MOONPIG vs ARB: Which Cryptocurrency Offers Better Long-Term Investment Potential in 2024?

Introduction: Investment Comparison Between MOONPIG and ARB

In the cryptocurrency market, the comparison between MOONPIG vs ARB has become a topic of interest for investors. These two assets exhibit notable differences in market cap ranking, application scenarios, and price performance, representing distinct positioning within the crypto ecosystem.

MOONPIG (MOONPIG): Launched in 2025, this satirical meme coin has emerged from internet culture, blending humor and community-driven energy. With no formal roadmap or corporate structure, it operates purely on viral memes and community participation.

Arbitrum (ARB): Introduced in 2023, ARB serves as the governance token for Arbitrum, a Layer 2 scaling solution designed to enhance Ethereum's transaction efficiency and reduce costs. It represents infrastructure-level blockchain technology.

This article will provide a comprehensive analysis of MOONPIG vs ARB through examining historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future projections, attempting to address investors' key question:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

MOONPIG and ARB Historical Price Trends

- 2025: MOONPIG experienced notable volatility following its launch in January 2025, reaching a peak price of $0.04 in June 2025.

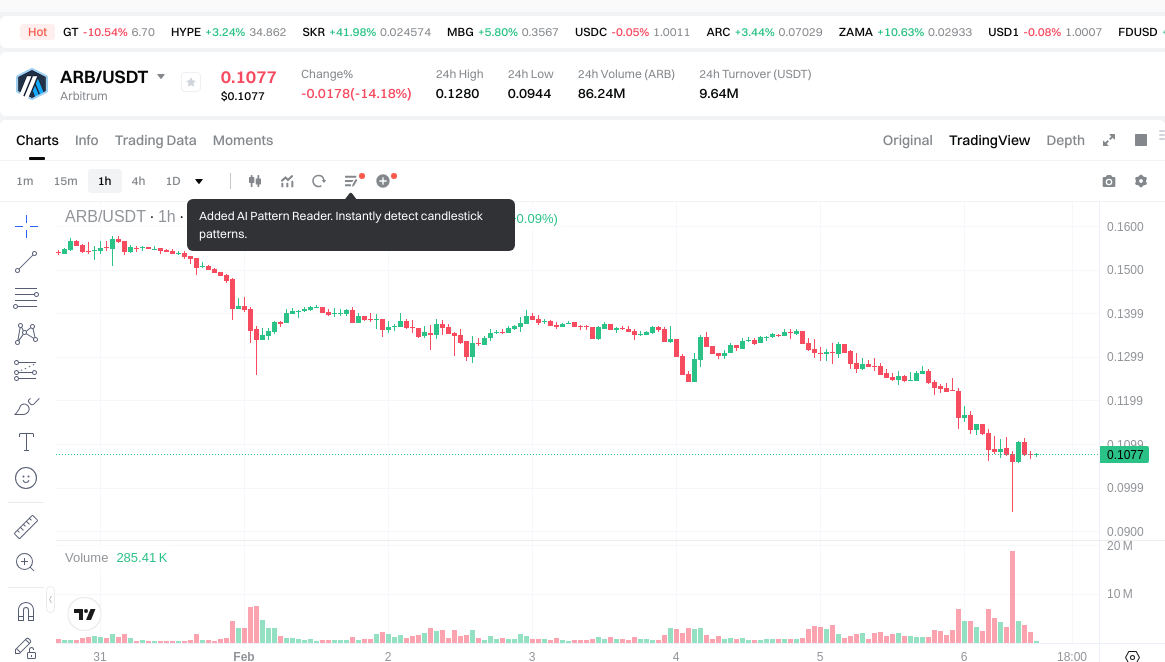

- 2023: ARB was introduced to the market in March 2023, with its price influenced by the adoption of Arbitrum's Layer 2 scaling solutions for Ethereum.

- Comparative Analysis: During the market cycle from June 2025 to February 2026, MOONPIG declined from its high of $0.04 to a low of $0.0003514, representing a significant correction. Meanwhile, ARB experienced a decline from its historical high of $2.39 (reached in January 2024) to approximately $0.1076, demonstrating different volatility patterns between the two assets.

Current Market Situation (2026-02-06)

- MOONPIG current price: $0.0003932

- ARB current price: $0.1076

- 24-hour trading volume: MOONPIG $21,257.53 vs ARB $9,664,586.99

- Market Sentiment Index (Fear & Greed Index): 9 (Extreme Fear)

View real-time prices:

- Check MOONPIG current price Market Price

- Check ARB current price Market Price

II. Core Factors Influencing MOONPIG vs ARB Investment Value

Supply Mechanism Comparison (Tokenomics)

- MOONPIG: Information regarding the supply mechanism is not available in the reference materials.

- ARB: Information regarding the supply mechanism is not available in the reference materials.

Institutional Adoption and Market Application

- Institutional Holdings: Information regarding institutional preference between MOONPIG and ARB is not available in the reference materials.

- Enterprise Adoption: Information regarding the application of MOONPIG and ARB in cross-border payments, settlement, and investment portfolios is not available in the reference materials.

- National Policy: Information regarding different countries' regulatory attitudes toward MOONPIG and ARB is not available in the reference materials.

Technology Development and Ecosystem Building

- MOONPIG Technology: The platform features intuitive technology that allows users to set reminders for special occasions and recommends cards based on recipient characteristics and customer preferences. The service includes personalized greeting cards for various life moments, with delivery services across the UK and US markets. A mobile application offers convenience and handwriting features.

- ARB Technology Development: Information regarding ARB's technology development is not available in the reference materials.

- Ecosystem Comparison: Information regarding DeFi, NFT, payment systems, and smart contract implementations for MOONPIG and ARB is not available in the reference materials.

Macroeconomic Environment and Market Cycles

- Performance in Inflationary Environment: Information regarding anti-inflation properties of MOONPIG and ARB is not available in the reference materials.

- Macroeconomic Monetary Policy: Information regarding the impact of interest rates and dollar index on MOONPIG and ARB is not available in the reference materials.

- Geopolitical Factors: Information regarding cross-border transaction demand and international situations affecting MOONPIG and ARB is not available in the reference materials.

III. 2026-2031 Price Forecast: MOONPIG vs ARB

Short-term Forecast (2026)

- MOONPIG: Conservative scenario suggests a range of $0.000334776 to $0.0003848, with optimistic projections reaching up to $0.00055796

- ARB: Conservative scenario indicates a range of $0.093351 to $0.1073, with optimistic projections potentially reaching $0.120176

Mid-term Forecast (2028-2029)

- MOONPIG may enter a gradual recovery phase, with projected price ranges between $0.00026090883 and $0.000497659435 in 2028, potentially extending to $0.0002942471805 to $0.0006865767545 by 2029

- ARB may enter a consolidation and growth phase, with anticipated price ranges between $0.1077895026 and $0.1713576708 in 2028, potentially expanding to $0.140844950064 to $0.207398058336 by 2029

- Key drivers: institutional capital inflows, ETF developments, and ecosystem expansion

Long-term Forecast (2031)

- MOONPIG: Baseline scenario suggests a range of $0.000434308838418 to $0.00072384806403, with optimistic scenario reaching up to $0.001020625770282

- ARB: Baseline scenario indicates a range of $0.190584344179101 to $0.19647870533928, with optimistic scenario potentially reaching $0.235774446407136

Disclaimer: Price predictions are based on historical data analysis and market trend modeling. Cryptocurrency markets are highly volatile and subject to various unpredictable factors. These forecasts should not be considered as financial advice or guarantees of future performance. Investors should conduct their own research and assess their risk tolerance before making investment decisions.

MOONPIG:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00055796 | 0.0003848 | 0.000334776 | -2 |

| 2027 | 0.000494949 | 0.00047138 | 0.0003912454 | 19 |

| 2028 | 0.000497659435 | 0.0004831645 | 0.00026090883 | 22 |

| 2029 | 0.0006865767545 | 0.0004904119675 | 0.0002942471805 | 24 |

| 2030 | 0.00085920176706 | 0.000588494361 | 0.00033544178577 | 49 |

| 2031 | 0.001020625770282 | 0.00072384806403 | 0.000434308838418 | 84 |

ARB:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.120176 | 0.1073 | 0.093351 | 0 |

| 2027 | 0.16264534 | 0.113738 | 0.06710542 | 5 |

| 2028 | 0.1713576708 | 0.13819167 | 0.1077895026 | 28 |

| 2029 | 0.207398058336 | 0.1547746704 | 0.140844950064 | 43 |

| 2030 | 0.21187104631056 | 0.181086364368 | 0.12313872777024 | 68 |

| 2031 | 0.235774446407136 | 0.19647870533928 | 0.190584344179101 | 82 |

IV. Investment Strategy Comparison: MOONPIG vs ARB

Long-term vs Short-term Investment Strategies

- MOONPIG: May appeal to investors with higher risk tolerance seeking exposure to meme coin volatility and community-driven projects. The asset's price fluctuations suggest it may be more suitable for short-term trading strategies focused on momentum and sentiment shifts.

- ARB: May appeal to investors interested in Layer 2 scaling solutions and Ethereum ecosystem infrastructure. The governance token structure suggests potential suitability for medium to long-term holdings aligned with blockchain technology development.

Risk Management and Asset Allocation

- Conservative Investors: MOONPIG 5-10% vs ARB 15-20%

- Aggressive Investors: MOONPIG 20-30% vs ARB 30-40%

- Hedging Tools: Stablecoin allocation, options strategies, cross-asset diversification

V. Potential Risk Comparison

Market Risks

- MOONPIG: Exhibits high volatility characteristics with significant price corrections observed from June 2025 to February 2026. Lower trading volume of $21,257.53 may indicate limited liquidity and potential for sharp price movements.

- ARB: Demonstrates substantial price fluctuations with decline from historical levels. However, higher trading volume of $9,664,586.99 suggests relatively better liquidity compared to MOONPIG. Price movements may be influenced by Ethereum network developments and Layer 2 adoption trends.

Technical Risks

- MOONPIG: Limited information available regarding technical infrastructure and scalability features. Community-driven nature without formal roadmap may present uncertainties in long-term development.

- ARB: As a Layer 2 solution token, technical risks may be associated with the underlying Arbitrum protocol's performance, network stability, and competition from other scaling solutions.

Regulatory Risks

- Both assets operate in an evolving regulatory environment. Meme coins like MOONPIG may face scrutiny regarding their utility and purpose, while infrastructure tokens like ARB may be subject to regulations affecting decentralized finance and governance mechanisms. Regulatory developments across different jurisdictions could impact both assets differently based on their classification and use cases.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- MOONPIG Characteristics: Community-driven meme coin with high volatility potential, launched in 2025 with satirical and viral appeal. Current price of $0.0003932 reflects significant correction from previous highs.

- ARB Characteristics: Governance token for Arbitrum Layer 2 scaling solution, introduced in 2023 with infrastructure-level positioning. Current price of $0.1076 with substantially higher trading volume indicating broader market participation.

✅ Investment Considerations:

- Novice Investors: May consider starting with smaller allocations and prioritizing assets with clearer use cases and higher liquidity. Understanding the fundamental differences between meme coins and infrastructure tokens is essential before making allocation decisions.

- Experienced Investors: May evaluate opportunities based on risk-reward profiles, market cycles, and portfolio diversification needs. Consider technical analysis, ecosystem developments, and market sentiment indicators when forming strategies.

- Institutional Investors: May focus on assets with established infrastructure, governance mechanisms, and regulatory clarity. Conducting thorough due diligence on tokenomics, technical foundations, and long-term viability remains crucial.

⚠️ Risk Disclosure: Cryptocurrency markets exhibit extreme volatility and carry significant risks. This content does not constitute investment advice, and investors should conduct independent research and consult with financial professionals before making investment decisions.

VII. FAQ

Q1: What is the fundamental difference between MOONPIG and ARB?

MOONPIG is a satirical meme coin launched in 2025 with no formal roadmap or corporate structure, operating purely on viral memes and community participation. ARB, introduced in 2023, serves as the governance token for Arbitrum, a Layer 2 scaling solution designed to enhance Ethereum's transaction efficiency and reduce costs, representing infrastructure-level blockchain technology with practical utility in the Ethereum ecosystem.

Q2: Which asset has better liquidity for trading?

ARB demonstrates significantly better liquidity with a 24-hour trading volume of $9,664,586.99 compared to MOONPIG's $21,257.53 as of February 6, 2026. This substantial difference indicates that ARB offers more favorable conditions for executing trades with minimal slippage, while MOONPIG's lower trading volume may result in higher volatility and difficulty entering or exiting positions at desired prices.

Q3: What are the price forecasts for MOONPIG and ARB by 2031?

For MOONPIG, the baseline scenario suggests a price range of $0.000434308838418 to $0.00072384806403 by 2031, with an optimistic scenario reaching up to $0.001020625770282. For ARB, the baseline scenario indicates a range of $0.190584344179101 to $0.19647870533928, with an optimistic scenario potentially reaching $0.235774446407136. These forecasts are based on historical data analysis and market trend modeling, though cryptocurrency markets remain highly unpredictable.

Q4: Which asset is more suitable for conservative investors?

Conservative investors may find ARB more suitable due to its infrastructure-level positioning, higher liquidity, and association with Ethereum's Layer 2 scaling technology. A recommended allocation for conservative portfolios would be 15-20% in ARB compared to 5-10% in MOONPIG. ARB's governance function and practical use case in blockchain infrastructure provide more tangible value propositions than MOONPIG's community-driven meme coin model.

Q5: What are the main risks associated with investing in MOONPIG?

MOONPIG carries several significant risks including extreme price volatility (declining from $0.04 in June 2025 to $0.0003932 by February 2026), limited liquidity with low trading volume, absence of a formal roadmap or corporate structure, and uncertainty regarding long-term development. The meme coin's value relies primarily on community sentiment and viral appeal rather than fundamental utility, making it susceptible to rapid sentiment shifts and potential regulatory scrutiny regarding its classification and purpose.

Q6: How does ARB's technology ecosystem differ from MOONPIG's?

ARB operates within the Ethereum ecosystem as a Layer 2 scaling solution, providing governance rights for the Arbitrum protocol which aims to improve transaction efficiency and reduce costs on the Ethereum network. This technological foundation connects ARB to broader blockchain infrastructure development and decentralized finance applications. In contrast, MOONPIG lacks a technological ecosystem focused on blockchain utility, instead emphasizing community engagement, viral marketing, and satirical internet culture without formal technical development initiatives.

Q7: What market conditions favor MOONPIG versus ARB?

MOONPIG may outperform during periods of extreme risk appetite, viral social media trends, and speculative market phases where meme coins gain attention through community-driven momentum. ARB may demonstrate stronger performance during periods focused on blockchain infrastructure development, Ethereum network upgrades, institutional adoption of Layer 2 solutions, and market conditions favoring assets with clear utility and governance mechanisms over purely speculative instruments.

Q8: Should investors choose between MOONPIG and ARB or hold both?

Diversification principles suggest that investors with sufficient risk tolerance might consider holding both assets in proportions aligned with their risk profiles and investment objectives. Aggressive investors might allocate 20-30% to MOONPIG and 30-40% to ARB, while conservative investors might prefer 5-10% to MOONPIG and 15-20% to ARB. However, the extreme difference in their fundamental characteristics, liquidity profiles, and risk-reward ratios means investors should carefully evaluate whether both assets align with their portfolio strategy rather than assuming diversification alone justifies dual holdings.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Is HARDProtocol (HARD) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability in 2024

Is SophiaVerse (SOPHIA) a good investment?: A Comprehensive Analysis of the Platform's Potential, Risks, and Market Viability in 2024

Is Statter Network (STT) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in 2024

Is StarHeroes (STARHEROES) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Market Outlook for 2024

Is Buz Economy (BUZ) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects