Is Beamable Network (BMB) a good investment?: A Comprehensive Analysis of Price Performance, Technology, and Market Potential

Introduction: Beamable Network (BMB) Investment Position and Market Outlook

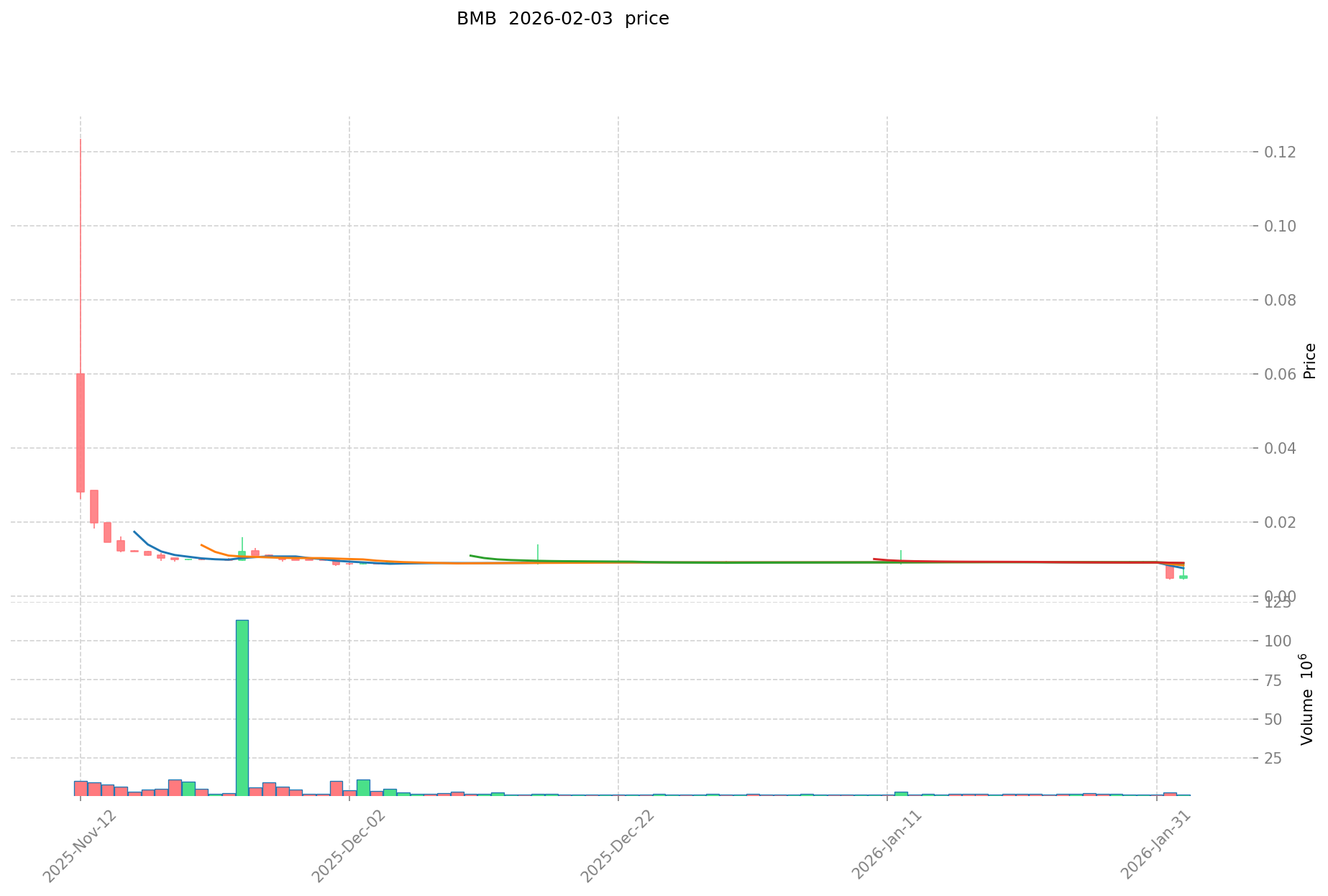

Beamable Network (BMB) is a digital asset in the cryptocurrency sector that aims to transform decentralized compute infrastructure. As of February 03, 2026, BMB maintains a market capitalization of approximately $1,061,802, with a circulating supply of 196,666,441 tokens and a current price around $0.005399. The token ranks 2468 in the broader crypto market and represents 0.00019% of total market dominance. Built on the Solana blockchain using the SPL algorithm, BMB positions itself as a component of compute capital markets, seeking to provide access to decentralized computing resources for AI applications and infrastructure workloads. Backed by venture firms including BITKRAFT Ventures, Scytale Digital, and Grand Banks Capital, the project reports billions of monthly API calls processed through its platform. The token's maximum supply is capped at 1,000,000,000 units, with current circulation representing 19.67% of the fully diluted valuation of $5,399,000. Recent price trends show volatility, with a 23.74% increase over 24 hours alongside notable declines of 40.14% over the past 7 days and 40.39% over 30 days. BMB is held by approximately 1,844 addresses and trades on 2 exchanges. When investors consider "Is Beamable Network (BMB) a good investment?", factors including its technological approach, market position, funding background, and price volatility patterns require comprehensive analysis. This article examines BMB's investment characteristics, historical performance, potential price trajectories, and associated risks to provide reference information for those evaluating this digital asset.

I. Price History and Current Investment Value of BMB

Historical Price Trends and Investment Performance of Beamable Network (BMB)

- November 2025: BMB token launch on Solana → Token listed at initial price, platform already processing billions of monthly API calls

- November 2025 to February 2026: Early trading volatility → Price experienced fluctuations between 0.004363 and 0.12349

- February 2026: Market adjustment period → Token declined from peak levels to current trading range

Current BMB Investment Market Status (February 2026)

- Current BMB Price: 0.005399

- 24-hour Trading Volume: 10,266.96

- Market Capitalization: 1,061,802.11

- Circulating Supply: 196,666,441 BMB (19.67% of total supply)

- Holder Count: 1,844 addresses

- Exchange Availability: Listed on 2 trading platforms

Click to view real-time BMB market price

II. Core Factors Influencing Whether BMB is a Good Investment

Supply Mechanism and Scarcity (BMB Investment Scarcity)

- Total and Circulating Supply: BMB has a maximum supply of 1,000,000,000 tokens, with a current circulating supply of 196,666,441 tokens, representing approximately 19.67% of the total supply. This controlled circulation may contribute to price dynamics as demand fluctuates.

- Market Cap to Fully Diluted Valuation Ratio: The current market cap to fully diluted valuation (FDV) ratio stands at 19.67%, indicating that a significant portion of tokens remains unreleased, which could impact future supply-side pressure.

- Investment Implication: The gradual release of tokens into circulation may influence long-term scarcity dynamics, which is an important consideration for investors evaluating the asset's potential value retention.

Institutional Investment and Mainstream Adoption (Institutional Investment in BMB)

- Venture Capital Support: Beamable Network has secured backing from leading venture firms including BITKRAFT Ventures, Scytale Digital, and Grand Banks Capital, signaling institutional confidence in the project's long-term viability.

- Platform Traction: The platform reportedly processes billions of monthly API calls, demonstrating operational engagement and real-world utility in decentralized compute infrastructure.

- Token Utility and Revenue Model: The BMB token is integrated into the network's economic model, with every workload generating on-chain revenue that is distributed among suppliers, the protocol, and stakers. This alignment of incentives may support sustained network activity and token demand.

Macroeconomic Environment and Market Context for BMB Investment

- Decentralized Compute Market Opportunity: Beamable positions itself as an alternative to centralized cloud providers such as AWS, targeting a compute market estimated to be valued at approximately $1 trillion. Shifts in enterprise adoption of decentralized infrastructure could influence BMB's investment outlook.

- Cost Efficiency Narrative: The protocol claims to offer cost reductions of more than 40% compared to traditional centralized compute services, which may attract enterprises seeking cost-effective infrastructure solutions in varying economic conditions.

- Market Volatility Considerations: BMB has experienced notable price fluctuations, with a 7-day price change of -40.14% and a 30-day change of -40.39% as of February 3, 2026. Such volatility reflects broader market sentiment and risk factors that investors should consider.

Technology and Ecosystem Development (Technology & Ecosystem for BMB Investment)

- On-Chain Protocol on Solana: Beamable Network operates on the Solana blockchain, utilizing the SPL token standard. The Solana network's performance characteristics, including high throughput and low transaction costs, may support the scalability of Beamable's compute marketplace.

- Tokenized Compute Capital Markets: The project's approach to transforming compute resources into a tokenized, tradable asset class represents a novel application of blockchain technology in infrastructure markets, potentially expanding use cases for the BMB token.

- Staking and Governance Mechanisms: The token's role in staking and revenue sharing may incentivize long-term holding and active participation in network governance, contributing to ecosystem engagement and potential value appreciation over time.

III. BMB Future Investment Forecast and Price Outlook (Is Beamable Network(BMB) worth investing in 2026-2030)

Short-term Investment Forecast (2026, short-term BMB investment outlook)

- Conservative Forecast: $0.00275 - $0.00440

- Neutral Forecast: $0.00440 - $0.00540

- Optimistic Forecast: $0.00540 - $0.00648

Mid-term Investment Outlook (2027-2028, mid-term Beamable Network(BMB) investment forecast)

- Market Phase Expectations: The project may enter an ecosystem expansion phase, with platform adoption and API call volumes potentially increasing, driving gradual network revenue growth.

- Investment Return Forecast:

- 2027: $0.00445 - $0.00677

- 2028: $0.00362 - $0.00890

- Key Catalysts: Decentralized compute market development, enterprise-level workload migration to the platform, partnerships with AI and infrastructure providers, and token economic model optimization.

Long-term Investment Outlook (Is BMB a good long-term investment?)

- Base Scenario: $0.00586 - $0.00930 (assuming steady ecosystem growth and maintained competitive advantages)

- Optimistic Scenario: $0.00930 - $0.01358 (assuming significant adoption growth and favorable market conditions)

- Risk Scenario: Below $0.00275 (considering extreme adverse market conditions or competitive pressure)

For long-term investment and price prediction details on BMB, visit: Price Prediction

2026-02-03 to 2031 Long-term Outlook

- Base Scenario: $0.00586 - $0.00930 (corresponding to steady progress and gradual mainstream application adoption)

- Optimistic Scenario: $0.00930 - $0.01358 (corresponding to large-scale adoption and favorable market environment)

- Transformative Scenario: Above $0.01358 (if the ecosystem achieves breakthrough developments and mainstream penetration)

- 2031-12-31 Predicted High: $0.01358 (based on optimistic development assumptions)

Disclaimer: The above forecasts are based on available market data and analytical models. Cryptocurrency markets are highly volatile and subject to various unpredictable factors. These projections do not constitute investment advice, and actual results may differ materially from predictions. Investors should conduct thorough research and assess their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0064788 | 0.005399 | 0.00275349 | 0 |

| 2027 | 0.006770346 | 0.0059389 | 0.004454175 | 10 |

| 2028 | 0.0088964722 | 0.006354623 | 0.00362213511 | 17 |

| 2029 | 0.010980788544 | 0.0076255476 | 0.006710481888 | 41 |

| 2030 | 0.01358262538512 | 0.009303168072 | 0.00586099588536 | 72 |

| 2031 | 0.01247275743413 | 0.01144289672856 | 0.009726462219276 | 111 |

IV. BMB Investment Strategy and Risk Management (How to invest in Beamable Network)

Investment Methodology (BMB investment strategy)

-

Long-term holding (HODL BMB): Suitable for conservative investors who believe in the project's vision of decentralizing compute capital markets on Solana. Given BMB's direct tie to network activity and revenue-sharing mechanism among suppliers, protocol, and stakers, long-term holders may benefit from potential network growth as more workloads migrate to the platform.

-

Active trading: Relies on technical analysis and swing trading strategies. With a 24-hour price change of 23.74% and recent volatility (7-day change of -40.14%), traders may find opportunities in price fluctuations. However, this approach requires constant market monitoring and risk tolerance for rapid price movements.

Risk Management (Risk management for BMB investment)

-

Asset allocation ratio:

- Conservative investors: Limit BMB exposure to 1-3% of overall crypto portfolio

- Aggressive investors: May allocate 5-10% depending on risk appetite

- Professional investors: Can customize allocation based on thorough due diligence and market analysis

-

Risk hedging solutions: Diversify across multiple asset classes including established cryptocurrencies, stablecoins, and traditional assets. Consider hedging tools such as stop-loss orders to limit downside exposure during volatile periods.

-

Secure storage: Use cold wallets for long-term holdings and hot wallets for active trading. Hardware wallets from reputable manufacturers are recommended for enhanced security of BMB tokens stored on the Solana network.

V. BMB Investment Risks and Challenges (Risks of investing in Beamable Network)

-

Market risk: BMB has demonstrated high volatility with a 24-hour price range between $0.004363 and $0.008985. The token experienced a -40.14% decline over 7 days and a -40.39% decline over 30 days. With a relatively low market capitalization of approximately $1.06 million and 24-hour trading volume of around $10,267, the token may be susceptible to significant price swings and limited liquidity.

-

Regulatory risk: As a decentralized compute infrastructure project operating across jurisdictions, BMB faces potential regulatory uncertainty. Different countries maintain varying policies toward tokenized compute resources and decentralized infrastructure services, which could impact network adoption and token utility.

-

Technical risk: While Beamable Network operates on the Solana blockchain using the SPL token standard, potential network security vulnerabilities, smart contract bugs, or platform upgrade failures could affect token functionality. The project's reliance on decentralized compute infrastructure also introduces operational risks related to network stability and service delivery.

-

Competition risk: Beamable Network positions itself as an alternative to centralized cloud providers like AWS in a competitive market. The project faces competition from both established cloud infrastructure providers and other decentralized compute networks, which may impact market share and adoption rates.

-

Project-specific risk: With only 1,844 holders and a circulating supply of approximately 19.67% of total supply (196,666,441 out of 1,000,000,000 tokens), BMB has a relatively concentrated token distribution. Future token unlocks could create selling pressure as more tokens enter circulation.

VI. Conclusion: Is Beamable Network a Good Investment?

-

Investment value summary: BMB presents an investment opportunity in the emerging decentralized compute infrastructure sector, with direct revenue-sharing mechanisms tied to network activity. The project targets a substantial market opportunity in compute resources and has backing from venture firms including BITKRAFT Ventures, Scytale Digital, and Grand Banks Capital. However, the token has experienced significant price volatility with notable declines over recent periods, and investors should be prepared for continued price fluctuations.

-

Investor recommendations: ✅ Beginners: Consider dollar-cost averaging (DCA) approach with small, regular investments rather than lump-sum purchases. Store tokens securely in hardware wallets compatible with Solana network. Thoroughly research the project's fundamentals and only invest amounts you can afford to lose.

✅ Experienced investors: May explore swing trading opportunities given recent volatility patterns. Maintain diversified portfolio allocation with BMB as a speculative position within broader crypto holdings. Monitor network metrics including platform usage and API call volumes for fundamental insights.

✅ Institutional investors: Consider strategic long-term allocation as part of decentralized infrastructure thesis. Conduct comprehensive due diligence on tokenomics, revenue-sharing mechanisms, and competitive positioning within the compute infrastructure landscape.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including the potential loss of principal. This content is provided for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is Beamable Network (BMB) and what makes it different from other blockchain projects?

Beamable Network (BMB) is a decentralized compute infrastructure project built on the Solana blockchain that tokenizes computing resources to create a marketplace for AI applications and infrastructure workloads. Unlike traditional blockchain projects, BMB positions itself as an alternative to centralized cloud providers like AWS, offering reportedly over 40% cost reductions while processing billions of monthly API calls. The project features an on-chain revenue-sharing model where every workload generates revenue distributed among suppliers, the protocol, and stakers, creating direct economic alignment between token holders and network activity.

Q2: Is Beamable Network (BMB) a good investment for beginners in 2026?

For beginners, BMB represents a high-risk, speculative investment that requires careful consideration. The token has demonstrated extreme volatility with a 7-day decline of -40.14% and 30-day decline of -40.39% as of February 2026, alongside a relatively small market capitalization of approximately $1.06 million. Beginners should only allocate 1-3% of their crypto portfolio to BMB, employ a dollar-cost averaging (DCA) strategy rather than lump-sum purchases, and use secure hardware wallets compatible with Solana. Only invest amounts you can afford to lose completely, as the token's low liquidity and high volatility present substantial downside risks.

Q3: What is the price prediction for BMB in 2026-2030?

Based on analytical models, BMB's conservative short-term forecast for 2026 ranges from $0.00275 to $0.00648, with a neutral outlook around the current price of $0.005399. Mid-term projections suggest potential growth to $0.00445-$0.00677 by 2027 and $0.00362-$0.00890 by 2028, assuming ecosystem expansion and increased platform adoption. Long-term forecasts for 2030 range from a base scenario of $0.00586-$0.00930 to an optimistic scenario of $0.00930-$0.01358, with the 2031 predicted high reaching $0.01358. However, these projections are highly speculative and actual performance may differ materially due to market volatility, regulatory developments, and competitive pressures in the decentralized compute infrastructure sector.

Q4: What are the main risks of investing in Beamable Network (BMB)?

BMB investments carry multiple significant risks: (1) Market risk—extremely high volatility with recent 40% monthly declines and low liquidity due to small trading volume ($10,267 daily) and limited exchange availability (only 2 platforms); (2) Regulatory risk—uncertain legal treatment of tokenized compute resources across different jurisdictions; (3) Technical risk—potential smart contract vulnerabilities, network security issues, or platform failures on the Solana blockchain; (4) Competition risk—facing established cloud providers and other decentralized compute networks in a crowded market; (5) Token concentration risk—with only 1,844 holders and 80% of tokens yet to be released, future unlocks could create significant selling pressure and price dilution.

Q5: How can I buy and store Beamable Network (BMB) tokens safely?

BMB tokens can be purchased on the 2 exchanges where they are currently listed, though investors should note the limited liquidity and trading volume. For secure storage, use cold wallet solutions such as hardware wallets compatible with the Solana SPL token standard for long-term holdings, as these provide the highest security against hacking and unauthorized access. For active trading purposes, reputable hot wallets with Solana network support may be used, but only keep amounts you intend to trade actively in hot storage. Always verify contract addresses, enable two-factor authentication on exchange accounts, and never share private keys or seed phrases with anyone.

Q6: What factors could drive BMB's price higher in the future?

Several key catalysts could potentially support BMB price appreciation: (1) Increased platform adoption—growth in billions of monthly API calls and enterprise-level workload migration to the decentralized compute marketplace; (2) Market expansion—broader acceptance of decentralized infrastructure as an alternative to centralized cloud services in the estimated $1 trillion compute market; (3) Strategic partnerships—collaborations with AI companies, infrastructure providers, or major enterprises seeking cost-efficient compute solutions; (4) Token economic optimization—improvements to the revenue-sharing model that enhance staker rewards and network incentives; (5) Institutional backing—continued support and additional investment from venture firms like BITKRAFT Ventures, Scytale Digital, and Grand Banks Capital demonstrating long-term confidence in the project's viability.

Q7: Should I hold BMB long-term or trade it actively?

The optimal strategy depends on your investment profile and risk tolerance. Long-term holding (HODL) suits conservative investors who believe in the project's vision of decentralizing compute capital markets and are willing to weather short-term volatility for potential network growth benefits through the revenue-sharing mechanism. This approach requires patience and conviction in the fundamental thesis. Active trading may appeal to experienced traders who can capitalize on BMB's high volatility (24-hour changes of 23.74% and significant weekly swings), but requires constant market monitoring, technical analysis skills, and higher risk tolerance. Most beginners should favor long-term holding with dollar-cost averaging, while professional investors might employ hybrid strategies combining core holdings with tactical trading positions based on comprehensive market analysis.

Q8: What is the circulating supply situation of BMB and how does it affect investment value?

BMB has a maximum supply of 1,000,000,000 tokens, with a current circulating supply of only 196,666,441 tokens (approximately 19.67% of total supply). This means approximately 803,333,559 tokens (80.33%) remain to be released into circulation, which represents significant potential supply-side pressure that could impact future price dynamics. The current market capitalization of $1,061,802 versus a fully diluted valuation (FDV) of $5,399,000 indicates a substantial gap, suggesting that investors should consider the dilution effect as more tokens enter circulation according to the project's vesting schedule. This controlled but substantial future supply release is a critical factor in long-term investment valuation and may create downward price pressure unless offset by proportional growth in demand, network adoption, and utility.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

What is NBLU: A Comprehensive Guide to Understanding Next-Generation Business Logic Units

What is MTRG: A Comprehensive Guide to Multi-Token Retrieval Generation in Modern AI Systems

What is KYO: A Comprehensive Guide to Understanding the Kyoto Protocol and Its Global Impact on Climate Change

How to Buy Bitcoin Anonymously

Top 10 Play-to-Earn NFT Games