Is OOOO (OOOO) a good investment?: A comprehensive analysis of market potential, risks, and future prospects for investors

Introduction: OOOO's Investment Position and Market Prospects

OOOO is a cryptographic asset in the digital currency field. As of February 9, 2026, OOOO has a market capitalization of approximately $168,116, with a circulating supply of around 158,600,000 tokens, and the current price stands at approximately $0.00106. Positioned as an AI-driven full-spectrum collaboration platform that breaks down barriers between multi-chain, multi-protocol, and multi-application environments, OOOO has gradually become a focal point for investors discussing "Is OOOO a good investment?" This article will comprehensively analyze OOOO's investment value, historical trends, future price forecasts, and investment risks to provide reference for investors.

According to available data, OOOO is based on the BEP-20 standard with a contract address on the BSC network. The token has a total supply of 1,000,000,000 tokens, with a current circulation ratio of 15.86%. The token is listed on 6 exchanges and has approximately 59,432 holders. In terms of recent price movements, OOOO has experienced a decline of 3.47% over the past hour, 3.99% over 24 hours, 44.2% over 7 days, 88.66% over 30 days, and 98.60% over the past year. The 24-hour trading volume stands at $12,158.79, with a 24-hour price range between $0.001046 and $0.001151.

The project's documentation indicates that AI Omninet aims to facilitate collaboration across different blockchain ecosystems and application environments. However, investors should note that the cryptocurrency market carries various risks, and price fluctuations can be influenced by multiple factors including market sentiment, technological developments, regulatory changes, and macroeconomic conditions.

I. OOOO Price History Review and Investment Value Status

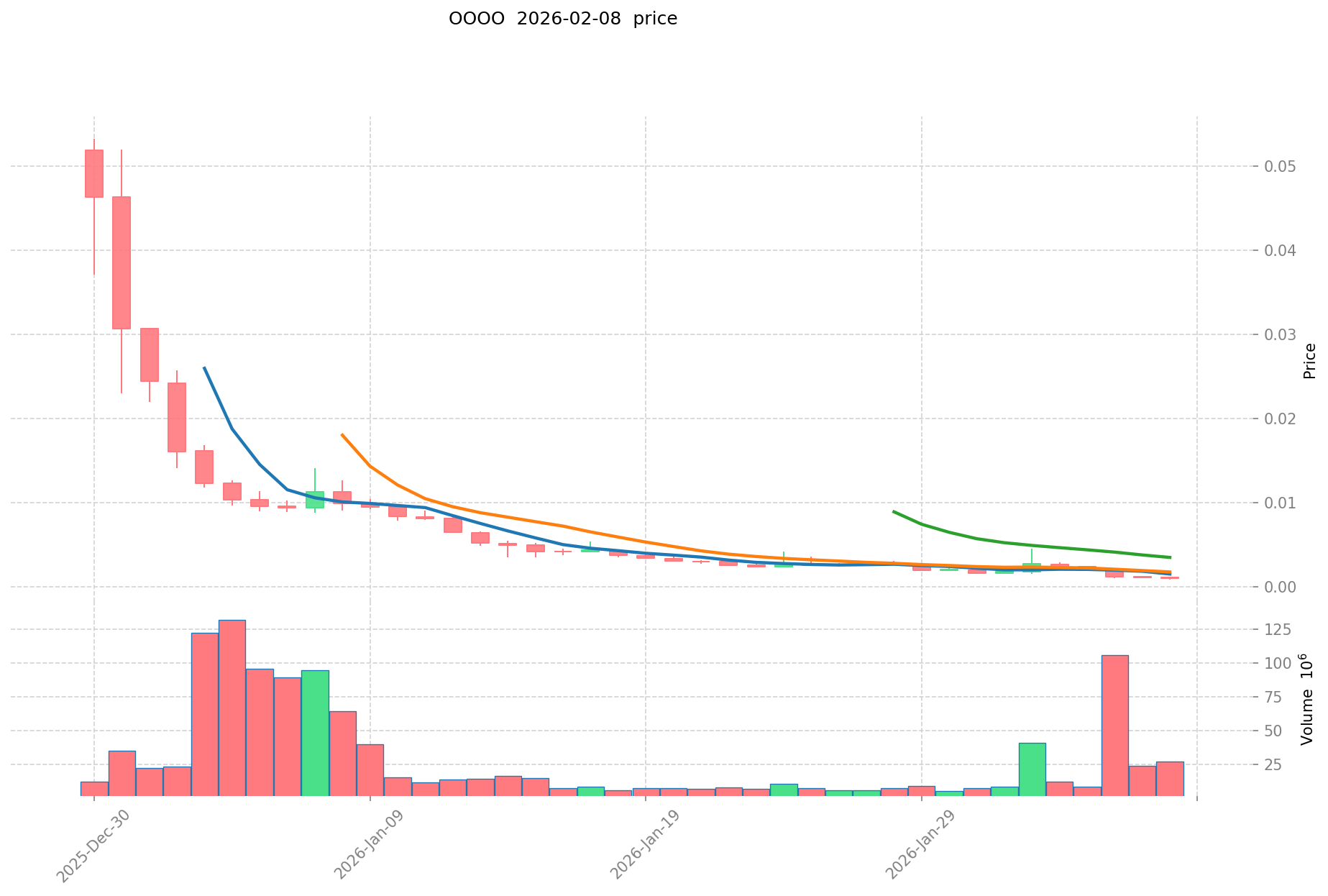

OOOO Historical Price Trend and Investment Return (oooo(OOOO) investment performance)

- December 2025: OOOO reached a significant price level of $0.05331, representing a notable upward movement from earlier trading periods

- February 2026: Market experienced substantial volatility, with price declining to $0.00084, reflecting broader market adjustments

- February 2026 (current): Trading around $0.00106, showing some recovery from recent lows with a circulating supply of 158.6 million tokens

Current OOOO Investment Market Status (February 2026)

- OOOO current price: $0.00106

- 24-hour trading volume: $12,158.79

- Market capitalization: $168,116

- Recent price performance: -3.99% (24h), -44.2% (7d), -88.66% (30d)

- Fully diluted market cap: $1,060,000 with 15.86% circulation ratio

Click to view real-time OOOO market price

II. Core Factors Influencing Whether OOOO is a Good Investment

Supply Mechanism and Scarcity (OOOO Investment Scarcity)

- Token Supply Structure: OOOO has a maximum supply of 1,000,000,000 tokens, with a current circulating supply of 158,600,000 tokens, representing approximately 15.86% of the total supply. The defined supply cap may contribute to potential scarcity dynamics as market adoption evolves.

- Historical Price Context: OOOO experienced notable price fluctuations, with data showing the token reached 0.05331 USD on December 30, 2025, and subsequently declined to 0.00084 USD on February 7, 2026. As of February 9, 2026, the token is trading at 0.00106 USD, reflecting significant volatility over recent months.

- Investment Consideration: The token's supply mechanism and circulation ratio are factors that market participants may consider when evaluating long-term investment potential, though price volatility remains a characteristic of the asset.

Market Adoption and Trading Activity (Institutional Investment in OOOO)

- Trading Volume: OOOO recorded a 24-hour trading volume of approximately 12,158.79 USD as of February 9, 2026, indicating relatively modest trading activity across six exchanges.

- Holder Base: The token has attracted approximately 59,432 holders, suggesting a level of community participation in the ecosystem.

- Market Position: With a market capitalization of approximately 168,116 USD and a market dominance of 0.000041%, OOOO occupies a relatively small position within the broader cryptocurrency market.

Macroeconomic Environment Impact on OOOO Investment

- Market Sentiment: The cryptocurrency market's performance is often influenced by broader macroeconomic conditions, including monetary policy adjustments, interest rate movements, and inflation trends. These external factors may affect investor interest in digital assets like OOOO.

- Volatility Patterns: OOOO has demonstrated substantial price volatility, with declines of 3.47% over 1 hour, 3.99% over 24 hours, 44.2% over 7 days, 88.66% over 30 days, and 98.60% over one year as of February 9, 2026. Such volatility patterns reflect the speculative nature and risk characteristics associated with the asset.

- Risk Assessment: Market participants should consider their personal risk tolerance and investment objectives when evaluating exposure to highly volatile cryptocurrencies like OOOO.

Technology and Ecosystem Development (Technology & Ecosystem for OOOO Investment)

- Project Concept: AI Omninet is described as AI-driven full-spectrum collaboration that aims to address interoperability challenges across multi-chain, multi-protocol, and multi-application environments.

- Technical Foundation: OOOO is deployed on the BSC (Binance Smart Chain) network, utilizing the BEP-20 token standard. The contract address is 0xf0a28bddac9d3045c95bf57df033e80685d881c0.

- Ecosystem Development: Information regarding specific technological upgrades, DeFi integrations, NFT applications, or payment use cases was not detailed in the reference materials. Prospective investors may wish to review the project's official documentation at https://docs.oooo.money/ for additional technical and roadmap information.

III. OOOO Future Investment Forecast and Price Outlook (Is oooo(OOOO) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term OOOO investment outlook)

- Conservative forecast: $0.00091 - $0.00106

- Neutral forecast: $0.00106 - $0.00110

- Optimistic forecast: $0.00110 - $0.00154

Mid-term Investment Outlook (2027-2028, mid-term oooo(OOOO) investment forecast)

- Market stage expectation: The token may experience gradual recovery following recent price declines, with potential market consolidation as the project develops its AI-driven multi-chain collaboration infrastructure.

- Investment return forecast:

- 2027: $0.00059 - $0.00154

- 2028: $0.00092 - $0.00172

- Key catalysts: Development of AI-powered full-spectrum collaboration features, expansion of multi-chain protocol integrations, and broader ecosystem adoption across different application environments.

Long-term Investment Outlook (Is OOOO a good long-term investment?)

- Base scenario: $0.00079 - $0.00225 (assuming steady development of the AI Omninet platform and moderate market conditions)

- Optimistic scenario: $0.00176 - $0.00264 (assuming successful implementation of multi-chain, multi-protocol collaboration features and increased adoption)

- Risk scenario: $0.00059 - $0.00092 (under conditions of limited ecosystem growth or challenging market environments)

Click to view OOOO long-term investment and price forecast: Price Prediction

2026-02-09 - 2031 Long-term Outlook

- Base scenario: $0.00091 - $0.00226 USD (corresponding to steady progress and gradual mainstream application enhancement)

- Optimistic scenario: $0.00154 - $0.00264 USD (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.00264 USD (such as breakthrough progress in ecosystem and mainstream popularization)

- 2031-12-31 forecast high: $0.00264 USD (based on optimistic development assumptions)

Disclaimer: Price predictions are speculative and based on historical data and market analysis. Cryptocurrency investments carry substantial risk, and actual prices may differ significantly from forecasts. This content does not constitute investment advice.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00110032 | 0.001058 | 0.00090988 | 0 |

| 2027 | 0.0015431988 | 0.00107916 | 0.000593538 | 1 |

| 2028 | 0.001717645014 | 0.0013111794 | 0.00091782558 | 23 |

| 2029 | 0.00225647418843 | 0.001514412207 | 0.00078749434764 | 42 |

| 2030 | 0.002469930589006 | 0.001885443197715 | 0.001753462173874 | 77 |

| 2031 | 0.002635001140966 | 0.00217768689336 | 0.001676818907887 | 105 |

IV. OOOO Investment Strategy and Risk Management (How to invest in OOOO)

Investment Methodology (OOOO investment strategy)

Long-term Holding (HODL OOOO)

For conservative investors seeking stability, a long-term holding strategy may be considered. This approach involves:

- Accumulating positions during market corrections

- Focusing on the project's fundamental development rather than short-term price fluctuations

- Regular portfolio review and rebalancing based on market conditions

Active Trading Strategy

For traders with technical analysis capabilities, active trading approaches include:

- Monitoring key support and resistance levels based on historical price data

- Utilizing volume indicators to identify potential trend reversals

- Implementing stop-loss orders to manage downside risk

- Capitalizing on price volatility through swing trading opportunities

Risk Management (Risk management for OOOO investment)

Asset Allocation Recommendations

- Conservative Investors: Allocate no more than 1-3% of total portfolio to OOOO, given its high volatility profile

- Aggressive Investors: May consider 5-10% allocation, with strict risk management protocols

- Professional Investors: Should conduct thorough due diligence and consider liquidity constraints before position sizing

Risk Hedging Solutions

- Diversify across multiple crypto assets to reduce concentration risk

- Maintain exposure to established cryptocurrencies alongside smaller-cap positions

- Consider correlation patterns with broader crypto market movements

- Set predetermined exit points for both profit-taking and loss limitation

Secure Storage Practices

- Cold Wallet Storage: For long-term holdings, utilize hardware wallets or air-gapped solutions

- Hot Wallet Usage: Maintain only trading amounts on exchanges or hot wallets

- Hardware Wallet Recommendations: Research reputable hardware wallet providers that support BEP-20 tokens

- Security Protocols: Enable two-factor authentication, use unique passwords, and regularly update security measures

V. OOOO Investment Risks and Challenges (Risks of investing in OOOO)

Market Risks

- High Volatility: OOOO has demonstrated significant price fluctuations, with a 7-day decline of 44.2% and a 30-day decline of 88.66% as of February 9, 2026

- Price Manipulation Potential: With a market capitalization of approximately $168,116 and trading volume of $12,158.79 over 24 hours, the relatively low liquidity may expose investors to potential price manipulation risks

- Limited Exchange Availability: Trading on only 6 exchanges may result in liquidity constraints and wider bid-ask spreads

Regulatory Risks

- Jurisdictional Uncertainties: Cryptocurrency regulations vary significantly across jurisdictions and continue to evolve

- Compliance Requirements: Potential regulatory changes may impact token utility, trading accessibility, or project operations

- Cross-border Transaction Restrictions: Some regions may impose limitations on cryptocurrency transactions or exchanges

Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token deployed on BSC (contract address: 0xf0a28bddac9d3045c95bf57df033e80685d881c0), potential smart contract bugs or exploits could affect token functionality

- Network Dependencies: The project's operations depend on the underlying BSC blockchain infrastructure

- Project Development Risks: The success of AI-driven full-spectrum collaboration technology remains subject to ongoing development and market adoption

VI. Conclusion: Is OOOO a Good Investment?

Investment Value Summary

OOOO presents as an emerging project in the AI-driven blockchain collaboration space. However, the token has experienced substantial price volatility, with notable declines across multiple timeframes. The current price of $0.00106 represents a significant decrease from its historical high of $0.05331 recorded on December 30, 2025. With a circulating supply representing 15.86% of the total supply and a holder count of 59,432, the project demonstrates some level of community participation.

Investor Recommendations

✅ Beginner Investors:

- Consider dollar-cost averaging to mitigate timing risk

- Store tokens in secure, self-custody wallets compatible with BEP-20 tokens

- Limit exposure to a small percentage of overall portfolio

- Prioritize understanding the project fundamentals before investing

✅ Experienced Investors:

- Monitor technical indicators and volume patterns for potential entry and exit points

- Implement strict position sizing and risk management protocols

- Diversify holdings across multiple asset classes and market cap ranges

- Stay informed about project developments and ecosystem updates

✅ Institutional Investors:

- Conduct comprehensive due diligence on project team, technology, and market positioning

- Assess liquidity constraints given the limited exchange availability

- Evaluate regulatory compliance and potential jurisdictional risks

- Consider strategic allocation only after thorough risk assessment

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including the potential loss of principal. The information presented in this analysis is for educational purposes only and does not constitute financial, investment, or legal advice. Past performance does not guarantee future results. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: Is OOOO a good investment in 2026?

The investment suitability of OOOO depends on individual risk tolerance and investment objectives. As of February 9, 2026, OOOO is trading at $0.00106 with a market capitalization of approximately $168,116. The token has experienced significant volatility, declining 88.66% over 30 days and 98.60% over the past year. While the project aims to provide AI-driven full-spectrum collaboration across multi-chain environments, investors should note the high-risk profile characterized by limited liquidity (24-hour trading volume of $12,158.79), availability on only 6 exchanges, and substantial price fluctuations. Conservative investors should limit exposure to 1-3% of their portfolio, while more aggressive investors might consider 5-10% allocation with strict risk management protocols.

Q2: What is the price prediction for OOOO in 2027-2028?

Mid-term forecasts for OOOO suggest potential price ranges of $0.00059 - $0.00154 in 2027 and $0.00092 - $0.00172 in 2028. These projections assume gradual recovery following recent price declines and successful development of the AI-powered multi-chain collaboration infrastructure. Key factors influencing these forecasts include the expansion of protocol integrations, broader ecosystem adoption across different application environments, and overall cryptocurrency market conditions. However, investors should recognize that these predictions are speculative and based on historical data analysis. Actual prices may differ significantly due to market sentiment changes, technological developments, regulatory shifts, and macroeconomic factors.

Q3: What are the main risks of investing in OOOO?

Investing in OOOO carries multiple risk categories. Market risks include high volatility (44.2% decline over 7 days as of February 2026), potential price manipulation due to low liquidity, and limited exchange availability restricting trading options. Technical risks involve smart contract vulnerabilities on the BSC network (contract address: 0xf0a28bddac9d3045c95bf57df033e80685d881c0), network dependencies, and project development uncertainties. Regulatory risks encompass jurisdictional uncertainties regarding cryptocurrency regulations, potential compliance requirement changes, and cross-border transaction restrictions. The relatively small market capitalization of $168,116 and modest trading volume indicate higher susceptibility to market manipulation and liquidity constraints compared to established cryptocurrencies.

Q4: How should I store OOOO tokens securely?

For secure OOOO token storage, adopt a multi-layered approach based on your holding strategy. Long-term holders should utilize cold wallet solutions such as hardware wallets or air-gapped storage devices that support BEP-20 tokens on the BSC network. Keep only trading amounts in hot wallets or on exchanges to minimize exposure to potential security breaches. Implement comprehensive security protocols including two-factor authentication (2FA) on all exchange accounts, unique strong passwords for different platforms, and regular security updates. Research reputable hardware wallet providers compatible with BEP-20 tokens before making storage decisions. Never share private keys or recovery phrases, and maintain backup copies in secure, offline locations.

Q5: What is OOOO's current market position and trading activity?

As of February 9, 2026, OOOO occupies a relatively small position within the cryptocurrency market. The token has a market capitalization of approximately $168,116 with a market dominance of 0.000041%. It trades on 6 exchanges with a 24-hour trading volume of $12,158.79. The circulating supply stands at 158,600,000 tokens (15.86% of the 1,000,000,000 total supply), with approximately 59,432 holders. Recent price performance shows declines of 3.99% over 24 hours, 44.2% over 7 days, and 88.66% over 30 days. The 24-hour price range fluctuated between $0.001046 and $0.001151, indicating active but relatively modest trading activity compared to larger market cap cryptocurrencies.

Q6: What factors could influence OOOO's future price?

Multiple factors may impact OOOO's future price trajectory. Technology and ecosystem development factors include successful implementation of AI-driven full-spectrum collaboration features, expansion of multi-chain protocol integrations, and adoption across different application environments. Market adoption factors encompass increasing trading volume, exchange listings expansion, and growth in the holder base beyond the current 59,432 participants. Macroeconomic influences include broader cryptocurrency market sentiment, monetary policy changes, interest rate movements, and inflation trends. Additionally, the project's ability to increase its circulation ratio beyond the current 15.86%, achieve technical milestones outlined in project documentation, and navigate regulatory developments will significantly affect long-term price performance.

Q7: What investment strategies are suitable for OOOO?

Two primary investment strategies may be considered for OOOO depending on investor profile. Conservative investors might adopt a long-term holding (HODL) strategy, accumulating positions during market corrections, focusing on fundamental project development rather than short-term price movements, and conducting regular portfolio reviews for rebalancing based on market conditions. Active traders with technical analysis capabilities could implement swing trading strategies by monitoring key support and resistance levels from historical price data, utilizing volume indicators to identify trend reversals, implementing stop-loss orders for downside protection, and capitalizing on price volatility opportunities. Both strategies require strict risk management protocols including appropriate position sizing (1-3% for conservative investors, 5-10% for aggressive investors), diversification across multiple crypto assets, and predetermined exit points for profit-taking and loss limitation.

Q8: How does OOOO's supply mechanism affect its investment potential?

OOOO's supply mechanism features a maximum supply cap of 1,000,000,000 tokens, with a current circulating supply of 158,600,000 tokens representing 15.86% of the total. This defined supply cap may contribute to potential scarcity dynamics as market adoption evolves, though significant unlocked supply remains. The token reached a high of $0.05331 on December 30, 2025, before declining to $0.00084 on February 7, 2026, demonstrating substantial volatility patterns. The relatively low circulation ratio suggests that future token releases could impact price dynamics through increased supply. Investors should monitor the token unlock schedule and circulation ratio changes, as these factors influence supply-demand dynamics and potential price movements. The scarcity aspect must be balanced against the project's development progress, market adoption rates, and overall cryptocurrency market conditions when evaluating long-term investment potential.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Top Cold Wallets for Cryptocurrency: Rankings

Funding Rate Analysis: Bitcoin Price Prediction and Investment Strategies

Is Ethereum becoming irrelevant?

What is PSTAKE: A Comprehensive Guide to Persistence's Liquid Staking Token

What is MAK: A Comprehensive Guide to Understanding Microkernel Architecture and Its Applications