ADAPAD vs BTC: Which Cryptocurrency Offers Better Investment Potential in 2024?

Introduction: ADAPAD vs BTC Investment Comparison

In the cryptocurrency market, the comparison between ADAPAD and BTC has always been a topic that investors cannot avoid. The two not only differ significantly in market capitalization ranking, application scenarios, and price performance, but also represent different crypto asset positioning. ADAPAD (ADAPAD): Since its launch, it has gained market recognition as a token launch platform on Cardano with a deflationary mechanism. The deflationary triggers are linked to sales, unlocking, and IDO participation, with primary mechanisms including a 10% fee on all token sales and up to 25% early unlock fees. Bitcoin (BTC): Since 2008, it has been hailed as digital gold and remains one of the cryptocurrencies with the highest trading volume and market capitalization globally. Proposed by Satoshi Nakamoto, Bitcoin operates as a decentralized P2P digital currency that does not rely on any central authority for issuance. This article will comprehensively analyze the investment value comparison between ADAPAD and BTC around historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question that investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

ADAPAD and BTC Historical Price Trends

- 2021: ADAPAD experienced significant price volatility following its launch, reaching an all-time high of $1.28 in October 2021 amid the broader crypto market bull run.

- 2021: BTC achieved notable gains during the same period, with institutional adoption and mainstream recognition driving substantial price appreciation, though specific numerical data from reference materials is limited.

- Comparative Analysis: During the 2021-2026 market cycle, ADAPAD declined from its peak of $1.28 to approximately $0.0012408, representing substantial downward pressure. Meanwhile, BTC demonstrated different price dynamics, declining from previous highs while maintaining significantly higher absolute price levels.

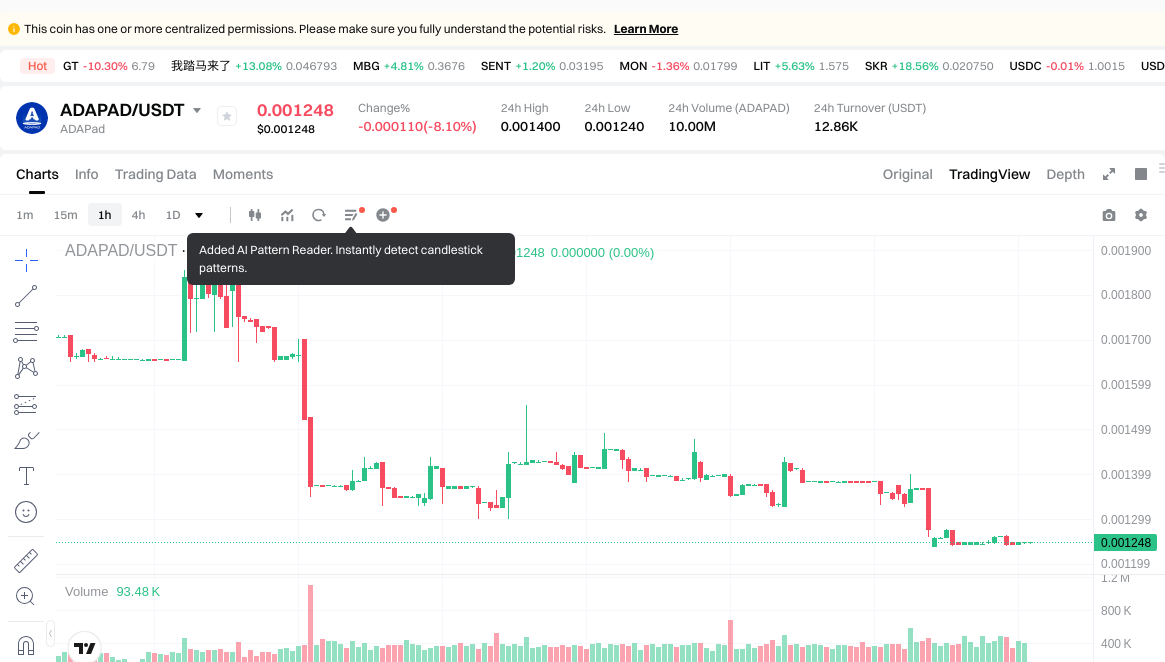

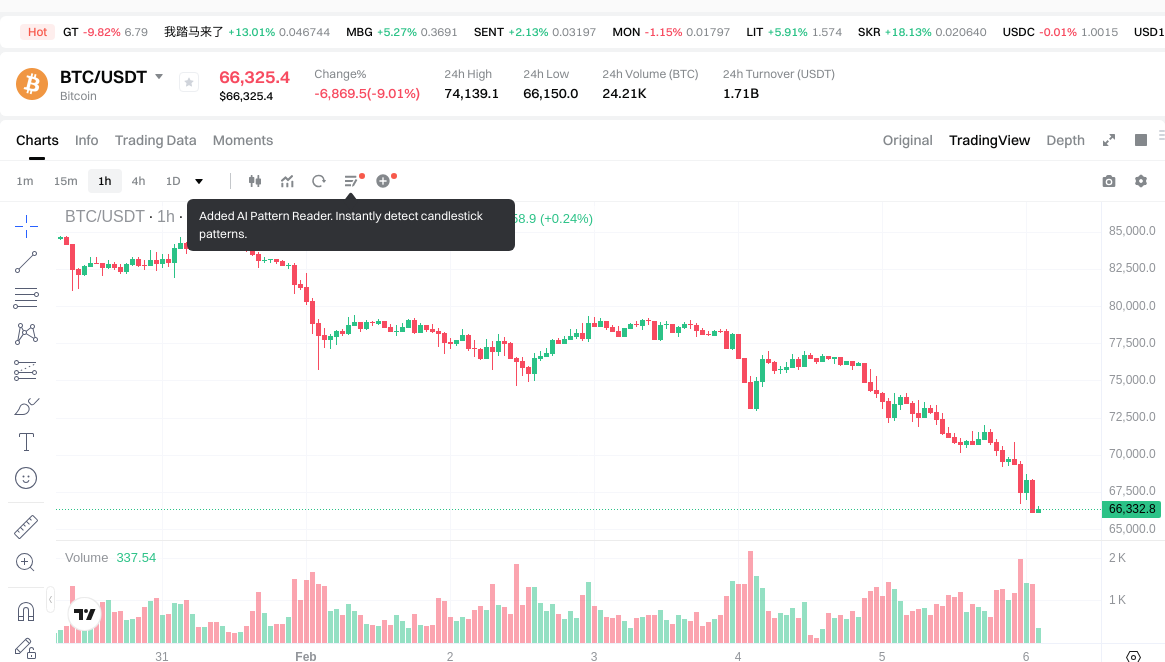

Current Market Status (February 6, 2026)

- ADAPAD Current Price: $0.001245

- BTC Current Price: $66,258.9

- 24-Hour Trading Volume: ADAPAD $12,844.50 vs BTC $1,710,059,998.33

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

View real-time prices:

- Check ADAPAD current price Market Price

- Check BTC current price Market Price

II. Core Factors Influencing ADAPAD vs BTC Investment Value

Supply Mechanism Comparison (Tokenomics)

- ADAPAD: Operates as a token issuance platform on Cardano with a deflationary mechanism. The deflationary model is triggered through multiple factors including sales activity, unlocking events, and IDO participation. Key deflationary mechanisms include a 10% fee on all token sales and up to 25% on early unlocking events.

- BTC: Features a fixed supply cap of 21 million coins with a halving mechanism that reduces block rewards approximately every four years, creating programmatic scarcity over time.

- 📌 Historical Pattern: Supply mechanisms have historically influenced price cycles, with scarcity-driven models tending to create supply-demand imbalances during periods of increased market demand.

Institutional Adoption and Market Application

- Institutional Holdings: Based on available materials, institutional preference patterns between ADAPAD and BTC show distinct positioning, with each asset serving different roles within the cryptocurrency ecosystem.

- Enterprise Adoption: The materials indicate varying levels of adoption across cross-border payments, settlement systems, and investment portfolios, though specific comparative data requires further analysis.

- National Policies: Regulatory attitudes toward both assets differ across jurisdictions, impacting their respective market positioning and accessibility.

Technology Development and Ecosystem Building

- ADAPAD Technology: Functions as a token launch platform on Cardano, integrating NFT capabilities and operating within a space exploration-themed ecosystem. Development is supported by an experienced industry team.

- BTC Technology: Continues development in areas related to network security, scalability, and adoption infrastructure.

- Ecosystem Comparison: The two assets occupy different positions within DeFi, NFT, payment, and smart contract landscapes, with varying degrees of implementation and market penetration.

Macroeconomic Environment and Market Cycles

- Performance in Inflationary Environments: The materials suggest that macroeconomic trends, including inflation dynamics, influence both assets differently based on their respective characteristics and market positioning.

- Macroeconomic Monetary Policy: Interest rate fluctuations, US dollar index movements, and broader monetary policy decisions impact both ADAPAD and BTC, though the degree and nature of influence may vary.

- Geopolitical Factors: Cross-border transaction demand and international circumstances represent external variables affecting both assets' market performance and adoption trajectories.

III. 2026-2031 Price Prediction: ADAPAD vs BTC

Short-term Prediction (2026)

- ADAPAD: Conservative $0.0011232 - $0.001248 | Optimistic $0.001248 - $0.00179712

- BTC: Conservative $40,463.008 - $66,332.8 | Optimistic $66,332.8 - $80,926.016

Mid-term Prediction (2028-2029)

- ADAPAD may enter a consolidation phase, with estimated price range of $0.001097461248 - $0.002372452992

- BTC may enter a growth phase, with estimated price range of $52,993.956484512 - $92,087.858809152

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Prediction (2031)

- ADAPAD: Base scenario $0.001544302472274 - $0.002271033047462 | Optimistic scenario $0.002271033047462 - $0.003065894614074

- BTC: Base scenario $66,019.5234870510528 - $106,483.10239846944 | Optimistic scenario $106,483.10239846944 - $146,946.6813098878272

Disclaimer

ADAPAD:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00179712 | 0.001248 | 0.0011232 | 0 |

| 2027 | 0.0017052672 | 0.00152256 | 0.0012484992 | 22 |

| 2028 | 0.002372452992 | 0.0016139136 | 0.001097461248 | 29 |

| 2029 | 0.00221243345856 | 0.001993183296 | 0.00141516014016 | 60 |

| 2030 | 0.002439257717644 | 0.00210280837728 | 0.001514022031641 | 68 |

| 2031 | 0.003065894614074 | 0.002271033047462 | 0.001544302472274 | 82 |

BTC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 80926.016 | 66332.8 | 40463.008 | 0 |

| 2027 | 94245.64224 | 73629.408 | 53013.17376 | 11 |

| 2028 | 89813.1518784 | 83937.52512 | 70507.5211008 | 26 |

| 2029 | 92087.858809152 | 86875.3384992 | 52993.956484512 | 31 |

| 2030 | 123484.60614276288 | 89481.598654176 | 79638.62280221664 | 35 |

| 2031 | 146946.6813098878272 | 106483.10239846944 | 66019.5234870510528 | 60 |

IV. Investment Strategy Comparison: ADAPAD vs BTC

Long-term vs Short-term Investment Strategies

- ADAPAD: May appeal to investors with higher risk tolerance who are interested in Cardano ecosystem development, NFT integration, and early-stage token launch platforms. The deflationary mechanism tied to sales and IDO participation presents distinct tokenomics characteristics that may influence price dynamics over time.

- BTC: May suit investors seeking exposure to an established digital asset with widespread recognition, institutional participation, and a well-defined supply schedule through its halving mechanism. The fixed supply cap and historical market cycles provide a different risk-return profile.

Risk Management and Asset Allocation

- Conservative Investors: A portfolio weighting approach might consider higher BTC allocation relative to ADAPAD, given BTC's established market position and liquidity characteristics. Specific allocation percentages should be determined based on individual risk tolerance and investment objectives.

- Aggressive Investors: Those with higher risk appetite might explore increased ADAPAD allocation within a diversified portfolio, acknowledging the platform's early-stage positioning and higher volatility profile. However, BTC may still serve as a core holding for portfolio stability.

- Hedging Instruments: Stablecoin reserves, options strategies, and cross-asset diversification can help manage downside risk exposure across both positions during periods of market volatility.

V. Potential Risk Comparison

Market Risk

- ADAPAD: Exhibits characteristics associated with smaller market capitalization assets, including lower liquidity levels ($12,844.50 in 24-hour volume as of February 6, 2026) and potential for higher price volatility. The asset has experienced significant price movement from its October 2021 peak of $1.28 to current levels around $0.001245.

- BTC: While subject to market-wide cryptocurrency volatility, demonstrates substantially higher liquidity ($1,710,059,998.33 in 24-hour volume) and deeper market participation. Price movements, though still volatile, occur within a more established trading infrastructure.

Technical Risk

- ADAPAD: As a token launch platform operating on Cardano, technical considerations include platform development progress, ecosystem adoption rates, and the effectiveness of its deflationary mechanisms (10% fee on token sales, up to 25% on early unlocking). Network stability depends on the underlying Cardano infrastructure.

- BTC: Technical considerations include network scalability developments, mining centralization patterns, and ongoing protocol upgrades. The Bitcoin network's security model relies on proof-of-work consensus and distributed hash rate.

Regulatory Risk

- Global regulatory frameworks continue to evolve, with varying approaches across jurisdictions affecting both assets differently. ADAPAD's positioning as a token launch platform may face regulatory scrutiny related to securities classification and platform operations. BTC faces ongoing regulatory discussions around classification, taxation, and institutional custody requirements. Both assets remain subject to changing policy environments that could impact market access and adoption trajectories.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ADAPAD Characteristics: Functions as a token launch platform on Cardano with integrated NFT capabilities and a deflationary mechanism tied to platform activity. The ecosystem operates within a space exploration theme and is supported by an experienced team. Current market positioning reflects early-stage platform development with corresponding price levels.

- BTC Characteristics: Maintains position as an established digital asset with widespread institutional recognition, fixed supply cap of 21 million coins, and programmatic scarcity through halving events. The network provides decentralized peer-to-peer value transfer without reliance on central authorities.

✅ Investment Considerations:

- Beginner Investors: May consider prioritizing familiarity with fundamental cryptocurrency concepts, market dynamics, and risk management principles before position sizing. Starting with more established assets with higher liquidity may facilitate learning while managing exposure.

- Experienced Investors: Portfolio construction might incorporate both assets based on distinct risk-return profiles, with allocation decisions reflecting individual investment objectives, time horizons, and risk tolerance levels. Diversification across market capitalizations and use cases may help balance portfolio characteristics.

- Institutional Investors: Asset selection may depend on mandate requirements, liquidity needs, custody capabilities, and regulatory compliance frameworks. Each asset presents different operational considerations regarding infrastructure requirements and risk management protocols.

⚠️ Risk Disclosure: Cryptocurrency markets exhibit high volatility and significant price fluctuations. This analysis does not constitute investment advice, financial guidance, or recommendations to buy or sell any asset. Investors should conduct independent research, assess personal financial circumstances, and consult qualified professionals before making investment decisions. Past performance does not indicate future results.

VII. FAQ

Q1: What is the main difference between ADAPAD's and BTC's supply mechanisms?

ADAPAD operates with a deflationary mechanism triggered by platform activities, while BTC features a fixed supply cap with programmatic scarcity. ADAPAD's deflationary model activates through sales (10% fee), early unlocking events (up to 25% fee), and IDO participation, meaning supply reduction is tied directly to platform usage. In contrast, BTC's supply mechanism is predetermined with a maximum of 21 million coins, implementing halving events approximately every four years that reduce mining rewards, creating predictable scarcity independent of transaction activity. This fundamental difference means ADAPAD's supply dynamics respond to platform engagement levels, whereas BTC's scarcity follows a fixed schedule regardless of market conditions.

Q2: How do the current liquidity levels compare between ADAPAD and BTC?

BTC demonstrates substantially higher liquidity with 24-hour trading volume of $1,710,059,998.33 compared to ADAPAD's $12,844.50 as of February 6, 2026. This significant disparity reflects BTC's established market position with deeper order books, broader exchange listings, and higher institutional participation. The liquidity difference impacts several practical considerations: BTC positions can typically be entered or exited with minimal slippage across various order sizes, while ADAPAD's lower volume may result in greater price impact for larger transactions. For investors, higher liquidity generally translates to improved price discovery, tighter bid-ask spreads, and reduced execution risk during volatile market conditions.

Q3: What role does each asset play within the cryptocurrency ecosystem?

ADAPAD functions as a token launch platform on Cardano with integrated NFT capabilities, while BTC serves as a decentralized peer-to-peer digital currency and store of value. ADAPAD's ecosystem focuses on facilitating token launches within the Cardano network, incorporating space exploration themes and NFT functionalities, positioning it as infrastructure for new project deployment. BTC, proposed by Satoshi Nakamoto in 2008, operates as a decentralized payment system and is often referred to as "digital gold" due to its role as a potential store of value and inflation hedge. These distinct purposes mean ADAPAD targets users interested in token launch platforms and Cardano ecosystem development, while BTC appeals to those seeking exposure to an established digital asset with widespread recognition.

Q4: How has the price performance differed between ADAPAD and BTC from 2021 to 2026?

Both assets experienced significant volatility from their 2021 peaks, though at vastly different price scales. ADAPAD reached an all-time high of $1.28 in October 2021 during the broader crypto market bull run, subsequently declining to approximately $0.001245 by February 2026—representing substantial downward pressure from peak levels. BTC also achieved notable gains during 2021 driven by institutional adoption and mainstream recognition, followed by declines from previous highs while maintaining significantly higher absolute price levels at $66,258.9 as of February 6, 2026. The percentage drawdowns and recovery patterns reflect each asset's market positioning, with ADAPAD's price movement characteristic of smaller market capitalization assets and BTC's volatility occurring within a more established trading framework.

Q5: What are the key technical considerations for each asset?

ADAPAD's technical considerations center on platform development and Cardano network stability, while BTC's focus on network security and scalability. For ADAPAD, technical factors include platform development progress, ecosystem adoption rates, effectiveness of deflationary mechanisms (10% sales fee, up to 25% early unlock fee), and reliability of the underlying Cardano infrastructure. BTC's technical considerations encompass network scalability developments, mining centralization patterns, protocol upgrades, and the security model based on proof-of-work consensus with distributed hash rate. Additionally, ADAPAD's technical roadmap relates to token launch functionality and NFT integration, whereas BTC development focuses on layer-two solutions, network efficiency improvements, and maintaining decentralization across the mining ecosystem.

Q6: How might regulatory environments affect ADAPAD and BTC differently?

ADAPAD faces potential regulatory scrutiny related to token launch platform operations and securities classification, while BTC encounters discussions around asset classification and institutional custody. As a token launch platform, ADAPAD may be subject to regulatory frameworks governing securities offerings, platform licensing requirements, and jurisdictional compliance for facilitating token sales. These considerations vary significantly across different regulatory regimes and may impact platform operations and market access. BTC faces ongoing regulatory discussions regarding its classification as a commodity versus security, taxation treatment, institutional custody requirements, and integration into traditional financial systems. Both assets remain subject to evolving policy environments, though the specific regulatory risks differ based on their functional purposes and market positioning within the cryptocurrency ecosystem.

Q7: What portfolio allocation approach might suit different investor profiles?

Conservative investors might consider higher BTC allocation relative to ADAPAD, while aggressive investors may explore increased ADAPAD exposure within diversified portfolios. For conservative investors prioritizing capital preservation and lower volatility, a portfolio weighting approach could emphasize BTC given its established market position, higher liquidity ($1.71 billion vs. $12,844.50 in 24-hour volume), and institutional participation. Aggressive investors with higher risk tolerance might allocate more substantially to ADAPAD, acknowledging its early-stage platform positioning, higher volatility profile, and potential for growth within the Cardano ecosystem. However, specific allocation percentages should reflect individual risk tolerance, investment objectives, time horizons, and overall portfolio construction. Regardless of profile, hedging instruments such as stablecoin reserves, options strategies, and cross-asset diversification can help manage downside risk exposure during market volatility periods.

Q8: What timeframe considerations should influence investment decisions between these assets?

Short-term and long-term investment horizons present different considerations for ADAPAD versus BTC positioning. For short-term perspectives (2026), ADAPAD's conservative prediction ranges from $0.0011232 to $0.001248, with optimistic scenarios reaching $0.00179712, while BTC ranges conservatively from $40,463.008 to $66,332.8, with optimistic scenarios at $80,926.016. Long-term projections (2031) show ADAPAD's base scenario between $0.001544302472274 and $0.002271033047462, with BTC ranging from $66,019.5234870510528 to $106,483.10239846944. These timeframe differences suggest that ADAPAD may require longer holding periods to potentially realize gains from platform development and ecosystem adoption, while BTC's established market cycles and institutional participation may provide different risk-return dynamics across various investment horizons. Investors should align asset selection with their specific time horizons and liquidity requirements.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Hot vs. cold crypto wallets — which is right for you?

APR vs. APY in Crypto Assets: An In-Depth Guide to Their Key Differences

Understanding Demand and Supply Zones in Trading: Comprehensive Guide and Application Strategies

What Are Nodes?

What Is an IDO? Initial DEX Offering Explained