Is Ordz Games(GAME·OF·BITCOIN) (GAMES) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Outlook

Introduction: Ordz Games (GAMES) Investment Position and Market Outlook

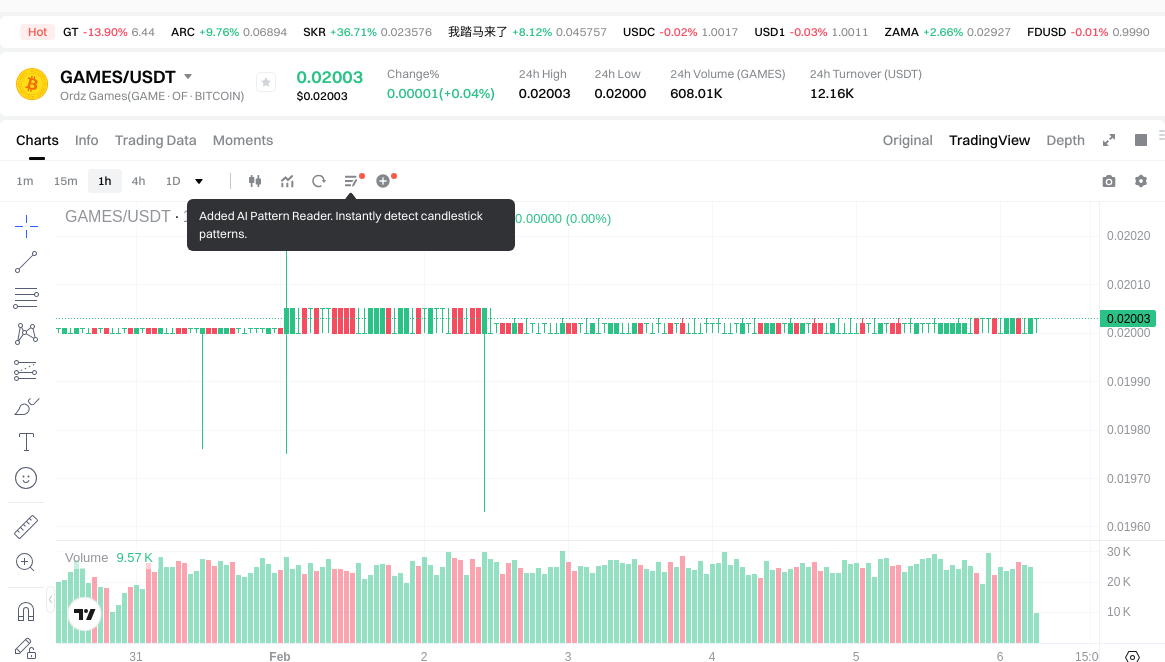

GAMES is a digital asset within the cryptocurrency sector, launched in 2024, and has established a notable presence in the Bitcoin-based gaming ecosystem. As of February 6, 2026, GAMES maintains a market capitalization of approximately $420,630, with a circulating supply of 21,000,000 tokens, and a current price around $0.02003. Positioned as a gaming project built on Bitcoin utilizing Ordinals, Runes, and DEPIN technologies, GAMES has attracted attention from investors exploring "Is Ordz Games (GAMES) a good investment?" With backing from entities including Waterdrip Capital, Unisat, Satoshi Lab, CoinSummer, and Sora Venture, the project has developed a community of over 100,000 social followers and 120,000 players across four gaming seasons. The project introduced the BitBoy One, a web3 gaming device, which received coverage from industry publications such as Decrypt, CoinDesk, and VentureBeat. This article provides an analysis of GAMES investment characteristics, historical price performance, future price considerations, and associated investment risks to serve as a reference for market participants.

I. Price History Review and Investment Value Status of GAMES

Historical Price Trends and Investment Returns of GAMES (Ordz Games(GAME·OF·BITCOIN)(GAMES) Investment Performance)

- April 2024: GAMES launched at a public sale price of $0.38, subsequently experiencing significant volatility as the market adjusted to its novel positioning as Bitcoin's first fully on-chain gaming project.

- April 29, 2024: The token experienced a notable price surge, though specific percentage gains were not disclosed in available materials.

- September 26, 2025: GAMES reached a relatively lower price level during a broader market correction phase.

- 2024-2025 Market Cycle: The token demonstrated substantial volatility, with price movements reflecting both the broader cryptocurrency market conditions and project-specific developments including multiple gaming seasons and community expansion.

Current GAMES Investment Market Status (February 2026)

- Current GAMES Price: $0.02003

- Market Sentiment (Fear & Greed Index): Data unavailable in provided materials

- 24-Hour Trading Volume: $12,140.28

- Circulating Supply: 21,000,000 GAMES (100% of maximum supply)

- Market Capitalization: $420,630

- Fully Diluted Valuation: $420,630

- Market Dominance: 0.000018%

- Exchange Availability: Listed on 1 exchange (Gate.com confirmed)

- Holder Count: 1,024 addresses

Click to view real-time GAMES market price

Recent Price Performance:

- 1-Hour Change: +0.15%

- 24-Hour Change: -0.09%

- 7-Day Change: -0.05%

- 30-Day Change: -8.72%

- 1-Year Change: -75.03%

Project Development Status: Ordz Games has established itself as a pioneering Bitcoin-native gaming ecosystem, supported by prominent investors including Waterdrip Capital, Unisat, Satoshi Lab, CoinSummer, and Sora Venture. The project has successfully launched the BitBoy One gaming device and accumulated over 100,000 social media followers and 120,000 players across four gaming seasons, representing the largest gaming community on Bitcoin.

II. Core Factors Influencing Whether GAMES is a Good Investment (Is Ordz Games(GAME·OF·BITCOIN)(GAMES) a Good Investment)

Supply Mechanism and Scarcity (GAMES investment scarcity)

- Fixed supply model → influences price and investment value

- Total supply capped at 21,000,000 GAMES with 100% circulating supply, establishing a scarcity framework similar to Bitcoin's limited issuance model

- Investment significance: scarcity characteristics serve as a potential foundation for long-term investment considerations

Institutional Investment and Mainstream Adoption (Institutional investment in GAMES)

- Institutional backing trends: supported by Waterdrip Capital, Unisat, Satoshi Lab, CoinSummer, and Sora Venture

- Early-stage institutional participation indicates initial validation within the Bitcoin gaming sector

- Policy and regulatory developments for Bitcoin-based gaming projects may influence future investment prospects

Macroeconomic Environment Impact on GAMES Investment

- Broader gaming sector performance has experienced challenges with reduced investment inflows in recent years

- Economic conditions affecting risk appetite may impact speculative GameFi projects

- Market volatility considerations remain relevant given the 75.03% decline over the past year period

Technology and Ecosystem Development (Technology & Ecosystem for GAMES investment)

- Ordinals x Runes x DEPIN framework: builds Bitcoin layer-one gaming infrastructure with fully on-chain game deployment

- Hardware innovation: BitBoy One web3 gaming device reportedly sold out within 2 minutes during initial public sale, as covered by Decrypt, CoinDesk, and VentureBeat

- Community engagement: operational track record across 4 gaming seasons with approximately 120,000 players and over 100,000 social media followers represents established user base within Bitcoin gaming ecosystem

III. GAMES Future Investment Prediction and Price Outlook (Is Ordz Games(GAME·OF·BITCOIN)(GAMES) worth investing in 2026-2031)

Short-term Investment Prediction (2026, short-term GAMES investment outlook)

- Conservative Forecast: $0.0190285 - $0.02003

- Neutral Forecast: $0.02003 - $0.022

- Optimistic Forecast: $0.022 - $0.024036

Mid-term Investment Outlook (2027-2028, mid-term Ordz Games(GAME·OF·BITCOIN)(GAMES) investment forecast)

- Market Stage Expectation: The asset may experience gradual development in the mid-term period, with potential price movements influenced by Bitcoin ecosystem adoption and gaming sector expansion.

- Investment Return Prediction:

- 2027: $0.01586376 - $0.02952422

- 2028: $0.0131470911 - $0.0358322679

- Key Catalysts: Bitcoin layer-1 gaming ecosystem development, BitBoyOne device adoption trends, and community engagement growth.

Long-term Investment Outlook (Is GAMES a good long-term investment?)

- Base Scenario: $0.025 - $0.034 (assuming steady development of Bitcoin gaming infrastructure and moderate user adoption)

- Optimistic Scenario: $0.034 - $0.049 (assuming broader acceptance of Bitcoin-based gaming solutions and successful ecosystem expansion)

- Risk Scenario: $0.013 - $0.022 (under challenging market conditions or slower-than-expected adoption rates)

Click to view GAMES long-term investment and price prediction: Price Prediction

2026-02-06 - 2031 Long-term Outlook

- Base Scenario: $0.025 - $0.034 USD (corresponding to steady progress and gradual mainstream application enhancement)

- Optimistic Scenario: $0.034 - $0.049 USD (corresponding to large-scale adoption and favorable market environment)

- Transformative Scenario: Above $0.049 USD (such as breakthrough progress in ecosystem and mainstream popularization)

- 2031-12-31 Predicted High: $0.048651645842514 USD (based on optimistic development assumptions)

Disclaimer: Price predictions are based on historical data and market analysis models. Cryptocurrency markets are highly volatile and subject to various factors including regulatory changes, technological developments, and market sentiment. These predictions should not be considered as investment advice. Past performance does not guarantee future results.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.024036 | 0.02003 | 0.0190285 | 0 |

| 2027 | 0.02952422 | 0.022033 | 0.01586376 | 10 |

| 2028 | 0.0358322679 | 0.02577861 | 0.0131470911 | 28 |

| 2029 | 0.0323457108975 | 0.03080543895 | 0.026492677497 | 53 |

| 2030 | 0.035996155413075 | 0.03157557492375 | 0.025260459939 | 57 |

| 2031 | 0.048651645842514 | 0.033785865168412 | 0.021622953707784 | 68 |

IV. GAMES Investment Strategy and Risk Management (How to invest in Gaming Tokens)

Investment Methodology (GAMES investment strategy)

-

Long-term Holding (HODL GAMES): Suitable for conservative investors who believe in the long-term development of Bitcoin-native gaming ecosystems. Given the project's focus on on-chain games and community building with over 100,000 social followers and 120,000 players across past gaming seasons, patient investors may consider accumulating during market downturns.

-

Active Trading: Relies on technical analysis and swing trading strategies. Traders should monitor price movements within the $0.01683-$0.02003 range observed in recent periods, considering the token's volatility and relatively low 24-hour trading volume of approximately $12,140.

Risk Management (Risk management for GAMES investment)

-

Asset Allocation Ratio:

- Conservative investors: Allocate no more than 1-2% of crypto portfolio to GAMES

- Aggressive investors: May allocate 3-5% with close monitoring

- Professional investors: Up to 5-10% with hedging strategies and deep market analysis

-

Risk Hedging Solutions: Diversify across multiple gaming tokens and broader crypto assets; consider Bitcoin allocation as a hedge given GAMES operates within the Bitcoin ecosystem.

-

Secure Storage: Use cold wallets for long-term holdings; hardware wallets recommended for larger amounts; hot wallets only for active trading portions.

V. GAMES Investment Risks and Challenges (Risks of investing in Gaming Tokens)

-

Market Risk: High volatility with price fluctuations ranging from $0.01683 to historical levels; relatively small market capitalization of approximately $420,630 increases susceptibility to price swings; limited exchange availability (currently listed on 1 exchange) may impact liquidity.

-

Regulatory Risk: Bitcoin-based gaming projects face uncertain regulatory landscapes across jurisdictions; potential policy changes regarding on-chain gaming, NFTs (Ordinals), and Runes protocol could impact project viability.

-

Technical Risk: Dependence on Bitcoin network and Runes protocol introduces technical dependencies; smart contract vulnerabilities in gaming implementations; hardware product risks associated with BitBoy One device; integration challenges across Ordinals, Runes, and DePIN technologies.

-

Project-Specific Risk: Relatively early-stage project with limited track record; competitive pressure from other blockchain gaming platforms; execution risk in maintaining player engagement across gaming seasons; reliance on continued community growth.

VI. Conclusion: Is Gaming Tokens a Good Investment?

-

Investment Value Summary: GAMES represents an innovative approach to Bitcoin-native gaming through its integration of Ordinals, Runes, and DePIN technologies. The project has demonstrated community traction with over 120,000 players and backing from notable investors including Waterdrip Capital, Unisat, and Satoshi Lab. However, the token has experienced significant price decline of approximately 75% over the past year, reflecting broader market challenges and the speculative nature of gaming tokens.

-

Investor Recommendations:

✅ Beginners: Consider dollar-cost averaging with small allocations; prioritize secure wallet storage; thoroughly research the Bitcoin gaming ecosystem before investing.

✅ Experienced Investors: Evaluate swing trading opportunities within established support/resistance levels; maintain diversified portfolio across gaming and non-gaming crypto assets; monitor project development milestones and community metrics.

✅ Institutional Investors: Assess strategic positioning within the Bitcoin gaming narrative; evaluate team execution capability and partnerships; consider modest allocation as part of broader Web3 gaming thesis.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including potential total loss of capital. This content is for informational purposes only and does not constitute investment advice. Conduct thorough due diligence and consider consulting financial advisors before making investment decisions.

VII. FAQ

Q1: What makes GAMES different from other blockchain gaming tokens?

GAMES distinguishes itself as Bitcoin's first fully on-chain gaming project utilizing Ordinals, Runes, and DEPIN technologies. Unlike Ethereum-based gaming tokens, GAMES operates entirely on Bitcoin layer-1 infrastructure, leveraging Bitcoin's security and decentralization. The project has introduced the BitBoy One, a web3 gaming device that sold out within 2 minutes during its initial public sale and received coverage from major industry publications including Decrypt, CoinDesk, and VentureBeat. With backing from prominent investors such as Waterdrip Capital, Unisat, and Satoshi Lab, GAMES has built the largest gaming community on Bitcoin with over 120,000 players across four gaming seasons and 100,000+ social media followers, demonstrating substantial user engagement within the Bitcoin ecosystem.

Q2: Why has GAMES experienced a 75% price decline over the past year?

The 75% decline from GAMES' launch price of $0.38 to its current level around $0.02003 reflects multiple market factors. The broader cryptocurrency gaming sector has faced reduced investment inflows in recent years, with many GameFi projects experiencing similar retracements. GAMES' small market capitalization of approximately $420,630 and limited exchange availability (currently listed on 1 exchange) contribute to higher volatility and susceptibility to market-wide downturns. Additionally, the token launched during a period of heightened interest in Bitcoin-based innovations, which subsequently normalized. The relatively low 24-hour trading volume of around $12,140 indicates limited liquidity, which can amplify price movements in both directions.

Q3: Is GAMES suitable for long-term investment or short-term trading?

GAMES can serve different investment strategies depending on investor profile and risk tolerance. For long-term holders, the project's positioning within the Bitcoin gaming ecosystem, institutional backing, and fixed supply of 21,000,000 tokens (100% circulating) may appeal to those believing in Bitcoin-native gaming adoption. Conservative investors should allocate no more than 1-2% of their crypto portfolio to GAMES, while aggressive investors may consider 3-5% with close monitoring. For short-term traders, the token's volatility presents swing trading opportunities within the $0.01683-$0.02003 range observed in recent periods. However, traders should note the relatively low trading volume, which may limit execution at desired prices. Active traders should employ technical analysis and maintain strict risk management given the asset's speculative nature.

Q4: What are the primary risks associated with investing in GAMES?

GAMES investment carries several distinct risk categories. Market risk includes high volatility due to its small market capitalization, limited liquidity from single-exchange availability, and susceptibility to broader crypto market downturns. Regulatory risk stems from uncertain legal frameworks surrounding Bitcoin-based gaming, Ordinals, and Runes protocol across different jurisdictions, with potential policy changes impacting project viability. Technical risk involves dependence on Bitcoin network infrastructure, Runes protocol stability, smart contract vulnerabilities in gaming implementations, and hardware product risks associated with the BitBoy One device. Project-specific risk includes its early-stage development with limited track record, competitive pressure from established blockchain gaming platforms, execution challenges in maintaining player engagement, and reliance on continued community growth for ecosystem development.

Q5: What price range can investors expect for GAMES by 2031?

Based on analytical models and historical data patterns, GAMES price projections for 2031 range across multiple scenarios. The base scenario anticipates $0.025 - $0.034, assuming steady development of Bitcoin gaming infrastructure and moderate user adoption rates. An optimistic scenario projects $0.034 - $0.049, contingent upon broader acceptance of Bitcoin-based gaming solutions and successful ecosystem expansion. The predicted high for December 31, 2031 stands at approximately $0.0487, based on optimistic development assumptions. However, a risk scenario suggests $0.013 - $0.022 under challenging market conditions or slower-than-expected adoption rates. These predictions incorporate factors including the project's community growth trajectory, technological developments in the Bitcoin ecosystem, and broader cryptocurrency market conditions. It is important to note that cryptocurrency markets are highly volatile and subject to numerous unpredictable factors, making these projections speculative rather than guaranteed outcomes.

Q6: How does GAMES' fixed supply model influence its investment characteristics?

GAMES employs a fixed supply model with a total cap of 21,000,000 tokens and 100% circulating supply, mirroring Bitcoin's scarcity-driven value proposition. This deflationary tokenomics structure means no additional tokens can be created, potentially supporting price appreciation if demand increases over time. Unlike projects with ongoing token emissions or inflationary models, GAMES eliminates dilution risk for existing holders. The complete circulation of the maximum supply also provides transparency, as there are no locked tokens awaiting release that could create future selling pressure. For investors, this scarcity characteristic establishes a fundamental supply constraint that may support long-term value if the project successfully expands its user base and gaming ecosystem. However, fixed supply alone does not guarantee price appreciation, as demand factors including user adoption, competitive positioning, and broader market conditions remain critical determinants of investment performance.

Q7: What role do institutional investors play in GAMES' ecosystem development?

GAMES has secured backing from notable institutional investors including Waterdrip Capital, Unisat, Satoshi Lab, CoinSummer, and Sora Venture, providing several strategic advantages for the project's development. These institutional partnerships offer more than capital, delivering credibility within the cryptocurrency industry and potential access to broader networks and resources. Institutional involvement suggests professional due diligence has been conducted on the project's technology, team, and market opportunity, which may provide confidence to retail investors evaluating the project. These investors typically maintain longer-term perspectives and can provide stability during market volatility. However, institutional backing does not eliminate investment risk, as even well-funded projects can face execution challenges, market headwinds, or technological obstacles. Investors should view institutional participation as one factor among many when conducting comprehensive investment analysis.

Q8: What metrics should investors monitor to assess GAMES' ongoing performance?

Investors should track multiple performance indicators to evaluate GAMES' development trajectory. Community metrics including active player counts across gaming seasons, social media follower growth from the current 100,000+ base, and wallet address increases from the current 1,024 holders provide insights into user adoption trends. Market metrics such as trading volume evolution from the current $12,140 daily average, exchange listing expansions beyond the current single platform, and market capitalization changes from the current $420,630 level indicate liquidity and market interest. Development milestones including new game releases, BitBoy One device sales and user engagement, technological upgrades to the Ordinals, Runes, and DEPIN framework, and strategic partnership announcements signal ecosystem progress. Price performance relative to Bitcoin and broader gaming token indices provides context for investment returns. Regular monitoring of these metrics enables investors to make informed decisions about position adjustments and long-term holding strategies.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

New NISA vs. Bitcoin: A Comparison of Benefits and Drawbacks

Inverted Hammer Candlestick Pattern: A Comprehensive Guide

How Liquidity Provider Tokens Work

What Is Staking? How to Earn Passive Income with Staking

Top White Label Cryptocurrency Exchanges Today