How GTBTC Is Changing the Way You Hold Bitcoin: From Idle Storage to Continuous Yield

Image: https://www.gate.com/staking/BTC

1. BTC Holders Confront a Practical Challenge

For years, BTC has been regarded as an asset you simply hold. As the market matures, more BTC holders recognize a key issue: BTC offers stability, but lacks efficiency. During prolonged periods of market consolidation, BTC often trades sideways, locking in value without generating additional cash flow. This dynamic is not ideal for long-term investors.

GTBTC was developed to address this very challenge.

2. GTBTC Is Not a “Quick Profit” Instrument

Many users initially associate GTBTC with high-yield investment products. In fact, GTBTC is not designed for aggressive returns. Instead, it serves as an “enhanced BTC holding method.” Users are not taking on new risk assets; rather, they add a relatively stable yield layer atop their existing BTC holdings.

This concept closely mirrors “income-generating assets” in traditional finance.

3. How GTBTC Delivers Ongoing Yield on BTC

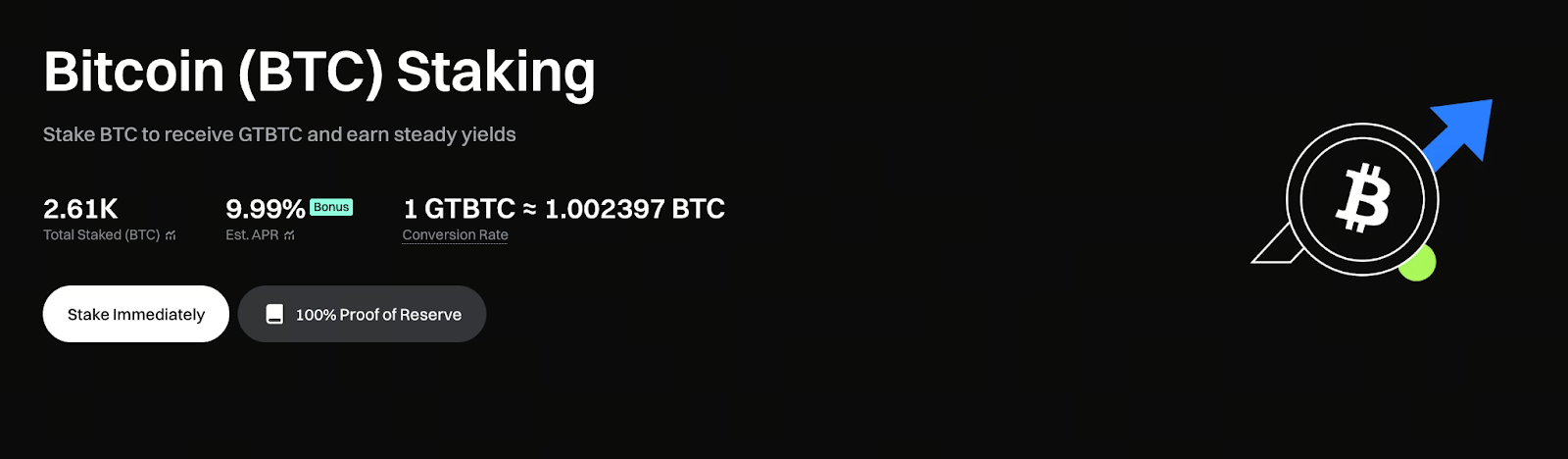

When users convert BTC to GTBTC, their assets remain within the BTC ecosystem, entering a unified yield management structure. Gate employs staking and strategic approaches to manage BTC, distributing generated yield to users as GTBTC. The current annualized yield for GTBTC is 9.99%.

The entire process is streamlined—users do not need to operate frequently or master complex on-chain details. The experience is comparable to traditional financial products.

4. GTBTC Shifts “Time Value”—Not Risk

It is crucial to note that GTBTC does not eliminate BTC price volatility risk. Fluctuations in BTC price still impact overall asset value.

What GTBTC changes is this: BTC is no longer entirely idle while “waiting for market action.”

Even during sideways markets, GTBTC continues to accumulate yield, enhancing overall returns over time.

5. Which Investment Mindset Suits GTBTC?

GTBTC is not for everyone, but it is particularly well-suited for:

- Investors who prefer not to trade frequently but want to avoid idle assets

- Those seeking stable yields without pursuing high-risk returns

- Long-term allocators who view BTC as a strategic asset, not a speculative tool

For these users, GTBTC acts as a “long-term yield buffer,” rather than a short-term arbitrage instrument.

6. What Does Adding GTBTC to Your Portfolio Mean?

From an asset allocation perspective, GTBTC bridges “spot BTC” and “active trading.” It preserves BTC’s essential attributes while introducing a sustained yield mechanism and lowering holding costs. This gives BTC a stronger profile as a “core asset” within diversified portfolios.

This shift is highly meaningful for investors building long-term portfolios.

7. Is GTBTC Worth Considering? It Depends on Your Goals

Deciding on GTBTC ultimately hinges on your objectives. If your strategy relies on frequent market swings, GTBTC may not be optimal. But if you prioritize a balance between “long-term holding and stable yield,” GTBTC offers a clear pathway.

In today’s market, more BTC holders are seriously evaluating this type of strategic product.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About