Gate TradFi Launches Web Version: How Users Can Trade Global Assets in One Place

What the Gate TradFi Web Launch Means

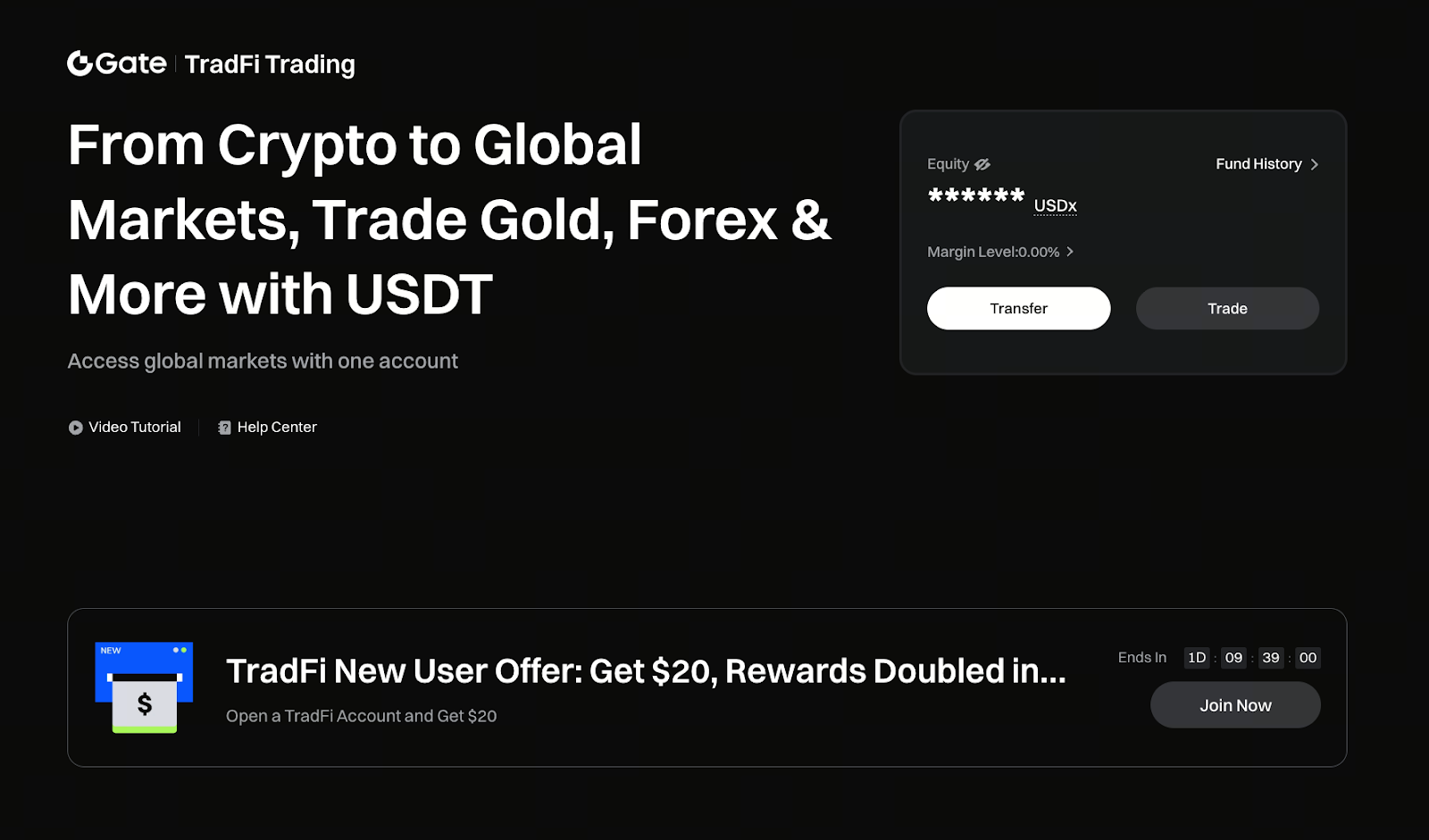

Image: https://www.gate.com/tradfi

Gate, a global leader in crypto asset trading, has announced the official launch of its TradFi section on the web platform, concluding the public beta phase. Users can now access TradFi trading via both the app and the web, enabling a seamless multi-device trading experience. With the web rollout, Gate takes a significant step forward in integrating crypto assets with traditional financial trading.

Core Positioning of TradFi Products

Gate TradFi is a dedicated area for trading traditional financial asset Contracts for Difference (CFDs). Users can engage in price speculation on global mainstream assets—such as forex, gold, indices, commodities, and popular stocks—without directly holding the underlying assets. With the web version now live, users can easily switch between the app and web according to their preferences. Account balances, positions, and risk management data remain synchronized, greatly enhancing trading continuity and operational efficiency.

Unified Account System Lowers Barriers to Cross-Market Trading

Gate TradFi maintains its unified account system for account structure. Users do not need to open additional accounts and can trade crypto assets, spot, derivatives, and TradFi products all under one Gate account. This integrated design allows users to easily build cross-market trading strategies, reduces the complexity of managing multiple platforms, and improves asset management efficiency.

USDT Collateral System Makes Fund Transfers More Intuitive

TradFi uses USDT as collateral for fund management. When users transfer funds to their TradFi sub-account, balances are automatically displayed as USDx, with no additional conversion fees. The process is streamlined and intuitive. After updating the app or logging in via the web, users can activate TradFi access and start trading quickly, effectively lowering the entry barrier to traditional finance trading.

CFD Trading Mechanism and Technical Support Advantages

Gate TradFi adopts CFD rules consistent with traditional market practices, including fixed trading hours, scheduled market closures, and a cross-margin model. The platform supports hedging with both long and short positions and integrates the MT5 system to enhance execution stability and risk management. Leverage for forex, metals, and indices is up to 500x, while stock CFDs offer 5x leverage—primarily targeting advanced users with risk management experience.

Multi-Asset Coverage Creates Trading Opportunities

Gate TradFi supports forex, gold, silver, NASDAQ 100 (NAS100), S&P 500 (SPX500), and select stocks, providing unified access to multiple markets. This delivers more trading opportunities and asset allocation options for users.

Low Fee Structure Enhances Trading Competitiveness

TradFi CFD trading fees are as low as $0.018 per order. Main trading pairs use fixed rates, which can be adjusted based on VIP level. Overnight fees for positions held during market closures are charged according to standard market practices. The overall fee structure is transparent, offering a distinct cost advantage.

Exclusive TradFi Promotions Continue to Engage Users

Gate has launched several TradFi user promotions. For example, the TradFi launch celebration features a $150,000 prize pool, awarding gold and silver rewards to participants. The “Gate TradFi Gold Lucky Bag” event has completed its first round of gold rewards, with more activities planned to further boost user engagement.

Future Development Direction After Completing Multi-Platform Deployment

With the conclusion of the public beta and the completion of both web and app deployment, Gate is steadily building a unified trading framework for both crypto and traditional financial assets. Moving forward, the platform will continue to expand TradFi product offerings and cross-market trading tools, providing users with an even more diversified and efficient global asset trading experience.

Click here to access Gate TradFi: https://www.gate.com/tradfi

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?