Gold and Silver Hit Record Highs as Trump’s Greenland Tariff Threat Weighs on Bitcoin

Global Market Turbulence: Rapid Rise in Risk Aversion

From January 19 to 20, global financial markets saw sharp volatility driven by the latest US political and trade developments. President Trump issued strong statements to Europe over the Greenland issue, threatening to impose a 10% tariff on goods from eight European countries starting February 1, with plans to raise the tariff to 25% in June.

This unexpected “tariff black swan” event quickly fueled concerns about renewed US–EU trade tensions, putting broad pressure on risk assets. Both the Euro Stoxx Index and US equity futures experienced significant pullbacks, while risk aversion surged across global markets.

In the forex and commodities markets, capital swiftly shifted toward defensive allocations:

- The US Dollar Index retreated

- Traditional safe-haven assets like gold and silver saw sustained buying support

- Clear signs of sector rotation emerged in capital flows

Why Are Gold and Silver Repeatedly Setting New Highs?

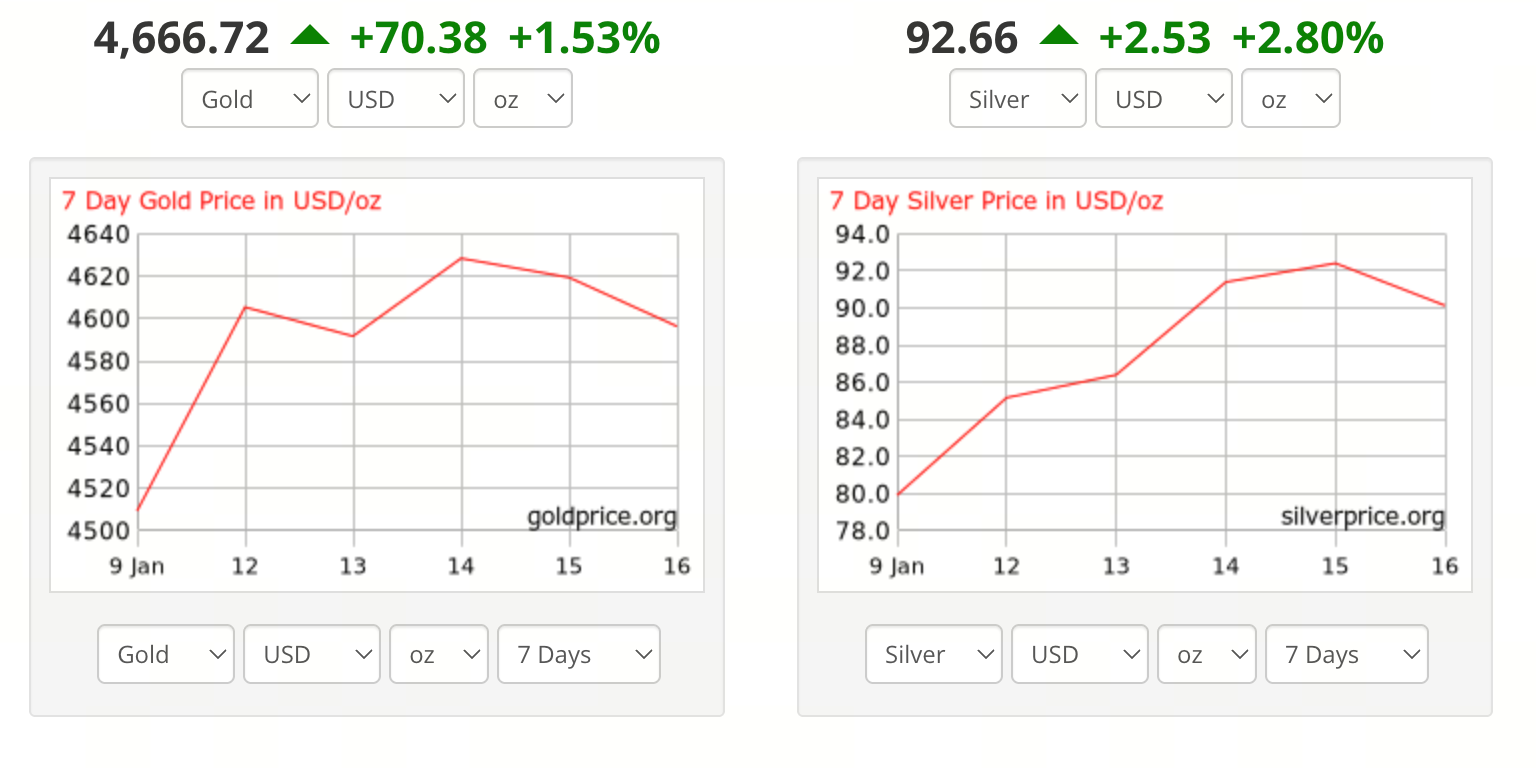

Source: https://goldprice.org/

With safe-haven demand intensifying, precious metals have continued to break through historical ranges.

According to the latest data:

- Spot gold briefly touched $4,690 per ounce

- Spot silver broke above $94 per ounce

Both set new all-time highs, making them the strongest-performing asset classes during this bout of market turbulence.

The main drivers behind the surge in precious metals are as follows:

1. Tariff threats boost safe-haven demand: Concerns over escalating US–EU trade frictions threaten global growth and financial stability, accelerating capital flows into traditional safe-haven assets.

2. Rising uncertainty over the global economic outlook: Prolonged trade conflict could continue to suppress manufacturing, cross-border investment, and corporate earnings, reinforcing defensive market sentiment.

3. Weaker dollar increases precious metals’ appeal: A declining dollar reduces the holding cost of dollar-denominated precious metals, further amplifying price movements.

Against a backdrop of multiple macro uncertainties, gold and silver have once again demonstrated their “safe-haven asset” status during periods of geopolitical and policy shocks.

Bitcoin Pullback: A Direct Signal of Shifting Risk Appetite

Source: https://www.gate.com/trade/BTC_USDT

In contrast to the strength in precious metals, risk assets came under broad pressure, with Bitcoin standing out as a prime example. Following the escalation of tariff threats, Bitcoin’s price briefly dropped to around $92,000.

The market largely attributes this pullback to the following factors:

1. Sharp decline in risk appetite: As macro uncertainty rises, investors tend to reduce exposure to highly volatile assets, with crypto assets bearing the brunt.

2. Forced liquidations amplifying short-term volatility: Concentrated liquidations in the derivatives market led to a brief liquidity squeeze, accelerating the price decline.

3. Stronger correlation with traditional risk assets: Recently, Bitcoin’s correlation with equities has increased significantly, making it more vulnerable to shocks during global risk events.

This price action underscores that, amid rapidly rising risk aversion, crypto assets do not always act as “digital gold” but often behave more like high-risk assets.

Spillover Effects of Tariff Threats and Key Areas to Watch

President Trump’s tariff plan is seen as part of a broader trade strategy. Should US–EU tensions continue to escalate, the impact could extend well beyond financial markets, potentially affecting:

- Global supply chain stability

- Manufacturing costs and pricing structures

- Exchange rate policies and cross-border capital flows

The European Union has begun evaluating countermeasures, including:

- Imposing tariffs on tens of billions of euros worth of US goods

- Activating trade tools such as the “anti-coercion mechanism”

Uncertainty in transatlantic relations is becoming a new source of macro risk for markets. In this environment, investors are closely monitoring the following key variables:

- Central bank interest rate and liquidity policy directions

- Tariff implementation details and negotiation progress

- The pace of capital shifts between risk and safe-haven assets

Investment Strategy and Risk Advisory

With short-term uncertainty on the rise, market participants need to focus more on risk management:

- Diversify asset allocations and avoid excessive concentration in any single market or asset

- Continuously monitor macro signals, especially policy and trade developments

- Enforce strict risk controls and stay alert to trading risks from increased volatility

Short-term volatility does not necessarily indicate a reversal of long-term trends. However, during periods of concentrated macro risk release, price swings often precede clear directional signals.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About