the advantages and disadvantages of ZYRA compared to similar tokens?

ZYRA excels in high performance and low transaction fees, making it efficient for users. However, its ecosystem applications remain limited compared to established competitors. Platforms like FLOW have more developed gaming and NFT ecosystems with larger user bases, giving them stronger network effects currently.

What are the risks to pay attention to when investing in ZYRA tokens?

ZYRA token investments carry market volatility risks, liquidity concerns, and potential regulatory changes. Cryptocurrency markets are highly speculative. Conduct thorough research before investing.

What is ZYRA's historical price performance and future development prospects?

ZYRA has demonstrated dynamic price movements reflecting market demand and ecosystem developments. Historical trends show volatility with growth potential tied to adoption metrics and network expansion. Future prospects appear positive with strong fundamentals supporting upside momentum through 2026 and beyond.

Where can I buy ZYRA? How to trade ZYRA safely?

ZYRA can be purchased on major cryptocurrency platforms. For safe trading, enable two-factor authentication, use secure wallets, and backup your private keys. Always verify platform legitimacy before transactions.

2025 Worthwhile Zero-Knowledge Projects to Watch: The Future of Scalable and Private Blockchains

What is zk-SNARKs? Understanding encryption technology that promotes Web3 privacy

How Zero-Knowledge Proofs are Changing Privacy in Crypto Assets: From ZK-Rollups to Private Transactions

Nillion: Solving the Web3 Data Privacy Dilemma with Blind Computation

Humanity Protocol: Revolutionizing Web3 Identity Verification in 2025

Bedrock Deep Dive: Comprehensive Analysis of Whitepaper, Technical Innovations & Future Roadmap

Expertise in Determining Entry and Exit Points Through Multi-Timeframe Analysis

NFT Trading: How to Buy and Sell NFTs - A Step-by-Step Guide

How Bitcoin Futures Trading Works: Principles and Pros & Cons

Comprehensive Guide to Cryptocurrency Scalping Trading

Master Japanese candlestick charts like a professional and explore the most well-known patterns with examples