PENG vs ZIL: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the DeFi Ecosystem

Introduction: Investment Comparison Between PENG and ZIL

In the cryptocurrency market, the comparison between PENG vs ZIL has been a topic that investors cannot avoid. The two show differences in market cap ranking, application scenarios, and price performance, representing distinct crypto asset positioning.

PENG (PENG): Launched in 2024, this meme-inspired token positions itself as a penguin-themed digital asset. According to available data, PENG has a circulating supply of 100 million tokens with a market cap of approximately $346,800, ranking at 3353 in the crypto market as of February 2026.

ZIL (ZIL): Emerging in 2018, Zilliqa has been recognized for its high-throughput blockchain platform utilizing sharding technology. With a circulating supply of approximately 19.91 billion tokens and a market cap of around $88 million, it ranks 318th in the market, representing a more established position in the blockchain ecosystem.

This article will comprehensively analyze the investment value comparison between PENG vs ZIL through historical price trends, supply mechanisms, technical ecosystems, and future predictions, attempting to address investors' most pressing question:

"Which is the better buy right now?"

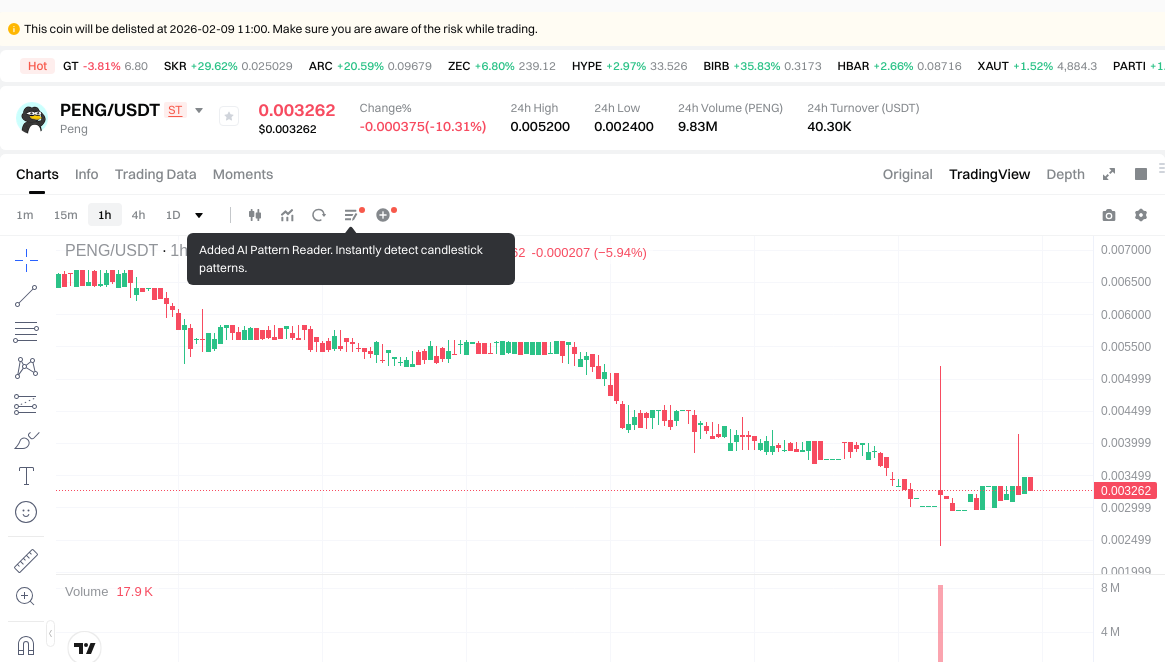

I. Historical Price Comparison and Current Market Status

PENG (Coin A) and ZIL (Coin B) Historical Price Trends

- March 2024: PENG reached its all-time high of $1.2 on March 18, 2024, driven by initial market enthusiasm and trading activity.

- May 2021: ZIL achieved its historical peak of $0.255376 on May 7, 2021, supported by network development milestones and broader market momentum.

- Comparative analysis: During the recent market cycle, PENG declined from its peak of $1.2 to a low of $0.0024 recorded on February 5, 2026, representing a decline of approximately 99.8%. In contrast, ZIL dropped from its high of $0.255376 to a low of $0.00239616 on March 13, 2020, before experiencing various recovery phases throughout subsequent years.

Current Market Status (February 6, 2026)

- PENG current price: $0.003468

- ZIL current price: $0.004421

- 24-hour trading volume: PENG $40,341.60 vs ZIL $1,027,566.71

- Market sentiment index (Fear & Greed Index): 9 (Extreme Fear)

View real-time prices:

- Check PENG current price Market Price

- Check ZIL current price Market Price

II. Core Factors Influencing PENG vs ZIL Investment Value

Supply Mechanism Comparison (Tokenomics)

The reference materials provide limited specific information regarding the supply mechanisms of PENG and ZIL. According to available analysis, PENG's value appears to rely heavily on social engagement and speculative activity, with concerns noted about structural risks including concentration and lack of inherent utility. The token economics model represents one aspect that may differentiate these assets, though detailed supply parameters require further investigation.

📌 Historical Pattern: Supply mechanism design can influence price cycles through scarcity dynamics and distribution schedules, though specific historical patterns for these tokens were not detailed in the provided materials.

Institutional Adoption and Market Application

-

Institutional Holdings: The reference materials do not provide comparative data on institutional preference between PENG and ZIL.

-

Enterprise Adoption: Limited information is available regarding the comparative application of PENG or ZIL in cross-border payments, settlement systems, or investment portfolios.

-

National Policies: The materials do not contain specific information about regulatory attitudes toward these two assets across different jurisdictions.

Technological Development and Ecosystem Building

According to the reference materials, both projects' investment value is influenced by technological development and ecosystem construction. Community engagement and ecosystem growth appear as relevant factors for value assessment. However, specific technical upgrades, their content, and potential impacts for either PENG or ZIL are not detailed in the provided materials.

- Ecosystem Comparison: The materials do not provide detailed comparative analysis of DeFi integration, NFT functionality, payment applications, or smart contract implementation between these two projects.

Macroeconomic Environment and Market Cycles

-

Performance in Inflationary Environments: The reference materials do not contain comparative analysis of anti-inflation properties for PENG versus ZIL.

-

Macroeconomic Monetary Policy: The materials note that macroeconomic trends represent a core factor affecting investment value, though specific impacts of interest rates or dollar index movements on these particular assets are not detailed.

-

Geopolitical Factors: While cross-border transaction demand and international situations may influence cryptocurrency markets generally, specific impacts on PENG and ZIL are not addressed in the provided materials.

Investment decisions should consider inherent risks and market dynamics for both assets. The reference materials emphasize that structural risks, market adoption, and technological development represent key considerations, though comprehensive comparative data between PENG and ZIL remains limited in the available documentation.

III. 2026-2031 Price Prediction: PENG vs ZIL

Short-term Forecast (2026)

- PENG: Conservative $0.0029358 - $0.003262 | Optimistic $0.003262 - $0.00355558

- ZIL: Conservative $0.0030774 - $0.00446 | Optimistic $0.00446 - $0.0053966

Mid-term Forecast (2028-2029)

- PENG may enter a gradual recovery phase, with projected price range of $0.003556731486 - $0.0041886188883

- ZIL may enter an expansion phase, with projected price range of $0.00587995473 - $0.00903179231955

- Key drivers: institutional capital inflows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- PENG: Baseline scenario $0.003307457581428 - $0.0040334848554 | Optimistic scenario $0.005888887888884 - $0.007193720239605

- ZIL: Baseline scenario $0.004729788605792 - $0.008016590857275 | Optimistic scenario $0.011062895383039 - $0.013832627524228

Disclaimer

PENG:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00355558 | 0.003262 | 0.0029358 | -5 |

| 2027 | 0.0041587238 | 0.00340879 | 0.0019089224 | -1 |

| 2028 | 0.003972944745 | 0.0037837569 | 0.003556731486 | 9 |

| 2029 | 0.0041886188883 | 0.0038783508225 | 0.003684433281375 | 11 |

| 2030 | 0.005888887888884 | 0.0040334848554 | 0.003307457581428 | 16 |

| 2031 | 0.007193720239605 | 0.004961186372142 | 0.004365844007484 | 43 |

ZIL:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0053966 | 0.00446 | 0.0030774 | 0 |

| 2027 | 0.007195318 | 0.0049283 | 0.00295698 | 11 |

| 2028 | 0.00794096979 | 0.006061809 | 0.00587995473 | 37 |

| 2029 | 0.00903179231955 | 0.007001389395 | 0.00581115319785 | 58 |

| 2030 | 0.011062895383039 | 0.008016590857275 | 0.004729788605792 | 81 |

| 2031 | 0.013832627524228 | 0.009539743120157 | 0.008776563670544 | 115 |

IV. Investment Strategy Comparison: PENG vs ZIL

Long-term vs Short-term Investment Strategies

-

PENG: May appeal to investors with higher risk tolerance who focus on speculative opportunities and community-driven narratives. The token's reliance on social engagement suggests it may attract those interested in momentum-based trading strategies.

-

ZIL: May suit investors interested in established blockchain infrastructure and ecosystem development. With a longer operating history since 2018 and broader market recognition, it may attract those seeking exposure to utility-focused blockchain platforms.

Risk Management and Asset Allocation

- Conservative Investors: PENG 5-10% vs ZIL 90-95%

- Aggressive Investors: PENG 20-30% vs ZIL 70-80%

- Hedging Tools: Stablecoin allocation, options strategies, cross-asset portfolio diversification

Asset allocation should be adjusted based on individual risk profiles, market conditions, and investment timeframes. Both assets exhibit volatility characteristics typical of cryptocurrency markets.

V. Potential Risk Comparison

Market Risk

-

PENG: Exhibits substantial price volatility with a decline of approximately 99.8% from its peak. Lower market cap ranking at 3353 and limited trading volume ($40,341.60 in 24 hours) may result in liquidity constraints and price sensitivity to market movements.

-

ZIL: While holding a higher market cap ranking at 318 with greater trading volume ($1,027,566.71 in 24 hours), it has experienced significant price fluctuations across market cycles. Market sentiment remains at extreme fear levels (Fear & Greed Index: 9), indicating broader market uncertainty.

Technical Risk

-

PENG: Structural concerns include potential concentration risks and questions regarding inherent utility beyond social engagement. Limited information available regarding technical infrastructure and development roadmap.

-

ZIL: As a blockchain platform utilizing sharding technology, technical considerations may include network scalability implementation, validator distribution, and potential security considerations inherent in complex technical architectures.

Regulatory Risk

Both assets operate within the evolving global regulatory landscape for digital assets. Regulatory developments across jurisdictions may impact trading availability, compliance requirements, and market access. The differentiated nature of these assets (meme-inspired token versus infrastructure platform) may result in varying regulatory considerations.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

PENG Characteristics: Represents a speculative asset with community-driven dynamics. Current low price point and meme-token positioning may attract traders focused on volatility-based opportunities, though structural risks and limited utility present significant considerations.

-

ZIL Characteristics: Offers exposure to blockchain infrastructure development with established market presence since 2018. Higher market cap ranking and trading volume suggest greater liquidity, though historical price volatility and market cycle sensitivity remain relevant factors.

✅ Investment Considerations:

-

New Investors: May consider starting with smaller positions in more established assets while building understanding of cryptocurrency market dynamics and risk factors. Comprehensive research and risk assessment should precede any investment decision.

-

Experienced Investors: May evaluate both assets based on portfolio diversification objectives, risk tolerance levels, and market cycle positioning. Consideration of historical performance patterns, market structure, and ecosystem development trajectories remains relevant.

-

Institutional Investors: Should conduct thorough due diligence regarding liquidity profiles, regulatory compliance frameworks, and technical infrastructure. Assessment of counterparty risks, custody solutions, and portfolio integration strategies represents standard institutional practice.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate substantial volatility. This analysis does not constitute investment advice. Market conditions, regulatory environments, and project developments may change rapidly. Investors should conduct independent research and consider consulting qualified financial professionals before making investment decisions.

VII. FAQ

Q1: What is the fundamental difference between PENG and ZIL as crypto assets?

PENG is a meme-inspired token launched in 2024 with primary reliance on social engagement and speculative activity, while ZIL is an established blockchain infrastructure platform utilizing sharding technology since 2018. PENG operates with a circulating supply of 100 million tokens and a market cap of approximately $346,800 (ranking 3353), positioning itself as a community-driven speculative asset without detailed inherent utility. In contrast, ZIL maintains approximately 19.91 billion tokens in circulation with a market cap around $88 million (ranking 318), representing a high-throughput blockchain ecosystem designed for scalable decentralized applications. The fundamental distinction lies in their value propositions: PENG derives value primarily from community sentiment and trading momentum, whereas ZIL's value proposition centers on technological infrastructure and ecosystem development.

Q2: How do the historical price performances of PENG and ZIL compare?

Both assets have experienced significant downturns from their respective peaks, though at different timeframes and magnitudes. PENG reached its all-time high of $1.2 on March 18, 2024, before declining approximately 99.8% to $0.0024 by February 5, 2026, currently trading at $0.003468. ZIL achieved its historical peak of $0.255376 on May 7, 2021, subsequently declining to a low of $0.00239616 on March 13, 2020, with current trading at $0.004421 as of February 6, 2026. The comparative analysis reveals that PENG's decline occurred within a compressed two-year period, while ZIL's price movements span multiple market cycles since 2018, demonstrating different volatility patterns and market maturity levels.

Q3: What are the projected price ranges for PENG and ZIL through 2031?

Short-term 2026 projections suggest PENG may trade between $0.0029358 - $0.00355558, while ZIL could range from $0.0030774 - $0.0053966. By 2028-2029, PENG's projected range extends to $0.003556731486 - $0.0041886188883, whereas ZIL may reach $0.00587995473 - $0.00903179231955, indicating potential expansion phases driven by institutional capital inflows and ecosystem growth. Long-term forecasts for 2030-2031 present baseline scenarios of $0.003307457581428 - $0.0040334848554 for PENG and $0.004729788605792 - $0.008016590857275 for ZIL. Optimistic scenarios project PENG at $0.005888887888884 - $0.007193720239605 and ZIL at $0.011062895383039 - $0.013832627524228. These projections reflect varying growth trajectories, with ZIL demonstrating potentially higher percentage gains based on ecosystem development assumptions.

Q4: What are the primary risks associated with investing in PENG versus ZIL?

PENG carries substantial market risk evidenced by its 99.8% decline from peak, limited trading volume of $40,341.60 in 24 hours, and lower liquidity due to its market cap ranking at 3353. Structural concerns include potential concentration risks and limited inherent utility beyond social engagement, with insufficient information regarding technical infrastructure. ZIL, while maintaining higher liquidity with $1,027,566.71 in 24-hour trading volume and ranking 318, faces technical risks associated with sharding implementation, validator distribution, and network scalability challenges. Both assets operate within evolving regulatory frameworks, though their differentiated nature (meme token versus infrastructure platform) may attract varying regulatory considerations. The current market sentiment index of 9 (Extreme Fear) indicates broader market uncertainty affecting both assets, with PENG exhibiting greater sensitivity to sentiment shifts due to its speculative positioning.

Q5: How should investors allocate between PENG and ZIL based on risk tolerance?

Conservative investors may consider allocating 5-10% to PENG and 90-95% to ZIL, prioritizing established infrastructure and ecosystem development over speculative positioning. Aggressive investors with higher risk tolerance might allocate 20-30% to PENG and 70-80% to ZIL, accepting greater volatility exposure for potential momentum-based opportunities. Asset allocation should incorporate hedging tools including stablecoin reserves, options strategies, and cross-asset portfolio diversification to mitigate cryptocurrency market volatility. New investors should start with smaller positions in more established assets while building market understanding, whereas experienced investors may evaluate both assets based on portfolio diversification objectives and market cycle positioning. Institutional investors require thorough due diligence regarding liquidity profiles, regulatory compliance frameworks, and custody solutions before implementing allocation strategies.

Q6: What factors could influence the future performance of PENG and ZIL?

PENG's future performance depends heavily on sustained community engagement, social media momentum, and speculative trading activity, with limited visibility into technological development or ecosystem expansion plans. Market sentiment shifts and broader meme-token sector trends represent primary drivers for PENG. ZIL's performance trajectory relates to blockchain infrastructure adoption, sharding technology implementation success, DeFi integration depth, and smart contract ecosystem growth. Macroeconomic factors including institutional capital inflows, ETF developments, monetary policy changes, and regulatory clarity will impact both assets, though with different sensitivities. ZIL may benefit more from enterprise adoption trends and technological validation, while PENG remains more susceptible to community sentiment fluctuations and speculative capital movements within cryptocurrency markets.

Q7: Which asset offers better liquidity and trading accessibility?

ZIL demonstrates superior liquidity characteristics with 24-hour trading volume of $1,027,566.71 compared to PENG's $40,341.60, representing approximately 25 times greater trading activity. The market cap differential ($88 million for ZIL versus $346,800 for PENG) further emphasizes ZIL's established market presence and trading depth. Higher liquidity typically results in tighter bid-ask spreads, reduced slippage on larger orders, and improved price discovery mechanisms. PENG's limited trading volume may create challenges for investors seeking to execute substantial positions without significant price impact. ZIL's ranking at 318 versus PENG's 3353 suggests broader exchange availability and integration into various trading platforms, potentially offering investors greater accessibility and flexibility in portfolio management operations.

Q8: What investment strategy best suits each asset?

PENG may align with short-term trading strategies focused on volatility-based opportunities, momentum trading, and speculative positioning within the meme-token sector. Investors considering PENG should maintain strict risk management protocols, including position sizing limits and stop-loss disciplines, due to its substantial price volatility and structural uncertainties. ZIL may suit longer-term investment strategies emphasizing blockchain infrastructure development, ecosystem growth participation, and utility-focused positioning. Strategic considerations for ZIL include monitoring network development milestones, validator economics, and ecosystem application growth. Both assets require continuous evaluation of market conditions, regulatory developments, and project-specific factors. Portfolio integration should reflect individual risk profiles, with PENG representing higher-risk speculative allocation and ZIL offering exposure to established blockchain infrastructure, though both maintain significant cryptocurrency market volatility characteristics requiring comprehensive risk assessment.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is MASA: A Comprehensive Guide to the Multi-Agent System Architecture

What is WBAI: A Comprehensive Guide to Understanding Weighted Bias and Artificial Intelligence Applications

What is HARD: Understanding the Challenges of Achieving Excellence in Modern Work Environments

What is NC: A Comprehensive Guide to Numerical Control Technology in Modern Manufacturing

What is ANLOG: A Comprehensive Guide to Analog Signal Processing and Its Modern Applications