Once in "paper loss"! Strategy increases holdings by 855 Bitcoins again. How long can buying more on dips sustain?

59m ago

"Big Short" star Michael Burry warns: Bitcoin crash triggers over $1 billion sell-off in gold and silver

2h ago

Trending Topics

View More5.06K Popularity

3.64K Popularity

2K Popularity

1.43K Popularity

1.72K Popularity

Hot Gate Fun

View More- MC:$2.77KHolders:00.00%

- MC:$2.82KHolders:20.12%

- MC:$2.79KHolders:10.00%

- MC:$3.12KHolders:32.00%

- MC:$2.78KHolders:10.00%

Pin

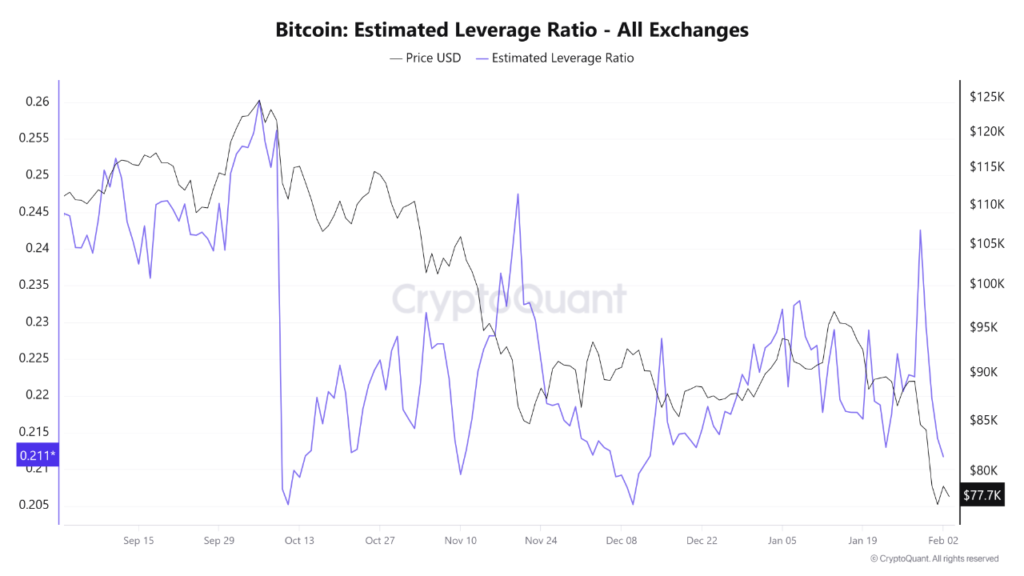

MICA Daily|BTC leverage ratio drops to the lowest level since mid-December

Recent data on the “Estimated Leverage Ratio” in the BTC market shows a clear shift in investor behavior. Data from across the platform indicates that the leverage ratio has dropped to approximately 0.21, the lowest level since mid-December (when trading activity was relatively high). This decline reflects a decreased reliance on leveraged positions among investors and suggests that most traders’ risk appetite is weakening. In contrast, Binance’s data presents a slightly different picture. Although there has been a noticeable decline from previous peaks, the leverage ratio on Binance remains around 0.17, higher than its December levels. This indicates that, compared to the overall market, Binance traders still maintain relatively high leverage exposure.

In contrast, Binance’s data presents a slightly different picture. Although there has been a noticeable decline from previous peaks, the leverage ratio on Binance remains around 0.17, higher than its December levels. This indicates that, compared to the overall market, Binance traders still maintain relatively high leverage exposure.