WAMPL vs SOL: Comprehensive Comparison of Two Rising Blockchain Tokens in the Crypto Market

Introduction: WAMPL vs SOL Investment Comparison

In the cryptocurrency market, the comparison between WAMPL and SOL has consistently been a topic that investors cannot overlook. Both exhibit notable differences in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

WAMPL (Wrapped Ampleforth): Launched in 2021, this wrapped token has gained market recognition as a decentralized unit of account and building block for DeFi protocols, serving as the primary collateral asset in the SPOT protocol and facilitating ecosystem integrations across centralized and decentralized platforms.

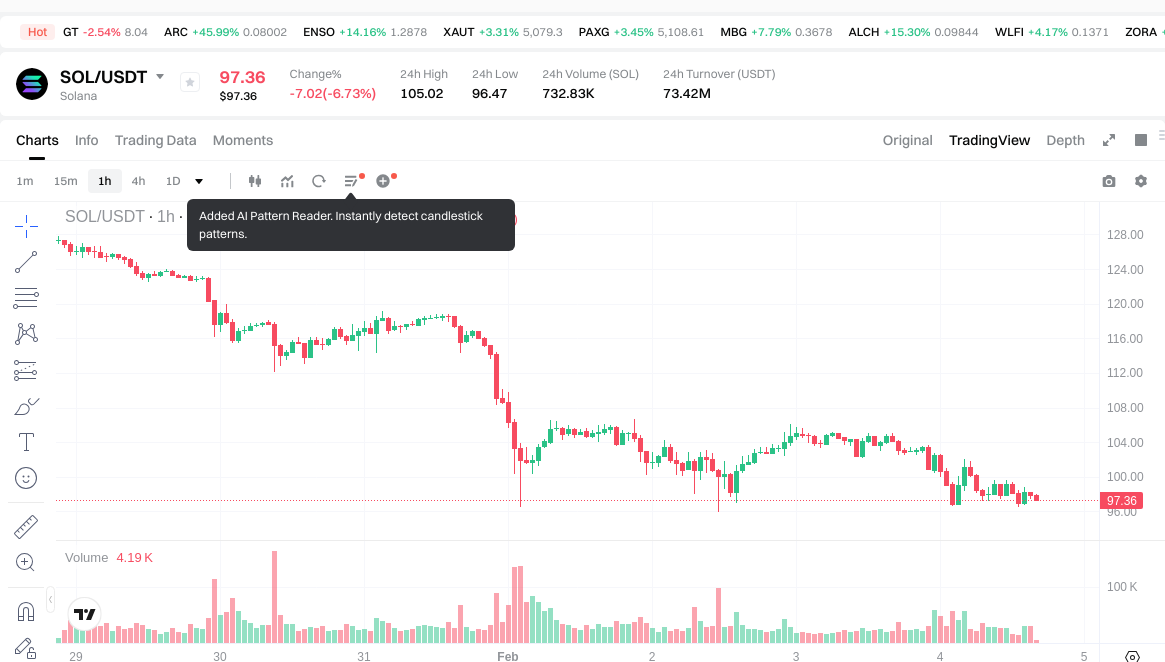

SOL (Solana): Emerging in 2020, this high-performance blockchain protocol has been recognized as a scalable infrastructure solution, currently ranking 7th globally by market capitalization with trading volumes exceeding $73 million in the past 24 hours.

This article provides a comprehensive analysis of the investment value comparison between WAMPL and SOL, examining historical price movements, supply mechanisms, institutional adoption, technical ecosystems, and future projections. The analysis aims to address the question that concerns investors most:

"Which presents potentially different risk-return characteristics for consideration?"

As of February 4, 2026, WAMPL trades at $1.179 with a market cap of approximately $747,708, while SOL trades at $97.96 with a market cap exceeding $55 billion. This substantial difference in scale and positioning forms the foundation for understanding their respective roles in diversified crypto portfolios.

I. Historical Price Comparison and Current Market Status

WAMPL (Coin A) and SOL (Coin B) Historical Price Trends

-

2021: WAMPL experienced price fluctuations as part of the broader wrapped token ecosystem development. SOL witnessed a notable surge during this period, with the token price increasing by over 2,500% in the first quarter, driven by broader cryptocurrency market bullish trends and increased adoption of the Solana ecosystem.

-

2024: WAMPL reached a notable price level of $35.00 on July 23, 2024, reflecting increased trading activity. SOL continued its development trajectory, though it faced volatility influenced by market cycles and ecosystem developments.

-

Comparative Analysis: During recent market cycles, WAMPL has shown price movement from its notable level of $35.00 down to $1.145, while SOL has experienced fluctuations from its peak of $293.31 in January 2025 to current levels around $97.96.

Current Market Status (2026-02-04)

- WAMPL Current Price: $1.179

- SOL Current Price: $97.96

- 24-Hour Trading Volume: WAMPL $34,792.26 vs SOL $73,340,093.32

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

View Real-Time Prices:

- Check WAMPL Current Price Market Price

- Check SOL Current Price Market Price

II. Core Factors Influencing WAMPL vs SOL Investment Value

Supply Mechanism Comparison (Tokenomics)

- WAMPL: Adopts a non-dilutive inflation mechanism, primarily applied within the DeFi ecosystem

- SOL: Features a deflationary model with token burning mechanisms integrated into network operations

- 📌 Historical Pattern: Supply mechanisms influence price cycles through their interaction with market demand dynamics and ecosystem adoption rates

Institutional Adoption and Market Application

- Institutional Holdings: Analysis of institutional preference patterns remains subject to market conditions and regulatory developments

- Enterprise Adoption: Applications in cross-border payments, settlement systems, and investment portfolios vary based on technical capabilities and market maturity

- Regulatory Environment: Different jurisdictions demonstrate varying approaches to oversight, influencing adoption trajectories

Technical Development and Ecosystem Building

- WAMPL Technical Progress: Development focuses on DeFi protocol integration and elastic supply applications

- SOL Technical Evolution: Ongoing improvements in network scalability and transaction processing capabilities

- Ecosystem Comparison: DeFi applications, NFT marketplaces, payment solutions, and smart contract implementations show distinct characteristics across both platforms

Macroeconomic Environment and Market Cycles

- Inflationary Context Performance: Asset characteristics influence responses to macroeconomic pressures

- Monetary Policy Impact: Interest rate adjustments and currency index movements affect digital asset valuations

- Geopolitical Factors: Cross-border transaction requirements and international developments contribute to market dynamics

III. 2026-2031 Price Forecast: WAMPL vs SOL

Short-term Forecast (2026)

- WAMPL: Conservative $0.74-$1.18 | Optimistic $1.18-$1.46

- SOL: Conservative $60.37-$97.37 | Optimistic $97.37-$143.13

Mid-term Forecast (2028-2029)

- WAMPL may enter a consolidation phase with projected price range of $1.18-$2.18, showing gradual upward momentum through 2029

- SOL may enter an expansion phase with projected price range of $121.51-$219.48, reflecting broader market adoption

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- WAMPL: Baseline scenario $1.56-$1.91 | Optimistic scenario $2.14-$2.36

- SOL: Baseline scenario $107.00-$184.40 | Optimistic scenario $216.66-$322.83

Disclaimer: Price predictions are based on historical data analysis and market modeling. Cryptocurrency markets are highly volatile and subject to numerous unpredictable factors. These forecasts should not be considered as investment advice. Always conduct thorough research and consult with financial professionals before making investment decisions.

WAMPL:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 1.46196 | 1.179 | 0.74277 | 0 |

| 2027 | 1.8882864 | 1.32048 | 1.0167696 | 12 |

| 2028 | 1.668558528 | 1.6043832 | 1.299550392 | 36 |

| 2029 | 2.17650624912 | 1.636470864 | 1.17825902208 | 38 |

| 2030 | 2.3640458101344 | 1.90648855656 | 1.620515273076 | 61 |

| 2031 | 2.306088558014976 | 2.1352671833472 | 1.558745043843456 | 81 |

SOL:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 143.1339 | 97.37 | 60.3694 | 0 |

| 2027 | 138.2897425 | 120.25195 | 80.5688065 | 22 |

| 2028 | 169.3448085875 | 129.27084625 | 121.514595475 | 31 |

| 2029 | 219.4825063055625 | 149.30782741875 | 126.9116533059375 | 52 |

| 2030 | 248.933475263910937 | 184.39516686215625 | 106.949196780050625 | 88 |

| 2031 | 322.829838383920054 | 216.664321063033593 | 110.498803742147132 | 121 |

IV. Investment Strategy Comparison: WAMPL vs SOL

Long-term vs Short-term Investment Strategies

- WAMPL: May appeal to investors interested in DeFi protocol mechanics and elastic supply mechanisms, with focus on specialized decentralized finance applications and protocol-level innovations

- SOL: May appeal to investors seeking exposure to high-performance blockchain infrastructure with broader ecosystem applications spanning DeFi, NFTs, and enterprise solutions

Risk Management and Asset Allocation

- Conservative Investors: WAMPL 10-15% vs SOL 20-30% (with remainder in stablecoins and established assets)

- Aggressive Investors: WAMPL 20-30% vs SOL 40-50% (with higher allocation to growth-oriented positions)

- Hedging Tools: Stablecoin allocation for liquidity management, options strategies where available, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risks

- WAMPL: Lower liquidity levels with 24-hour trading volume of $34,792.26 may result in wider price spreads; market cap of approximately $747,708 indicates exposure to volatility from smaller capital flows

- SOL: Despite larger market cap exceeding $55 billion, faces price fluctuation risks associated with broader blockchain infrastructure sector sentiment; recent price movement from $293.31 to $97.96 demonstrates significant volatility potential

Technical Risks

- WAMPL: Integration complexity within DeFi protocols; dependency on broader Ampleforth ecosystem development; smart contract interaction risks in elastic supply mechanisms

- SOL: Network scalability challenges during high-demand periods; historical network stability concerns; validator distribution and consensus mechanism dependencies

Regulatory Risks

- Evolving global regulatory frameworks may impact both assets differently based on their classification: WAMPL as a DeFi-focused wrapped token versus SOL as Layer-1 blockchain infrastructure. Jurisdiction-specific approaches to digital asset oversight continue to develop, with potential implications for exchange listings, institutional adoption, and cross-border transactions.

VI. Conclusion: Which Presents Different Investment Characteristics?

📌 Investment Value Summary:

- WAMPL Characteristics: Specialized DeFi protocol positioning with elastic supply mechanics; lower market capitalization may present higher volatility; integration within Ampleforth ecosystem; price projections suggest conservative growth trajectory from $1.179 to $2.14-$2.36 range by 2031

- SOL Characteristics: Established Layer-1 blockchain infrastructure with broader ecosystem applications; larger market capitalization of $55 billion; extensive DeFi and NFT ecosystem development; price projections indicate potential movement from $97.96 to $216.66-$322.83 range by 2031

✅ Investment Considerations:

- Emerging Investors: May consider starting with more established assets featuring higher liquidity and broader market recognition; thorough research into tokenomics, supply mechanisms, and ecosystem fundamentals recommended before allocation decisions

- Experienced Investors: Portfolio diversification across different blockchain infrastructure tiers and DeFi protocol layers; assessment of risk tolerance relative to market capitalization differences and liquidity profiles

- Institutional Investors: Due diligence on regulatory compliance frameworks, custody solutions, and liquidity requirements; evaluation of ecosystem maturity and technical development roadmaps; consideration of allocation strategies aligned with mandate objectives

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate substantial volatility. This analysis does not constitute investment advice. Market conditions as of February 4, 2026 show Fear & Greed Index at 14 (Extreme Fear), indicating heightened uncertainty. Investors should conduct independent research, assess personal risk tolerance, and consult financial professionals before making allocation decisions.

VII. FAQ

Q1: What are the main differences between WAMPL and SOL's supply mechanisms?

WAMPL adopts a non-dilutive inflation mechanism with elastic supply characteristics primarily designed for DeFi protocol applications, while SOL features a deflationary model with token burning mechanisms integrated into network operations. WAMPL's elastic supply adjusts based on protocol mechanics within the Ampleforth ecosystem, whereas SOL's supply model is tied directly to network transaction activity and validator incentives. These fundamental differences influence how each asset responds to market demand cycles, with WAMPL's supply elasticity potentially dampening price volatility through automatic rebalancing, while SOL's deflationary mechanism creates scarcity effects that may amplify price movements during periods of high demand.

Q2: Which asset offers better liquidity for trading purposes?

SOL demonstrates significantly superior liquidity with 24-hour trading volume of $73,340,093.32 compared to WAMPL's $34,792.26. This substantial difference—over 2,000 times greater volume—means SOL traders can execute larger positions with minimal price impact and tighter bid-ask spreads. WAMPL's lower liquidity profile at approximately $35,000 daily volume may result in wider spreads, increased slippage on larger orders, and potentially longer execution times. For investors prioritizing quick entry and exit capabilities or trading substantial positions, SOL's liquidity advantage represents a critical practical consideration beyond theoretical investment merits.

Q3: How do the market capitalizations of WAMPL and SOL affect investment risk profiles?

WAMPL's market capitalization of approximately $747,708 versus SOL's $55+ billion represents a difference of over 73,000 times in market size. This dramatic disparity fundamentally shapes risk characteristics: WAMPL's micro-cap status means relatively small capital flows can generate significant price movements, creating both higher volatility potential and liquidity constraints. SOL's established position as the 7th largest cryptocurrency by market cap provides greater price stability, institutional accessibility, and regulatory clarity. Smaller market cap assets like WAMPL may offer asymmetric upside potential but carry substantially elevated risks including delisting vulnerability, ecosystem dependency, and extreme volatility during market stress periods.

Q4: What are the projected price trajectories for WAMPL and SOL through 2031?

Conservative projections suggest WAMPL may move from $1.179 (2026) to $1.56-$1.91 range by 2030-2031, representing potential growth of 32-62%, while optimistic scenarios project $2.14-$2.36 (81-100% growth). SOL's conservative forecast suggests movement from $97.96 to $107.00-$184.40 by 2030-2031 (9-88% growth), with optimistic scenarios reaching $216.66-$322.83 (121-230% growth). These projections indicate SOL may offer higher absolute growth potential in optimistic market conditions due to its established ecosystem and broader institutional adoption runway, while WAMPL's growth trajectory appears more constrained but potentially more stable given its specialized DeFi positioning. However, both assets face substantial uncertainty given the 5-year projection timeframe and inherent cryptocurrency market volatility.

Q5: Which asset is more suitable for DeFi-focused investment strategies?

WAMPL is specifically designed as a decentralized unit of account and building block for DeFi protocols, serving as the primary collateral asset in the SPOT protocol with deep integration into Ampleforth's elastic supply ecosystem. SOL, while supporting a robust DeFi ecosystem including lending protocols, DEXs, and yield farming platforms, functions primarily as Layer-1 infrastructure rather than a specialized DeFi primitive. For investors specifically targeting DeFi protocol mechanics, algorithmic stability mechanisms, and collateral applications, WAMPL offers more direct exposure to these specialized use cases. However, SOL provides broader DeFi ecosystem exposure with higher liquidity, more diverse protocol options, and greater institutional participation—making it potentially more suitable for investors seeking diversified DeFi exposure rather than concentrated positioning in elastic supply mechanisms.

Q6: How do regulatory considerations differ between WAMPL and SOL?

SOL faces regulatory scrutiny as a major Layer-1 blockchain infrastructure that supports extensive DeFi, NFT, and potentially security token activities, attracting attention from securities regulators globally regarding its initial distribution, ongoing validator economics, and ecosystem activity. WAMPL, as a wrapped token derivative of the Ampleforth protocol with elastic supply characteristics, may encounter different regulatory treatment related to its classification as either a utility token, algorithmic stablecoin variant, or novel financial instrument depending on jurisdiction. The regulatory risk profiles diverge significantly: SOL faces higher visibility and potential infrastructure-level regulation given its $55+ billion market cap and broad ecosystem, while WAMPL's specialized DeFi positioning and smaller scale may attract less immediate regulatory focus but potentially face greater uncertainty regarding its unique elastic supply mechanism's classification under evolving digital asset frameworks.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is GAIN: Understanding the Generative Adversarial Interaction Network and Its Applications in Modern AI

What is MDX: A Comprehensive Guide to Markdown with JSX Integration

What is XELS: A Comprehensive Guide to Understanding This Innovative Ecosystem

What is SHM: A Comprehensive Guide to Simple Harmonic Motion and Its Real-World Applications

2026 GAIN Price Prediction: Expert Analysis and Market Outlook for the Next Bull Cycle