Search results for "AEVO"

Hyperliquid ($HYPE) Leads Top Derivatives Projects By Social Activity

LunarCrush's latest report highlights the top 10 derivatives projects in the crypto market based on social activity, with Hyperliquid ($HYPE) leading by a significant margin. Aster ($ASTER) follows closely, while Jupiter ($JUP) and Avantis ($AVNT) show strong interaction numbers despite lower engagement. Projects like MYX Finance ($MYX) and FTX Token ($FTT) also maintain decent social presence, while Gains Network ($GNS) and Aevo ($AEVO) demonstrate varied interaction rates, with WOO ($WOO) and Synthetix ($SNX) trailing behind.

BlockChainReporter·01-18 05:03

Lighter's mandatory staking revolution! LIT tokens become the threshold, with 200 billion in trading volume dominating perpetual contracts

Lighter launches LIT staking feature, ratio 1:10 (1 LIT unlocks 10 USDC recharge). Immediate effect for new users, existing users have a two-week grace period until January 28. Launched in October, by December the trading volume exceeded 200 billion, surpassing Hyperliquid and Aevo. Financing of 68 million with a valuation of 1.5 billion, led by Founders Fund.

MarketWhisper·01-15 05:10

Crypto Watchlist Highlights Token Launches, Unlocks, Burns, and Major Policy Developments

_Crypto markets see Bitcoin steady near 87800 as altcoins like HYPE and AEVO gain attention amid token unlocks and burns._

Crypto markets are entering a period of selective activity as traders focus on upcoming token launches and unlocks. Bitcoin remains near 87,800, showing stability and low

LiveBTCNews·2025-12-29 07:25

Ribbon Finance Exploit Resolution Draws Fire as Critics Question Treatment of Old Deposits

Aevo, previously known as Ribbon Finance, is facing mounting criticism after outlining its plan to resolve a legacy vault exploit, a response that has triggered accusations of unfair treatment, heated social media backlash, and restricted discussion on X.

Aevo Proposes Partial Recovery After

AEVO4,47%

Coinpedia·2025-12-14 22:21

Ribbon Finance (Aevo) was hacked for 2.7 million USD after an oracle upgrade error

Thach Sanh

AEVO4,47%

TapChiBitcoin·2025-12-14 05:08

Aevo Vault hacked, $2.7 million lost. Officially pushes compensation plan: 20% discount on refunds, active users prioritized

Aevo (formerly Ribbon Finance)'s legacy DeFi options vault was hacked on December 12, resulting in losses of approximately $2.7 million. Aevo confirmed that its main platform was unaffected and proposed a compensation plan allowing users to withdraw after a 19% deduction of funds. The claim window is six months, aimed at protecting active users. The vault will be permanently decommissioned, and users can submit alternative proposals.

AEVO4,47%

動區BlockTempo·2025-12-14 03:40

Don't be discouraged by the crypto industry; be a pragmatic optimist.

Aevo founder states that he has wasted 8 years in the crypto industry, believing that crypto has become the largest speculative system in history. Nic Carter, founder of Castle Island Ventures, outlined five main purposes of cryptocurrencies and advocates that maintaining a pragmatic optimism is the right approach. This article is based on Carter's piece, compiled, translated, and written by PANews.

(Previous context: In-depth Reflection) I Have Wasted 8 Years in the Crypto Industry

(Additional background: From "Subscription Hell" to Precise Payments: A History of Online Pricing Models)

Table of Contents

Five Main Purposes of Cryptocurrency

1. Restoring Sound Money

2. Embedding Business Logic into Smart Contracts

3. Making Digital Assets "Real"

4.

動區BlockTempo·2025-12-12 03:40

Nic Carter analyzes the five major factions of the Crypto community: a shattered revolutionary dream or an inevitable path of technological evolution?

Aevo Co-founder Ken Chang recently published a long article titled “I wasted 8 years of my life in crypto,” directly pointing out that the crypto world has fallen from ideals to become the biggest gambling venue of all generations, sparking reflection within the community. Castle Island Ventures partner Nic Carter responded with an article, breaking down the crypto world into five major “purposes (telos),” indicating that pessimism stems from an obsession with a single narrative.

From idealism to disillusionment: Why do crypto creators feel collectively betrayed?

Ken Chang’s article reflects the frequent “fatigue” in the crypto space, originally believing they could create a new financial order, only to invert the purpose and create a 24/7 global casino.

He pointed out that the new L1

ChainNewsAbmedia·2025-12-11 09:03

“I Wasted 8 Years in Crypto”: Aevo Co-Founder’s Viral Exit Letter Shocks Asia

Ken Chan, former co-founder and ex-CEO of Aevo (the once-hyped Layer-2 derivatives chain), dropped a 40-tweet thread titled “I wasted 8 years in crypto” that instantly went nuclear across Asia.

AEVO4,47%

CryptopulseElite·2025-12-10 03:27

What can save you, my crypto world

Author: Nancy, PANews

“I wasted 8 years of my life in the crypto industry.”

Aevo co-founder Ken Chan published a post fiercely criticizing the crypto industry as having degenerated into a “super casino.” This “emotional outcry” quickly went viral across both domestic and international communities. Behind its millions of views, heated community debates erupted. Supporters see it as a wake-up call piercing the bubble, while critics argue it’s a case of beneficiaries biting the hand that feeds them.

Beyond the emotional venting, this debate reflects the collective anxiety and cyclical confusion currently plaguing the industry amid a liquidity crunch and a narrative vacuum.

Reduced to a super casino? What happened to the crypto ecosystem

In this lengthy article, Ken Chan frankly admits that the past eight years have been a journey from idealism to disillusionment.

As a libertarian and programmer deeply influenced by Ayn Rand’s works, he was once a devoted believer in the cypherpunk spirit, viewing Bitcoin as “belonging to the

PANews·2025-12-08 11:17

Returning to Cryptocurrency’s Mission: From Speculation Culture to Founder Burnout, Seeing the Industry’s Real Crisis

Aevo co-founder Zefram reflected in a lengthy post on his eight years building the crypto industry, expressing disappointment and believing it has essentially become a speculative casino. Haseeb believes this is part of human nature and emphasizes the long-term impact of crypto. Bitwise CEO Hunter urges people to take proactive action to change the status quo. Overall, the real crisis in the crypto industry lies in the loss of sense of mission and passion, rather than mere speculative behavior.

ETH3,38%

ChainNewsAbmedia·2025-12-08 04:50

Aevo Co-founder’s Long Post Criticizes the Industry: I Wasted 8 Years of My Life in Crypto

Original Title: I Wasted 8 Years of My Life in Crypto

Original Author: Ken Chan

Original Source:

Repost: Mars Finance

Editor's Note: This weekend, an article by Aevo co-founder and CTO Ken Chan (@kenchangh) went viral on overseas platforms. The article is titled "I Wasted 8 Years of My Life in Crypto."

Ken Chan's tone in the article is extremely pessimistic. He believes the industry has lost its idealism and has turned into the largest and most widely participated super casino in human history, and he feels disgusted that he once contributed to this casino. Although we do not agree with Ken Chan’s views

MarsBitNews·2025-12-08 03:24

Aevo Co-founder: I Wasted 8 Years in the Crypto Industry

Ken Chan expressed his disappointment with the crypto industry in the article, stating that the industry has become a giant casino and has lost its idealism. He reflected on his own experience and realized that what he was helping to build was a virtual economic system lacking a sustainable business model. He warned that this gambling-based economic mindset would have a long-term impact on the younger generation.

PANews·2025-12-07 23:31

Massive Setup Ahead: 5 High-Risk Altcoins Posting +40% Monthly Gains and Poised for a 2x–3x Move

Recent market data shows several altcoins, including Hyperliquid, Bittensor, ICP, Astar, and Aevo, experiencing over 40% monthly gains amid shifting sentiment toward high-risk assets. Breakouts remain unconfirmed, requiring sustained momentum and stronger volume for validation.

CryptoNewsLand·2025-11-23 02:34

Monad(MON) Airdrop Countdown: In-Depth Analysis of Investment Opportunities and Challenges of the "Ethereum Killer"

The high-performance parallel EVM public chain Monad, based on the backgrounds of the Solana and Pyth teams, will open for Airdrop claims on October 14. Its $244 million financing (led by Paradigm) and $3 billion valuation highlight institutional confidence. Monad achieves tens of thousands of TPS through parallel execution technology, surpassing Ethereum's performance by a hundred times while being fully EVM compatible. The Testnet has attracted 5.5 million users and over 100 ecological projects. Although the pre-market price on the AEVO platform reached $0.117, indicating high market expectations, investors should be wary of risks such as mainnet technical validation, intense public chain competition, and unclear token economics. A phased Build a Position strategy is recommended to participate in this highly anticipated Layer 1 project.

MarketWhisper·2025-10-11 03:24

Binance has launched AEVO/USDC, ME/USDC, and SNX/USDC Spot trading pairs and Bots services.

According to Mars Finance, Binance will launch the AEVO/USDC, ME/USDC, and SNX/USDC spot trading pairs on September 30, 2025, at 16:00, and will open bot services for these trading pairs. In addition, Binance will provide spot grid and spot Dollar Cost Averaging services for PUMP/USDC. Users must complete account verification to participate in trading these new trading pairs.

MarsBitNews·2025-09-29 07:24

PA Daily | Aevo's pre-market launches Monad; multiple KOLs reveal that there is a overlap of members between the Plasma and Blast teams.

Today's news highlights:

NVIDIA plans to invest $100 billion in OpenAI, with an initial funding of $10 billion.

Spot gold breaks through the $3760 mark, reaching a new high.

Trump will speak at the United Nations leaders' meeting tomorrow morning at 7:20.

KOL exposure: The Plasma team has overlapping members with the Blast team.

Aevo Pre-Launch platform launches Monad token MON trading

Rainbow

PANews·2025-09-23 09:42

Degen under Aevo launched "k-fold US stock leverage", first available on Coinbase, Robinhood, Circle, and MicroStrategy.

The decentralized exchange Aevo, focused on crypto assets options and perpetual futures trading, announced on July 8 via the X platform that it has officially launched U.S. stock trading services on its Aevo Degen trading platform, offering trading options with leverage of up to 1,000 times. (Background: Why is the tokenization of U.S. stocks considered the beginning of the blockchain devouring the world?) (Additional background: A comprehensive analysis of the tokenization of U.S. stocks, how far are we from a true market revolution?) The decentralized exchange Aevo, focused on crypto assets options and perpetual futures trading, announced on July 8 via the X platform that it has officially launched U.S. stock trading services on its Aevo Degen trading platform, offering trading options with leverage of up to 1,000 times. What if you

動區BlockTempo·2025-07-09 03:35

Aevo Reignites Monthly AEVO Token Buybacks After AGP-2 Approval

space! Aevo, a prominent decentralized derivatives exchange, has officially announced the resumption of its monthly on-chain buybacks for the AEVO token. This significant move comes directly after the successful approval of the AGP-2 proposal by the Aevo governance community. The announcement,

BitcoinWorldMedia·2025-05-10 21:07

Ethereum Upgrade Sparks Interest in These 5 Layer-2 Tokens

Key Ethereum Layer-2 tokens like Arbitrum (ARB), StarkNet (STRK), Mantle (MNT), Aevo (AEVO), and Fuel (FUEL) are experiencing volatility, drawing market attention.

The upgrades tied to Pectra, including reduced calldata costs and smart accounts, position Layer-2 solutions like Fuel and Aevo for

ETH3,38%

AsiaTokenFund·2025-05-09 07:12

Layer 2 Innovations: The Best Coins and Projects to Watch for Explosive 10X Growth in 2025

Aevo, SKALE, and Myria are Ethereum Layer 2 solutions competing for scalability and efficiency dominance in 2025. Aevo offers secure and low-latency decentralized derivatives trading with 5,000+ TPS, while SKALE supports up to 2,000 TPS, zero gas fees with an extensive network for gaming and streaming apps. Myria, which focuses on NFTs and blockchain games, enables 9,000 TPS and offers an NFT marketplace, developer-friendly tools, and a MYRIA token.

CryptoFrontNews·2025-01-14 03:49

Delphi Digital 2025 Outlook: BTC's potential remains huge, Stable Coin will continue to rise

原文作者:Stacy Muur

原文编译:深潮 TechFlow

## 导读

随着年末的到来,各种研究与预测纷至沓来。@Delphi\_Digital 近期发布了《 2025 市场展望》,深入探讨了当前市场状况的分析与对未来趋势的展望,涵盖了对于比特币价格走势、主要趋势和风险因素等一系列的内容。

鉴于全文过长,完整阅读需要耗费大量时间,深潮 TechFlow 特此编译 Stacy Muur 对于《 2025 市场展望》核心观点整理的文章。

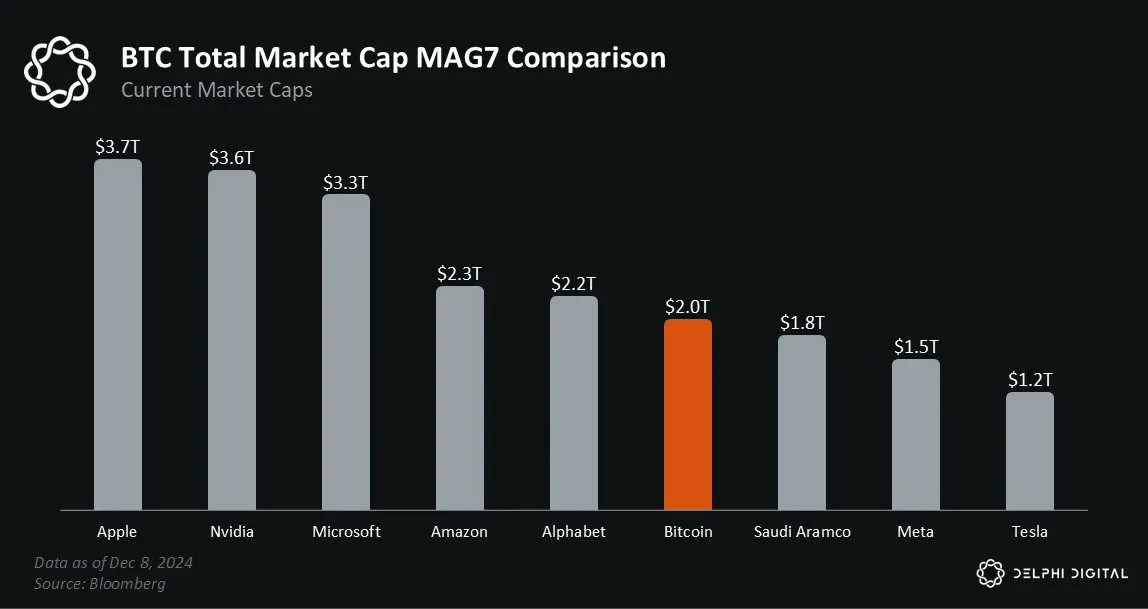

本文将 Delphi Digital 报告分为 3 大部分:比特币的崛起、山寨季的泡影以及未来发展的趋势。目前比特币的市值已达到约 2 万亿美元,山寨币的表现却乏善可陈。展望未来,稳定币的增长或将给市场复苏带来希望。在文末 Stacy Muur 也表达了自己对于 2025 年加密市场的独到看法,认为加密市场正从「狂野西部」向更规范的替代股票市场演变。Web3 原生用户会愿意承担高风险,参与投机性交易。而新入场的会采取稳健的风险管理,关注长期价值,部分叙事也许会被边缘化。

## 比特币的崛起

曾几何时, 10 万美元的比特币价格还被认为是天方夜谭。

而现在,这种观点已经发生了翻天覆地的变化。比特币目前的市值约为 2 万亿美元——令人瞩目。如果将比特币视为一家上市公司,它将成为全球第六大最有价值的公司。

尽管比特币已经吸引了广泛关注,但其增长潜力依然巨大:

* BTC 的市值仅占 MAG 7 (苹果、英伟达、微软、亚马逊、谷歌母公司 Alphabet、Meta 和特斯拉)总市值的 11% 。

* 它只占美国股票市场总市值的不到 3% ,全球股票市场总市值的约 1.5% 。

* 它的市值仅为美国公共债务总额的 5% ,以及全球(公共 + 私人)债务总额的不到 0.7% 。

* 美国货币市场基金中的资金总量是比特币市值的三倍。

* 比特币的市场价值仅约为全球外汇储备资产总额的 15% 。假设全球央行将其黄金储备的 5% 转投比特币,这将为比特币带来超过 1500 亿美元的购买力——相当于今年 IBIT 净流入的三倍。

* 当前全球家庭净资产已创历史新高,超过 160 万亿美元,比疫情前的峰值高出 40 万亿美元。这一增长主要由房价上涨和股市繁荣推动。作为对比,这一数字是比特币当前市值的 80 倍。

在一个美联储和其他央行推动货币每年贬值 5-7% 的世界中,投资者需要追求 10-15% 的年回报率,才能抵消未来购买力的损失。

你需要知道:

* 如果货币每年贬值 5% ,其实际价值将在 14 年内减半。

* 如果贬值率为 7% ,则这一过程将缩短至 10 年。

这正是比特币和其他高增长行业备受关注的原因。

## 山寨季的泡影

尽管比特币今年创下了一个又一个历史新高,但 2024 年对大多数山寨币来说并不友好。

* $ETH 未能突破历史高点。

* $SOL 虽然创下新高,但涨幅仅比之前高点多出几美元,与其市值和网络活动的增长相比,这一表现显得微不足道。

* $ARB 年初表现强劲,但随着年末的临近,其表现逐渐下滑。

还有许多类似的例子。只需查看你投资组合中 90% 山寨币的表现数据即可。

**为什么会这样?**

首先,比特币的主导地位是关键因素。BTC 在今年表现异常强劲,受 ETF 流入和特朗普相关因素的推动,其价格年初至今已上涨超过 130% ,主导地位达到三年来的最高水平。

其次,是市场的分化现象。

今年的市场分化是加密市场的新特征。在以往的周期中,资产价格通常同步波动。当 BTC 上涨 1% 时,ETH 通常上涨 2% ,山寨币则上涨 3% ,形成一种可预测的模式。然而,这个周期却大不相同。

尽管有少数资产表现极为亮眼,但更多的资产处于亏损状态。比特币的上涨并未带动其他资产价格全面上涨,许多人期待的「山寨季」并未如期而至。

最后, Meme 币和 AI 智能体(AI Agents)也在其中扮演了重要角色。

加密市场总是在「这是一场庞氏骗局」和「这项技术将改变世界」之间反复摇摆。而在 2024 年,「骗局」这一叙事占据了主导地位。

在公众的集体想象中,加密市场总是在「未来技术统一的全球金融系统」和「人类历史上最大的骗局」之间摆动,每两年一次。

为什么这种叙事似乎可以在两种极端之间交替循环,并且每两年就发生一次?

**Meme 币的超级周期与市场情绪**

Meme 币的超级周期进一步强化了人们对加密市场是「庞氏骗局」的印象。许多人开始质疑,加密市场的基本面是否真的重要,甚至将其视为一个「火星上的赌场」。这些担忧并非没有道理。

在此背景下,我想补充一个批注。

当 Meme 被称为年度表现最佳的资产时,人们通常只关注那些已经拥有显著市值并成功建立社区的「主流 Meme」(如 DOGE、SHIB)。然而, 95% 的 Meme 在推出后迅速失去价值,这一点常常被忽略。但即便如此,人们仍「愿意相信」。

这种信念促使许多此前投资于山寨币的资金转向 Memecoin——少数人获利,但大多数人未能成功。结果,资本流入主要集中在比特币(机构资金)和 Memecoin(高风险投资)之间,而大多数山寨币则被忽视。

Delphi 认为, 2025 年将是技术驱动市场转型的一年,这些技术将「改变世界」。

但我个人对此并不那么乐观。2024 年,大量专注于 Memecoin 的 KOL(关键意见领袖)涌现。当我尝试在 Telegram 上创建一个包含「真正有价值」频道的文件夹(你可以在这里找到),发现几乎所有频道都在讨论「ape calls」(即高风险短期投资建议)。这就是注意力经济的本质,而这些叙事深刻影响了市场趋势。

## 接下来的趋势是什么?

### 稳定币的增长与信贷扩张

当前市场面临的一个主要挑战是代币供应过剩。在私人投资和公开代币发行的推动下,大量新资产涌入。例如,仅在 2024 年,Solana 的 pump.fun 平台上就推出了超过 400 万种代币。然而,与此形成对比的是,加密市场总市值仅比上一周期增长了 3 倍,而 2017 年和 2020 年分别增长了 18 倍和 10 倍。

市场缺失的两大关键因素——稳定币增长和信贷扩张——正在重新出现。随着利率下降和监管环境的改善,投机行为预计将重新活跃,从而缓解当前市场的不平衡。稳定币在交易和抵押中的核心作用将对市场复苏起到至关重要的作用。

### 机构资本流入

直到去年,机构投资者由于监管不确定性,对加密资产仍持谨慎态度。然而,随着 SEC 勉强批准现货比特币 ETF,这一局面开始发生变化,为未来的机构资本流入铺平了道路。

机构投资者通常倾向于选择熟悉的投资领域。尽管少数机构可能会涉足 Memecoins,但更可能关注的是 ETH/SOL、DeFi 或基础设施等更具基本面支撑的资产。

Delphi 预测,未来一年市场可能会出现类似于以往周期的「全面反弹」。与以往不同的是,这次市场将更加关注基本面驱动的项目。例如,OG DeFi 项目(原始去中心化金融项目)凭借其经受住市场考验的记录,可能成为关注重点;基础设施资产(如 L1 协议)也可能重现辉煌。此外,RWA(现实世界资产)或新兴领域(如人工智能和 DePIN)也可能成为热点。

当然,并非所有代币都能像过去那样实现三位数的涨幅,但 Meme 的存在将成为市场的一部分。这可能标志着一个新的起点,一个由市场整体上涨推动的广泛加密反弹。

批注:大多数机构交易者通常依赖期权对冲策略。因此,如果出现「全面反弹」,最可能吸引机构兴趣的资产将是那些具有期权交易的资产——目前主要在 Deribit 和可能的 Aevo 平台上交易。

### 关于 Solana 的论点

@Solana 展现了区块链生态系统的强大韧性。在经历了 FTX 崩盘导致的 96% 市值下跌后,Solana 在 2024 年迎来了令人瞩目的复苏。

以下是其关键表现亮点:

* 开发者动能:通过举办黑客马拉松和发放空投(如 Jito 空投),Solana 成功重新激发了开发者和用户的兴趣。这种参与度的提升不仅推动了创新,还形成了一个技术开发与用户采用相辅相成的良性循环。

* 市场领导力:在 2024 年的加密市场趋势中,Solana 从 Meme 到 AI 应用领域都处于领先地位。特别值得注意的是,其实际经济价值(Real Economic Value,REV,即交易费用和 MEV 的综合衡量指标)超过以太坊 200% 以上,显示出强劲的市场活力。

* 未来展望:Solana 被认为有望在可扩展性和用户体验方面挑战以太坊的主导地位。相比于分散的 Layer-2 解决方案,Solana 提供了无缝的用户体验和高度集中的生态系统,这使其在竞争中占据了显著优势。

## Stacy 的最终看法

目前的市场状况可能让人联想到 2017-2018 年,当时比特币在新年前夕达到 2 万美元的历史高点,随后在 2018 年初开始回落。然而,我认为将 2018 年的加密市场与 2025 年相比并不恰当。两者处于完全不同的市场环境中——曾经混乱无序的「狂野西部」正在迅速演变为一种更具规范性的替代股票市场。

我们需要认识到,加密市场的范围远远超出了 Crypto Twitter(CT)和 X 平台的讨论圈。对于那些不活跃在这些平台上的人来说,他们对市场的理解和感知可能完全不同。

展望 2025 年,我认为加密市场将分化为两个主要方向:

* Web3 原生用户:这一群体深度参与加密市场,熟悉其独特的运作方式,并愿意承担高风险,参与 Meme、AI 智能体以及预售项目等投机性交易。这些行为让人联想起加密市场早期的「狂野西部」时代。

* 普通投资者:包括机构投资者和散户投资者,他们通常采取更稳健的风险管理方法,倾向于基于基本面的投资策略。他们将加密市场视为传统股票市场的替代品,关注的是长期价值而非短期投机。

那么,哪些领域可能会被边缘化呢?那些未能在其领域内或区块链生态系统中占据领先地位的早期 DeFi 项目、RWA(现实世界资产)和 DePIN(去中心化物联网)协议将可能逐渐失去市场关注。这仅是我的一点看法。

*PS:本文总结了 @Delphi\_Digital 的 2025 市场前瞻中的核心观点。如果想全面了解 Delphi 对 2025 年及未来的详细预测,我强烈建议阅读其原始研究报告。*

BTC2,26%

星球日报·2024-12-24 12:09

DYDX and AEVO Approaching Key Resistance Levels: What To Expect Ahead?

Bitcoin crosses $100,000 on its bullish trajectory while altcoins like DYDX and AEVO experience noticeable gains. Both are approaching crucial resistance levels, which could lead to short-term corrections or substantial upside opportunities if successfully broken through.

CoinsProbe·2024-12-06 12:46

Aevo: Pre-Launch market has been launched MOVE

CoinVoice has learned that according to the latest official announcement, Aevo has announced that its Pre-Launch market is now online.

AEVO4,47%

CoinVoice·2024-11-28 13:34

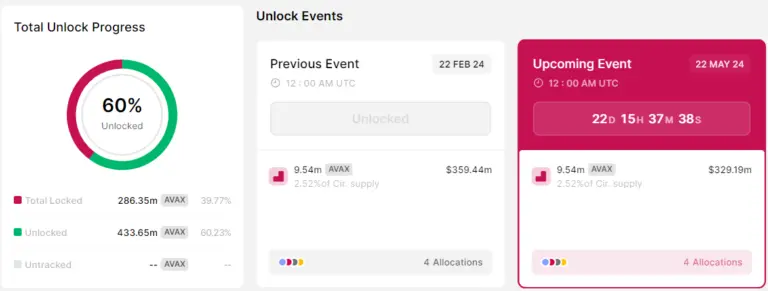

One Week Token Unlock: STRK unlocks approximately $78 million worth of Tokens

Next week, 16 projects will usher in Token Unlock events. A LARGE PROPORTION OF THOSE UNLOCKED INCLUDE STRK AND PIXEL, WITH $78.72 MILLION AND $20.72 MILLION, RESPECTIVELY. In addition, AEVO will carry out a "conversion unlock" of more than $1 billion.

The specific unlock details are as follows:

! [Token unlocking in one week: STRK unlocks about $78 million worth of Tokens] (https://piccdn.0daily.com/202405/11163701/5imttn1a4nlce8ve.png!webp)

Aevo

Project Twitter:

Project Official Website:

Unlocked this time: 848 million

The amount unlocked this time: about $1.06 billion

Aevo is a Decentralization derivatives trading platform and Layer 2

星球日报·2024-05-12 03:01

Encryption market watch in 2024: The unlocking of $3.58 billion in tokens in May may trigger market fluctuations

Brief Overview:

• In May 2024, Tokens involving Longest Encryption Projects will be unlocked, totaling $3.58 billion.

• Pyth Network (PYTH) led the way with a $1.2 billion PYTH Token release in May.

• Other highlights include major Token unlocking events for Aevo (AEVO) and Avalanche (AVAX).

奔跑财经·2024-04-29 11:52

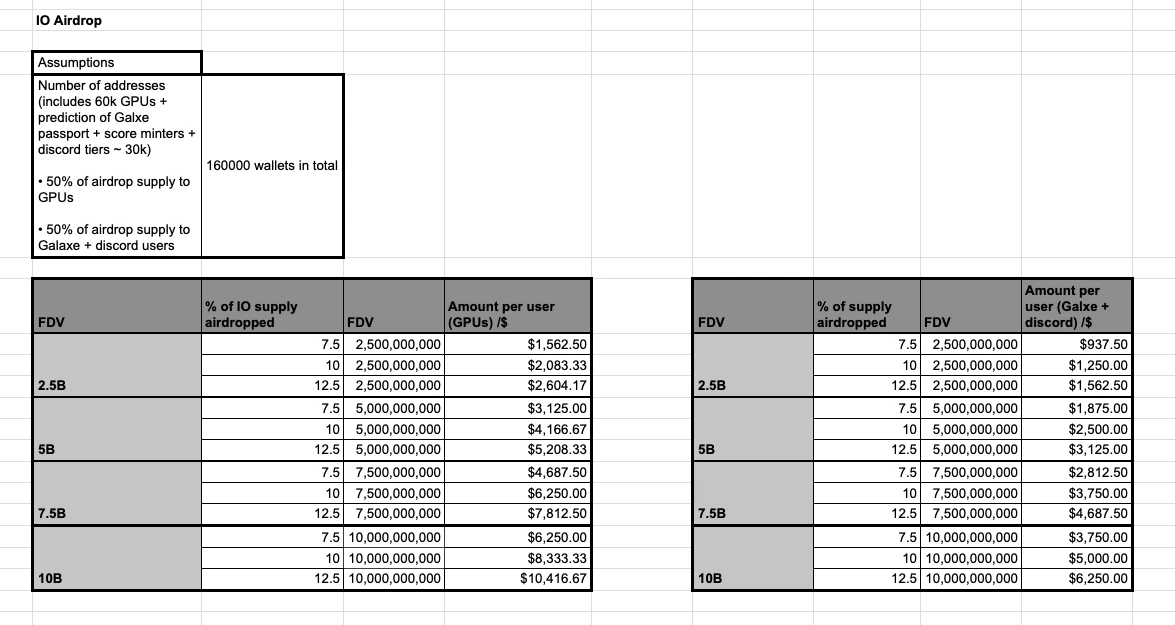

Inventory of Solana Ecosystem Airdrop Projects Worthy of Attention Recently

Original author: S◎LF, crypto KOL

Original compilation: Felix, PANews

Solana will receive unprecedented liquidity in April. It is expected that the total scale of several rounds of airdrops of its ecological projects will exceed US$3.3 billion. The following is the projects expected to be airdropped in April summarized by crypto KOL S◎LF.

Parcl

8% of the total supply of PRCL will be airdropped

PRCL is available for OTC trading on Aevo at $1.87

Using this price as a reference, approximately $150 million in tokens were airdropped to thousands of people

TGE (Token Generation Event): To be determined

Wormhole

17% of the total supply of W will be airdropped

W is available for OTC trading on Aevo at $1.68

星球日报·2024-04-01 11:18

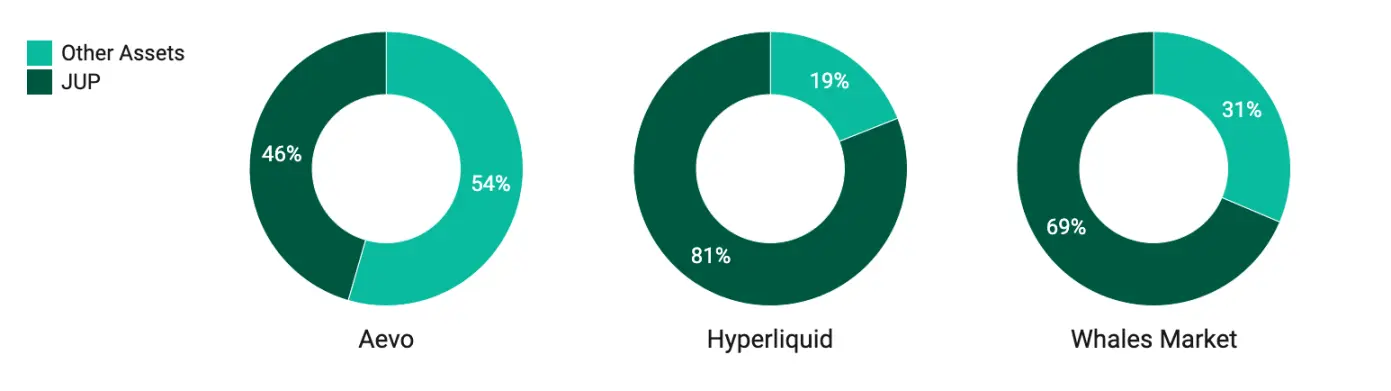

Bet on popular projects in advance and take stock of the current status of pre-launch protocols

Original author: THOR, HYPHIN

Original compilation: Luffy, Foresight News

Speculation is the lifeblood of the cryptocurrency market, and savvy opportunists often find new ways to bet on assets. In most cases, people invest in something that already exists because there is some data that allows people to make an informed decision. However, recent market trends indicate an increase in airdrop allocations and trading volumes of unreleased assets.

introduce

The surge in pre-market trading interest can largely be attributed to numerous airdrop events and highly anticipated projects looking to take advantage of the booming market and positive sentiment to push their tokens onto the public market.

With all the necessary catalysts in place for a new narrative, Aevo, Hyperliquid and Whales Market

星球日报·2024-02-28 11:10

Token incentives are coming, how does Aevo rise so quickly?

> DYDX-style on-chain contract experience + Deribit-style options trading + Pre-Launch module combination.

Written by: Nan Zhi, Odaily Planet Daily

DefiLlama data shows that the current Aevo TVL is US$48.5 million, the 24-hour derivatives trading volume reaches US$57.9 million, and the cumulative trading volume exceeds US$3.74 billion. Under DefiLlama's Options category, Aevo currently ranks first in TVL; in the on-chain derivatives category, it ranks tenth.

Odaily Planet Daily will analyze below how Aevo achieved its current status after the mainnet was launched only half a year ago.

Main business and features

ForesightNews·2024-01-22 13:29

An in-depth interpretation of TVL’s skyrocketing Manta Pacific

> Introduction to Manta’s public chain advantages and early revenue opportunities.

Written by: Biteye core contributor Lucky

Editor: Biteye core contributor Crush

01 Manta Pacific Introduction

The recent futures price of the popular Blast on Aevo has continued to increase with TVL. In just one week, it rose from the lowest of 3.5 dollars to 15.5 dollars, and then fell back to 7 dollars. It can be seen that the L2 model, which focuses on native income, has begun to be recognized by the market. .

And can Manta, which has also recently used New Paradigm to launch native revenue, surpass Blast? Let’s first take a look at what advantages Manta has. What are the revenue opportunities for players who entered Manta early?

ForesightNews·2024-01-02 13:54

Evening must-read | Multi-dimensional analysis of LSD track panorama

1. Su Zhu started his "flying life" from a mere absence of people to a surge in transactions?

As the world's first public market capable of trading encrypted claims and derivatives, the trading volume of OPNX (Open Exchange) was only $13.64 on the first day of its launch, but in less than three months, this number became 65 million dollars, and the records keep breaking. click to read

2. The ecological structure of order book DEX and 7 noteworthy order book DEX projects

There are 3 main types of Orderbook DEX (order book-style decentralized exchange): rollup-based (rollup-based), full-onchain (complete chain), high-perf (high performance). dYdX v4, Hyperliquid, Vertex, Aevo,...

金色财经_·2023-06-26 12:31

Load More