Is Only1 (LIKE) a good investment?: A Comprehensive Analysis of Its Market Potential and Risk Factors

Introduction: Only1 (LIKE) Investment Position and Market Prospects

Only1 (LIKE) represents a social media platform integrating NFT functionality, marketplace features, and blockchain infrastructure through its native token. Launched in August 2021, the platform has established a presence in the creator economy and NFT sectors. As of February 4, 2026, LIKE maintains a market capitalization of approximately $796,142.66, with a circulating supply of around 395.11 million tokens, representing 79.02% of its maximum supply of 500 million tokens. The current trading price stands at $0.002015. The platform enables content creators to mint NFTs and engage directly with their audience through various features including Genesis NFT minting and Star NFT bidding mechanisms using LIKE tokens. This article examines LIKE's investment characteristics, historical price movements, future price projections, and associated investment risks to provide reference information for those evaluating "Is Only1 (LIKE) a good investment?"

I. Only1 (LIKE) Price History Review and Investment Value Status

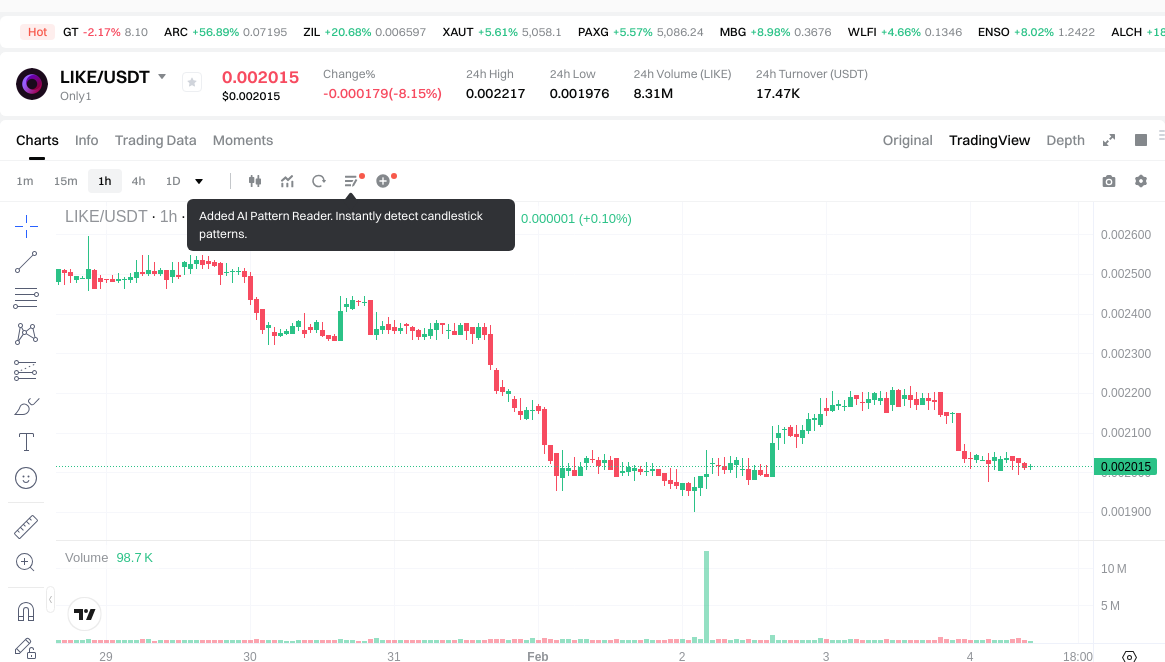

LIKE Historical Price Movement and Investment Performance (Only1(LIKE) investment performance)

- 2021: LIKE reached a notable price level of $1.041 on September 7, 2021 → Early investors who entered during the initial launch period experienced considerable gains during this period

- 2023: Market downturn phase → LIKE declined to $0.00133134 on August 6, 2023, reflecting broader market weakness and decreased investor interest

- 2024-2026: Extended volatility period → Price fluctuated between $0.001331 and $0.002217, with significant percentage swings indicating ongoing market uncertainty

Current LIKE Investment Market Status (February 2026)

- LIKE current price: $0.002015

- 24-hour trading volume: $17,539.53

- Circulating supply: 395,108,022 LIKE (79.02% of total supply)

- Market capitalization: $796,142.66

- Fully diluted valuation: $1,007,500

- Recent price changes: -0.54% (1H), -8.2% (24H), -20.54% (7D), -34.74% (30D), -90.5% (1Y)

Click to view real-time LIKE market price

II. Core Factors Affecting Whether LIKE is a Good Investment

Supply Mechanism and Scarcity (LIKE Investment Scarcity)

- Maximum supply capped at 500,000,000 tokens with approximately 79.02% currently in circulation → influences potential price dynamics

- Circulating supply of 395,108,022 LIKE tokens represents controlled token release → may affect market liquidity

- Investment significance: Fixed supply structure could provide foundational scarcity characteristics for long-term consideration

Institutional Investment and Mainstream Adoption (Institutional Investment in LIKE)

- Token holder base encompasses 38,066 addresses → indicates community distribution levels

- Trading availability across 4 exchanges → reflects current market accessibility

- Ecosystem positioning: Only1 platform integrates social media, NFT marketplace, and creator economy features → establishes differentiated positioning within Web3 social applications

Macroeconomic Environment Impact on LIKE Investment

- Broader cryptocurrency market conditions influence altcoin performance → affects LIKE trading patterns

- Market sentiment indicators show varying outlook perspectives → reflects general crypto market volatility

- Risk considerations: As with digital assets generally, macroeconomic shifts and regulatory developments can impact investment environments

Technology and Ecosystem Development (Technology & Ecosystem for LIKE Investment)

- Solana blockchain deployment: Contract address 3bRTivrVsitbmCTGtqwp7hxXPsybkjn4XLNtPsHqa3zR → enables transaction efficiency

- Platform functionality includes Genesis NFT minting and Star NFT bidding mechanisms → provides utility-driven token use cases

- Creator-fan interaction model with participation-based rewards → establishes platform engagement incentives

- NFT marketplace integration allows creators to monetize content directly → supports decentralized creator economy applications

III. LIKE Future Investment Prediction and Price Outlook (Is Only1(LIKE) worth investing in 2026-2031)

Short-term Investment Prediction (2026, short-term LIKE investment outlook)

- Conservative forecast: $0.0017732 - $0.002015

- Neutral forecast: $0.002015 - $0.00250

- Optimistic forecast: $0.00250 - $0.00300235

Mid-term Investment Outlook (2027-2029, mid-term Only1(LIKE) investment forecast)

- Market phase expectation: LIKE may experience gradual recovery with fluctuations as the platform continues to develop its social media and NFT integration features

- Investment return prediction:

- 2027: $0.00178115925 - $0.00328636425

- 2028: $0.00223109011125 - $0.0036508747275

- 2029: $0.002684841684525 - $0.004649359990275

- Key catalysts: Platform user growth, NFT market development, creator engagement levels, and adoption of LIKE token utility features

Long-term Investment Outlook (Is LIKE a good long-term investment?)

- Base scenario: $0.002456302721622 - $0.004021205262011 (assuming steady platform development and moderate user base expansion)

- Optimistic scenario: $0.004021205262011 - $0.005790535577296 (assuming strong creator adoption and NFT marketplace growth)

- Risk scenario: Below $0.002456302721622 (under challenging market conditions or limited platform traction)

Click to view LIKE long-term investment and price prediction: Price Prediction

2026-02-04 - 2031 Long-term Outlook

- Base scenario: $0.002456302721622 - $0.004021205262011 (corresponding to steady progress and gradual mainstream application improvement)

- Optimistic scenario: $0.004021205262011 - $0.005790535577296 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.005790535577296 (if ecosystem achieves breakthrough progress and mainstream popularization)

- 2031-12-31 predicted high: $0.005790535577296 (based on optimistic development assumptions)

Disclaimer: The above price predictions are based on historical data and market analysis models. Cryptocurrency markets are highly volatile and subject to various risks. These forecasts should not be considered as investment advice. Investors should conduct their own research and risk assessment before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00300235 | 0.002015 | 0.0017732 | 0 |

| 2027 | 0.00328636425 | 0.002508675 | 0.00178115925 | 24 |

| 2028 | 0.0036508747275 | 0.002897519625 | 0.00223109011125 | 43 |

| 2029 | 0.004649359990275 | 0.00327419717625 | 0.002684841684525 | 62 |

| 2030 | 0.00408063194076 | 0.003961778583262 | 0.002456302721622 | 96 |

| 2031 | 0.005790535577296 | 0.004021205262011 | 0.002975691893888 | 99 |

IV. Only1 Investment Strategy and Risk Management (How to invest in Only1)

Investment Methodology (Only1 investment strategy)

Long-term Holding (HODL Only1)

Long-term holding may be considered by investors who prefer a patient approach to cryptocurrency investments. This strategy involves purchasing LIKE tokens and holding them through market fluctuations, with the expectation that the platform's development and adoption could influence value over extended periods. Given Only1's focus on creator economy and NFT integration, investors following this approach typically monitor platform growth metrics, user adoption rates, and ecosystem development milestones.

Active Trading

Active trading of LIKE tokens relies on technical analysis and short-term price movements. With a 24-hour trading volume of approximately $17,539.53 and recent price fluctuations showing -8.2% change in 24 hours, traders may identify entry and exit points based on support and resistance levels. The token's price range between $0.001976 and $0.002217 within the past day provides reference points for swing trading strategies. However, the relatively limited liquidity compared to major cryptocurrencies requires careful position sizing.

Risk Management (Risk management for Only1 investment)

Asset Allocation Ratio

-

Conservative Investors: May consider allocating no more than 1-3% of their cryptocurrency portfolio to LIKE tokens, given the project's market capitalization of approximately $796,142 and its position outside the top 2,000 cryptocurrencies by ranking.

-

Aggressive Investors: Those with higher risk tolerance might allocate 5-10% of their crypto holdings, while maintaining exposure to more established assets as portfolio anchors.

-

Professional Investors: Institutional or experienced traders may employ dynamic allocation strategies, adjusting positions based on technical indicators, platform developments, and broader market conditions.

Risk Hedging Approaches

Diversification across multiple asset classes remains fundamental to risk management. Investors holding LIKE tokens might consider balancing their portfolio with:

- Established cryptocurrencies with larger market capitalizations

- Tokens from different sectors within the crypto ecosystem

- Traditional financial instruments to reduce overall portfolio volatility

Hedging tools such as stablecoins can provide liquidity buffers during market downturns, allowing investors to manage exposure without completely exiting positions.

Secure Storage

Given that LIKE operates on the Solana blockchain (contract address: 3bRTivrVsitbmCTGtqwp7hxXPsybkjn4XLNtPsHqa3zR), investors should utilize:

-

Cold Wallets: Hardware wallets compatible with Solana-based tokens, such as Ledger devices, offer enhanced security for long-term storage by keeping private keys offline.

-

Hot Wallets: For active traders, Solana-compatible software wallets like Phantom or Solflare provide convenient access while maintaining reasonable security through encryption and backup features.

-

Exchange Wallets: While convenient for trading, keeping significant holdings on exchanges introduces counterparty risk. Regular transfers to personal wallets are advisable for amounts exceeding immediate trading needs.

V. Only1 Investment Risks and Challenges (Risks of investing in Only1)

Market Risk

LIKE tokens demonstrate substantial price volatility, as evidenced by recent performance metrics. The token has experienced a -20.54% decline over seven days and -34.74% over thirty days. The difference between its historical high of $1.041 (September 7, 2021) and current price of $0.002015 represents approximately 99.8% decline from peak levels. Such volatility patterns indicate that investors may face significant short-term price fluctuations.

The token's relatively limited daily trading volume of $17,539.53 suggests lower liquidity compared to major cryptocurrencies, which can amplify price movements during periods of concentrated buying or selling activity. Additionally, with only approximately 38,066 holders, the distribution of tokens may create scenarios where large holders' actions could influence market prices.

Regulatory Risk

Cryptocurrency regulations continue to evolve across different jurisdictions, creating uncertainty for platforms combining social media features with token economics and NFT functionality. Key regulatory considerations include:

-

Securities Classification: Regulators in various countries may evaluate whether tokens associated with creator platforms fall under securities regulations, potentially affecting trading availability and compliance requirements.

-

Content Moderation Requirements: As a social media platform, Only1 may face content regulation requirements that vary significantly across different regions, potentially impacting operational flexibility.

-

NFT Regulatory Framework: The evolving regulatory treatment of NFTs, particularly regarding intellectual property rights, taxation, and secondary market transactions, introduces additional compliance considerations.

-

Geographic Restrictions: Changes in cryptocurrency policies across different countries could affect user accessibility and platform growth potential in specific markets.

Technical Risk

Several technical factors warrant consideration:

-

Network Dependencies: As a Solana-based project, LIKE tokens' functionality depends on Solana network performance and stability. Network congestion or technical issues affecting Solana could impact transaction processing and user experience.

-

Smart Contract Security: While specific audit information is not provided in available materials, smart contract vulnerabilities represent an inherent risk in blockchain-based platforms. Security incidents affecting the platform's contracts could impact token value and user assets.

-

Platform Development: The project's ability to maintain and upgrade its technology infrastructure, implement new features, and address emerging technical challenges affects long-term viability.

-

Competition: The creator economy and NFT platform space includes numerous competing projects, and technological advantages may erode as competitors introduce similar or superior features.

VI. Conclusion: Is Only1 a Good Investment?

Investment Value Summary

Only1 presents a specialized investment opportunity within the intersection of social media, creator economy, and NFT technology. The platform's integration of content creation, NFT minting, and direct creator-fan engagement addresses specific needs in the digital content ecosystem. However, the token's performance history, showing substantial decline from historical peaks and recent downward trends across multiple timeframes, reflects challenges common to smaller-cap cryptocurrency projects.

The circulating supply of approximately 395 million tokens represents 79.02% of the maximum supply of 500 million, indicating relatively high token circulation. The market capitalization of approximately $796,142 positions LIKE as a micro-cap cryptocurrency, which typically correlates with higher volatility and risk compared to more established digital assets.

Investor Recommendations

✅ Beginners: New cryptocurrency investors should approach LIKE tokens with particular caution due to the project's volatility profile and relatively limited liquidity. If considering exposure, employ dollar-cost averaging strategies with very small allocation percentages, and prioritize secure storage using hardware wallets compatible with Solana-based tokens. Thoroughly research the platform's functionality and development progress before investment.

✅ Experienced Investors: Those familiar with cryptocurrency markets might consider LIKE tokens as a speculative component within a diversified portfolio. Technical analysis of price movements, monitoring of platform development milestones, and active position management may be appropriate. Limit exposure to amounts aligned with high-risk tolerance levels, and maintain stop-loss disciplines to manage downside risk.

✅ Institutional Investors: Professional investors evaluating Only1 should conduct comprehensive due diligence covering technology infrastructure, team background, competitive positioning, and tokenomics sustainability. Any strategic allocation should account for liquidity constraints, regulatory uncertainties, and the platform's developmental stage. Consider whether the project's specific focus on creator economy aligns with broader investment theses regarding NFT and social token sectors.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including potential loss of principal. This analysis is provided for informational purposes only and does not constitute investment advice, financial guidance, or recommendation to buy, sell, or hold any cryptocurrency. Investors should conduct independent research, consider their financial situation and risk tolerance, and consult qualified financial advisors before making investment decisions. Past performance does not guarantee future results, and cryptocurrency markets remain highly volatile and speculative.

VII. FAQ

Q1: What is the current market position of Only1 (LIKE) token?

As of February 4, 2026, LIKE trades at $0.002015 with a market capitalization of approximately $796,142.66, positioning it as a micro-cap cryptocurrency outside the top 2,000 rankings. The token has experienced significant decline from its historical high of $1.041 (September 7, 2021), representing approximately 99.8% reduction from peak levels. With a circulating supply of 395.11 million tokens (79.02% of maximum supply) and daily trading volume of $17,539.53, LIKE demonstrates relatively limited liquidity compared to major cryptocurrencies. The token is available on 4 exchanges and has approximately 38,066 holders, reflecting its niche positioning within the creator economy and NFT sectors.

Q2: What are the primary use cases and utility of LIKE tokens?

LIKE tokens serve as the native currency for the Only1 platform, enabling multiple functions within the ecosystem. Token holders can participate in Genesis NFT minting, where creators launch exclusive NFT collections, and engage in Star NFT bidding mechanisms to acquire unique digital assets. The platform integrates social media features with NFT marketplace functionality, allowing content creators to monetize their work directly through blockchain technology. Additionally, LIKE tokens facilitate creator-fan interactions through participation-based reward systems, providing incentive structures for community engagement. Built on the Solana blockchain (contract address: 3bRTivrVsitbmCTGtqwp7hxXPsybkjn4XLNtPsHqa3zR), the token benefits from Solana's transaction efficiency and low fee structure.

Q3: What are the price predictions for LIKE tokens through 2031?

Short-term forecasts for 2026 range from conservative estimates of $0.0017732 - $0.002015 to optimistic scenarios of $0.00250 - $0.00300235. Mid-term projections suggest potential ranges of $0.00178115925 - $0.00328636425 for 2027, expanding to $0.002684841684525 - $0.004649359990275 by 2029, representing potential gains of 24-62% respectively. Long-term predictions for 2031 indicate a possible high of $0.005790535577296 under optimistic development scenarios, with base case estimates ranging from $0.002456302721622 to $0.004021205262011. These forecasts assume steady platform development, user base expansion, and creator adoption; however, actual outcomes depend on numerous variables including market conditions, competitive dynamics, and execution of the project's roadmap. Investors should note that cryptocurrency price predictions carry substantial uncertainty and past performance does not guarantee future results.

Q4: What investment strategies are suitable for LIKE tokens?

For LIKE tokens, investors can employ either long-term holding (HODL) strategies or active trading approaches depending on risk tolerance and investment objectives. Long-term holders should monitor platform development milestones, user adoption metrics, and ecosystem growth indicators that may influence token value over extended periods. Active traders can utilize technical analysis given recent price fluctuations showing -8.2% change in 24 hours, with support and resistance levels between $0.001976 and $0.002217 providing reference points for entry and exit decisions. Conservative investors should limit LIKE allocation to 1-3% of cryptocurrency portfolios given the project's micro-cap status, while aggressive investors with higher risk tolerance might allocate 5-10%. Regardless of strategy, proper asset allocation ratios, diversification across multiple asset classes, and secure storage using Solana-compatible hardware wallets like Ledger devices are essential risk management practices.

Q5: What are the main risks associated with investing in LIKE tokens?

LIKE tokens carry substantial market risk, evidenced by recent performance showing -20.54% decline over seven days and -34.74% over thirty days, with historical decline of approximately 99.8% from peak levels. The relatively limited daily trading volume of $17,539.53 indicates lower liquidity compared to major cryptocurrencies, which can amplify price movements during concentrated trading activity. Regulatory risks include potential securities classification, content moderation requirements for the social media platform, evolving NFT regulatory frameworks, and geographic restrictions that could affect user accessibility. Technical risks encompass dependency on Solana network performance, potential smart contract vulnerabilities, platform development challenges, and intense competition within the creator economy and NFT sectors. Additionally, with only approximately 38,066 holders, large holder actions could significantly influence market prices. Investors should approach LIKE as a high-risk, speculative investment appropriate only for amounts they can afford to lose completely.

Q6: How does Only1 differentiate itself within the competitive creator economy landscape?

Only1 distinguishes itself through integrated functionality combining social media features, NFT marketplace capabilities, and blockchain-based creator monetization tools on a single platform. The project leverages Solana blockchain technology to enable efficient, low-cost transactions for content creators and their audiences. Unique mechanisms include Genesis NFT minting, which allows creators to launch exclusive NFT collections, and Star NFT bidding systems that facilitate direct creator-fan engagement through token-based interactions. The platform's participation-based reward structure incentivizes community engagement, while its NFT marketplace integration enables creators to monetize content directly without traditional intermediaries. However, investors should recognize that the creator economy and NFT platform space includes numerous competing projects, and technological advantages may erode as competitors introduce similar or enhanced features. The platform's ability to attract and retain both creators and engaged audiences will be critical factors determining long-term sustainability and token value.

Q7: What storage options are recommended for securing LIKE tokens?

Given that LIKE operates on the Solana blockchain (contract address: 3bRTivrVsitbmCTGtqwp7hxXPsybkjn4XLNtPsHqa3zR), investors should prioritize Solana-compatible storage solutions. Cold wallets, particularly hardware wallets such as Ledger devices, offer optimal security for long-term holdings by maintaining private keys offline, protecting against hacking attempts and malware. For active traders requiring frequent access, Solana-compatible software wallets like Phantom or Solflare provide convenient functionality while maintaining reasonable security through encryption and backup features. Exchange wallets offer ease of trading but introduce counterparty risk; investors should limit exchange holdings to amounts needed for immediate trading activity and regularly transfer larger positions to personal wallets. Regardless of storage method, investors should implement backup procedures for recovery phrases, enable two-factor authentication where available, and verify wallet addresses carefully before conducting transactions to prevent irreversible losses.

Q8: Is Only1 (LIKE) suitable for different investor profiles?

Suitability varies significantly across investor profiles. Beginners should approach LIKE tokens with extreme caution due to high volatility, limited liquidity, and micro-cap status; new investors considering exposure should employ dollar-cost averaging with very small allocation percentages (under 1% of portfolio) and prioritize thorough research of platform functionality before investment. Experienced investors familiar with cryptocurrency markets might consider LIKE as a speculative component within diversified portfolios, utilizing technical analysis and active position management while limiting exposure to amounts aligned with high-risk tolerance levels. Institutional investors should conduct comprehensive due diligence covering technology infrastructure, team background, competitive positioning, and tokenomics sustainability, accounting for liquidity constraints and regulatory uncertainties. For all investor types, LIKE represents a high-risk, speculative investment appropriate only within the context of well-diversified portfolios where potential total loss would not materially impact overall financial position. Independent research and consultation with qualified financial advisors remain essential before making investment decisions.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

WAMPL vs SOL: Comprehensive Comparison of Two Rising Blockchain Tokens in the Crypto Market

QSP vs GMX: A Comprehensive Comparison of Two Leading Decentralized Exchange Protocols

How to Use MACD, RSI, and KDJ Technical Indicators for Crypto Trading Signals

How does Federal Reserve policy and inflation data impact BNB price movements in 2026?

What is Ethereum's fundamental analysis: how smart contracts, DeFi, and Layer 2 technology drive ETH's $357.8 billion valuation in 2026