Gate Stock Token Zone Explained: A Clear Definition of Product Boundaries for Tokenized Stock Price Services

Figure: https://www.gate.com/tokenized-stocks

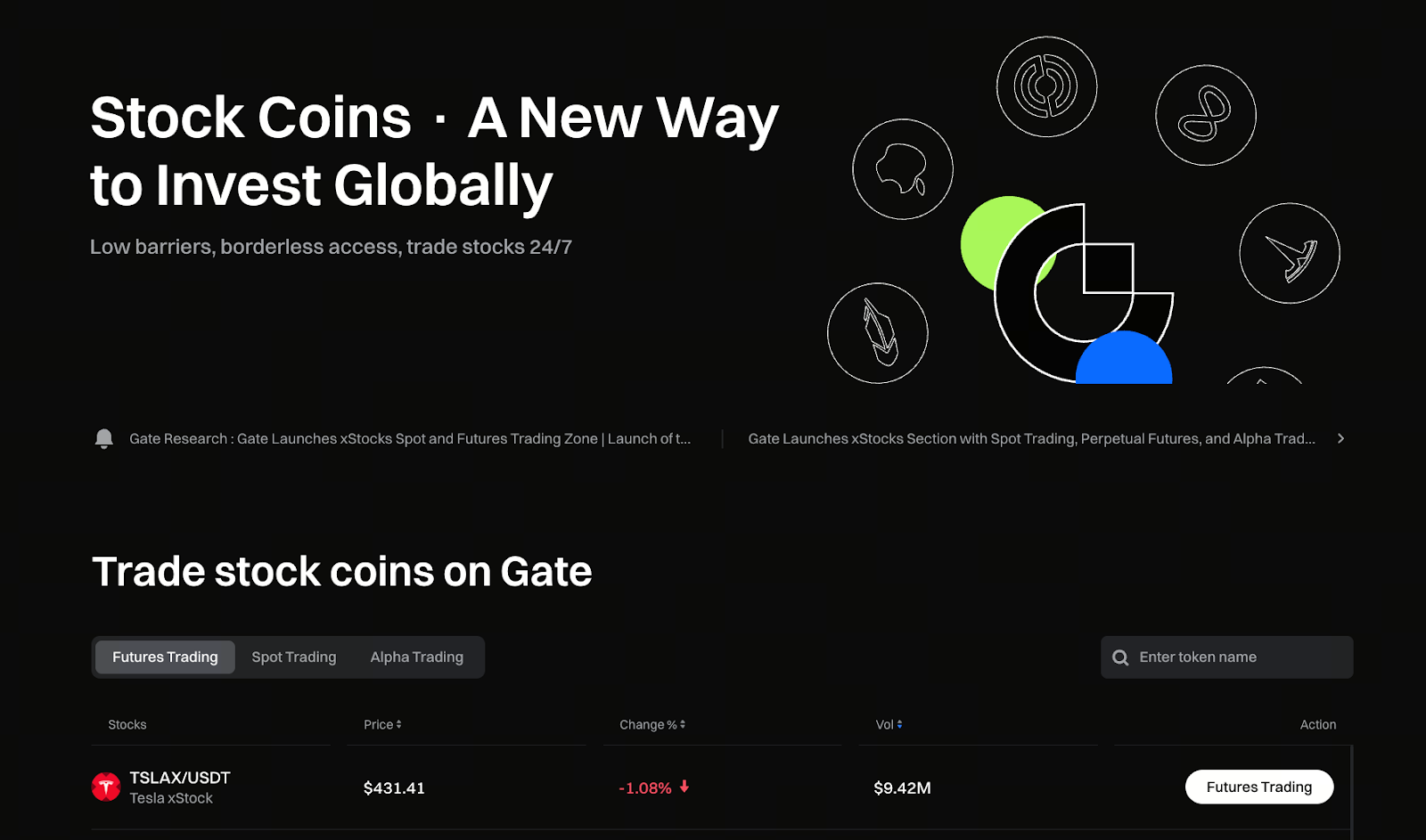

I. Overview of the Gate Tokenized Stocks Section

The Gate Tokenized Stocks section provides a service where select stock prices are tokenized, allowing users to track and engage with stock price movements as digital assets within a crypto trading environment. This feature enables users to participate in stock price fluctuations without direct exposure to the traditional securities market.

It’s important to note that the Gate Tokenized Stocks section does not offer physical or electronic stock custody. Users trade tokens that are linked to stock prices, not the actual stock itself. As a result, tokenized stocks are best used as tools for price tracking and market observation, rather than as traditional investment securities.

II. Price Correlation and Trading Logic for Tokenized Stocks

Tokenized stock prices generally track the price movements of their underlying stocks in traditional markets, aiming to mirror the direction and magnitude of those changes. However, since these tokens are traded in the digital asset market, their prices may also experience short-term volatility driven by trading volume, liquidity shifts, and market sentiment.

Within the Gate Tokenized Stocks section, trading follows standard digital asset protocols. Users can buy or sell tokens to engage with price changes, and the process is streamlined for ease of use. This approach reduces operational complexity, allowing users to monitor and respond to stock price volatility in a familiar trading environment.

III. Best Practices for Using Tokenized Stocks

Tokenized stocks are most effective as tools for participating in price movements. By tracking the price changes of tokenized stocks, users can observe how various stocks react to macroeconomic events, industry developments, or shifts in market sentiment—offering a clear, intuitive view of stock market dynamics.

Furthermore, the Gate Tokenized Stocks section is convenient for users who wish to monitor multiple asset classes on a single platform. This cross-market setup helps users develop a broader perspective on price trends, but is not primarily designed for long-term holding or value investing.

IV. Key Considerations Before Engaging with Gate Tokenized Stocks

While tokenized stocks make market participation more accessible, their inherent risks remain. Tokenized stock prices fluctuate with their underlying equities and may also be subject to broader digital asset market volatility, leading to potentially significant price swings in certain conditions.

Before trading in the Gate Tokenized Stocks section, users should understand that tokenized stocks are not the same as actual stocks—they do not confer shareholder rights, dividends, or governance privileges. Carefully managing trade size and assessing personal risk tolerance are critical prerequisites for participating in these price-based products. Gate also advises users to stay rational and exercise caution when engaging in any transactions involving price volatility.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About