What is SDN: A Comprehensive Guide to Software-Defined Networking Architecture and Implementation

Shiden Network's Positioning and Significance

In 2021, the team behind Plasm Network launched Shiden Network (SDN), designed to address the lack of smart contract functionality on Kusama's relay chain and the need for a versatile multi-chain dApp layer.

As a multi-chain decentralized application layer on Kusama Network, Shiden Network plays a key role in DeFi, NFTs, and cross-chain interoperability.

As of 2026, Shiden Network has established itself within the Kusama ecosystem, with an active development community and support for Ethereum Virtual Machine, WebAssembly, and Layer2 solutions.

This article will provide an in-depth analysis of its technical architecture, market performance, and future potential.

Origin and Development History

Birth Background

Shiden Network was created by the Plasm Network team in 2021, aiming to solve the absence of smart contract capabilities on Kusama's relay chain and enable diverse blockchain applications.

It emerged during the rapid expansion of the Polkadot and Kusama ecosystems, with the goal of providing a comprehensive smart contract platform that bridges multiple blockchains.

Shiden Network's launch brought new possibilities for developers and users seeking to build decentralized applications on Kusama.

Important Milestones

- 2021: Mainnet launch, achieving multi-chain support with EVM and WebAssembly compatibility from inception.

- 2021: PLM token holders were able to claim SDN tokens at a 1:1 ratio, establishing the initial token distribution.

- The network has continuously evolved its Layer2 solutions and cross-chain bridge capabilities to enhance performance and interoperability.

With support from the Astar Network foundation and the broader Kusama community, Shiden Network continues to optimize its technology, security, and real-world applications.

How Does Shiden Network Operate?

No Central Control

Shiden Network operates on a decentralized network of computers (nodes) distributed globally, free from control by banks or governments.

These nodes collaborate to validate transactions, ensuring system transparency and attack resistance, granting users greater autonomy and enhancing network resilience.

Blockchain Foundation

Shiden Network's blockchain is a public, immutable digital ledger that records every transaction.

Transactions are grouped into blocks and linked through cryptographic hashes to form a secure chain.

Anyone can view the records, establishing trust without intermediaries.

The platform's support for multiple virtual machines (EVM and WebAssembly) and Layer2 scaling solutions further enhances performance and flexibility.

Ensuring Fairness

Shiden Network utilizes Nominated Proof of Stake (NPoS) to validate transactions and prevent fraudulent activities such as double-spending.

Validators and nominators secure the network through staking SDN tokens and participating in consensus, earning SDN rewards for their contributions.

Its innovations include efficient cross-chain communication and compatibility with diverse blockchain standards.

Secure Transactions

Shiden Network employs public-private key cryptography to protect transactions:

- Private keys (similar to secret passwords) are used to sign transactions

- Public keys (similar to account numbers) are used to verify ownership

This mechanism ensures fund security while transactions maintain pseudonymity.

The network's multi-chain architecture and bridge protocols provide additional layers of security and interoperability.

ShidenNetwork (SDN) Market Performance

Circulation Overview

As of February 04, 2026, ShidenNetwork (SDN) has a circulating supply of 68,221,993.91 tokens, with a total supply of 87,519,207.77 SDN. The token follows an inflationary model with unlimited maximum supply.

SDN tokens enter the market through a distribution mechanism where PLM token holders from Plasm Network can claim SDN tokens at a 1:1 ratio. This distribution method impacts the supply-demand dynamics of the token ecosystem.

The current circulating supply represents approximately 83.67% of the total supply, indicating substantial token availability in the market.

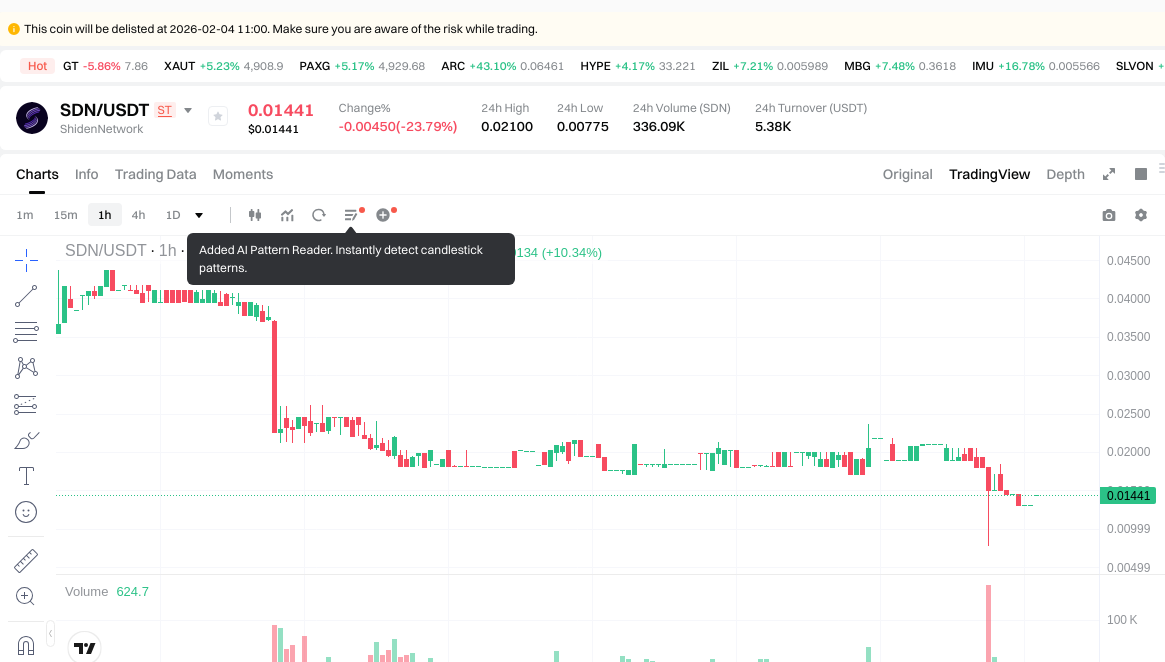

Price Fluctuations

ShidenNetwork (SDN) reached its all-time high of $8.36 on September 12, 2021, driven by strong market momentum during the broader crypto bull market and growing interest in Kusama parachain projects.

The token experienced its lowest price of $0.01412926 on February 03, 2026, influenced by extended market downtrend conditions and sector-wide price corrections.

These fluctuations reflect market sentiment shifts, adoption patterns, and broader cryptocurrency market dynamics. The token has experienced substantial price volatility, with recent performance showing a -23.79% change over 24 hours, -56.52% over 7 days, and -85.86% over the past year.

Click to view current SDN market price

On-chain Metrics

- Holder Count: Approximately 13,108 addresses (indicating user distribution and network participation)

- Market Capitalization: $890,979.24 with a fully diluted valuation of $1,143,000.85 (reflecting market valuation metrics)

- Trading Volume: $5,389.49 over 24 hours (demonstrating current market activity levels)

ShidenNetwork Ecosystem Applications and Partners

Core Use Cases

ShidenNetwork's ecosystem supports multiple applications:

- DeFi: Various decentralized finance protocols provide decentralized trading and liquidity solutions.

- NFT: Digital collectible platforms drive innovation in non-fungible token marketplaces.

Strategic Partnerships

ShidenNetwork operates as a multi-chain decentralized application layer on Kusama Network, serving as the canary network for Plasm Network. These foundational relationships provide a solid base for ShidenNetwork's ecosystem expansion.

Controversies and Challenges

ShidenNetwork faces the following challenges:

- Technical Hurdles: The network continues to optimize its support for Ethereum Virtual Machine, WebAssembly, and Layer2 solutions.

- Competition Pressure: Other blockchain platforms offering similar smart contract capabilities.

These issues have sparked discussions within the community and market, driving ShidenNetwork's continuous innovation.

ShidenNetwork Community and Social Media Atmosphere

Community Engagement

ShidenNetwork's community demonstrates solid activity, with 13,108 token holders. On X platform, relevant posts and hashtags frequently appear in discussions.

Social Media Sentiment

Sentiment on X presents varied perspectives:

- Supporters praise ShidenNetwork's multi-chain capabilities and smart contract flexibility, recognizing it as an important infrastructure layer for Kusama.

- Critics focus on price volatility and market challenges.

Trending Topics

X users actively discuss ShidenNetwork's technical development, ecosystem growth, and market performance, showcasing both its transformative potential and the obstacles on the path to mainstream adoption.

ShidenNetwork Additional Information Sources

- Official Website: Visit ShidenNetwork official website for features, use cases, and latest updates.

- Documentation: ShidenNetwork documentation provides detailed technical architecture and development guides.

- X Updates: ShidenNetwork maintains an active presence on X platform using @ShidenNetwork, with posts covering technical upgrades, community activities, and ecosystem developments.

ShidenNetwork Future Roadmap

- Ongoing Development: Continuous enhancement of EVM, WebAssembly, and Layer2 solution support, improving network performance and functionality

- Ecosystem Goals: Expanding the multi-chain decentralized application layer

- Long-term Vision: Becoming a key smart contract platform within the Kusama ecosystem

How to Participate in ShidenNetwork?

- Purchase Options: Acquire SDN on Gate.com and other supporting exchanges

- Storage Solutions: Use compatible wallets to securely store your tokens

- Participate in Governance: Engage with the community through official channels

- Build on the Ecosystem: Visit the developer documentation to develop DApps or contribute code

Summary

ShidenNetwork redefines decentralized applications through blockchain technology, providing multi-chain compatibility, smart contract flexibility, and Layer2 scalability. Its active community, comprehensive resources, and position within the Kusama ecosystem make it distinctive in the cryptocurrency space. Despite facing market volatility and competitive pressures, ShidenNetwork's innovative approach and clear development direction position it importantly in the future of decentralized technology. Whether you are a newcomer or an experienced participant, ShidenNetwork merits attention and engagement.

FAQ

What is Crypto SDN? How does it differ from traditional SDN?

Crypto SDN integrates cryptographic security into software-defined networks, enabling encrypted data transmission and enhanced network control. Unlike traditional SDN, it prioritizes cryptographic protection, decentralization, and blockchain-based verification, offering superior security for distributed systems and Web3 infrastructure.

What is the core technical principle of Crypto SDN? How does it combine cryptography and software-defined networking?

Crypto SDN integrates cryptographic protocols with SDN architecture by separating control and data planes with encryption. It uses advanced cryptography to secure controller-switch communications and network policy implementation, enabling programmable, encrypted, and secure network management with enhanced data protection and authentication mechanisms.

What are the practical application scenarios for Crypto SDN?

Crypto SDN enables dynamic resource allocation in data center networks, optimizes enterprise network management with flexible control, and enhances security through centralized architecture. It improves network efficiency and reduces operational costs in blockchain infrastructure.

What are the security advantages and potential risks of using Crypto SDN?

Security advantages: Enhanced network security through distributed control, dynamic routing, and reduced single-point failure risk. Potential risks: Blockchain dependency may introduce high costs, performance bottlenecks, and increased complexity in implementation and maintenance.

Crypto SDN在区块链网络中的作用是什么?

Crypto SDN通过分离控制和数据平面,提高网络管理灵活性和效率,简化规则管理,增强区块链网络的可编程性和扩展性。

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

TREAT vs ADA: Understanding the Key Differences Between Two Major Disability Rights Frameworks

TURBOS vs DOT: A Comprehensive Comparison of Two Rising Blockchain Platforms

Layer 1 and Layer 2 Blockchain Solutions: Understanding the Differences

How Web2.0 and Web3.0 Differ

How to Create an NFT and Maximize Your Profits When Selling