When Safe Havens Need Speed: Trading Gold and Silver with Gate Perpetual Futures

Risk Aversion Logic Is Being Redefined

Historically, gold and silver have been viewed almost exclusively as safe havens during market turbulence—assets that absorb risk rather than serve as tools for proactive market engagement. However, with information circulating faster and event impacts shortening, the traditional approach of waiting for prices to reflect risk is increasingly outpaced by modern trading dynamics.

This shift has prompted a new line of questioning in the market: Do safe-haven assets have to remain static, or can they become part of real-time strategy adjustment? This evolving perspective is precisely what’s driving precious metals toward the derivatives market.

A Critical Step for Precious Metals in the Crypto Trading Landscape

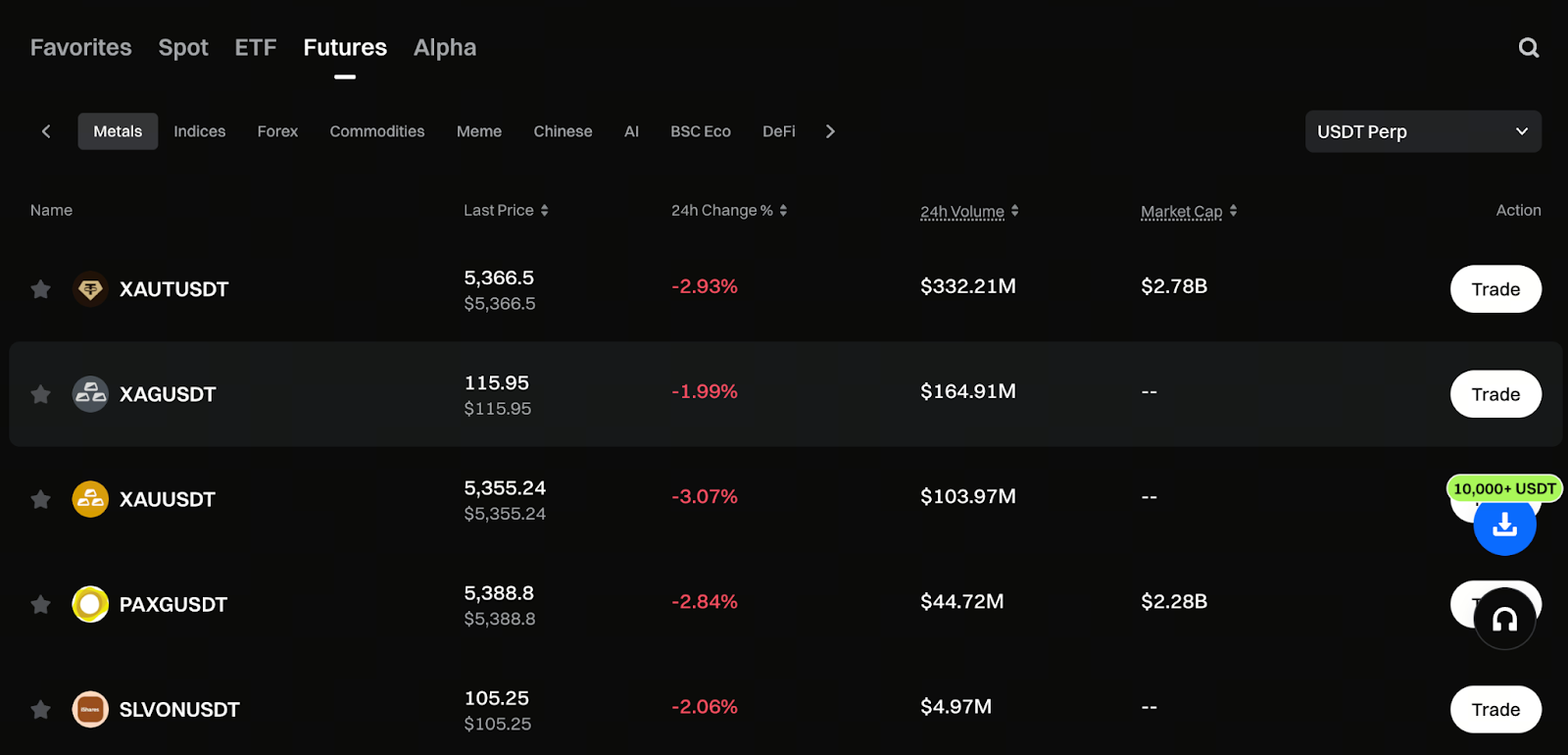

Gate’s introduction of perpetual contracts for precious metals integrates gold (XAU) and silver (XAG) into a USDT-settled, perpetual trading system. This enables these assets—previously confined to traditional market hours—to operate seamlessly in a 24/7 trading environment.

This structure allows traders to respond instantly to changes in interest rate policy, geopolitical developments, or macroeconomic data releases. Instead of waiting for markets to open, participants can adjust positions in real time, transforming risk aversion from a delayed response into immediate action.

Experience trading now in Gate’s Precious Metals section: https://www.gate.com/price/futures/category-metals/usdt

Seamless Cross-Market Trading—No Need to Relearn

Gate has fully integrated precious metals trading into its existing contract framework—XAU and XAG perpetuals use the same familiar order types, leverage settings, and risk management tools. For experienced contract traders, entering the precious metals market requires no new processes or fragmented account management. Instead, their established trading logic simply extends to a new asset class, minimizing both the learning curve and the cost of strategy transitions.

Safe-Haven Assets Regain Traction

With market uncertainty rising in 2026, capital is flowing back into assets with risk-averse characteristics, and precious metals prices are showing renewed momentum:

- Gold has risen about 7% year-to-date, repeatedly testing historical highs.

- Silver, which combines industrial and financial utility, has been even more volatile, surging roughly 23% year-to-date.

In this climate, precious metals perpetual contracts are more than allocation tools—they provide traders with entry points for frequent participation in price movements and the execution of short- and medium-term strategies.

Multi-Source Index Pricing for Strategic Stability

To avoid distortions from single-market pricing, Gate’s precious metals perpetual contracts use a multi-source index, aggregating prices from multiple markets as the contract benchmark. This approach maintains price fairness and transparency, even during periods of high volatility. For users employing leverage, hedging, or strategic trading, it provides a sound foundation for robust risk management.

Where TradFi and Crypto Strategies Converge

From a strategy allocation standpoint, precious metals perpetual contracts hold a unique position:

- Traditional market participants find gold and silver familiar and easy to assess.

- Crypto-native traders gain exposure to assets with distinct volatility profiles, helping diversify portfolio risk.

Whether for risk aversion in response to macro events, swing trading, or cross-market hedging, precious metals contracts build a practical bridge between traditional finance and crypto markets.

Extending the Multi-Asset Contract Landscape

The launch of precious metals perpetual contracts marks more than a one-off product update. Gate is systematically expanding its derivatives portfolio to include traditional assets. Leveraging existing liquidity and risk management frameworks, the contract market’s asset coverage is poised for continued growth.

Conclusion

With gold and silver entering the crypto perpetual contract market, they are no longer merely defensive assets passively absorbing risk. Instead, they have become strategic tools for active market engagement. Gate’s precious metals perpetual contracts offer greater operational flexibility for safe-haven assets and open new avenues for cross-market and multi-asset allocation. As the boundaries between TradFi and Crypto continue to blur, these products are becoming an essential part of advanced traders’ strategy portfolios.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About