DOMI vs CRO: A Comprehensive Comparison of Two Leading Cryptocurrency Exchange Platforms

Introduction: DOMI vs CRO Investment Comparison

In the cryptocurrency market, the comparison between DOMI and CRO has become a topic that investors cannot ignore. The two differ significantly in market cap ranking, application scenarios, and price performance, representing distinct crypto asset positions.

DOMI: Since its launch in 2022, this token has gained market attention through its positioning as an NFT-based 3D blockchain MMORPG with an old-school skill and level mechanism combined with a modern interface.

CRO (Cronos): Launched in 2018, it has been recognized as a leading blockchain ecosystem partnering with Crypto.com and over 500 application developers, focusing on decentralized finance and gaming with an addressable user base exceeding a hundred million people globally.

This article will provide a comprehensive analysis of the investment value comparison between DOMI and CRO, covering historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to answer the question that investors care about most:

"Which is the better buy right now?"

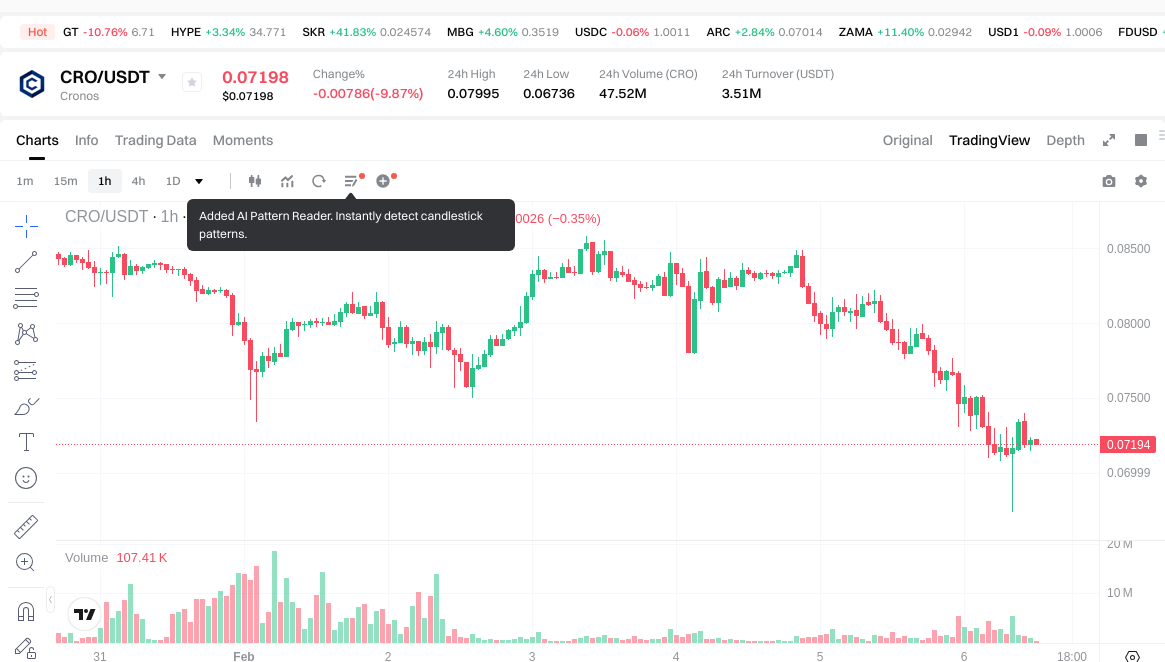

I. Historical Price Comparison and Current Market Overview

Historical Price Trends of DOMI (Coin A) and CRO (Coin B)

- 2022: DOMI reached an all-time high of $0.407925 on February 1, 2022, marking a period of notable price elevation during the early stage of the project.

- 2021: CRO experienced significant growth, reaching its all-time high of $0.965407 on November 24, 2021, driven by the expansion of the Cronos blockchain ecosystem and its partnership with Crypto.com.

- Comparative Analysis: During market cycles, DOMI declined from its peak of $0.407925 to a low of $0.00071954, while CRO experienced a decline from $0.965407 to $0.0121196, showing substantial volatility across both assets.

Current Market Status (2026-02-06)

- DOMI Current Price: $0.0008212

- CRO Current Price: $0.07212

- 24-Hour Trading Volume: DOMI $14,950.75 vs CRO $3,522,183.61

- Market Sentiment Index (Fear & Greed Index): 9 (Extreme Fear)

View real-time prices:

- Check DOMI Current Price Market Price

- Check CRO Current Price Market Price

II. Core Factors Influencing DOMI vs CRO Investment Value

Supply Mechanism Comparison (Tokenomics)

-

DOMI: Based on available information regarding pharmaceutical CRO operations, the company demonstrates a revenue model tied to contract research services rather than token-based economics. From 2021 to 2023, DOMI-related entities showed consistent revenue growth, with major clients contributing stable income streams. The business model relies on fixed-term service contracts with pharmaceutical enterprises.

-

CRO Industry Model: Contract Research Organizations operate on project-based revenue structures, with income dependent on client contracts and service delivery timelines. Revenue sustainability correlates directly with client retention and order backlog. As of December 31, 2023, pending contracts represented transaction values of approximately RMB 1.327 billion, providing revenue security for future periods.

-

📌 Historical Pattern: Investment value in CRO sector companies correlates with order book stability, client portfolio quality, and operational capacity expansion rather than token supply dynamics.

Institutional Adoption and Market Application

-

Institutional Holdings: CRO service providers attract investment based on client quality metrics. During 2021-2023, companies serving large-scale pharmaceutical enterprises (annual revenue ≥10 million RMB) demonstrated stronger revenue stability, with 35 such clients in 2023 compared to 12 in 2021.

-

Enterprise Adoption: The CRO business model centers on pharmaceutical R&D services rather than payment settlement systems. Major clients include established pharmaceutical groups and emerging biotechnology companies. Client concentration among top five customers ranged from 22.47% to 25.18% during 2021-2023, indicating diversified revenue sources.

-

Regulatory Environment: CRO operations face pharmaceutical industry regulations including NMPA (China), FDA (United States), OECD GLP certification, and AAALAC accreditation standards, which directly impact service delivery capabilities and market competitiveness.

Technical Development and Ecosystem Building

-

Service Capacity Expansion: Investment value correlates with facility expansion and animal testing capacity growth. Companies continuously expand through facility construction and experimental capacity enhancement to meet increasing market demand.

-

Quality System Development: Organizations maintain certification compliance with international standards (cGMP requirements, quality control systems) and implement digital quality cost management incorporating EFC, POC, and PONC concepts to analyze operational cost-quality relationships.

-

Ecosystem Comparison: Unlike blockchain-based ecosystems, CRO value creation focuses on preclinical research services, biological analysis capabilities, safety evaluation systems, and comprehensive drug development support platforms. Success depends on technical expertise, regulatory compliance, and client service quality rather than DeFi or NFT applications.

Macroeconomic Factors and Market Cycles

-

Economic Environment Performance: CRO industry growth demonstrates high correlation with pharmaceutical industry prosperity and biotechnology sector investment activity. Sustained revenue growth during 2021-2023 reflected strong industry demand despite varying macroeconomic conditions.

-

Macroeconomic Policy Impact: Investment decisions in CRO sector companies respond to healthcare industry policies, pharmaceutical innovation incentives, and biotech funding availability rather than interest rate fluctuations or dollar index movements.

-

Market Development Factors: Cross-border collaboration opportunities, international pharmaceutical partnerships, and global regulatory harmonization influence business expansion potential. Client portfolio stability and sustainable contract renewal rates represent critical value drivers for long-term investment consideration.

III. 2026-2031 Price Prediction: DOMI vs CRO

Short-term Forecast (2026)

- DOMI: Conservative $0.000665172 - $0.0008212 | Optimistic $0.0008212 - $0.001059348

- CRO: Conservative $0.0366843 - $0.07193 | Optimistic $0.07193 - $0.0949476

Mid-term Forecast (2028-2029)

- DOMI may enter a gradual accumulation phase, with estimated price range of $0.000754 - $0.001445

- CRO may enter a moderate growth phase, with estimated price range of $0.0508 - $0.0998

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- DOMI: Base scenario $0.001078 - $0.001630 | Optimistic scenario $0.001946 - $0.002299

- CRO: Base scenario $0.0720 - $0.1153 | Optimistic scenario $0.1344 - $0.1499

Disclaimer

DOMI:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.001059348 | 0.0008212 | 0.000665172 | 0 |

| 2027 | 0.00118474524 | 0.000940274 | 0.00062998358 | 14 |

| 2028 | 0.0013068868326 | 0.00106250962 | 0.0007543818302 | 29 |

| 2029 | 0.001445331836086 | 0.0011846982263 | 0.000663431006728 | 44 |

| 2030 | 0.001946222246165 | 0.001315015031193 | 0.001078312325578 | 60 |

| 2031 | 0.002299172280537 | 0.001630618638679 | 0.001059902115141 | 98 |

CRO:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0949476 | 0.07193 | 0.0366843 | 0 |

| 2027 | 0.096789008 | 0.0834388 | 0.05006328 | 15 |

| 2028 | 0.0946195992 | 0.090113904 | 0.0540683424 | 24 |

| 2029 | 0.099756091728 | 0.0923667516 | 0.05080171338 | 28 |

| 2030 | 0.1344859903296 | 0.096061421664 | 0.072046066248 | 33 |

| 2031 | 0.14985581779584 | 0.1152737059968 | 0.0864552794976 | 59 |

IV. Investment Strategy Comparison: DOMI vs CRO

Long-term vs Short-term Investment Strategies

-

DOMI: May appeal to investors focused on early-stage GameFi projects with NFT-integrated gaming mechanics, though the asset exhibits limited liquidity with 24-hour trading volume of $14,950.75 as of February 6, 2026. The token's historical volatility from $0.407925 (February 2022) to current levels of $0.0008212 suggests consideration for speculative allocations within diversified portfolios.

-

CRO: May suit investors seeking exposure to established blockchain ecosystems with institutional partnerships, demonstrated by integration with Crypto.com and over 500 application developers. The asset shows relatively higher liquidity with 24-hour trading volume of $3,522,183.61, indicating broader market participation compared to DOMI.

Risk Management and Asset Allocation

-

Conservative Investors: Potential allocation framework could consider 15-25% CRO and 5-10% DOMI within crypto-specific portfolio segments, balanced with non-correlated assets. The lower allocation to DOMI reflects its earlier development stage and liquidity constraints.

-

Aggressive Investors: Portfolio structures might explore 30-40% CRO and 15-25% DOMI allocations within risk-tolerant crypto holdings, acknowledging higher volatility characteristics. Such allocations require continuous monitoring given market sentiment indicators showing Extreme Fear (Fear & Greed Index: 9).

-

Hedging Tools: Implementation of stablecoin positions (USDT, USDC) for liquidity management, utilization of options contracts where available for downside protection, and cross-asset correlation analysis to manage portfolio volatility during market cycles.

V. Potential Risk Comparison

Market Risk

-

DOMI: The token demonstrates significant price compression from historical peaks, with current trading at $0.0008212 compared to the February 2022 high of $0.407925. Limited trading volume of $14,950.75 indicates potential liquidity constraints during market stress periods. The GameFi sector exposure introduces cyclical demand patterns tied to gaming adoption trends.

-

CRO: Price movements from November 2021 peak of $0.965407 to current $0.07212 reflect broader cryptocurrency market cycles. Higher trading volume of $3,522,183.61 provides improved liquidity conditions. Ecosystem performance correlates with Cronos blockchain adoption rates and partnership developments with Crypto.com platform activities.

Technical Risk

-

DOMI: As an NFT-based gaming project launched in 2022, scalability considerations include network capacity for handling multiplayer gaming transactions and NFT minting operations. Infrastructure stability depends on underlying blockchain performance and smart contract execution efficiency.

-

CRO: The Cronos blockchain ecosystem faces technical requirements including transaction throughput optimization for DeFi applications and gaming platforms. Network security architecture and validator distribution patterns influence operational resilience. Integration complexity with partner applications across 500+ developers requires continuous protocol maintenance.

Regulatory Risk

Global regulatory frameworks continue evolving for cryptocurrency assets, with differing approaches across jurisdictions. Gaming-integrated tokens like DOMI may face scrutiny regarding digital asset classification and gaming regulations. Blockchain platforms like CRO operating through exchange partnerships encounter regulatory considerations related to financial service provisions, cross-border transactions, and compliance requirements varying by market. Policy developments in major economies including updates to cryptocurrency taxation, custody requirements, and reporting standards could influence both assets differently based on their operational models and geographic exposure.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

DOMI Characteristics: Represents exposure to NFT-integrated GameFi sector with MMORPG mechanics combining traditional gaming elements and blockchain technology. Limited current liquidity and substantial price decline from historical peaks indicate early-stage positioning. Price predictions suggest potential ranges of $0.000665172 - $0.001059348 for 2026, with long-term scenarios extending to $0.001946 - $0.002299 by 2030-2031.

-

CRO Characteristics: Provides access to established blockchain ecosystem with institutional partnerships spanning over 500 developers and integration with Crypto.com platform. Demonstrates higher liquidity conditions and broader market participation. Price forecasts indicate potential ranges of $0.0366843 - $0.0949476 for 2026, with long-term projections of $0.1344 - $0.1499 by 2030-2031.

✅ Investment Considerations:

-

Beginner Investors: Focus on understanding fundamental differences between early-stage gaming tokens and established ecosystem platforms. Consider starting with smaller position sizes while building knowledge of market dynamics, technical developments, and risk management principles. Prioritize liquidity considerations and avoid concentration in single assets.

-

Experienced Investors: Evaluate portfolio allocation based on risk tolerance, existing crypto exposure, and sector diversification objectives. Consider CRO for ecosystem exposure and DOMI for speculative GameFi positioning within controlled allocation limits. Implement systematic rebalancing protocols and maintain awareness of market sentiment indicators.

-

Institutional Investors: Conduct comprehensive due diligence on custody solutions, regulatory compliance frameworks, and liquidity management strategies. Assess correlation patterns with broader crypto markets and traditional assets. Consider both assets within structured allocation frameworks addressing fiduciary responsibilities and risk management mandates.

⚠️ Risk Notice: The cryptocurrency market exhibits significant volatility characteristics. This content does not constitute investment advice. Market conditions, regulatory developments, and technical factors can substantially impact asset performance. Conduct independent research and consider consulting qualified financial professionals before making investment decisions.

VII. FAQ

Q1: What is the fundamental difference between DOMI and CRO as investment assets?

DOMI is an early-stage GameFi token focused on NFT-integrated MMORPG gaming launched in 2022, while CRO is an established blockchain ecosystem token partnered with Crypto.com and over 500 developers since 2018. The key distinction lies in their market maturity: DOMI exhibits limited liquidity with $14,950.75 daily trading volume and represents speculative exposure to the gaming sector, whereas CRO demonstrates substantially higher liquidity at $3,522,183.61 daily volume and provides access to a comprehensive DeFi and gaming ecosystem with an addressable user base exceeding one hundred million globally.

Q2: How do the historical price performances of DOMI and CRO compare?

Both assets have experienced significant corrections from their all-time highs, with DOMI declining approximately 99.8% from $0.407925 (February 2022) to current levels of $0.0008212, while CRO declined approximately 92.5% from $0.965407 (November 2021) to $0.07212. CRO's historical peak occurred during the 2021 bull market driven by Cronos blockchain expansion, whereas DOMI's peak coincided with early-stage project launch enthusiasm. The substantial drawdowns in both assets reflect broader cryptocurrency market cycles, though CRO has maintained relatively higher price stability and trading volume throughout market downturns.

Q3: What are the projected price ranges for DOMI and CRO through 2031?

For 2026, DOMI's conservative forecast ranges from $0.000665172 to $0.0008212, with optimistic scenarios reaching $0.001059348, while CRO's conservative range spans $0.0366843 to $0.07193, with optimistic projections up to $0.0949476. Long-term forecasts for 2030-2031 suggest DOMI could reach $0.001946 to $0.002299 under optimistic conditions, representing potential increases of 60-98% from current levels. CRO's long-term projections indicate ranges of $0.1344 to $0.1499, suggesting potential gains of 33-59%. These predictions assume continued ecosystem development, institutional adoption, and favorable macroeconomic conditions for cryptocurrency markets.

Q4: What risk management strategies should investors consider for DOMI versus CRO?

Conservative investors might consider portfolio allocations of 15-25% CRO and 5-10% DOMI within crypto-specific segments, reflecting CRO's higher liquidity and established ecosystem versus DOMI's early-stage positioning. Aggressive investors with higher risk tolerance could explore 30-40% CRO and 15-25% DOMI allocations within risk-appropriate crypto holdings. Essential risk management tools include maintaining stablecoin positions (USDT, USDC) for liquidity management, implementing systematic rebalancing protocols, and utilizing options contracts where available for downside protection. Given the current market sentiment indicator showing Extreme Fear (Fear & Greed Index: 9), position sizing should reflect heightened volatility expectations.

Q5: How does liquidity differ between DOMI and CRO, and why does it matter?

CRO demonstrates substantially superior liquidity with 24-hour trading volume of $3,522,183.61 compared to DOMI's $14,950.75, representing approximately 235 times higher trading activity. This liquidity differential matters significantly for execution risk, slippage costs, and exit strategy flexibility. Limited liquidity in DOMI creates potential challenges during market stress periods, including wider bid-ask spreads, difficulty executing larger position sizes without price impact, and reduced ability to exit positions quickly. Institutional investors particularly require adequate liquidity for portfolio management, while retail investors benefit from tighter spreads and improved price discovery that higher liquidity provides.

Q6: What are the primary technical and ecosystem development factors influencing each asset?

DOMI's value proposition centers on its NFT-integrated MMORPG gaming mechanics combining traditional skill-based progression with blockchain technology, requiring successful execution of gaming adoption, NFT marketplace development, and player community growth. Technical considerations include network scalability for multiplayer transactions and smart contract stability. CRO's ecosystem value derives from its integration with Crypto.com, partnership network spanning 500+ application developers, and blockchain infrastructure supporting DeFi and gaming applications. Technical factors include transaction throughput optimization, validator network security, and protocol maintenance across diverse applications. CRO benefits from established infrastructure and institutional partnerships, while DOMI's success depends on gaming market penetration and user acquisition.

Q7: How might regulatory developments impact DOMI and CRO differently?

Gaming-integrated tokens like DOMI face dual regulatory considerations encompassing both cryptocurrency asset classification and gaming regulations, potentially including scrutiny of in-game economies, NFT ownership frameworks, and digital asset securities determinations. CRO operates within blockchain ecosystem regulations affecting exchange-partnered platforms, encountering compliance requirements related to financial service provisions, cross-border transaction monitoring, and custody standards. Regulatory developments in major economies regarding cryptocurrency taxation, reporting standards, and custody requirements could influence both assets differently based on their operational models. CRO's institutional partnerships may provide regulatory clarity advantages, while DOMI's gaming focus introduces sector-specific compliance considerations that continue evolving across jurisdictions.

Q8: Which asset is more suitable for different investor profiles?

Beginner investors should prioritize CRO due to higher liquidity, established ecosystem presence, and broader market participation, starting with smaller position sizes while building market knowledge. The lower entry barrier and improved price discovery make CRO more suitable for learning cryptocurrency investment principles. Experienced investors can evaluate both assets within diversified portfolios, considering CRO for ecosystem exposure (15-40% allocation within crypto holdings) and DOMI for speculative GameFi positioning (5-25% allocation for risk-tolerant profiles). Institutional investors require comprehensive due diligence on custody solutions, regulatory frameworks, and liquidity management, with CRO offering advantages in institutional-grade infrastructure, while DOMI requires specialized assessment of gaming sector dynamics and early-stage project risks within fiduciary responsibility frameworks.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

New NISA vs. Bitcoin: A Comparison of Benefits and Drawbacks

Inverted Hammer Candlestick Pattern: A Comprehensive Guide

How Liquidity Provider Tokens Work

What Is Staking? How to Earn Passive Income with Staking

Top White Label Cryptocurrency Exchanges Today