What Role Does GTBTC Play in the Gate Ecosystem?

Image: https://www.gate.com/staking/BTC

From Single BTC to Multi-Form BTC

Traditionally, BTC has been viewed in a single form: you buy it, hold it, and wait for price movements.

Within platform-driven asset systems, however, BTC is often segmented into distinct functional layers—some designated for trading, others for collateral, and some for generating yield.

GTBTC is a result of this asset evolution.

Why Gate Launched GTBTC

In Gate’s product ecosystem, on-chain earning, asset management, and trading are interconnected, not isolated. The platform requires an asset form that meets all of the following criteria:

- Remains anchored to BTC’s core value

- Supports BTC staking yields

- Is identifiable and manageable within the platform

GTBTC fundamentally separates BTC’s yield-generating attribute and standardizes it as a token.

GTBTC and Regular BTC: The Relationship

GTBTC is not a wholly new BTC substitute. In terms of asset structure, it acts as a functional mapping of BTC within the Gate ecosystem. When users stake BTC, it is wrapped as GTBTC, representing the corresponding asset rights. When users exit those scenarios, GTBTC can be redeemed for BTC.

Both maintain the same value anchor, but each serves a distinct function.

GTBTC’s Role in Gate’s Product Ecosystem

In Gate’s overall product structure:

- BTC is the foundational asset

- Staking mechanisms generate yield

- GTBTC is the intermediary layer connecting the two

GTBTC enables the platform to manage yield attribution, asset flows, and user rights with greater clarity, while giving users a more intuitive view of their asset status.

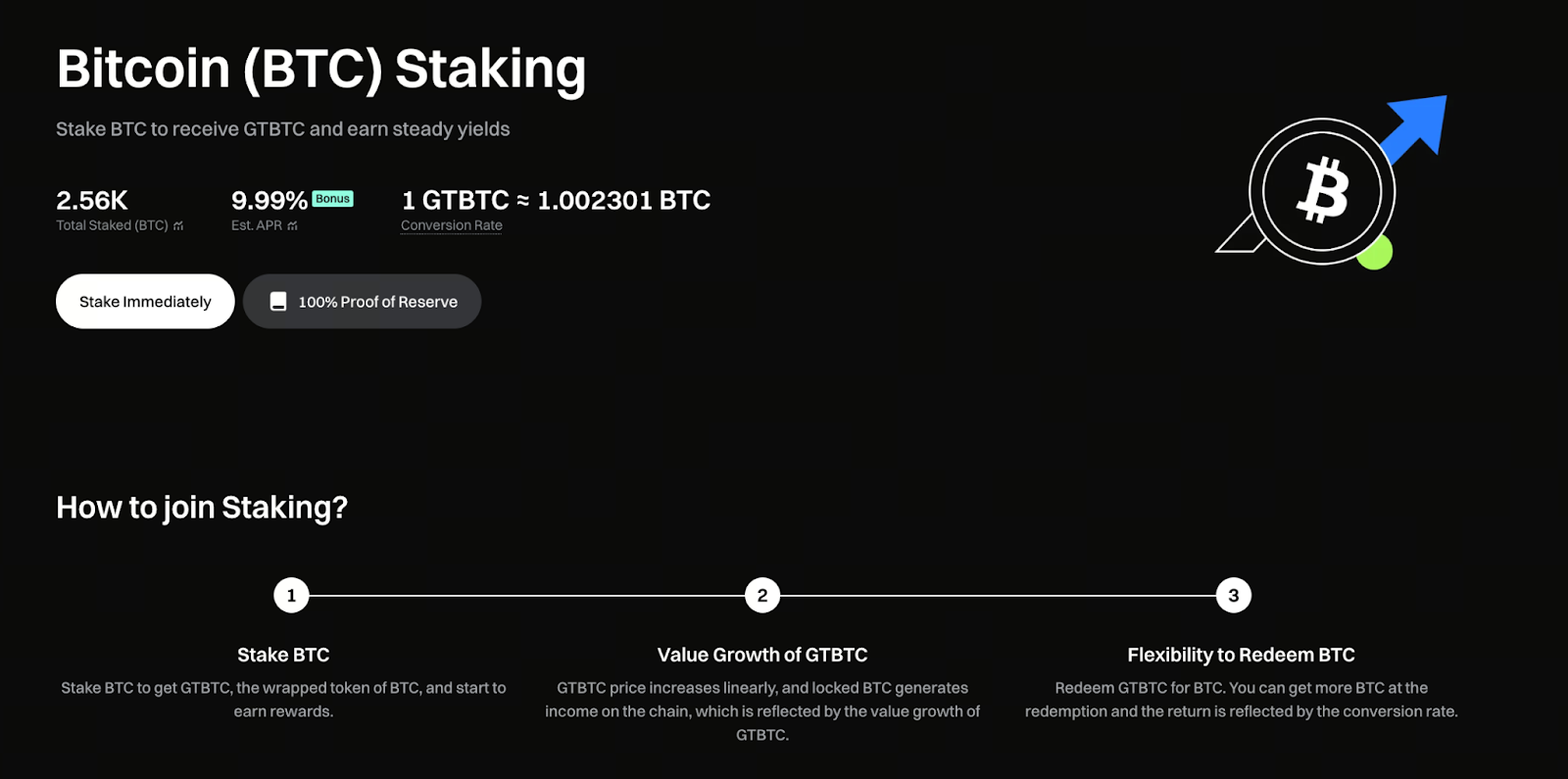

Currently, the reference annualized yield for BTC staking via GTBTC is about 9.99%. However, this figure is not the sole reason for GTBTC’s existence.

GTBTC: More Than Just Yield

Viewed purely by annualized returns, GTBTC is similar to many financial products. But from an asset structure perspective, it represents a more systematic way to utilize BTC. In the Gate ecosystem, GTBTC functions as an interface, allowing BTC to be deployed across different scenarios without repeatedly dismantling or restructuring the underlying asset.

Conclusion

GTBTC’s value isn’t about making BTC more aggressive—it’s about making BTC more versatile. When assets are no longer passively stored but are clearly defined by roles and functions, long-term holding becomes a more rational strategy.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About