Is Nodecoin (NC) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability in 2024

Introduction: Nodecoin (NC)'s Investment Position and Market Prospects

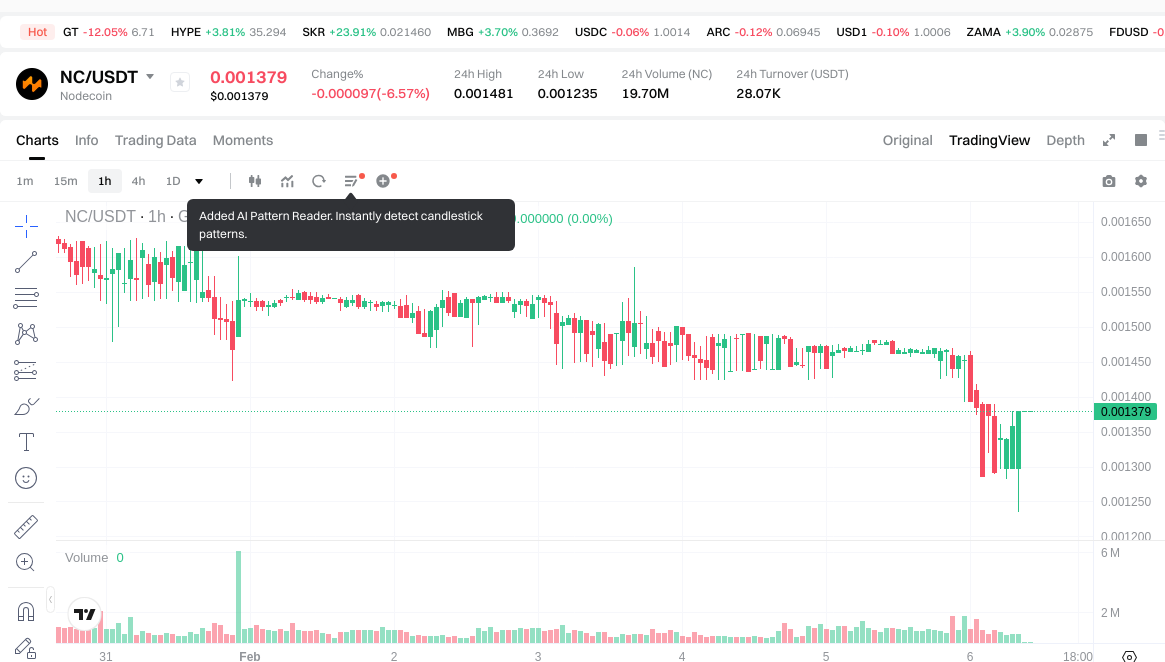

Nodecoin (NC) represents an emerging asset in the cryptocurrency sector, having launched in January 2025 as part of the decentralized bandwidth-sharing and predictive intelligence ecosystem. As of February 6, 2026, NC maintains a market capitalization of approximately $408,171, with a circulating supply of around 295,990,695 tokens and a current trading price near $0.001379. The platform has evolved from a bandwidth-sharing network—where users contribute unused internet resources to support AI data retrieval—into a signal and prediction engine that aggregates user inputs, social activity, and on-chain data to deliver structured market sentiment insights. With its positioning as a real-time predictive intelligence platform driven by verified human signals and market behavior, NC has attracted attention from 128,161 holders across 7 exchanges. This analysis examines NC's investment characteristics, historical price movements, future price projections, and associated risks to provide investors with comprehensive reference materials when evaluating whether Nodecoin (NC) represents a suitable addition to their portfolios.

I. Nodecoin (NC) Price History and Current Investment Value

Historical Price Performance and Investment Returns

- January 2025: NC launched at a price of 0.1 USD, providing early investors with opportunities for returns as the price showed initial growth

- January 17, 2025: NC reached a notable price level of 0.335 USD during its early trading period

- 2025: Throughout the year, NC experienced price fluctuations, with the token navigating through various market cycles

- February 2026: The price declined to 0.001235 USD, representing a significant adjustment from earlier levels

Current NC Market Status (February 2026)

- Current NC Price: 0.001379 USD

- 24-Hour Trading Volume: 28,444.81 USD

- Market Capitalization: 408,171.17 USD

- Circulating Supply: 295,990,695 NC (approximately 29.6% of total supply)

- Total Supply: 999,962,813 NC

- Maximum Supply: 1,000,000,000 NC

Click to view real-time NC market price

Recent Price Movements

- 1-Hour Change: +0.42%

- 24-Hour Change: -6.5%

- 7-Day Change: -14.97%

- 30-Day Change: -26.84%

- 1-Year Change: -97.61%

II. Core Factors Influencing Whether NC is a Good Investment

Supply Mechanism and Scarcity (NC Investment Scarcity)

- Supply structure: NC has a maximum supply of 1,000,000,000 tokens, with a current circulating supply of 295,990,695 tokens (29.6% of max supply). The controlled supply mechanism may contribute to potential scarcity dynamics over time.

- Historical performance context: NC experienced notable price volatility, with trading activity since its launch on January 13, 2026. The token's price movements reflect market response to supply distribution patterns.

- Investment relevance: The circulating-to-max supply ratio of approximately 30% indicates that a significant portion of tokens remains outside current circulation, which may influence future market dynamics and investment considerations.

Institutional Investment and Mainstream Adoption (Institutional Investment in NC)

- Holder distribution: NC currently has 128,161 token holders, indicating a developing user base for a recently launched asset.

- Exchange accessibility: The token is listed on 7 exchanges, with Gate.com among the platforms supporting NC trading, providing multiple access points for potential investors.

- Market position: With a market cap of approximately $408,171 and a market dominance of 0.000058%, NC represents an early-stage digital asset in the broader cryptocurrency landscape.

Macroeconomic Environment's Impact on NC Investment

- Market conditions: As a newly launched token in early 2026, NC's investment profile may be influenced by prevailing monetary policies and interest rate environments affecting risk asset allocation.

- Volatility context: The token has shown significant price fluctuations, with short-term changes ranging from +0.42% (1H) to -97.61% (1Y from launch price of $0.1), reflecting sensitivity to market conditions.

- Risk considerations: Economic uncertainty and broader cryptocurrency market trends may impact investor appetite for emerging tokens like NC.

Technology and Ecosystem Development (Technology & Ecosystem for NC Investment)

- Core infrastructure: Nodepay operates as a real-time predictive intelligence platform built on a decentralized bandwidth-sharing network, where users contribute unused internet resources to support AI data retrieval.

- Platform evolution: The project has developed from a bandwidth-sharing network into a signal and prediction engine that aggregates user inputs, social activity, and on-chain data for market sentiment analysis.

- Ecosystem application: The platform aims to provide verifiable, real-time intelligence driven by verified human signals and market behavior, positioning itself as a next-generation network infrastructure. This technological foundation may influence the token's long-term utility and investment value proposition.

III. NC Future Investment Forecast and Price Outlook (Is Nodecoin(NC) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term NC investment outlook)

- Conservative forecast: $0.00080 - $0.00120

- Neutral forecast: $0.00120 - $0.00160

- Optimistic forecast: $0.00160 - $0.00187

Mid-term Investment Outlook (2027-2028, mid-term Nodecoin(NC) investment forecast)

- Market stage expectation: NC may experience a consolidation phase with gradual price recovery as the project continues to develop its real-time predictive intelligence platform and expand its decentralized bandwidth-sharing network.

- Investment return forecast:

- 2027: $0.00145 - $0.00203

- 2028: $0.00143 - $0.00260

- Key catalysts: Platform adoption growth, expansion of AI data retrieval capabilities, increased user participation in the bandwidth-sharing network, and broader integration of verified human signals into market intelligence services.

Long-term Investment Outlook (Is NC a good long-term investment?)

- Base scenario: $0.00175 - $0.00292 (assuming steady ecosystem development and moderate adoption of the predictive intelligence platform)

- Optimistic scenario: $0.00260 - $0.00362 (assuming accelerated mainstream adoption, enhanced network effects, and favorable regulatory environment for decentralized AI platforms)

- Risk scenario: Below $0.00122 (in case of adverse market conditions, limited user adoption, or intensified competition in the AI and predictive intelligence sector)

Click to view NC long-term investment and price forecast: Price Prediction

2026-2031 Long-term Outlook

- Base scenario: $0.00175 - $0.00292 (corresponding to steady progress and gradual increase in mainstream application)

- Optimistic scenario: $0.00260 - $0.00362 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.00362 (if the ecosystem achieves breakthrough progress and mainstream popularity)

- 2031-12-31 forecast high: $0.00362 (based on optimistic development assumptions)

Disclaimer: The above forecasts are for reference only and do not constitute investment advice. Cryptocurrency markets are highly volatile and subject to various risks. Investors should conduct their own research and consider their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00187544 | 0.001379 | 0.00079982 | 0 |

| 2027 | 0.002034025 | 0.00162722 | 0.0014482258 | 18 |

| 2028 | 0.00259948395 | 0.0018306225 | 0.00142788555 | 32 |

| 2029 | 0.00294602078925 | 0.002215053225 | 0.00121827927375 | 60 |

| 2030 | 0.003251476628977 | 0.002580537007125 | 0.001754765164845 | 87 |

| 2031 | 0.003615848454383 | 0.002916006818051 | 0.001924564499913 | 111 |

IV. Nodecoin (NC) Investment Strategy and Risk Management (How to invest in cryptocurrency)

Investment Methodology (Nodecoin investment strategy)

Long-term Holding (HODL Nodecoin)

Long-term holding may be suitable for conservative investors who believe in the platform's underlying technology and growth potential. Nodepay's evolution from a decentralized bandwidth-sharing network into a real-time predictive intelligence platform represents a unique value proposition in the AI data retrieval space. However, investors should note that NC has experienced considerable price volatility since its launch on January 13, 2025, with the current price of $0.001379 representing a decline from its initial offering price of $0.1.

Active Trading Strategy

Active trading strategies rely on technical analysis and swing trading opportunities. Given NC's 24-hour trading volume of approximately $28,444 and recent price movements showing a 1-hour gain of 0.42% against 24-hour, 7-day, and 30-day declines of 6.5%, 14.97%, and 26.84% respectively, traders may identify short-term entry and exit points. The token's 24-hour price range between $0.001235 and $0.001481 indicates potential volatility windows for active positioning.

Risk Management (Risk management for Nodecoin investment)

Asset Allocation Ratios

- Conservative investors: Consider limiting NC allocation to 1-3% of total crypto portfolio

- Moderate investors: May allocate 3-7% depending on risk tolerance

- Aggressive investors: Could consider up to 10-15% allocation with appropriate risk mitigation

Risk Hedging Solutions

Implementing a diversified asset portfolio that includes established cryptocurrencies alongside emerging projects like NC can help mitigate concentration risk. Investors may consider pairing NC positions with more stable digital assets or using portfolio rebalancing strategies to maintain desired exposure levels.

Secure Storage

- Hot Wallets: Suitable for active trading portions, ensuring convenience for frequent transactions

- Cold Wallets: Recommended for long-term holdings to minimize security vulnerabilities

- Hardware Wallets: Ledger or Trezor devices that support Solana-based tokens provide enhanced security for NC storage

Given NC's contract address on the Solana blockchain (B89Hd5Juz7JP2dxCZXFJWk4tMTcbw7feDhuWGb3kq5qE), investors should ensure their chosen wallet solution supports SPL20 tokens.

V. Nodecoin (NC) Investment Risks and Challenges (Risks of investing in cryptocurrency)

Market Risks

NC demonstrates significant price volatility, with a 97.61% decline over a one-year perspective. The token's market capitalization of approximately $408,171 and relatively modest 24-hour trading volume suggest limited liquidity, which may amplify price swings during periods of heightened buying or selling pressure. The gap between market cap and fully diluted valuation ($1,378,948) at 29.6% indicates substantial token supply yet to enter circulation, potentially creating future dilution pressure.

Regulatory Risks

As with all cryptocurrency projects, NC operates within an evolving regulatory landscape. Different jurisdictions maintain varying approaches to digital asset classification, taxation, and permissible use cases. The platform's AI data retrieval infrastructure and bandwidth-sharing model may face regulatory scrutiny as authorities develop frameworks for decentralized networks and data privacy. Investors should monitor regulatory developments in their respective regions and understand how changes might affect NC's operational capacity and market access.

Technical Risks

Nodepay's infrastructure relies on decentralized bandwidth sharing and AI data retrieval systems. Potential technical vulnerabilities include:

- Network security challenges inherent to distributed systems

- Integration risks associated with aggregating user signals, social activity, and on-chain data

- Scalability considerations as the platform grows its user base (currently 128,161 holders)

- Protocol upgrade execution risks that could affect platform functionality

The project's presence on 7 exchanges provides some distribution, but limited exchange availability compared to more established projects may constrain liquidity and market depth.

VI. Conclusion: Is Cryptocurrency a Good Investment?

Investment Value Summary

Nodecoin (NC) represents an emerging project in the AI-powered predictive intelligence space, building on a decentralized bandwidth-sharing foundation. While the platform's approach to aggregating verified human signals and market behavior presents interesting technological concepts, the token has experienced substantial price depreciation since launch. The current market cap of approximately $408,171 with a circulating supply of 295,990,695 tokens (29.6% of max supply) indicates an early-stage project with considerable uncertainty regarding future value trajectory.

Investor Recommendations

✅ Beginners

- Consider dollar-cost averaging if pursuing exposure, spreading purchases over time to mitigate timing risk

- Prioritize secure storage using hardware wallets compatible with Solana-based tokens

- Limit allocation to amounts affordable to lose given the project's early stage and price volatility

- Conduct thorough research beyond price movements, understanding the platform's technology and roadmap

✅ Experienced Investors

- May explore tactical trading opportunities based on technical analysis and short-term price patterns

- Consider NC as a small portion of a diversified cryptocurrency portfolio

- Monitor development milestones, partnership announcements, and platform adoption metrics

- Implement stop-loss strategies to manage downside exposure

✅ Institutional Investors

- Evaluate NC within the context of emerging AI and data infrastructure themes

- Assess team background, technological differentiation, and competitive positioning

- Consider pilot allocation sizing appropriate for early-stage, high-risk digital assets

- Implement rigorous due diligence processes covering technical, operational, and regulatory dimensions

⚠️ Disclaimer: Cryptocurrency investment carries substantial risk of capital loss. This content is provided for informational purposes only and does not constitute financial, investment, or trading advice. Individuals should conduct independent research and consult with qualified financial professionals before making investment decisions.

VII. FAQ

Q1: What is Nodecoin (NC) and what makes it different from other cryptocurrency projects?

Nodecoin (NC) is a cryptocurrency token launched in January 2025 that powers a decentralized bandwidth-sharing and predictive intelligence ecosystem. Unlike traditional cryptocurrencies, NC operates as part of a platform where users contribute unused internet resources to support AI data retrieval, while also functioning as a signal and prediction engine that aggregates user inputs, social activity, and on-chain data to deliver structured market sentiment insights. Built on the Solana blockchain with a contract address of B89Hd5Juz7JP2dxCZXFJWk4tMTcbw7feDhuWGb3kq5qE, NC distinguishes itself by combining real-time predictive intelligence with verified human signals and market behavior analysis, positioning itself as next-generation network infrastructure in the AI-powered data intelligence space.

Q2: How has NC's price performed since launch and what is its current market position?

NC launched at $0.1 in January 2025 and reached $0.335 on January 17, 2025, before experiencing significant price correction. As of February 6, 2026, NC trades at approximately $0.001379, representing a 97.61% decline from its launch price. The token maintains a market capitalization of $408,171 with a circulating supply of 295,990,695 tokens (29.6% of the 1 billion maximum supply) and a 24-hour trading volume of $28,444. Recent price movements show a 1-hour gain of 0.42%, but declines of 6.5% (24H), 14.97% (7D), and 26.84% (30D), indicating ongoing downward pressure. The token is currently listed on 7 exchanges with 128,161 holders.

Q3: What are the projected price forecasts for NC from 2026 to 2031?

Short-term forecasts for 2026 range from conservative ($0.00080-$0.00120) to optimistic ($0.00160-$0.00187) scenarios. Mid-term projections suggest 2027 prices between $0.00145-$0.00203 and 2028 prices between $0.00143-$0.00260. Long-term forecasts vary significantly: the base scenario estimates $0.00175-$0.00292 by 2031, assuming steady ecosystem development, while the optimistic scenario projects $0.00260-$0.00362 if accelerated mainstream adoption occurs. The 2031 predicted high reaches $0.00362 under favorable conditions, though a risk scenario below $0.00122 remains possible if adverse market conditions or limited adoption materialize. These projections represent potential outcomes rather than guaranteed returns.

Q4: What investment strategy should I consider when investing in NC?

Investment approaches depend on risk tolerance and investment horizon. Long-term holding (HODL) may suit conservative investors who believe in Nodepay's AI data retrieval technology and platform evolution, though significant price volatility should be considered. Active trading strategies can capitalize on short-term price movements, given NC's 24-hour volatility range. Asset allocation recommendations include 1-3% for conservative investors, 3-7% for moderate investors, and up to 10-15% for aggressive investors within crypto portfolios. Risk management should include diversification across multiple digital assets, secure storage using hardware wallets compatible with Solana-based tokens (such as Ledger or Trezor), and implementation of stop-loss strategies to protect against downside exposure.

Q5: What are the main risks associated with investing in NC?

NC investment carries several significant risks. Market risk includes substantial price volatility (97.61% one-year decline) and limited liquidity with modest trading volume that may amplify price swings. The gap between current circulating supply (29.6%) and maximum supply indicates potential future dilution pressure. Regulatory risk stems from evolving frameworks around digital assets, AI platforms, and data privacy that could affect NC's operational capacity. Technical risks include network security vulnerabilities in distributed systems, integration challenges in aggregating user signals and on-chain data, scalability considerations as the user base grows, and protocol upgrade execution risks. Limited exchange availability (7 exchanges) compared to established projects may constrain market depth and liquidity access for investors.

Q6: How does NC's technology platform create value for token holders?

NC derives value from its dual-function infrastructure: first as a decentralized bandwidth-sharing network where users contribute unused internet resources to support AI data retrieval, and second as a real-time predictive intelligence platform aggregating verified human signals, social activity, and on-chain data. This technology aims to provide verifiable market sentiment insights driven by actual user behavior rather than purely algorithmic analysis. The platform's evolution from basic bandwidth sharing to sophisticated signal and prediction capabilities represents its core value proposition. However, the token's current market performance suggests that translating this technological concept into sustained market value remains a developmental challenge, with adoption metrics and network effects being critical factors for future value creation.

Q7: Is NC suitable for my investment portfolio in 2026?

NC suitability depends on individual circumstances, risk tolerance, and investment objectives. For beginners, NC represents a high-risk, early-stage project best approached through dollar-cost averaging with allocations limited to amounts affordable to lose, while prioritizing secure storage and thorough research beyond price movements. Experienced investors may find tactical trading opportunities or include NC as a small diversified portfolio component, implementing stop-loss strategies and monitoring development milestones. Institutional investors should evaluate NC within emerging AI and data infrastructure themes, conducting rigorous due diligence on team background, technological differentiation, and competitive positioning before any pilot allocation. Given the 97.61% price decline since launch, substantial market cap below $500,000, and significant technical and market uncertainties, NC should be considered speculative with no guarantee of value recovery or growth.

<>

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

What Are RWAs (Real World Assets): A Complete Guide to Tokenizing Real-World Assets

How to Begin Trading NFTs

Smooth Love Potion (SLP) Price Prediction: Short-term and Long-term Analysis

Cryptocurrency Halving Explained: The Comprehensive Guide

Top Cold Wallets for Cryptocurrency: Rankings