ROUTE vs MANA: A Comprehensive Comparison of Two Leading Blockchain Routing Protocols in Decentralized Networks

Introduction: Investment Comparison Between ROUTE and MANA

In the cryptocurrency market, the comparison between ROUTE vs MANA remains a topic investors cannot overlook. Both exhibit notable differences in market cap ranking, application scenarios, and price performance, representing distinct crypto asset positioning.

ROUTE (Router Protocol): Launched in 2024, it has gained market recognition as a chain abstraction protocol enabling seamless cross-chain transfers and messaging in a secure, decentralized environment.

MANA (Decentraland): Since its inception in 2017, it has been recognized as a blockchain-based virtual world platform, ranking among cryptocurrencies with substantial trading volume and established market presence.

This article will comprehensively analyze the investment value comparison of ROUTE vs MANA through historical price trends, supply mechanisms, technical ecosystems, and future outlook, attempting to address the question investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

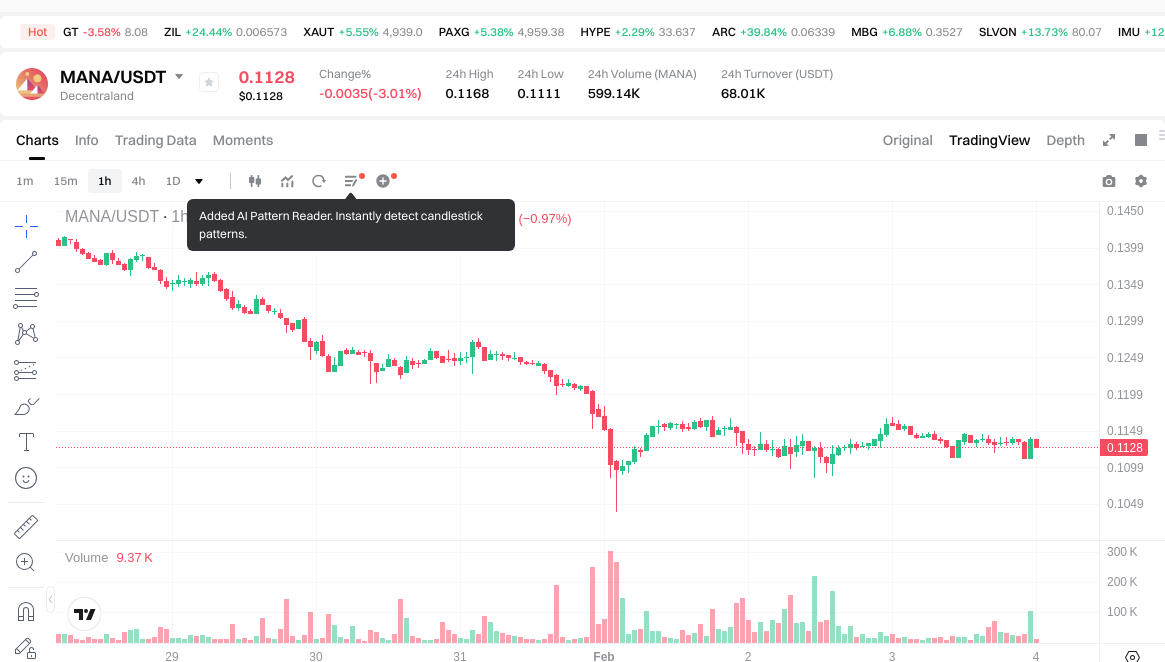

ROUTE (Router Protocol) and MANA (Decentraland) Historical Price Trends

- 2024: ROUTE experienced notable volatility, reaching a historical high of $0.08108 in November 2024, followed by a substantial decline.

- 2021: MANA witnessed its price peak at $5.85 in November 2021, driven by increased interest in metaverse-related projects.

- 2017: MANA's historical low of $0.00923681 was recorded in October 2017, during its early market entry phase.

- 2026: ROUTE recorded a historical low of $0.0013 in February 2026, reflecting significant downward pressure.

- Comparative analysis: During the recent market cycle, ROUTE declined from its historical high of $0.08108 to a low of $0.0013, representing a decline of approximately 98.40%. MANA, meanwhile, dropped from its peak of $5.85 to current levels around $0.1135, marking a decrease of approximately 98.06% from its all-time high.

Current Market Status (February 4, 2026)

- ROUTE current price: $0.001391

- MANA current price: $0.1135

- 24-hour trading volume: ROUTE recorded $28,213.43, while MANA achieved $65,953.79

- Market sentiment index (Fear & Greed Index): 17 (Extreme Fear)

- ROUTE showed a 24-hour price change of 2.78%, while MANA experienced a decline of 1.89%

- ROUTE's market capitalization stands at $902,396.16, compared to MANA's $217,816,074.20

View real-time prices:

- Check ROUTE current price Market Price

- Check MANA current price Market Price

II. Core Factors Influencing ROUTE vs MANA Investment Value

Supply Mechanism Comparison (Tokenomics)

- ROUTE: The investment value is influenced by supply mechanism factors, with market performance and tokenomics serving as key determinants for potential investment opportunities.

- MANA: Investment considerations involve supply dynamics and economic security factors that may affect valuation.

- 📌 Historical Pattern: Supply mechanisms have been observed to influence price cycle variations, with conservative valuation approaches often presenting investment opportunities in market conditions.

Institutional Adoption and Market Application

- Institutional Holdings: Available data suggests institutional interest varies based on supply mechanisms and market performance metrics.

- Enterprise Adoption: Applications in various financial scenarios may be influenced by credit risk ratings and related factors that affect adoption decisions.

- National Policies: Regulatory considerations and policy frameworks represent factors that stakeholders evaluate when making investment decisions.

Technical Development and Ecosystem Building

- ROUTE Technical Development: The innovative navigation system represents a factor that may influence investment considerations, though specific technical upgrade details require further evaluation.

- MANA Technical Development: Color combination functionality in specific applications represents a technical characteristic, with importance varying based on use case contexts.

- Ecosystem Comparison: DeFi, NFT, payment systems, and smart contract implementations represent areas where ecosystem development may occur, subject to market conditions and adoption trends.

Macroeconomic Environment and Market Cycles

- Inflation Environment Performance: Asset performance characteristics in various economic conditions remain subject to multiple macroeconomic factors and market dynamics.

- Macroeconomic Monetary Policy: Interest rates and currency index movements represent external factors that may influence digital asset valuations.

- Geopolitical Factors: Cross-border transaction requirements and international developments may present considerations for market participants evaluating different assets.

III. 2026-2031 Price Forecast: ROUTE vs MANA

Short-term Forecast (2026)

- ROUTE: Conservative $0.00124488 - $0.001368 | Optimistic $0.001368 - $0.00172368

- MANA: Conservative $0.097008 - $0.1128 | Optimistic $0.1128 - $0.165816

Medium-term Forecast (2028-2029)

- ROUTE may enter a gradual accumulation phase, with estimated price range of $0.00113155488 - $0.002791168704 in 2028, potentially expanding to $0.00184745193408 - $0.0033908927904 by 2029

- MANA may enter a moderate expansion phase, with estimated price range of $0.10657062 - $0.1534616928 in 2028, potentially reaching $0.107877886272 - $0.165511277568 by 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2031)

- ROUTE: Baseline scenario $0.002877324538193 - $0.003093897352896 | Optimistic scenario $0.003093897352896 - $0.003465165035243

- MANA: Baseline scenario $0.142327285362662 - $0.18484063034112 | Optimistic scenario $0.18484063034112 - $0.21626353749911

Disclaimer

ROUTE:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00172368 | 0.001368 | 0.00124488 | -1 |

| 2027 | 0.0022260096 | 0.00154584 | 0.0010357128 | 11 |

| 2028 | 0.002791168704 | 0.0018859248 | 0.00113155488 | 35 |

| 2029 | 0.0033908927904 | 0.002338546752 | 0.00184745193408 | 68 |

| 2030 | 0.003323074934592 | 0.0028647197712 | 0.002664189387216 | 105 |

| 2031 | 0.003465165035243 | 0.003093897352896 | 0.002877324538193 | 122 |

MANA:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.165816 | 0.1128 | 0.097008 | 0 |

| 2027 | 0.14488032 | 0.139308 | 0.10587408 | 22 |

| 2028 | 0.1534616928 | 0.14209416 | 0.10657062 | 25 |

| 2029 | 0.165511277568 | 0.1477779264 | 0.107877886272 | 30 |

| 2030 | 0.21303665869824 | 0.156644601984 | 0.13784724974592 | 38 |

| 2031 | 0.21626353749911 | 0.18484063034112 | 0.142327285362662 | 62 |

IV. Investment Strategy Comparison: ROUTE vs MANA

Long-term vs Short-term Investment Strategies

- ROUTE: May suit investors focused on cross-chain infrastructure development and emerging protocol opportunities, with considerations for higher volatility tolerance

- MANA: May suit investors interested in metaverse applications and established market presence, with attention to virtual world platform adoption trends

Risk Management and Asset Allocation

- Conservative investors: ROUTE 15-20% vs MANA 30-40%

- Aggressive investors: ROUTE 35-45% vs MANA 25-35%

- Hedging instruments: stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risks

- ROUTE: Limited trading volume of $28,213.43 may present liquidity considerations, with market capitalization of $902,396.16 indicating smaller market presence

- MANA: Price declined approximately 98.06% from historical peak, with current trading at $0.1135 reflecting extended market correction phase

Technical Risks

- ROUTE: Scalability considerations and network stability factors require ongoing evaluation

- MANA: Platform adoption rates and technical infrastructure development represent areas for continued assessment

Regulatory Risks

- Global regulatory frameworks may affect both assets differently based on their respective use cases, with cross-chain protocols and virtual world platforms facing distinct policy considerations across jurisdictions

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ROUTE advantages: Cross-chain protocol positioning with potential for infrastructure development, though accompanied by considerations regarding market capitalization scale and trading volume levels

- MANA advantages: Established market presence since 2017 with metaverse application focus, representing a more mature project with broader recognition, though facing considerations related to distance from historical price peaks

✅ Investment Recommendations:

- Novice investors: Consider established assets with broader market recognition and liquidity profiles, with allocation decisions based on individual risk tolerance and research

- Experienced investors: Evaluate portfolio diversification opportunities across different market segments, with attention to technical development trajectories and adoption metrics

- Institutional investors: Assess liquidity requirements, regulatory compliance frameworks, and strategic positioning within broader digital asset allocation strategies

⚠️ Risk Disclaimer: The cryptocurrency market exhibits substantial volatility characteristics. This content does not constitute investment advice.

VII. FAQ

Q1: What are the main differences in supply mechanisms between ROUTE and MANA?

ROUTE and MANA exhibit distinct tokenomics structures that influence their investment characteristics. ROUTE operates as a cross-chain protocol token with supply dynamics tied to infrastructure development and network utility requirements. MANA functions within the Decentraland ecosystem with supply mechanisms designed to support virtual world transactions and platform governance. Both assets' valuations are influenced by their respective supply frameworks, though specific circulation details and emission schedules represent key factors that investors should evaluate when comparing these assets. Historical patterns suggest that supply mechanisms have demonstrated correlation with price cycle variations across different market conditions.

Q2: How do current market capitalizations reflect the maturity levels of ROUTE vs MANA?

As of February 4, 2026, ROUTE maintains a market capitalization of $902,396.16, while MANA stands at $217,816,074.20, representing approximately a 241x difference in market size. MANA's substantially larger market cap reflects its establishment since 2017 and broader market recognition within the metaverse sector. ROUTE's smaller capitalization, combined with its 2024 launch, positions it as an emerging protocol with higher growth potential but correspondingly elevated risk profile. The trading volume disparity ($28,213.43 for ROUTE vs $65,953.79 for MANA) further illustrates differences in market liquidity and investor participation levels.

Q3: What price performance should investors expect from ROUTE and MANA through 2031?

Price forecasts suggest divergent trajectories for both assets. ROUTE projections indicate conservative 2026 estimates of $0.00124488-$0.001368, potentially reaching $0.002877324538193-$0.003093897352896 by 2031 under baseline scenarios, representing approximately 122% cumulative growth from 2026 levels. MANA forecasts suggest 2026 ranges of $0.097008-$0.1128, with 2031 baseline estimates of $0.142327285362662-$0.18484063034112, indicating approximately 62% growth potential. These projections assume continued ecosystem development, institutional adoption trends, and favorable macroeconomic conditions, though actual performance may vary significantly based on market dynamics and adoption rates.

Q4: Which asset better suits investors with different risk tolerances?

Risk profile considerations differ substantially between ROUTE and MANA. Conservative investors may find MANA's established market presence, larger market capitalization, and seven-year operational history more aligned with risk-averse strategies, potentially allocating 30-40% within diversified crypto portfolios. ROUTE may suit aggressive investors comfortable with emerging protocol risk and higher volatility, with suggested allocations of 35-45% for those seeking exposure to cross-chain infrastructure development. Conservative investors considering ROUTE should limit exposure to 15-20% given liquidity considerations and smaller market capitalization. Both allocations should incorporate stablecoin hedging and portfolio diversification strategies.

Q5: What are the primary technical development factors distinguishing ROUTE from MANA?

ROUTE's technical positioning centers on cross-chain interoperability infrastructure, enabling seamless asset transfers and messaging across blockchain networks in decentralized environments. This positions ROUTE within the blockchain infrastructure layer with dependency on cross-chain adoption trends and interoperability demand growth. MANA's technical framework supports virtual world platform functionality, including digital land ownership, NFT integration, and metaverse application development. The technical ecosystems differ fundamentally—ROUTE focusing on protocol-level infrastructure versus MANA's application-layer platform services. Investors should evaluate which technical thesis aligns with their conviction regarding future blockchain adoption patterns.

Q6: How do current market conditions affect the investment outlook for ROUTE vs MANA?

The current market sentiment index of 17 (Extreme Fear) suggests depressed conditions that historically have preceded accumulation phases. ROUTE's 98.40% decline from its November 2024 high of $0.08108 and MANA's 98.06% decline from its November 2021 peak of $5.85 indicate both assets have experienced substantial corrections. Such extreme drawdowns may represent potential value opportunities for long-term investors, though downside risks persist in sustained bear market conditions. The 24-hour price movements (ROUTE +2.78%, MANA -1.89%) demonstrate ongoing volatility, while limited trading volumes suggest reduced market participation that could affect liquidity during position entry or exit.

Q7: What regulatory considerations should investors evaluate when comparing ROUTE and MANA?

Regulatory frameworks may affect ROUTE and MANA differently based on their distinct use cases. ROUTE's cross-chain protocol functionality may face regulatory scrutiny related to interoperability standards, cross-border transaction compliance, and decentralized infrastructure classification across various jurisdictions. MANA's virtual world platform positioning may encounter regulations concerning digital property rights, virtual asset taxation, metaverse content governance, and platform liability frameworks. Both assets operate in evolving regulatory environments where policy developments could materially impact adoption trajectories and market valuations. Investors should monitor jurisdiction-specific regulations and compliance requirements that may affect their holdings.

Q8: What liquidity factors should investors consider when choosing between ROUTE and MANA?

Liquidity profiles differ significantly between these assets. ROUTE's 24-hour trading volume of $28,213.43 indicates limited market depth, potentially resulting in higher slippage during order execution and difficulty entering or exiting large positions without price impact. MANA's $65,953.79 daily volume, while modest in absolute terms, represents approximately 2.3x greater liquidity than ROUTE. Institutional investors requiring substantial position sizes should carefully evaluate liquidity constraints, particularly for ROUTE, where smaller market capitalization and trading volume may limit allocation capacity. Market makers, exchange listings, and trading pair availability represent additional liquidity considerations that may affect execution quality and portfolio management flexibility.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Understanding PoS in Cryptocurrency: A Beginner’s Guide to Proof-of-Stake

What is crypto? How do you explain digital currencies to a young child?

What is MENGO: Understanding the Grassroots Organization Empowering Communities in Uganda

What is SDN: A Comprehensive Guide to Software-Defined Networking Architecture and Implementation

Top 11 Leading Exchanges for Traders