What is HTM: A Comprehensive Guide to Hierarchical Temporal Memory and Its Applications in Machine Learning

Hatom's Positioning and Significance

In 2023, the Hatom team launched Hatom (HTM), aiming to address fragmentation and accessibility challenges in the DeFi ecosystem. As a comprehensive DeFi infrastructure on MultiversX, Hatom plays a critical role in decentralized finance, lending protocols, and liquid staking.

As of 2026, Hatom has established itself as a key ecosystem player on MultiversX, with an active development community. This article will provide an in-depth analysis of its technical architecture, market performance, and future potential.

Origin and Development Journey

Background

Hatom was created by its development team in 2023, aiming to solve the lack of mature lending infrastructure and native stablecoin solutions on MultiversX. It emerged during the expansion of blockchain scalability solutions, with the goal of providing secure, transparent, and user-friendly DeFi services to transform the landscape. The launch of Hatom brought new possibilities to MultiversX blockchain users and DeFi participants.

Key Milestones

- 2023: Platform launch, establishing lending protocols and liquid staking services.

- 2023: Token listing on Gate.com, expanding market accessibility.

- Ongoing development of native stablecoin and additional enterprise solutions.

With support from its community and development team, Hatom continues to optimize its technology, security, and real-world applications.

How Hatom Works

Decentralized Architecture

Hatom operates on the MultiversX blockchain, a decentralized network of nodes distributed globally, independent of traditional financial institutions. These nodes collaborate to validate transactions, ensuring system transparency and attack resistance, empowering users with greater autonomy and enhancing network resilience.

Blockchain Foundation

Hatom's infrastructure leverages MultiversX's blockchain, a public, immutable digital ledger that records all protocol activities. Transactions are grouped into blocks and linked through cryptographic hashing to form a secure chain. Anyone can view records, establishing trust without intermediaries. MultiversX's technology enhances performance through advanced consensus mechanisms.

Security Mechanisms

Hatom builds on MultiversX's Secure Proof of Stake (SPoS) consensus mechanism, which ensures transaction validation and prevents fraudulent activities. Validators maintain network security through staking and node operation, receiving rewards for their contributions. The protocol emphasizes scalability and security within the MultiversX ecosystem.

Secure Protocol Design

Hatom implements cryptographic security measures inherent to the MultiversX blockchain:

- Private keys are used to authorize protocol interactions

- Public addresses verify ownership and transaction validity

This architecture ensures fund security while maintaining transparent on-chain operations. The protocol incorporates additional safety features through its lending and staking mechanisms.

Hatom's Market Performance

Circulation Overview

As of February 03, 2026, Hatom's circulating supply stands at 69,275,577 HTM tokens, with a total supply of 100,006,500 tokens and a maximum supply capped at 100,000,000 tokens. The circulating supply represents approximately 69.28% of the total supply, indicating a relatively high proportion of tokens already in circulation. The token distribution and issuance mechanism contribute to the supply-demand dynamics within the MultiversX ecosystem, where Hatom operates as a DeFi protocol offering lending, liquid staking, and stablecoin services.

Price Fluctuations

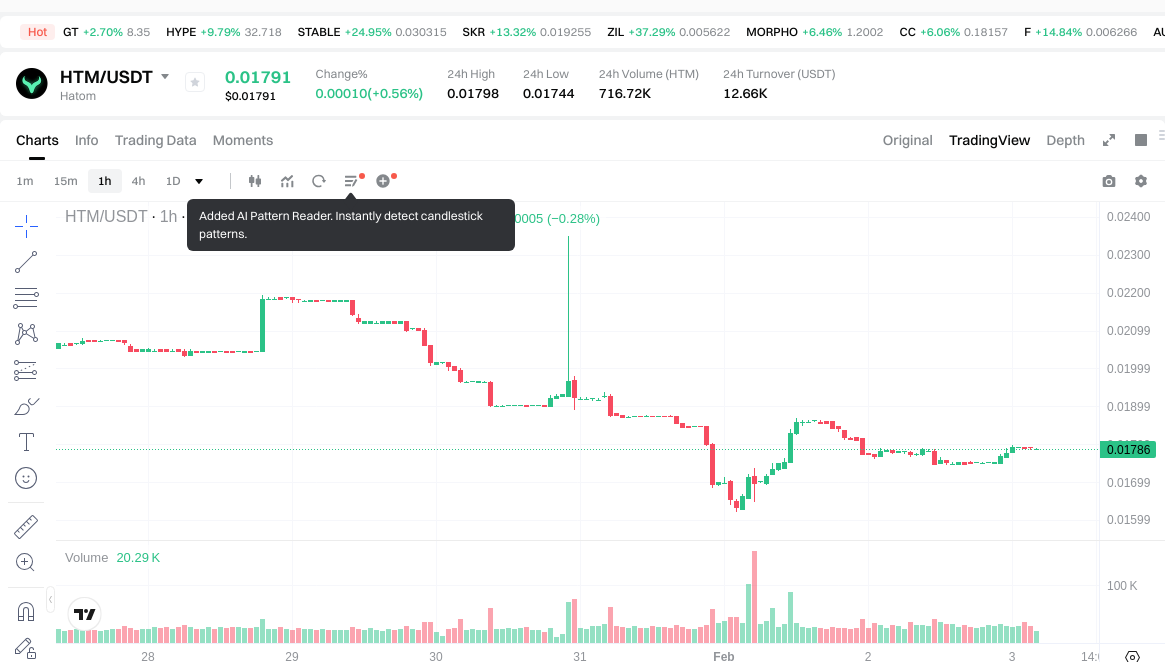

Hatom reached a notable price level of $3.788 on November 23, 2023, driven by market conditions and interest in DeFi protocols within the MultiversX blockchain ecosystem. The token experienced significant price movement, with its lowest recorded price of $0.01621 occurring on January 31, 2026, reflecting broader market corrections and shifting sentiment in the cryptocurrency sector.

Recent price trends show mixed performance across different timeframes:

- 1-hour change: -0.11%

- 24-hour change: +0.56%

- 7-day change: -13.059%

- 30-day change: -27.96%

- 1-year change: -97.25%

These fluctuations illustrate the volatility characteristic of cryptocurrency markets and reflect changing investor sentiment, market conditions, and adoption trends within the DeFi sector.

Click to view current HTM market price

On-Chain Metrics

- 24-hour trading volume: Approximately $12,643 (indicating current market activity levels)

- Market capitalization: $1,240,726 (representing the circulating token value)

- Fully diluted market cap: $1,791,116 (projecting total value at maximum supply)

Hatom Ecosystem Applications and Partners

Core Use Cases

Hatom's ecosystem supports multiple applications:

- DeFi: Lending Protocol, providing decentralized borrowing and lending services.

- Liquid Staking: Native staking solutions, driving enhanced yield opportunities and liquidity.

- Stablecoin: Native stablecoin infrastructure, enabling stable value exchange within the ecosystem.

Strategic Partnerships

Hatom operates within the MultiversX blockchain ecosystem, leveraging its technical infrastructure for scalability and security. These ecosystem relationships provide a solid foundation for Hatom's expansion.

Challenges

Hatom faces the following challenges:

- Market Competition: Pressure from other DeFi protocols across various blockchain platforms

- Price Volatility: Significant price fluctuations, with a decline of approximately 97.25% over the past year

- Market Adoption: Building user base and transaction volume in a competitive DeFi landscape

These issues have sparked discussions within the community and market, while also driving Hatom's continuous innovation.

Hatom Community and Social Media Atmosphere

Community Engagement

Hatom's community demonstrates activity through its presence on social platforms.

On X platform, related posts and hashtags (such as #HTM or #Hatom) engage with the DeFi community.

Factors such as protocol updates and DeFi market trends contribute to community discussions.

Social Media Sentiment

Sentiment on X shows varied perspectives:

- Supporters praise Hatom's DeFi infrastructure, transparency, and MultiversX integration, viewing it as a promising DeFi protocol.

- Critics focus on price performance and market competition.

Recent trends reflect the broader DeFi market conditions.

Popular Topics

X users discuss Hatom's DeFi positioning, protocol features, and market performance, showcasing both its innovation potential and challenges in achieving mainstream adoption.

Hatom Additional Information Sources

- Official Website: Visit Hatom Official Website for features, use cases, and latest updates.

- White Paper: Hatom White Paper details its technical architecture, objectives, and vision.

- X Updates: On X platform, Hatom uses @HatomProtocol for community engagement, posts cover protocol updates, DeFi developments, and ecosystem news.

Hatom Future Roadmap

- Ecosystem Goals: Expanding DeFi services and product offerings within the MultiversX ecosystem

- Long-term Vision: Establishing a comprehensive DeFi infrastructure on MultiversX

How to Participate in Hatom?

- Purchase Channels: Buy HTM on Gate.com

- Storage Solutions: Use compatible MultiversX wallets for secure storage

- Engage with Ecosystem: Explore lending, staking, and stablecoin services through the Hatom protocol

- Build Ecosystem: Visit GitHub and official documentation to contribute to development

Summary

Hatom through blockchain technology has established a DeFi ecosystem on MultiversX, providing lending protocols, liquid staking, and native stablecoin services. Its ecosystem focus, technical infrastructure, and DeFi offerings position it within the decentralized finance space. Despite facing market volatility and competitive pressures, Hatom's comprehensive product suite and ecosystem vision give it a role in MultiversX's DeFi future. Whether you are a newcomer or an experienced participant, Hatom presents opportunities for engagement in decentralized finance.

FAQ

What is HTM crypto and what problem does it solve?

HTM crypto is a decentralized finance token enabling lending, borrowing, and earning without intermediaries. It solves accessibility and flexibility issues in traditional finance by providing permissionless financial services to users globally.

How do I buy and store HTM tokens?

Create an account on a crypto exchange, purchase stablecoins like USDT, and swap them for HTM tokens. Store your HTM in a secure wallet or hardware wallet for safekeeping.

What is the total supply and tokenomics of HTM?

HTM has a total supply of 100,006,500 tokens with 69,275,577 currently circulating. The maximum supply is capped at this level, ensuring controlled token distribution and long-term value sustainability.

Is HTM a safe investment and what are the main risks?

HTM offers relative safety with proper fundamentals, but carries market volatility and liquidity risks. Main concerns include price fluctuation, regulatory changes, and low trading volume during market downturns.

How does HTM differ from other similar cryptocurrencies?

HTM focuses on decentralized finance within the MultiversX ecosystem, emphasizing scalability and interoperability. Unlike established cryptocurrencies, HTM offers enhanced flexibility and efficiency for DeFi applications, making it distinctly positioned for next-generation blockchain solutions.

What is the development roadmap and future plans for HTM?

HTM's roadmap prioritizes healthcare technology integration, enhanced patient care solutions, and regulatory compliance. Future plans include blockchain adoption, global expansion, ecosystem development, and strategic partnerships to advance decentralized healthcare infrastructure.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

How to Select a Cryptocurrency Exchange: Top 5 International Recommendations

Top 7 Bitcoin Mining Machines for Profitable Operations

Comprehensive Guide to Token Offerings

Trading Patterns: A Beginner’s Guide

What is a node in cryptocurrency and how do you set one up