Final Week Frenzy: Polymarket Bets Pile In as Logan Paul’s Pikachu Illustrator Sits Above $6.3M

Goldin’s 2026 Pokémon & TCG Auction has entered its final stretch, and all eyes are on one card: Logan Paul’s Pikachu Illustrator. With just days remaining before the gavel drops Sunday night, the auction has become less about nostalgia and more about probability, positioning, and what traders think the hobby’s crown jewel is actually worth.

Prediction Market Odds Weigh In as Logan Paul’s Pikachu Illustrator Heads Toward Auction Night Showdown

As the buzz intensifies—fueled by Netflix’s King of Collectibles: The Goldin Touch and Logan Paul’s own social megaphone— prediction market Polymarket has turned the sale into a live, dollar-denominated referendum. The numbers suggest collectors are confident the card clears elite territory, but far less certain it rewrites the record books again.

The auction centers on a Japanese Corocoro Pikachu Illustrator card graded PSA GEM MT 10—the only example of its kind. The card is already the Guinness World Record holder for the most expensive Pokémon card ever sold, and it comes with extras that blur the line between collectible and spectacle, including the custom diamond necklace Paul wore at Wrestlemania 38 and a Maverick-branded presentation box.

Logan Paul with his Pikachu Illustrator card and case.

The listing is handled by Goldin, with extended bidding set to begin at 10 p.m. ET on Sunday, Feb. 15. Before that, Paul and Goldin founder Ken Goldin plan to host a first-edition Pokémon box break live on Paul’s YouTube channel at 9 p.m. ET. The livestream is expected to act as a hype accelerant just ahead of closing, funneling attention—and potentially bidders—into the final hour.

Logan Paul with his Pikachu Illustrator card and case.

The listing is handled by Goldin, with extended bidding set to begin at 10 p.m. ET on Sunday, Feb. 15. Before that, Paul and Goldin founder Ken Goldin plan to host a first-edition Pokémon box break live on Paul’s YouTube channel at 9 p.m. ET. The livestream is expected to act as a hype accelerant just ahead of closing, funneling attention—and potentially bidders—into the final hour.

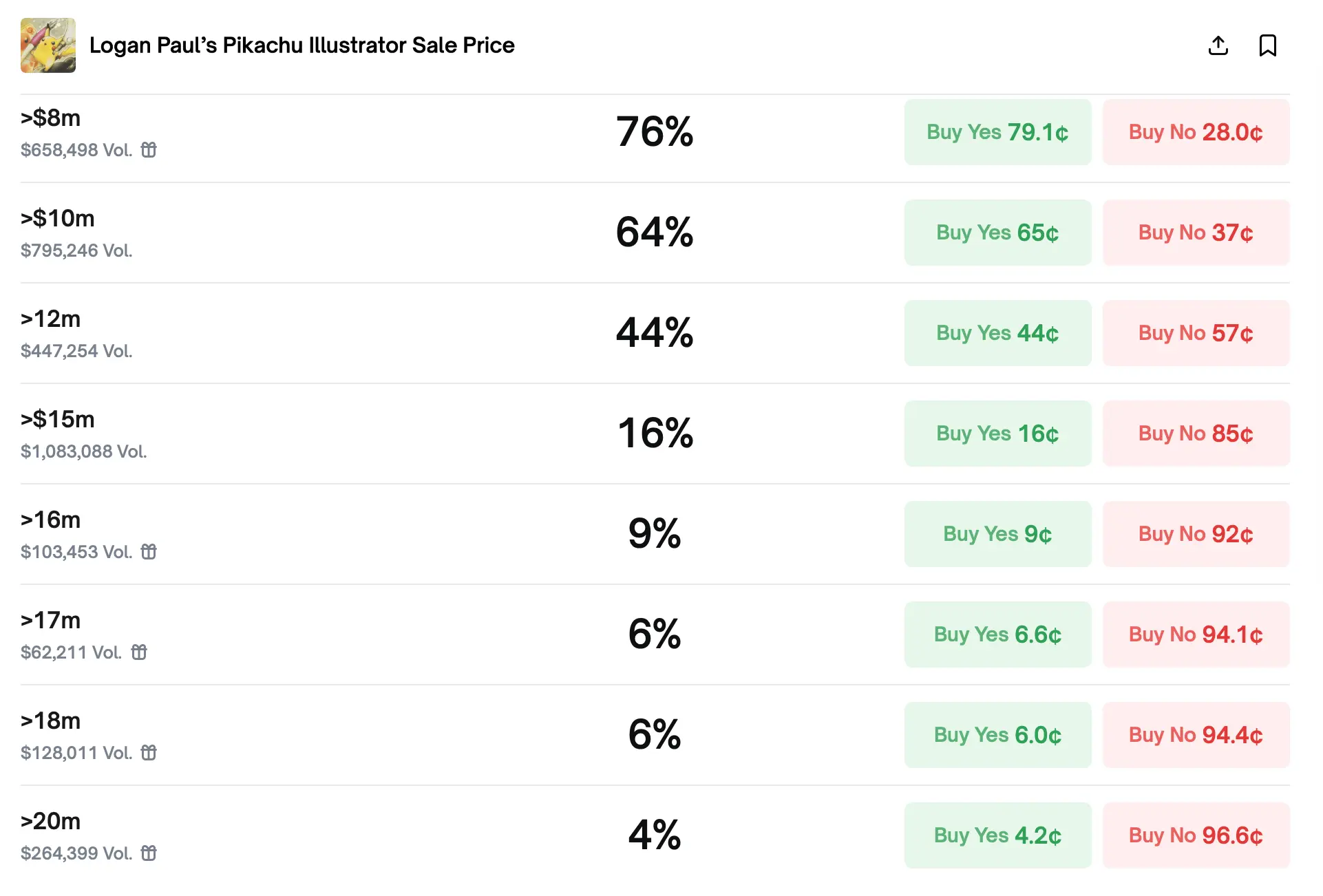

Onchain sentiment, however, tells a more measured story. According to Polymarket data, traders assign roughly a 96% probability that the final sale price exceeds $6 million, and conviction remains high through the $7 million to $8 million range. That confidence starts to fray at $10 million, where odds drop to about 65%, marking what traders appear to view as the auction’s true battleground.

Beyond that point, optimism thins quickly. Odds fall to roughly 44% above $12 million and sink into the teens for $15 million and higher. Polymarket prices north of $18 million are treated as long shots, with single-digit probabilities despite notable speculative volume—suggesting hedging behavior rather than genuine belief in a moonshot outcome.

Higher-end odds for Logan Paul’s Pikachu Illustrator via Polymarket on Tuesday, Feb. 10, 2026.

In total, Polymarket users have pushed approximately $8.75 million in volume across the various price thresholds, with more than 11 million shares traded. Liquidity clusters around midrange outcomes, reinforcing the idea that traders are positioning for a strong but not absurd finish.

Higher-end odds for Logan Paul’s Pikachu Illustrator via Polymarket on Tuesday, Feb. 10, 2026.

In total, Polymarket users have pushed approximately $8.75 million in volume across the various price thresholds, with more than 11 million shares traded. Liquidity clusters around midrange outcomes, reinforcing the idea that traders are positioning for a strong but not absurd finish.

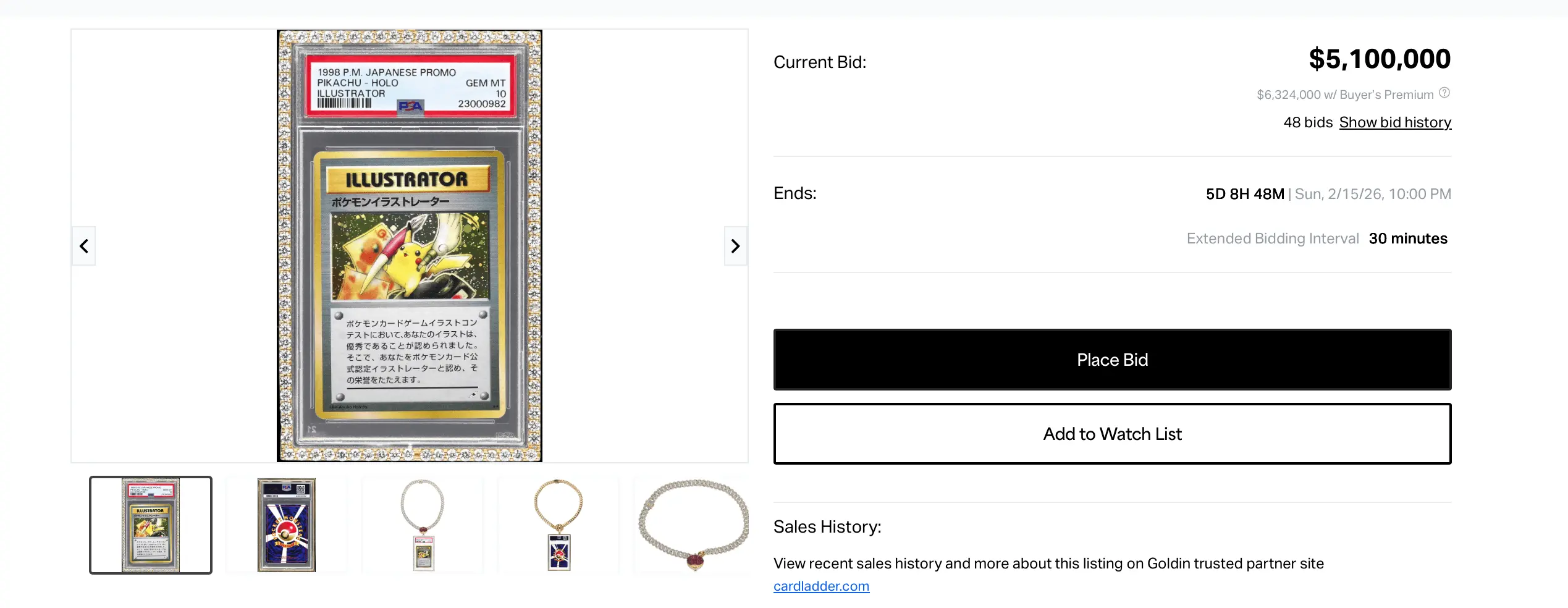

Meanwhile, the live auction itself has already crossed meaningful psychological markers. As of midweek, the high bid stands at $5.1 million, translating to about $6.32 million after buyer’s premium, with 48 bids logged as of today and several days remaining. Extended bidding rules—30-minute resets when late bids arrive—mean Sunday night could stretch well past bedtime.

The $5.1 million number in the screenshot marks the current high bid—auction-speak for the hammer price—while $6,324,000 “with buyer’s premium” is the real check the winner writes if the sale stopped right there. Goldin tacks on a 24% buyer’s premium to the final bid, a standard auction-house fee that lands squarely on the buyer, not the seller.

The cultural backdrop matters, too. Pokémon nostalgia is colliding with influencer-era collectibles economics, and Paul’s personal involvement—from hand-delivering the card to hyping the finale—adds a performative layer few trophy assets enjoy. Still, Polymarket’s pricing implies traders are discounting spectacle in favor of historical comps and market gravity.

The $5.1 million number in the screenshot marks the current high bid—auction-speak for the hammer price—while $6,324,000 “with buyer’s premium” is the real check the winner writes if the sale stopped right there. Goldin tacks on a 24% buyer’s premium to the final bid, a standard auction-house fee that lands squarely on the buyer, not the seller.

The cultural backdrop matters, too. Pokémon nostalgia is colliding with influencer-era collectibles economics, and Paul’s personal involvement—from hand-delivering the card to hyping the finale—adds a performative layer few trophy assets enjoy. Still, Polymarket’s pricing implies traders are discounting spectacle in favor of historical comps and market gravity.

In other words, the crowd expects fireworks, just not a miracle. Clearing $7 million looks close to consensus. Breaking decisively above $10 million would require fresh capital, emotional bidding, or a whale with a point to prove.

By late Sunday, one thing will be certain: whether the hobby’s most famous card stayed within expectations—or reminded everyone that rational markets and iconic collectibles don’t always get along.

Also read: US Equities Grind Higher: Dow Advances While S&P 500, Nasdaq Tread Lightly

FAQ ❓

- **What is being auctioned at Goldin this weekend?**A PSA GEM MT 10 Pikachu Illustrator card owned by Logan Paul, widely considered the most valuable Pokémon card in existence.

- **When does the auction close?**Extended bidding begins at 10 p.m. ET on Sunday, Feb. 15, following a live Pokémon box break at 9 p.m. ET.

- **What does Polymarket expect the final price to be?**Traders are highly confident that the sale exceeds $6 million, with skepticism increasing sharply above $10 million.

- **Why is this auction drawing so much attention?**It combines a record-setting card, a global influencer, a Netflix series, and millions in prediction-market volume.