IOSG Weekly Brief | Ethereum Repricing: From Rollup-Centric to "Security Settlement Layer" #313

As the difficulty of decentralized Layer 2 evolution increases, Ethereum’s strategic focus is returning to the mainnet. Through institutionalized scaling and endogenous security mechanisms, it reinforces its position as the world’s most trusted “security settlement layer.” Its core value has shifted from traffic to settlement sovereignty.

(Background recap:)

(Additional context:)

This article’s outline

- Returning to the origin: Ethereum’s values

- Valuation misconceptions: why Ethereum should not be viewed as a “tech company”

- Paradigm restructuring: finding valuation anchors beyond cash flow

- Security settlement layer: core value anchor (45%, risk hedge period raised)

- Monetary attributes: settlement and collateral (35%, dominated by utility expansion phase)

- Platform / network effects: growth options (10%, bull market amplifier)

- Revenue assets: cash flow floor (10%, bear market support)

- Dynamic calibration: macro constraints and cycle adaptation

- Conditions for institutional second curve

- Conclusion: value anchoring in the darkest hour

Authors | Jacob Zhao & Jiawei @IOSG

On February 3, 2026, Vitalik posted a reflection on Ethereum’s scaling roadmap on X. As the reality of fully decentralized Layer 2 evolution is re-recognized as increasingly difficult, and with the mainnet’s throughput expected to significantly improve in the coming years, the original idea of “using L2 as Ethereum’s core scaling vehicle” is no longer valid. Ethereum’s strategic focus is shifting back to the mainnet itself—through institutionalized scaling and protocol-intrinsic security mechanisms, strengthening its position as the world’s most trusted settlement layer. Scaling is no longer the sole goal; security, neutrality, and predictability have become Ethereum’s core assets.

Key changes:

- Ethereum is entering a “L1-first paradigm”: As the mainnet directly scales and fees continue to decline, the original assumption that L2 would bear the core of scaling is no longer valid.

- L2 is no longer “brand sharding” but a trust spectrum: Decentralization of L2s progresses more slowly than expected, making it difficult to inherit Ethereum’s security uniformly. Its role is being redefined as a spectrum of networks with different trust levels.

- Ethereum’s core value shifts from “traffic” to “settlement sovereignty”: ETH’s value is no longer limited to gas or blob revenues but is rooted in its institutionalized premium as the most secure global EVM settlement layer and native asset.

- Scaling strategy is shifting toward protocol endogenous solutions: Building on the continued direct expansion of L1, exploring native verification and security mechanisms at the protocol layer may reshape the security boundary and value capture between L1 and L2.

- Valuation framework is undergoing structural transition: The importance of security and institutional trust is rising sharply, while fee-based and platform effects are declining. ETH’s valuation is shifting from a cash flow model to an asset premium model.

This article will analyze the paradigm shift and valuation reconstruction of Ethereum’s pricing model, layered through facts (technological and institutional changes), mechanisms (impact on value capture and pricing logic), and deductions (implications for allocation and risk-return).

Returning to the origin: Ethereum’s values

Understanding Ethereum’s long-term value hinges not on short-term price volatility but on its consistent design philosophy and value orientation.

- Trustworthy neutrality: Ethereum’s core goal is not efficiency or profit maximization but to serve as a trustworthy, neutral infrastructure—transparent rules, predictable, unbiased, not controlled by any single entity, accessible to all without permission. The security of ETH and on-chain assets ultimately depends on the protocol itself, not any institution’s credit.

- Ecology first, not revenue: Ethereum’s key upgrades reflect a consistent decision logic—actively sacrificing short-term protocol revenue to lower usage costs, expand ecosystem scale, and enhance system resilience. Its goal is not to “collect tolls” but to be an indispensable neutral settlement and trust backbone in the digital economy.

- Decentralization as a means: The mainnet focuses on maximum security and finality, while Layer 2 networks are on a different trust spectrum: some inherit mainnet security and pursue efficiency, others differentiate by functionality. This enables the system to serve global settlement and high-performance applications simultaneously, rather than L2 as “brand sharding.”

- Long-termist technical approach: Ethereum adheres to a slow but steady evolution path, prioritizing system security and trustworthiness. From PoS transition to subsequent scaling and verification optimizations, its roadmap aims for sustainable, verifiable, irreversible correctness.

Security Settlement Layer: Refers to Ethereum mainnet providing irreversible finality services to Layer 2 and on-chain assets via decentralized validators and consensus mechanisms.

This security settlement layer signifies the establishment of “settlement sovereignty”, marking Ethereum’s shift from a “confederation” to a “federation”—a “constitutional moment” in building its digital nation, and a major upgrade to its architecture and core.

Post-American independence, under confederation terms, the 13 states resembled a loose alliance—each printing its own currency, imposing tariffs on each other, free-riding: enjoying common defense but refusing to pay; benefiting from the union’s brand but governing separately. This structural issue lowered national credit and hindered unified foreign trade, severely hampering economic growth.

In 1787, the U.S. entered its “Constitutional Moment”: the new constitution granted the federal government three key powers: direct taxation, interstate trade regulation, and a unified currency. But what truly brought the federal government to life was Hamilton’s 1790 economic plan: federal assumption of state debts, paying back reconstructed national credit at face value, and establishing a national bank as a financial hub. The unified market unleashed scale effects, boosting national credit and attracting capital, enabling infrastructure development. The U.S. evolved from 13 mutually defensive small states into the world’s largest economy.

Today, Ethereum’s structural dilemma is entirely analogous.

Each L2 resembles a “sovereign state,” with its own user base, liquidity pools, and governance tokens. Liquidity is fragmented; cross-L2 interactions are frictional; L2s enjoy Ethereum’s security layer and brand but cannot reciprocate L1 value. Locking liquidity on each L2 is rational short-term, but if all do so, Ethereum’s core competitive advantage erodes.

Ethereum’s current roadmap essentially is its constitutional formation and the creation of a central economic system—building “settlement sovereignty”:

- Native Rollup Precompile = Federation Constitution: L2s can build differentiated functions outside EVM, while the EVM part can leverage native precompiles for Ethereum-level security verification. Not connecting is possible but sacrifices trustless interoperability with the ecosystem.

- Synchronous Composability = Unified Market: Through native rollup precompiles and mechanisms, trustless interoperability and synchronized composability between L2s and L1 are becoming possible, directly removing “interstate trade barriers,” and preventing liquidity from being trapped in isolated islands.

- Rebuilding L1 value capture = Federation Taxation: When all key cross-L2 interactions revert to L1 settlement, ETH re-emerges as the ecosystem’s settlement hub and trust anchor. Control over the settlement layer equals value capture.

Ethereum is using a unified settlement and verification system to transform fragmented L2 ecosystems into an irreplaceable “digital nation”—a historical inevitability. Of course, this transition may be slow, but history shows that once completed, the network effects released will far surpass linear growth during fragmentation. The U.S. turned 13 small states into the world’s largest economy through a unified economic system. Similarly, Ethereum will transform its loose L2 ecosystem into the largest secure settlement layer and even a global financial infrastructure.

▲ Ethereum core upgrade roadmap and valuation impact (2025-2026)

Valuation misconceptions: why Ethereum should not be viewed as a “tech company”

Applying traditional corporate valuation models (P/E, DCF, EV/EBITDA) to Ethereum is fundamentally a category error. Ethereum is not a profit-maximizing company but an open digital economic infrastructure. Companies seek shareholder value maximization, whereas Ethereum aims for ecosystem scale, security, and censorship resistance. To achieve this, Ethereum has repeatedly deliberately suppressed protocol revenues (e.g., via EIP-4844 introducing Blob DAs, structurally lowering L2 data publication costs, and reducing L1 fees from rollup data). From a corporate perspective, this resembles “revenue destruction,” but from an infrastructure view, it sacrifices short-term fees for long-term neutrality premium and network effects.

A more appropriate framework is to see Ethereum as a global neutral settlement and consensus layer: providing security, finality, and trustworthy coordination for digital economy. ETH’s value is rooted in multiple structural demands—rigid settlement needs, on-chain finance and stablecoin scale, staking and burn mechanisms affecting supply, and long-term, sticky institutional adoption via ETFs, corporate treasuries, and RWAs.

Paradigm restructuring: finding valuation anchors beyond cash flow

By the end of 2025, the Hashed team’s ethval.com provided a detailed, reproducible quantitative model set for Ethereum, but traditional static models struggle to capture the dramatic narrative shift in 2026. Therefore, we repurposed its systematic, transparent, and reproducible underlying models (covering revenue, monetary, network effects, and supply structure) to reshape the valuation architecture and weighting logic:

- Structural reconstruction: Map models onto four major value quadrants—“security, monetary, platform, revenue”—and aggregate for valuation.

- Rebalancing weights: Significantly increase the weights of security and settlement premium, weaken the marginal contribution of protocol revenue and L2 expansion.

- Risk control overlay: Introduce macro and on-chain risk perception triggers, enabling the valuation framework to adapt across cycles.

- Eliminate “circular reasoning”: Models with current price inputs (e.g., staking scarcity, liquidity premium) are no longer used as fair value anchors, only as position and risk appetite indicators.

Note: The models below are not for precise point forecasting but for illustrating the relative valuation directions of different value sources across cycles.

Security settlement layer: core value anchor (45%, risk hedge period raised)

We regard the security settlement layer as Ethereum’s most fundamental value source, assigning it a baseline weight of 45%; during periods of rising macro uncertainty or risk aversion, this weight is further increased. This judgment stems from Vitalik’s latest definition of “truly scaling Ethereum”: scaling is not about TPS but about creating block space fully backed by Ethereum itself. Any high-performance environment relying on external trust assumptions does not constitute an extension of Ethereum’s core.

Within this framework, ETH’s value mainly reflects a trust premium of a global, sovereign-free settlement layer, rather than protocol revenue. This premium is supported by validator scale and decentralization, long-term security track record, institutional adoption, regulatory clarity, and endogenous rollup verification mechanisms.

Pricing-wise, we mainly use two complementary approaches: Validator Economics (revenue equilibrium mapping) and Staking DCF (perpetual staking discounting), jointly depicting ETH as a “global security settlement layer” with institutional premium.

-

Validator Economics (revenue equilibrium pricing): Based on annual staking cash flow per ETH and target real yield, derive a theoretical fair price:

Fair Price = (Annual Staking Cash Flow per ETH) / Target Real Yield

This expression depicts the equilibrium relationship between yield and price, serving as a directional relative valuation tool, not an independent pricing model.

-

Staking DCF (perpetual staking discounting): Treat ETH as a long-term asset generating sustainable real staking income, discount its cash flows perpetually:

M_staking = Total Real Staking Cash Flow / (Discount Rate − Long-term Growth Rate)

ETH Price (staking) = M_staking / Circulating Supply

Essentially, this valuation layer is not about platform revenue capacity but about global clearing network settlement credit.

Currency attributes: settlement and collateral (35%, utility expansion phase)

We see currency attributes as Ethereum’s second core value source, with a baseline weight of 35%, becoming the main utility anchor during neutral markets or on-chain economic expansion. This is not about “ETH equals USD” narrative but about its structural role as the native settlement fuel and ultimate collateral in on-chain finance. Stablecoin circulation, DeFi liquidation, and RWA settlement all depend on ETH-supported settlement layers.

Pricing models extend the quantity theory (MV=PQ), but with layered modeling of ETH’s usage scenarios to address different velocity scales:

High-frequency settlement layer (gas payments, stablecoin transfers)

- M_transaction = Annual transaction volume / V_high

- V_high ≈ 15-25 (based on historical on-chain data)

Medium-frequency financial layer (DeFi interactions, lending liquidation)

- M_defi = Annual DeFi volume / V_medium

- V_medium ≈ 3-8 (based on mainstream DeFi protocol turnover)

Low-frequency collateral layer (staking, re-staking, long-term locking)

- M_collateral = Total ETH collateral value × (1 + Liquidity Premium)

- Liquidity Premium = 10-30% (compensation for liquidity sacrifice)

Platform / network effects: growth options (10%, bull market amplifier)

Platform and network effects are viewed as growth options in Ethereum valuation, assigned only 10% weight, used to explain nonlinear premiums during bull phases. We adopt a trust-adjusted Metcalfe model to avoid equating different security levels of L2 assets:

- Metcalfe model: M_network = a × (Active Users)^b + m × Σ (L2 TVL_i × TrustScore_i)

- Network effect valuation: ETH Price(network) = M_network / Circulating Supply

Revenue assets: cash flow floor (10%, bear market support)

Protocol revenue is seen as a cash flow floor in Ethereum valuation, not a growth driver, with a 10% weight. It mainly plays a role during bear markets or extreme risk phases, depicting valuation lower bounds.

Gas and blob fees provide minimal operational costs, influenced by EIP-1559’s supply dynamics. Valuation uses P/S and fee yield models, taking conservative estimates as bottom bounds. As mainnet scales, protocol revenue’s importance diminishes; its core role is in downside safety margins.

- P/S Floor: M_PS = Annual Protocol Revenue × P/S multiple

- P/S valuation: ETH Price (P/S) = M_PS / Circulating Supply

- Fee yield model: M_Yield = Annual Protocol Revenue / Target Fee Yield

- Fee yield valuation: ETH Price (Yield) = M_Yield / Circulating Supply

- Cash flow floor (minimum of both): P_Revenue_Floor = min(P_PS, P_Yield)

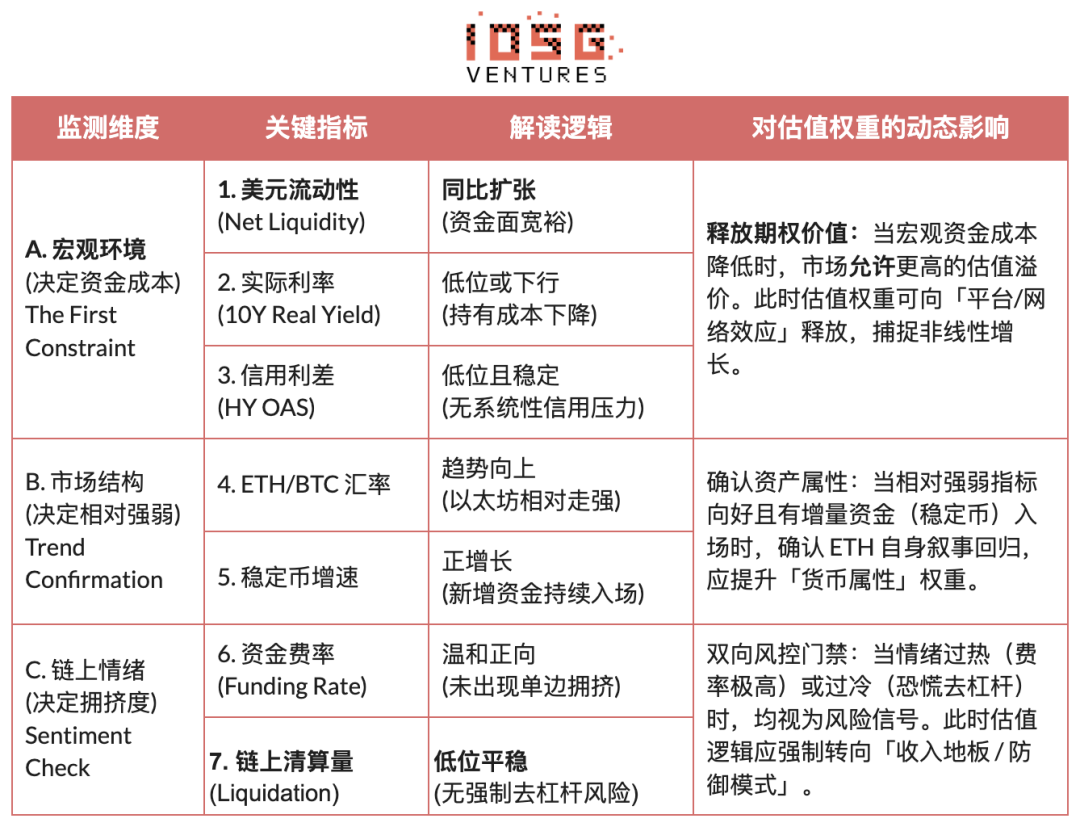

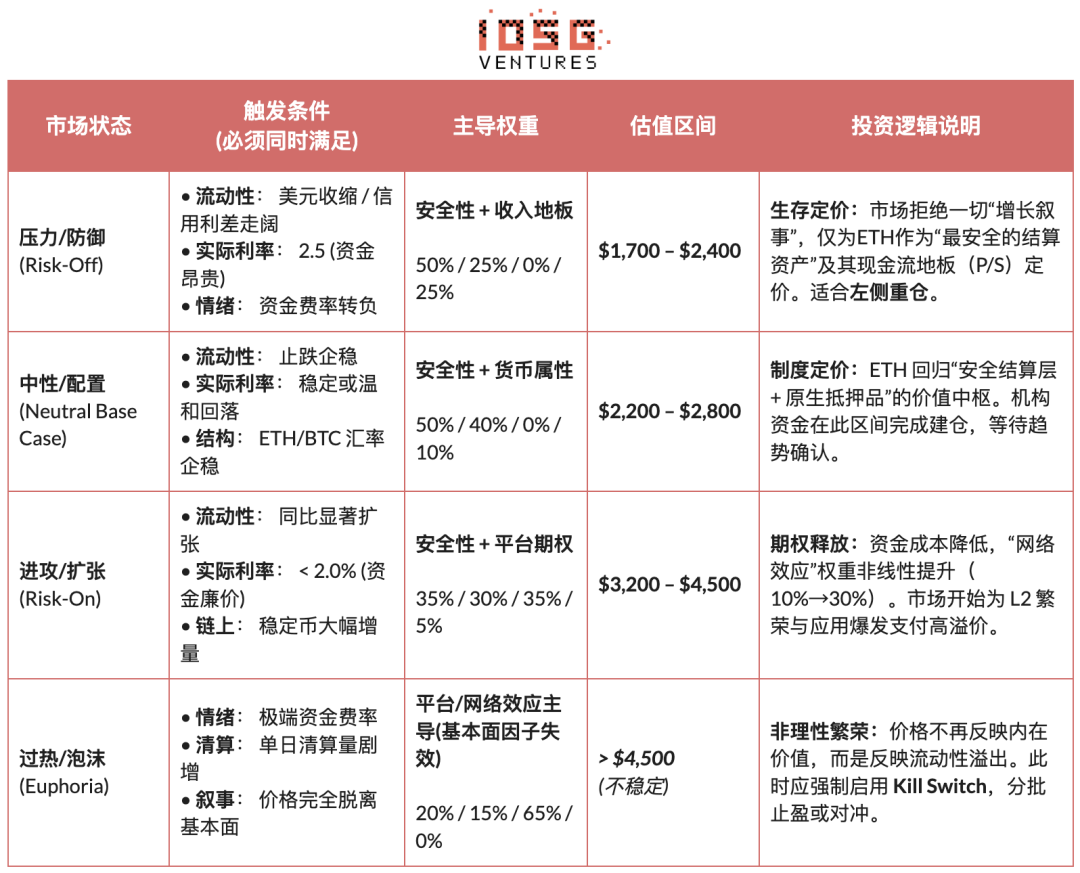

Dynamic calibration: macro constraints and cycle adaptation

If the previous sections establish Ethereum’s “intrinsic value center,” this chapter introduces an external environment adaptation system independent of fundamentals. Valuation cannot operate in a vacuum; it must be constrained by macro conditions (cost of capital), market structure (relative strength), and on-chain sentiment (congestion). Based on this, we build a Regime Adaptation mechanism that dynamically adjusts valuation weights across cycles—during loose periods, releasing option premiums; during risk-off phases, retreating to income floors—enabling a transition from static models to dynamic strategies. (Note: due to space, only the logic framework is shown here.)

Institutional second curve: conditional pathway

All previous analysis is based on internal technological, valuation, and cycle logic. This chapter discusses a different level: when ETH is no longer solely priced by crypto-native capital but gradually integrated into traditional finance, how will its valuation power, asset attributes, and risk structure change? The institutional second curve is not an extension of existing logic but an exogenous redefinition:

- Asset attribute change (Beta → Carry): The arrival of ETH spot ETFs addresses custody and compliance issues; future staking ETFs will introduce on-chain yield into institutional portfolios. ETH shifts from a “non-yielding, high-volatility asset” to a “yield-bearing, allocation-type asset,” expanding potential buyers from trading funds to pensions, insurers, and long-term accounts sensitive to yield and duration.

- Usage change (Holding → Using): If institutions no longer see ETH merely as a tradable asset but as a settlement and collateral infrastructure, demand shifts accordingly. JPMorgan’s tokenized funds, compliant stablecoins, and RWA deployments on Ethereum indicate ETH’s demand is moving from “holding” to “operating”—for settlement, clearing, and risk management.

- Tail risk transformation (Uncertainty → Pricing): As stablecoin regulation (e.g., GENIUS Act) and Ethereum’s roadmap and governance become more transparent, institutional concerns about regulatory and technical uncertainties are systematically reduced, meaning uncertainty begins to be priced rather than avoided.

The “institutional second curve” reflects a demand shift—from speculative to functional and institutional needs—driving ETH from a sentiment-driven asset to a foundational asset supporting settlement, collateral, and institutional use cases.

Conclusion: value anchoring in the darkest hour

In the past week, the industry experienced a sharp deleveraging, market sentiment plunged, and this is undoubtedly the “darkest hour” for crypto. Pessimism spreads among practitioners, and ETH, as the most representative asset of crypto spirit, is in the eye of the storm.

However, as rational observers, we need to pierce through the panic: Ethereum’s current experience is not a “collapse of value” but a profound “price anchor shift.” As L1 scaling advances directly, L2 is redefined as a trust spectrum, and protocol revenue yields to system security and neutrality, ETH’s valuation logic has structurally shifted to “security settlement layer + native currency attributes.”

In an environment of high macro real interest rates, limited liquidity, and unpriced on-chain cycle options, ETH’s price naturally converges to a structural value zone supported by settlement certainty, verifiable yields, and collective consensus. This zone is not driven by emotion but is the intrinsic core value after stripping platform growth premiums.

As long-term builders of the Ethereum ecosystem, we refuse to be “mindless bulls.” We aim to rigorously reason and demonstrate that only when macro liquidity, risk appetite, and network effects align will higher valuations be re-integrated by the market.

Therefore, for long-term investors, the key question now is not anxiously asking “Will Ethereum go up?” but to clearly recognize—in the current environment, what core value layer are we buying at the “floor price”?

Related Articles

ETH core contributor reveals Tomasz's resignation内幕: Long-term power struggles within the Ethereum Foundation

Ether Holds $2K as $242M Spot ETH ETF Outflow Could Reignite Downside