Search results for "ARCA"

Grayscale Pushes SUI ETF Forward: Can SUI Break $1.55 Amid Institutional Moves?

_Grayscale has submitted an updated S-1 filing for its Sui ETF and is moving closer to a listing on NYSE Arca._

_The proposed Grayscale Sui Staking ETF would allow investors to earn yields through staking, alongside working as a regular Sui ETF._

_Multiple firms including Bitwise and

SUI-0,91%

LiveBTCNews·01-27 17:30

Grayscale Files for BNB ETF, Expands Crypto ETF Strategy

Grayscale is converting its Near Trust into an ETF for easier trading on NYSE Arca, backed by robust partnerships for custody and administration with Coinbase and BNY Mellon. The company also seeks to launch ETFs for BNB and other cryptocurrencies, indicating a strategic expansion in the crypto ETF market.

BNB-1,34%

CryptoFrontNews·01-23 23:06

Spot BNB ETF is coming? Grayscale has officially submitted an S-1 registration statement to the SEC, and BNB has experienced a slight short-term rally.

Grayscale submitted an S-1 registration statement to the U.S. Securities and Exchange Commission on January 23, 2026, for a spot BNB ETF, marking a step forward in the plan to include BNB as a mainstream investment product. The ETF is planned to be listed on NYSE Arca and will hold actual BNB in a 1:1 ratio, allowing investors to gain price exposure to BNB. This is the second major asset management company in the review process, reflecting the continued expansion of the crypto ETF market. Following the news, BNB price slightly increased.

BNB-1,34%

動區BlockTempo·01-23 14:30

Grayscale Submits S-1 for NEAR ETF Listing Under GSNR Ticker on NYSE Arca

Grayscale has filed an S-1 with the SEC to turn its Near Trust into an ETF, which may list on NYSE Arca as GSNR.

NEAR Protocol rebounds, and futures open interest gains after the filing of ETFs by Grayscale.

Grayscale Investments has submitted an S-1 registration statement with the United

CryptoNewsFlash·01-23 12:30

Grayscale Submits S-1 for NEAR ETF Listing Under GSNR Ticker on NYSE Arca

Grayscale has filed an S-1 with the SEC to turn its Near Trust into an ETF, which may list on NYSE Arca as GSNR.

NEAR Protocol rebounds, and futures open interest gains after the filing of ETFs by Grayscale.

Grayscale Investments has submitted an S-1 registration statement with the United

CryptoNewsFlash·01-22 12:25

Grayscale Files to Convert NEAR Protocol Trust into ETF on NYSE Arca

_Grayscale files to convert NEAR Protocol Trust into an ETF on NYSE Arca. NEAR price rebounds 3%, showing growing market interest._

Grayscale Investments has filed an S-1 form with the U.S. SEC to convert its Grayscale Near Trust into a spot ETF.

If approved, the Grayscale Near Trust ETF

LiveBTCNews·01-21 14:50

Can Grayscale’s NEAR ETF unlock a fresh spot bid for NEAR price at $2–$3?

Grayscale files to convert its NEAR Trust into a spot ETF with staking, NYSE Arca listing, and Coinbase custody, raising questions about NEAR's next price trend.

Summary

Grayscale filed a Form S‑1 to convert Grayscale Near Trust into a spot NEAR ETF on NYSE Arca, mirroring its spot Bitcoin ETF

Cryptonews·01-21 13:54

Grayscale Submits S-1 for NEAR ETF Listing Under GSNR Ticker on NYSE Arca

Grayscale has filed an S-1 with the SEC to turn its Near Trust into an ETF, which may list on NYSE Arca as GSNR.

NEAR Protocol rebounds, and futures open interest gains after the filing of ETFs by Grayscale.

Grayscale Investments has submitted an S-1 registration statement with the United

CryptoNewsFlash·01-21 12:20

USDD Integrates Chainlink Price Feeds Across Ethereum, BNB Chain, and Tron

USDD has adopted Chainlink Price Feeds, bringing standardized pricing data to Tron, Ethereum, and BNB Chain.

Grayscale’s GLNK on NYSE Arca gives LINK exposure via brokerages, with 0% fees for three months before rising to 0.35% annually.

USDD has adopted Chainlink Price Feeds, making its pri

CryptoNewsFlash·01-21 11:35

Breaking: Grayscale Files for Spot NEAR ETF as Token Defies Market Crash

In a bold move signaling continued institutional embrace of alternative layer-1 blockchains, Grayscale Investments has filed an S-1 registration statement with the U.S. SEC to convert its Grayscale Near Trust into a spot exchange-traded fund (ETF).

The proposed "Grayscale Near Trust ETF," ticker GSNR, aims to list on the NYSE Arca, providing traditional investors with a regulated avenue to gain exposure to NEAR Protocol's native token. The announcement catalyzed a 3% price rebound for NEA

TOKEN-6,31%

CryptopulseElite·01-21 04:15

ARCA Holds $0.00541-$0.00587 Key Support As Bullish Structure Builds Amid Whales Buying Legend of...

Legend of Arcadia's cryptocurrency ARCA shows strong consolidation and bullish momentum, with analysts predicting a possible price surge due to increased buying from large investors. The token's support levels suggest a potential gain of 60% as it approaches key resistance levels.

ARCA-0,44%

BlockChainReporter·01-19 00:03

Bitwise Launches Chainlink ETF, Boosting Institutional Access to LINK

Bitwise has rolled out its new Chainlink exchange-traded fund (ETF), trading under the ticker CLNK on NYSE Arca. This move offers investors a regulated route to gain exposure to Chainlink (LINK) without directly holding the tokens. The approval of the ETF provides institutional investors with a

LINK-0,28%

CryptoBreaking·01-16 10:15

Bitwise Launches Chainlink ETF CLNK on NYSE Arca

Bitwise’s CLNK ETF offers spot Chainlink exposure via NYSE Arca, tracking the CME CF LINK-Dollar Reference Rate.

The fund charges a 0.34% fee, waived for three months, with LINK held in Coinbase Custody cold storage.

CLNK joins Grayscale’s GLNK as institutional interest grows in Chainlink

CryptoFrontNews·01-15 12:11

Bitwise Launches Chainlink ETF, Boosting Institutional Access to LINK

Bitwise has rolled out its new Chainlink exchange-traded fund (ETF), trading under the ticker CLNK on NYSE Arca. This move offers investors a regulated route to gain exposure to Chainlink (LINK) without directly holding the tokens. The approval of the ETF provides institutional investors with a

LINK-0,28%

CryptoBreaking·01-15 10:10

Chainlink ETF adds a new player: Bitwise enters the scene, what does the quiet return of institutional funds indicate?

American cryptocurrency asset management giant Bitwise officially launched its spot Chainlink ETF on the NYSE Arca exchange, with the trading symbol CLNK. This product is the second exchange-traded fund in the US market to directly hold LINK tokens, directly competing with Grayscale's GLNK product launched in December last year.

CLNK charges a management fee of 0.34% and offers a three-month fee waiver for initial investors for assets up to $500 million. This move provides traditional institutional investors with a regulated, non-custodial exposure channel to LINK, coinciding with nearly $64 million in net inflows into Grayscale's similar product, indicating that institutional capital interest in core infrastructure assets of the crypto ecosystem is steadily rebounding, potentially signaling a new development stage for altcoin ETF narratives.

MarketWhisper·01-15 02:08

LINK Hits Monthly High as Bitwise Launches Chainlink ETF on NYSE

In brief

Bitwise Asset Management launched a Chainlink ETF on the NYSE Arca on Wednesday.

It's the second spot Chainlink ETF to hit U.S. markets following Grayscale's product debut in December.

LINK was recently trading for $14.25, its highest price in a month.

Bitwise Asset Management l

Decrypt·01-14 16:15

Bitwise Chainlink ETF Approved for NYSE Arca Listing

_Bitwise secures regulatory approval for Chainlink ETF, enabling NYSE Arca listing and regulated investor exposure to LINK._

Bitwise has received regulatory approval to list its Chainlink ETF on NYSE Arca. Consequently, the product could begin trading as early as tomorrow. The approval is

LiveBTCNews·01-14 11:10

SEC Approves Bitwise Chainlink Spot ETF to Trade on NYSE

Bitwise has secured regulatory approval to launch a Chainlink exchange-traded fund (ETF) in the United States.

The move marks another milestone in the expansion of regulated crypto investment products. The ETF will trade on NYSE Arca under the ticker CLNK, offering investors direct price exposure t

TheCryptoBasic·01-14 08:29

Bitwise Gets SEC Nod for Spot Chainlink ETF on NYSE Arca

CLNK ETF launches with 0.34% annual fee; first $500M assets get waived sponsor fee for 3 months.

Staking not included at launch but planned as a secondary objective to boost investor returns.

Chainlink price spiked 9.8%, but bearish signals suggest watch levels at $13.2–$12.8 for

CryptoFrontNews·01-07 19:06

SEC Approves Bitwise Spot Chainlink ETF for NYSE Arca Listing

_SEC approval enables Bitwise to launch the first spot Chainlink ETF, expanding regulated institutional access to LINK markets._

Chainlink reached a historic milestone after U.S. regulators approved its first spot exchange-traded fund. Consequently, the decision marks Chainlink’s official move i

LiveBTCNews·01-07 16:05

Grayscale applies for the first Bittensor spot ETF: Can TAO price break $300 in one month?

Grayscale Investments, the world's largest digital asset management company, has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission for the Grayscale Bittensor Trust, planning to convert it into a spot exchange-traded fund listed on NYSE Arca with the ticker symbol GTAO. This will be the first investment product in the U.S. to offer direct exposure to Bittensor's native token TAO, marking the first time the AI + crypto frontier narrative enters the traditional capital markets in the form of a mainstream compliant financial product.

Buoyed by this news, the TAO price surged above $223 within 24 hours, and the market is now buzzing about whether it can leverage this momentum to challenge the $300 mark by January 2026. The application coincides with the Bittensor network's first "halving" in mid-December, reducing the daily issuance from 7,200 TAO to 3,600 TAO. The contraction on the supply side, combined with potential demand driven by the influx of large funds from the ETF, creates a resonance that adds a new dimension to TAO's long-term value narrative.

MarketWhisper·2025-12-31 06:51

The first AI coin ETF is here! Grayscale applies for Bittensor ETF to challenge Bitcoin

Grayscale has submitted a registration statement for Bittensor Trust (TAO) to the SEC, marking the first launch of a Bittensor spot ETF in the United States. The product will be traded on the NYSE Arca under the ticker GTAO and is custodied by the largest compliant crypto exchange in the United States. This application comes a few weeks after Bittensor's first halving in mid-December, and TAO is currently stable at approximately $222.

MarketWhisper·2025-12-31 02:46

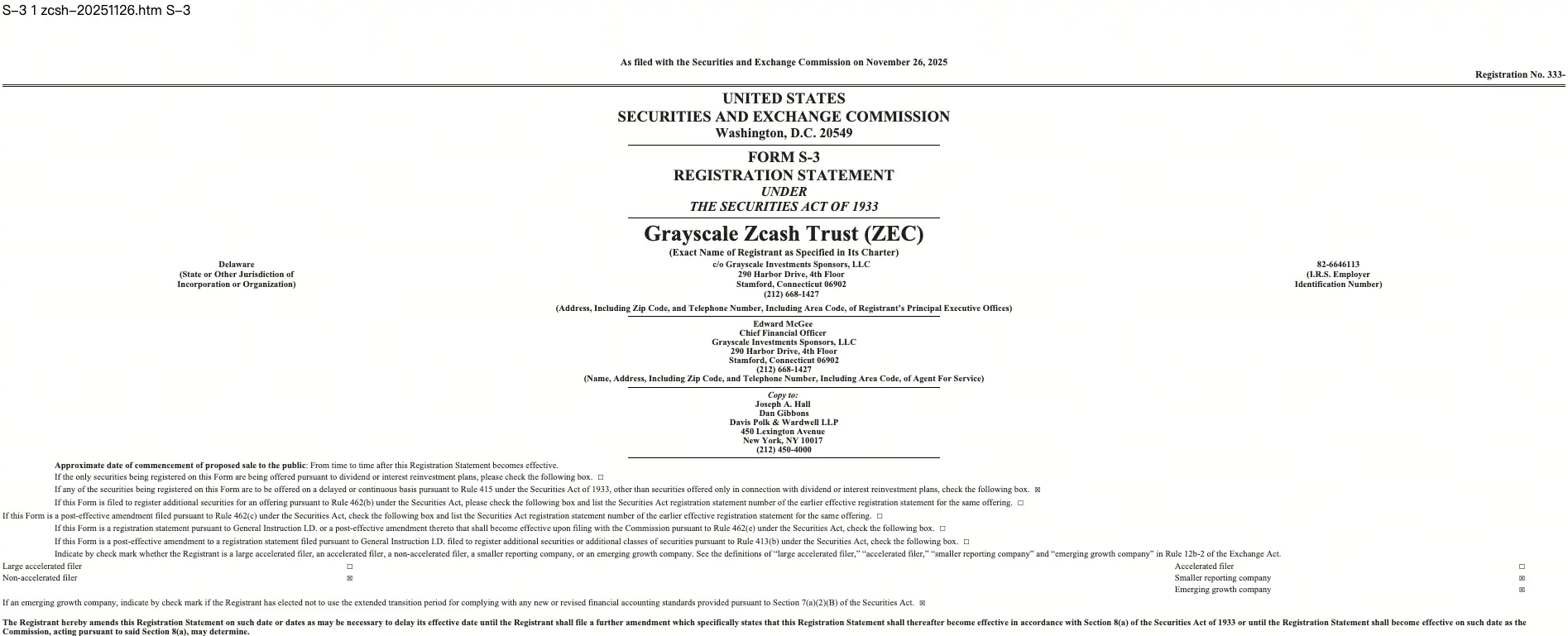

Zcash Data Shows Privacy Adoption Holding Firm Into 2026

Zcash shielded supply share stayed near 23%, holding gains after the early 2025 surge.

Grayscale sought a Zcash ETF listing on NYSE Arca, placing privacy assets within regulated finance.

Zcash, known as a privacy-focused cryptocurrency, reported a steady portion of shielded balances a

ZEC-2,59%

CryptoNewsFlash·2025-12-30 08:45

Zcash Data Shows Privacy Adoption Holding Firm Into 2026

Zcash shielded supply share stayed near 23%, holding gains after the early 2025 surge.

Grayscale sought a Zcash ETF listing on NYSE Arca, placing privacy assets within regulated finance.

Zcash, known as a privacy-focused cryptocurrency, reported a steady portion of shielded balances a

ZEC-2,59%

CryptoNewsFlash·2025-12-29 08:40

Stablecoin ETF is here! Amplify's asset tokenization dual product targets the trillion-dollar market

Amplify ETFs launches two innovative ETF products, namely the Amplify Stablecoin Technology ETF and the Amplify Tokenization Technology ETF, marking institutional capital's entry into the stablecoin and asset tokenization sectors. Both ETFs have an expense ratio of 0.69% and are listed on the NYSE Arca exchange.

MarketWhisper·2025-12-24 06:15

Amplify ETFs for stablecoins, tokenization go live for trading

Digital asset manager Amplify has launched two exchange-traded funds tracking blockchain projects across stablecoins and tokenization.

The company said on Tuesday that its Amplify Stablecoin Technology ETF (STBQ) and Amplify Tokenization Technology ETF (TKNQ) both went live on the NYSE Arca exchan

BTC-2,68%

Cointelegraph·2025-12-24 03:11

Bitwise 10 Crypto Index ETF Lists on NYSE Arca

The Bitwise 10 Crypto Index ETF (BITW) has begun trading on NYSE Arca, offering investors diversified exposure to ten large-cap crypto assets. The fund tracks the Bitwise 10 Index, focusing on major cryptocurrencies while addressing unique sector risks.

CryptoFrontNews·2025-12-10 18:01

Bitwise Launches $1.25B Crypto ETF on NYSE Arca, Offering Top Digital Assets

Bitwise has officially launched its new cryptocurrency exchange-traded fund (ETF) on the NYSE Arca, providing investors with an accessible and regulated product to gain exposure to leading digital assets. The ETF, trading under the ticker BITW, offers a diversified basket of cryptocurrencies,

CryptoBreaking·2025-12-10 08:35

Bitwise 10 Crypto Index Fund secures SEC nod to trade as NYSE Arca ETP

Bitwise's $1.25b 10-asset crypto fund wins SEC approval to uplist from OTC to NYSE Arca as a regulated ETP, giving institutions index-style exposure to top coins.

Summary

SEC approves Bitwise 10 Crypto Index Fund to trade as an exchange-traded product on NYSE Arca after a delayed review and

Cryptonews·2025-12-10 07:54

BITW Crypto Fund Trades on NYSE; Securitize Plans to Go Public via SPAC

Headlines

▌Bitwise's Cryptocurrency Index Fund BITW to Trade on NYSE Arca

Crypto asset management firm Bitwise Asset Management has announced that its crypto index fund—the Bitwise 10 Crypto Index ETF (BITW)—will be upgraded to trade on the New York Stock Exchange Arca, becoming an exchange-traded product. BITW, first launched in 2017, is the first cryptocurrency index fund, designed to track the Bitwise 10 Large Cap Crypto Index, providing investors with broad and diversified exposure to the cryptocurrency market. The fund holds the 10 largest crypto assets by market cap, with active screening and monthly rebalancing.

金色财经_·2025-12-09 23:54

Bitwise crypto index fund moves from over-the-counter to NYSE Arca for trading

Bitwise Asset Management's 10 Crypto Index Fund (BITW) has transitioned from over-the-counter trading to NYSE Arca, enhancing mainstream crypto investment options. This shift allows for diversified exposure to major cryptocurrencies and is expected to attract more institutional investors despite ongoing market volatility.

Cointelegraph·2025-12-09 18:27

Grayscale Debuts Chainlink ETF on NYSE Arca With Oracle Focus

Grayscale's Chainlink Trust ETF (GLNK) has commenced trading on NYSE Arca, fulfilling increased investor interest in Oracle-powered blockchain solutions. It allows indirect investment in Chainlink's infrastructure without owning LINK directly.

LINK-0,28%

Coinpedia·2025-12-04 05:34

Franklin Solana ETF listed, US Solana spot ETF single-day total net outflow of $32.19 million

On December 3, the Franklin Solana ETF was listed on NYSE Arca, bringing the total number of spot ETFs to 7. However, there was no net inflow on the first day, with a trading volume of only $120,000. The total net outflow for Solana spot ETFs reached $32.19 million, with total net assets valued at $915 million. The fund flows of multiple ETFs indicate that the market is still in a period of adjustment.

SOL-4,97%

DeepFlowTech·2025-12-04 02:48

Franklin Solana ETF Clears Final Step Before Trading, With Fee Waiver Putting Pressure on Rival S...

NYSE Arca approved the Franklin Solana ETF, clearing the final step before SOEZ begins trading.

The ETF will charge a 0.19% fee with a waiver on the first $5B in assets until May 2026.

Institutional SOL activity grows as firms pursue staking products and new capital raises.

NYSE Arca has approved

CryptoFrontNews·2025-12-03 23:02

Grayscale Launches First US Chainlink ETF on NYSE Arca

In brief

GLNK opened on NYSE Arca as the first U.S. spot Chainlink ETF after converting from a private trust.

Grayscale told Decrypt the launch relied on SEC guidance issued during the government shutdown.

GLNK saw more than 1.17 million shares traded on debut, far above typical volume levels f

Decrypt·2025-12-03 01:33

Grayscale’s Chainlink ETF Set for Potential NYSE Arca Debut This Week

In brief

Data shared by Bloomberg ETF analyst Eric Balchunas points to a December 2 transition from OTC trading to NYSE Arca.

An amended S-1 outlines cash-only creations at launch and confirms LINK as the sole asset.

DOGE and XRP ETFs followed a similar path before going live on the same

Decrypt·2025-12-02 15:33

Grayscale Chainlink Trust ETF (Ticker: GLNK) Launches on NYSE Arca as New Spot ETP

STAMFORD, Conn., December 2, 2025 – Grayscale Investments®, the world’s largest digital asset-focused investment platform\, today announced that Grayscale Chainlink Trust ETF (Ticker: GLNK) has begun trading on NYSE Arca as an exchange-traded product (ETP).

GLNK, an exchange traded product, is

CryptoBreaking·2025-12-02 15:21

First U.S. Chainlink ETF wins NYSE Arca listing approval

The Grayscale Chainlink Trust has become the first U.S. Chainlink ETF approved for trading on NYSE Arca, reflecting a policy shift by the SEC to streamline crypto fund approvals. This follows the conversion of several other crypto trusts to ETFs amidst evolving regulatory standards.

Cryptonews·2025-12-02 08:00

Grayscale Approved to Launch First Spot Chainlink ETF With Staking Feature

Grayscale's GLNK, the first spot Chainlink ETF with staking, has received approval for listing on NYSE Arca. This follows Grayscale's recent launches of XRP and Dogecoin ETFs. The GLNK offers direct exposure to LINK while enabling staking participation, reflecting growing institutional interest in Chainlink's applications.

CryptoNewsLand·2025-12-01 09:24

Zcash ETF sparks controversy! Grayscale packages Privacy Coin, not masking Address goes against the original intention.

Grayscale plans to list the Zcash ETF (ticker ZCSH) on the New York Stock Exchange Arca, marking the first serious inclusion of a Privacy Coin in the ETF filing, approved custodians, sanctions reviews, and broker Compliance within a series of regulatory frameworks. However, this faces a fundamental paradox: Grayscale will use transparent Address instead of shielded Address, which essentially undermines the privacy protection concept that ZEC originally relied on.

ZEC-2,59%

MarketWhisper·2025-12-01 05:11

NYSE Arca applies to list an actively managed encryption ETF: a combination of BTC, ETH, XRP, DOGE, and SHIB.

The New York Stock Exchange Arca trading platform has officially submitted an application to the SEC seeking to list the T. Rowe Price actively managed crypto ETF. This fund will adopt a flexible allocation strategy, dynamically adjusting the position ratios of the five major mainstream digital assets: Bitcoin, Ether, XRP, Dogecoin, and Shiba Inu. This marks another significant move by traditional asset management giants into multi-asset crypto ETFs following the approval of Grayscale's ETF that includes DOGE and XRP, indicating that active management strategies have officially entered the digital asset space.

MarketWhisper·2025-11-28 05:42

Grayscale Seeks Approval for First Zcash Spot ETF

ZEC’s 1,000% surge and rising shielded use strengthen the case for a regulated spot ETF.

The proposed ZCSH ETF will list on NYSE Arca with Coinbase as custodian and a 2.5% fee.

Approval remains uncertain as privacy assets face scrutiny despite Grayscale’s ETF track record.

Grayscale filed a

ZEC-2,59%

CryptoFrontNews·2025-11-27 14:47

Grayscale DOGE ETF's first day volume is lukewarm: analysts' expectations fall short, is the meme coin ultimately a misstep?

The Grayscale Spot DOGE ETF was officially listed on the New York Stock Exchange Arca zone, with a first-day volume of only about $1.4 million, far below analysts' previous strong performance predictions. This ETF has set a management fee of 0.35%, but has achieved a zero-fee rate through a temporary exemption, a strategy aimed at attracting initial capital inflows, which has not been able to reverse the market's lukewarm response. Compared to the recently launched XRP and Solana ETFs, the DOGE ETF's debut appears relatively lackluster, reflecting the unique challenges of meme assets in institutional products, as well as the impact of intensified market competition on capital diversion.

MarketWhisper·2025-11-27 08:08

Grayscale submits application for Zcash Spot ETF, how much higher can the leader in Privacy Coins ZEC rise?

The world's largest digital asset management company Grayscale has submitted an S-3 registration statement to the U.S. Securities and Exchange Commission, planning to convert its Zcash trust into a Spot ETF, which will be the first regulated exchange-traded fund focused on Privacy Coin. The trust currently holds approximately $150 million worth of ZEC and will be listed on NYSE Arca after the conversion, with an annual fee rate of 2.5%. This move marks the formal entry of privacy-enhancing encryption currencies into mainstream finance, coinciding with the announcement by India's Reliance Group that it will convert its entire crypto investment portfolio into ZEC. Zcash is currently priced at $505, ranking among the top fifteen in market capitalization of Crypto Assets.

MarketWhisper·2025-11-27 02:28

Bitwise's Dogecoin ETF Launches on NYSE Arca: A Fresh Attempt to Revive the Market

Trading for a new exchange-traded fund (ETF) tracking the price of Dogecoin begins today. The NYSE Arca has officially approved the listing of the Bitwise fund, marking another step in expanding the range of crypto ETFs available on the U.S. market.

🔹 Dogecoin ETF Under Ticker BWOW Enters the

Moon5labs·2025-11-26 14:00

Grayscale Dogecoin Trust ETF (Ticker: GDOG) Begins Trading on NYSE Arca as First Dogecoin ETP in ...

STAMFORD, Conn., November 24, 2025 – Grayscale Investments®, the world’s largest digital asset-focused investment platform\, today announced that Grayscale Dogecoin Trust ETF (Ticker: GDOG) has begun trading on NYSE Arca, the first pure spot Dogecoin ETP available in the United States. GDOG, an

CryptoBreaking·2025-11-26 09:55

Grayscale Investments Launches Grayscale XRP Trust ETF (Ticker: GXRP) on NYSE Arca

STAMFORD, Conn., November 24, 2025 – Grayscale Investments®, the world’s largest digital asset-focused investment platform\, today announced that Grayscale XRP Trust ETF (Ticker: GXRP) has begun trading on NYSE Arca as an ETP. GXRP, an exchange traded product, is not registered under the Investment

XRP-0,86%

CryptoBreaking·2025-11-26 09:51

The debut of the Grayscale DOGE ETF was cold; what are the reasons behind it?

Author: Blockchain Knight

On November 24, the Grayscale Dogecoin ETF (GDOG) was listed on the NYSE Arca but faced a "cold opening."

On the first day, the trading volume in the secondary market was only 1.41 million USD, far below the 12 million USD predicted by Bloomberg analysts, and the net inflow of funds was 0, indicating no new capital was injected into the ecosystem. This performance clearly reveals that the market's demand for regulated products has been seriously overestimated.

The cooling of GDOG forms a stark contrast with the successful cases during the same period. The Solana ETF (BSOL), launched in late October, attracted $200 million in its first week, primarily due to its practical attribute of staking rewards, providing a difficult-to-access investment mechanism for traditional investors.

GDOG only provides exposure to social sentiment, as an ordinary spot product, with its underlying asset being Robi.

PANews·2025-11-26 07:10

A Slow Debut for Grayscale’s Spot Dogecoin ($DOGE) ETF

Grayscale’s newly launched spot $DOGE ETF ($GDOG) commenced trading on NYSE Arca on Monday, delivering a performance well below expectations. On its first day, $GDOG recorded a trading volume of $1.41 million and reported

DOGE1,39%

CryptoDaily·2025-11-26 06:44

Franklin Templeton files 8-A for spot Solana ETF, indicating imminent debut

Franklin Templeton's Form 8-A filing for the Solana ETF positions it for imminent trading on NYSE Arca. With strong inflows exceeding $560M since October, the ETF aims to offer spot exposure backed by SOL holdings, reflecting growing interest in altcoin ETFs.

Cryptonews·2025-11-26 04:30

Load More