Search results for "L1"

Vitalik warns that Ethereum's "L2 initial vision" may be outdated! L1 is accelerating scaling and efficiency, and L2 must introduce breakthrough innovations.

Ethereum founder Vitalik Buterin pointed out that the role of Layer 2 is no longer applicable because its decentralization progress is slow and Ethereum itself has scaled rapidly. He called on the community to rethink the positioning of L2, emphasizing that it should be seen as a means of diverse innovation and unique value, rather than just an extension of Ethereum.

ETH-3,67%

動區BlockTempo·9h ago

Vitalik: Reject the crypto doomsday scenario, be the last line of defense against AI tyranny

Vitalik Returns to Chiang Mai, Deeply Analyzes Market Predictions, SocialFi, Decentralized Stablecoins, and Ethereum's Role in the AI Era, and Warns that Crypto will Die if It Becomes Purely Speculative.

(Previous Highlights: Vitalik Arrives in Taipei! Ethereum Foundation Mission, Next Steps? Full Answer with EF New Executive Director)

(Background Supplement: Vitalik Blurts Out "Ethereum's Yearly Leap Plan": L1 Scaling Will Increase Throughput by 10 Times)

Table of Contents

Vitalik's Reflection in Chiang Mai: Technical Mastery, Why Applications Are Lost

Behind the $70,000 Profit: Vitalik's "Anti-Frenzy" Strategy and Oracle Concerns

Survival Strategies for Ethereum in the AI Era

Vitalik's Dialogue with 706 Community: About Driving Forces

動區BlockTempo·01-28 07:20

Solana Price Prediction: Retail Goes All In on DeepSnitch AI’s 100x Presale, SOL and XRP Gearing for a Possible Bounce

Solana price prediction turns bullish near $130 after tariff delay sparks recovery. DeepSnitch AI raises $1.3M presale at $0.03609, fueling 100x hype with AI trading tools.

After a $7M exploit, L1 protocol Saga paused its SagaEVM chainlet. Saga’s US dollar-pegged stablecoin also declined to $0

CaptainAltcoin·01-22 14:15

L1 Blockchain Saga Hacked for $7 Million! Emergency Chain Halt, Stablecoin Decoupling Causes TVL Halve

Layer 1 Modular Blockchain Saga was hacked on January 21, resulting in a loss of $7 million, causing the stablecoin Saga Dollar to depeg, with the price dropping to $0.75, and TVL decreasing by 55%. The attacker used malicious contracts to transfer assets. The Saga team immediately paused the chain operation and tracked suspicious addresses to prevent further losses. This incident highlights the security risks of cross-chain bridges.

動區BlockTempo·01-22 08:50

Ethereum Foundation Maps Path To zkEVM Proofs On Mainnet L1

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

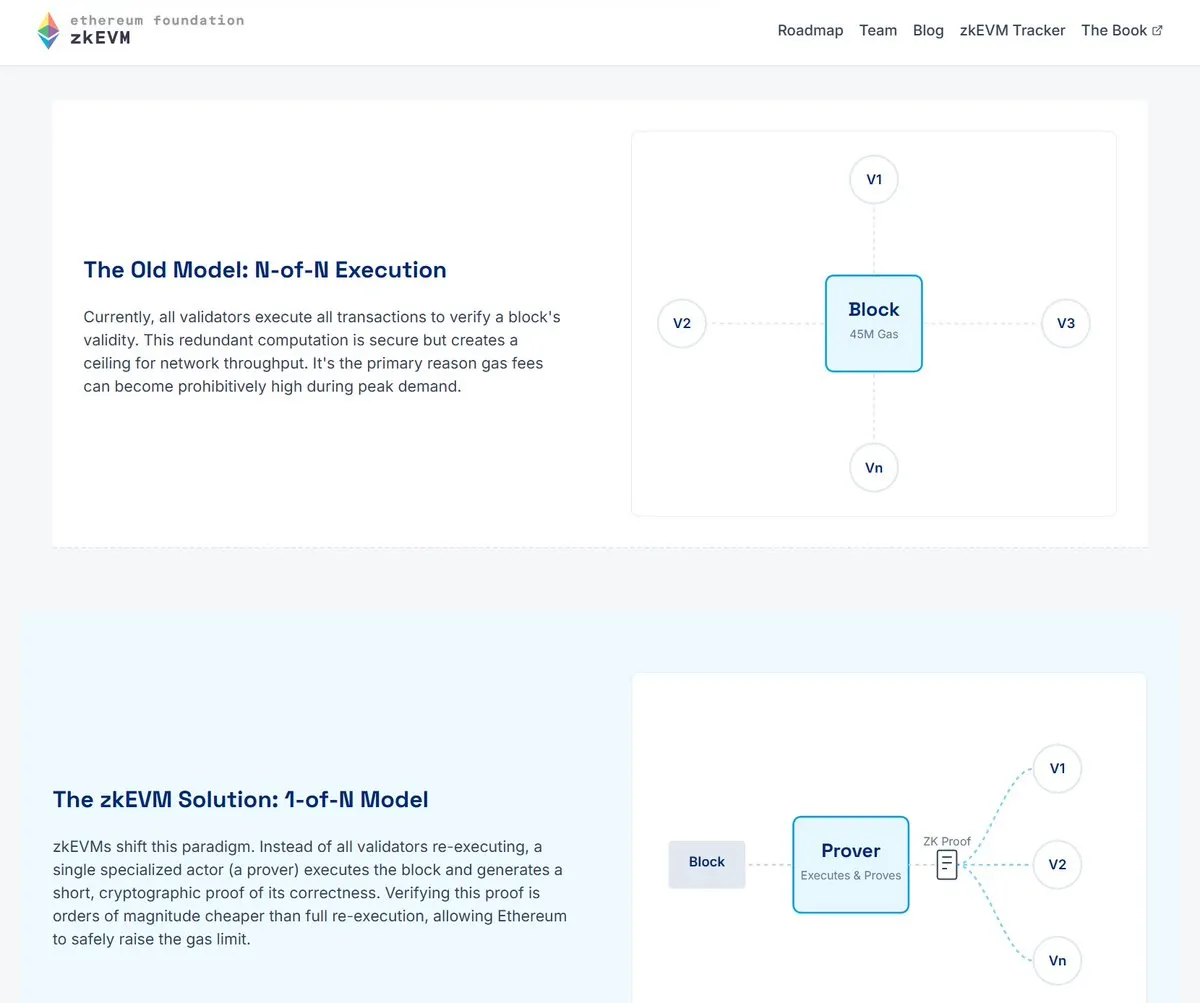

The Ethereum Foundation has published a step-by-step plan to let Ethereum’s main chain validate blocks using zkEVM proofs, reducing the need for validators to re-run every computation themselves. Th

Bitcoinistcom·01-16 19:35

Top 10 Trends of 2026 Revealed | Binance Research: Will Triple Policy Benefits Trigger a New Bull Market in the Crypto Market?

Binance Research reports that 2026 will usher in a period of strong liquidity and compliance in the crypto market, driven mainly by policy stimulation, monetary easing, and de-regulation. The report emphasizes that traders need to pay attention to macro factors, with the process of Bitcoin financialization accelerating, L1 ecosystem competition shifting toward value realization, and stablecoin trading volume surpassing Visa. It is predicted that the market will become an institutional hedging tool. If these trends develop simultaneously, they could trigger structural growth in the market.

ChainNewsAbmedia·01-16 03:43

'Send It Straight to 0': Solana's Official Account Goes Unexpectedly Brutal on Ethereum's Starknet - U.Today

Solana's recent critique of Starknet highlights the ongoing rivalry between L1 and L2 solutions. While Starknet's activity has dwindled post-token launch, Solana's market performance remains strong, signaling an escalating competition in the crypto space.

UToday·01-14 16:05

Podcast Ep.338ㅡVenezuela reportedly holds up to 660,000 BTC… Will it affect Bitcoin's price?

In early 2026, one of the biggest waves in the cryptocurrency market could be Venezuela's massive Bitcoin reserves, holding up to 660,000 BTC. This claim originates from a recent report related to intelligence agencies and is believed to potentially have a significant impact on the macro supply structure and market psychology of Bitcoin L1 assets.

The report suggests that the Venezuelan government may have accumulated Bitcoin through undisclosed channels over several years, with an estimated maximum of 660,000 BTC, worth approximately $67 billion at current market prices. This far exceeds the holdings of major companies like MicroStrategy and Tesla, and is comparable to sovereign wealth funds. If true, it would become the largest single-country holding case.

However, this claim has not yet been officially verified, and no on-chain wallets have been identified as definitively owned by the state. Given Bitcoin's decentralized nature, even if there are government-controlled holdings, it is difficult to prove ownership legally, and should be viewed accordingly.

BTC-3,24%

TechubNews·01-13 14:00

Why does Ethereum urgently need ZK technology?

Ethereum is promoting ZK (Zero-Knowledge) integration across the entire network to improve performance and maintain decentralization. ZK integration can simplify transaction verification processes, enhance efficiency, and lay the foundation for future Gas limit increases. Vitalik expressed excitement about ZKEVM entering the Alpha stage, emphasizing that all ZK teams remain important and contribute to the development of technological diversity. Although ZK integration may impact L2, strengthening L1 will also benefit L2 users. Overall, Ethereum's progress in the ZK field signifies the continued deepening of its technological innovation.

PANews·01-13 00:34

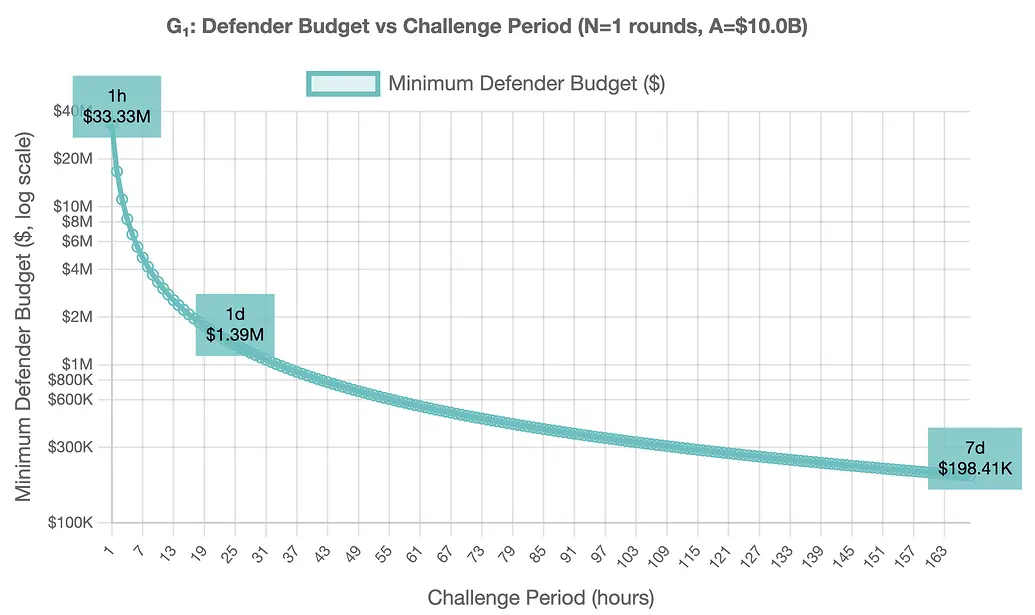

Starknet releases post-mortem report: blockifier vulnerability caused transaction processing errors

Starknet has released an analysis report regarding the brief mainnet outage on January 5th, pointing out that the issue stemmed from a block generator vulnerability, which led to erroneous transaction processing. The affected operations were state write actions in specific scenarios. Although events occurred, their impact was limited because they were not confirmed by the L1 layer due to the proof layer mechanism. The outage lasted approximately 18 minutes and was the second major interruption since 2025.

TechubNews·01-11 01:28

SEI Crypto Daily Activity Hits 1.4M as Price Trades Near $0.125

SEI crypto daily active addresses reached 1.4M by end of 2025.

MC/TVL ratio of SEI crypto remains lower than many L1 competitors.

Upcoming Giga upgrades and institutional integrations could drive adoption.

SEI crypto has been trading near $0.12–$0.125 while

SEI-2,44%

CryptoFrontNews·01-10 00:06

Sui: Complete the full build of Sui Stack by 2026, with a series of updates planned for release

Sui will complete its evolution from L1 to a unified developer platform by 2026, launching new features such as private transactions, USDsui stablecoin, and free stablecoin transfers, to promote DeFi development and the scaling of Bitcoin finance.

SUI-1,63%

TechubNews·01-02 07:10

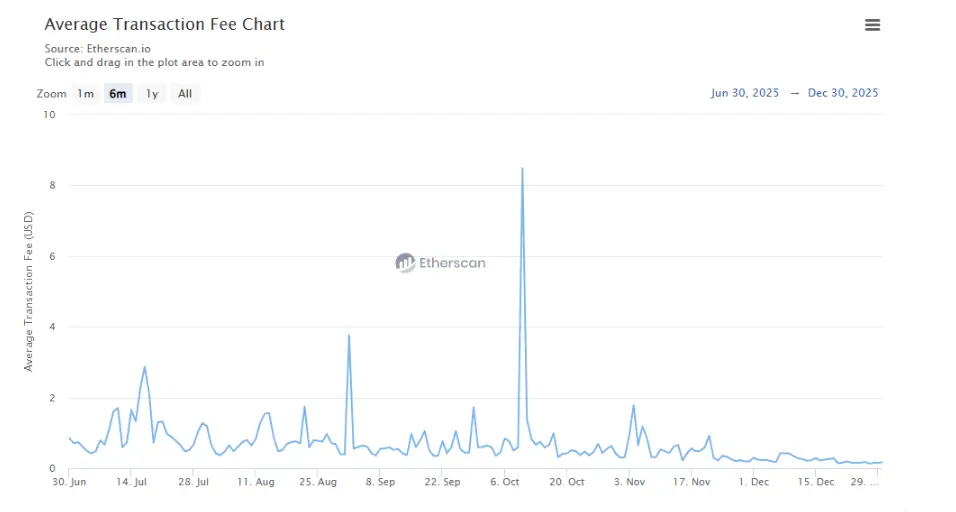

The number of Ethereum L1 transactions reaches 2.2 million per day

Ethereum has reached a milestone of 2.2 million transactions in one day, with average fees dropping to $0.17. This reflects increased network usage and significant performance improvements, restoring confidence in Ethereum layer-1 amidst ongoing development and major upgrades planned for 2025.

ETH-3,67%

TapChiBitcoin·2025-12-31 09:49

Vitalik Buterin Discusses Imbalance of Power in Crypto Governance: Is It Time to Reset the Balance? Code Is Law Is Not Absolute

As 2025 draws to a close, Ethereum co-founder Vitalik Buterin published an in-depth article exploring the governance structure of the cryptocurrency ecosystem, titled "The Balance of Power in Crypto Governance." In the article, he highlights several potential risks in current crypto governance and suggests that the balance of power among developers, communities, L1 protocol designers, and token holders should be re-examined.

Developers vs. Community: Who Calls the Shots?

Vitalik's primary concern is the dominant role that developers play in crypto projects. He points out that many communities appear decentralized on the surface but are actually led by a small core group of developers making decisions. He mentions that while this model has its efficiency, it can also lead to abuse of power, lack of transparency, and even run counter to the original spirit. "We often

ETH-3,67%

ChainNewsAbmedia·2025-12-31 03:03

Ethereum in 2026: Glamsterdam and Heze-Bogota Forks to Drive L1 Scaling and Interoperability

As Ethereum enters 2026, the network is poised for significant upgrades aimed at dramatically improving Layer 1 (L1) scalability, interoperability, and user experience.

ETH-3,67%

CryptopulseElite·2025-12-26 05:50

Ethereum 2026: Fork Glamsterdam and Heze-Bogota, expanding L1 and more

2026 is expected to be a pivotal period for Ethereum expansion. The Glamsterdam upgrade will bring perfect parallel processing to the chain and increase the gas limit from the current 60 million to 200 million.

A large number of validators will shift from re-executing transactions to verifying proofs.

TapChiBitcoin·2025-12-26 02:57

Glamsterdam & Hegota Forks: Ultimate Guide to L1 Scaling Strategies

Ethereum Set for Major Scaling Advancements in 2026

The upcoming year promises transformative upgrades for Ethereum, targeted at significantly boosting its scalability and efficiency. Central to these developments is the Glamsterdam fork, scheduled for mid-2026, which aims to introduce perfect

CryptoBreaking·2025-12-26 01:59

2026 Ethereum Explosion? Dual Fork Sparks Parallel Processing, ZK Rewrite Blockchain History

Ethereum is expected to undergo two major forks in 2026: the mid-year Glamsterdam fork introduces perfect parallel processing and ZK proofs, with the Gas limit soaring to 200 million; the end-of-year Heze-Bogota fork enhances censorship resistance. About 10% of validators will switch from re-executing transactions to verifying ZK proofs, with L1 scaling up to 10,000 transactions per second.

MarketWhisper·2025-12-26 01:53

Ethereum's "second-level" evolution: from fast confirmation to settlement compression, how does Interop eliminate waiting time?

Author: imToken

If you often cross between Base, Arbitrum, or Optimism, you must have felt a subtle "disconnect."

Although individual L2 transactions are almost instant, when you try to transfer assets from chain A to chain B, you often have to wait several minutes or even longer. This is not because L2 itself is slow, but because in traditional processes, a transaction involving cross-layer and cross-chain operations must go through a lengthy and rigorous process:

L2 sequencer ordering → Submission to L1 → L1 reaching consensus and finality. In short, under the current Ethereum architecture, finality on L1 usually takes two Epochs (about 13

PANews·2025-12-25 23:07

Layer 1 tokens face reckoning as user growth stalls and revenues concentrate

OAK Research says 2025 punished undifferentiated L1 and L2 tokens as users rotated, MAUs fell 25%, and revenue pooled in stablecoins while dev activity stayed resilient.

Summary

OAK Research reports major Layer 1 tokens suffered steep 2025 drawdowns even as Bitcoin held relatively stable,

Cryptonews·2025-12-25 12:54

Ethereum L1 Hits 2025 Record with Over 1.9 Million Daily Transactions - U.Today

Major progress

More scaling challenges

According to a recent social media post by Etherscan, the Ethereum network processed a record-breaking 1.91 million transactions on Layer 1 (L1) in a single day. At the same time, the fees are incredibly low at $0.16.

This shows that the network can now

UToday·2025-12-24 15:09

ZKsync Announces New Protocol Upgrade to Redefine Interoperability and Settlement

ZKsync is set to launch a protocol upgrade in Q1 2026 that will enhance interoperability and settlement operations, temporarily shifting to Ethereum L1. The upgrade will support direct asset transactions and improve cross-chain functionality, aiming to boost adoption and stability in the ecosystem.

BlockChainReporter·2025-12-24 14:33

Read Messari's 100,000-word report on 60 encryption trends for 2026 in 10 minutes.

This article summarizes from Messari's 100,000-word annual report, combining AI and human insights, and outlines the following 60 encryption trends for 2026.

1. If L1 does not have real growth, encryption money will increasingly flow towards Bitcoin.

2. ETH is currently still the "younger brother" of Bitcoin, not an independent leader. ETH has support from institutions and enterprises, and can earn alongside Bitcoin, but it is not yet fully able to stand on its own.

3. The correlation between ZEC and Bitcoin has dropped to 0.24, serving as a privacy hedge against Bitcoin.

4. Application-specific currencies (such as Virtuals Protocol, Zora) will become an emerging trend in 2026.

Take Virtuals Protocol as an example to introduce application-specific currency:

When a user creates an AI agent, a token exclusive to the agent will be issued.

PANews·2025-12-24 04:03

From minute-level proof to slot-level security: what does real-time verification with zkEVM mean?

Written by: Tia, Techub News

When "zkEVM achieves real-time verification, reducing proof latency from 16 minutes to 16 seconds" is mentioned repeatedly, it is often understood as a mere performance improvement. However, in the zk framework, time is not a neutral metric.

The magnitude of the delay directly determines whether the zkEVM can enter the timing critical path of the system, thereby changing its role in the architecture.

16 seconds is not just "faster", but it is the first time that zk proofs have been brought into the time scale close to the block slot. This step has fundamentally different implications for L2 zkEVM and L1 zkEVM.

On L2 zkEVM: From "Post-Finality" to Slot-Level Trustworthy State

In L2 zkEVM, the function of zk proofs is to provide

TechubNews·2025-12-23 08:07

Ethereum has completed another important technological advancement. Will it achieve a breakthrough in 2026?

The zkEVM ecosystem has achieved a leap in performance after a year of hard work, with the proof time for Ethereum blocks dropping sharply from 16 minutes to 16 seconds, and cost reductions reaching 45 times. The participating zkVMs can now complete 99% of Mainnet block proofs on target hardware within 10 seconds.

On December 18, the Ethereum Foundation (EF) announced the implementation of the real-time proof mechanism and the removal of performance bottlenecks, but emphasized that the real challenge lies in reliability. A lack of security support for speed will become a burden, and several mathematical conjectures relied upon by zkEVM based on the STARK algorithm have been disproven in recent months, leading to a decrease in security levels.

EF previously set a comprehensive real-time proof target in July, covering multiple dimensions such as latency, hardware, security, etc., and has now met the standards through EthProofs benchmark testing.

The core transformation lies in shifting from pursuing throughput to provable security, clarifying that the L1-level zkEVM must achieve a 128-bit security standard, aligning with mainstream cryptographic norms.

ETH-3,67%

PANews·2025-12-22 09:06

Ethereum has made another important technological advancement. Will it achieve a leap in 2026?

The zkEVM ecosystem has seen significant performance improvements over the past year, with Ethereum block proof time reduced from 16 minutes to 16 seconds and costs dropped by 45 times. The Ethereum Foundation emphasizes security challenges and has set a three-phase security roadmap with the goal of achieving 128-bit security standards by 2026. While it still faces multiple challenges, successfully meeting these standards will enhance Ethereum's Gas limits and Block Size, promoting the development of a trusted L1 settlement layer.

ETH-3,67%

TechubNews·2025-12-22 07:28

Galaxy: Is the Universal L1 dead? You're wrong.

Source: Galaxy; Translated by: Golden Finance

In the past few weeks, there has been a constant stream of news about new "enterprise-level" blockchains designed for specific application scenarios. DTCC is tokenizing securities held at DTC on Canton. Stripe has launched a testnet for its payment-focused blockchain, Tempo. Robinhood is building its own L2 layer for storing real-world assets.

For crypto natives, these developments may trigger a familiar anxiety: the cypherpunk values that underpin cryptocurrencies are being diluted. The permissionless, generalized blockchains that facilitated the mainstream adoption of cryptocurrencies will be bypassed by existing regulated institutions with distribution channels and balance sheets.

If tokenization, real-world assets, and stablecoins are increasingly deployed on private or semi-permissioned tracks, what role does decentralized protocol have left? This is a

L1-5,83%

金色财经_·2025-12-22 04:12

What Is Tempo? The Payments-Focused Layer-1 Blockchain Incubated by Stripe and Paradigm

In the rapidly evolving world of blockchain and cryptocurrency, a new contender has emerged specifically tailored for real-world payments: Tempo, a purpose-built Layer-1 (L1) network incubated by fintech giant Stripe and leading crypto venture firm Paradigm.

CryptopulseElite·2025-12-15 02:13

After the Wealth Effect Disappears — The Myth or Lament of Decentralization

In God Protocol We Trust

Ethereum is shifting towards L1 scaling and privacy, with the US stock backend engine DTCC holding a trillion dollars and beginning to migrate on-chain. It seems a promising new wave of cryptocurrency is on the horizon.

But the profit logic for institutions and retail investors is completely different.

Institutions have extremely high tolerance in time and space, with ten-year investment cycles and leverage arbitrage with tiny spreads, which are far more reliable than retail investors' fantasies of a thousand-fold return in one year. In the upcoming cycle, it is very likely that on-chain prosperity, institutional influx, and retail pressure will occur simultaneously.

Please do not be surprised; the spot ETF and DAT for BTC, the four-year cycle of BTC, the disappearance of altcoin seasons, and the Korean trend of “abandoning coins for stocks” have already repeatedly validated this logic.

On 10·11

金色财经_·2025-12-13 04:56

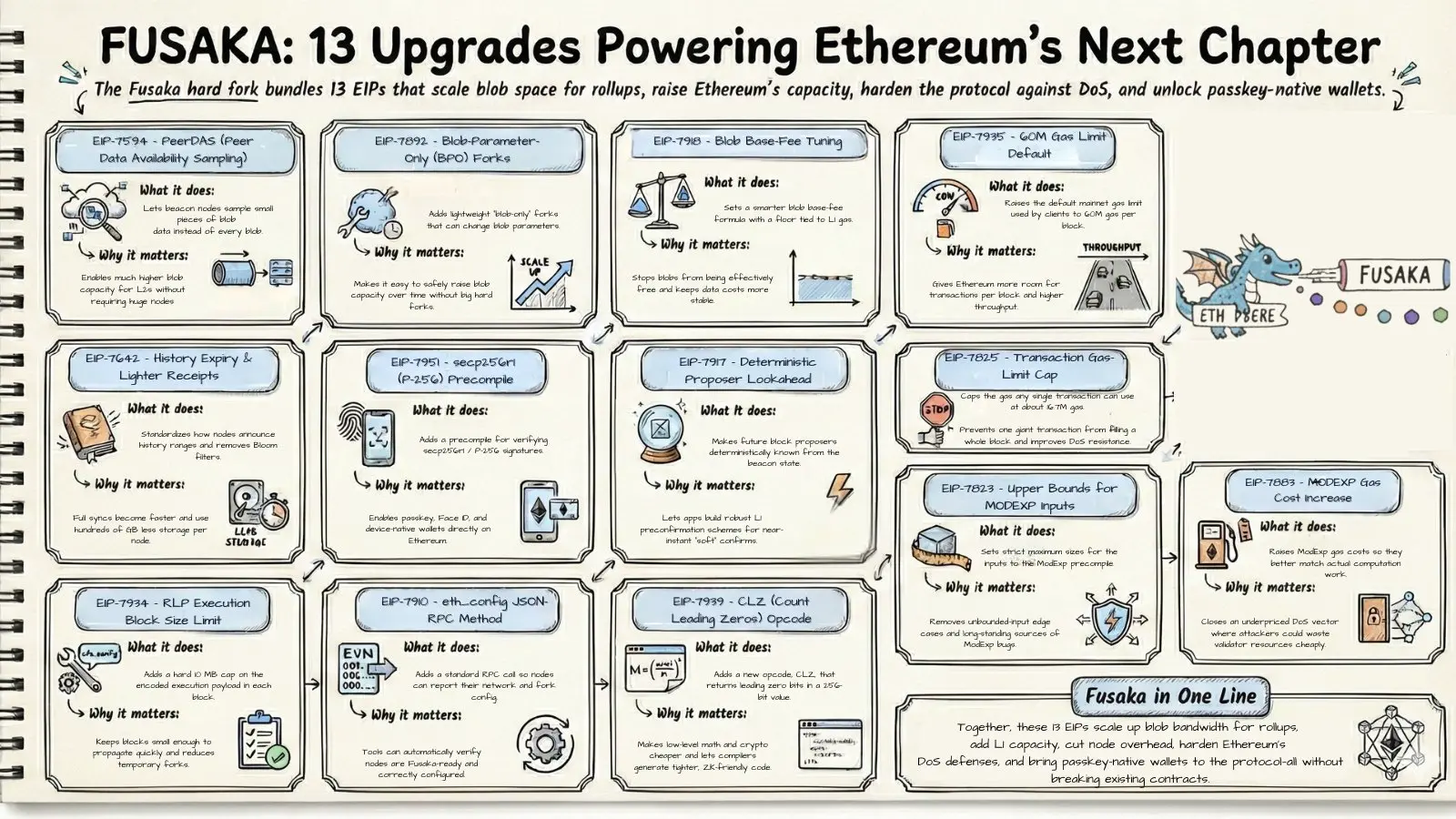

Ethereum’s Fusaka Upgrade Strengthens Security While Scaling

Fusaka enables secure scaling on Ethereum, supporting EIP-7951 and biometric transactions for everyday devices.

Layer 2 rollups improve scalability without compromising Ethereum L1’s security and decentralization.

Ethereum pursues Trillion Dollar Security, safeguarding billions in user assets and

ETH-3,67%

CryptoFrontNews·2025-12-12 10:32

Interop Roadmap "Accelerates": After Fusaka Upgrade, Ethereum Interoperability May Take a Key Leap

Fusaka Upgrade's EIP-7825 Proposal limits the Gas cap per transaction to eliminate obstacles for Ethereum to achieve L1 zkEVM and real-time proof, turning "real-time proof" from a theoretical impossibility into an engineeringly schedulable process, paving the way for interoperability finality.

(Previous context: BitMine invests 110 million USD and adds 33,000 ETH! Tom Lee urges: ETH has already bottomed out)

(Additional background: Vitalik responds to "Prysm client" vulnerability incident: It's okay if Ethereum occasionally lacks finality! Just avoid finalization errors)

Table of Contents

1. The underestimated EIP-7825 behind Fusaka upgrade

2. L1 zkEVM: The "trust anchor" for Ethereum interoperability

3. Fusaka & EIP-782

ETH-3,67%

動區BlockTempo·2025-12-11 13:55

Nic Carter analyzes the five major factions of the Crypto community: a shattered revolutionary dream or an inevitable path of technological evolution?

Aevo Co-founder Ken Chang recently published a long article titled “I wasted 8 years of my life in crypto,” directly pointing out that the crypto world has fallen from ideals to become the biggest gambling venue of all generations, sparking reflection within the community. Castle Island Ventures partner Nic Carter responded with an article, breaking down the crypto world into five major “purposes (telos),” indicating that pessimism stems from an obsession with a single narrative.

From idealism to disillusionment: Why do crypto creators feel collectively betrayed?

Ken Chang’s article reflects the frequent “fatigue” in the crypto space, originally believing they could create a new financial order, only to invert the purpose and create a 24/7 global casino.

He pointed out that the new L1

ChainNewsAbmedia·2025-12-11 09:03

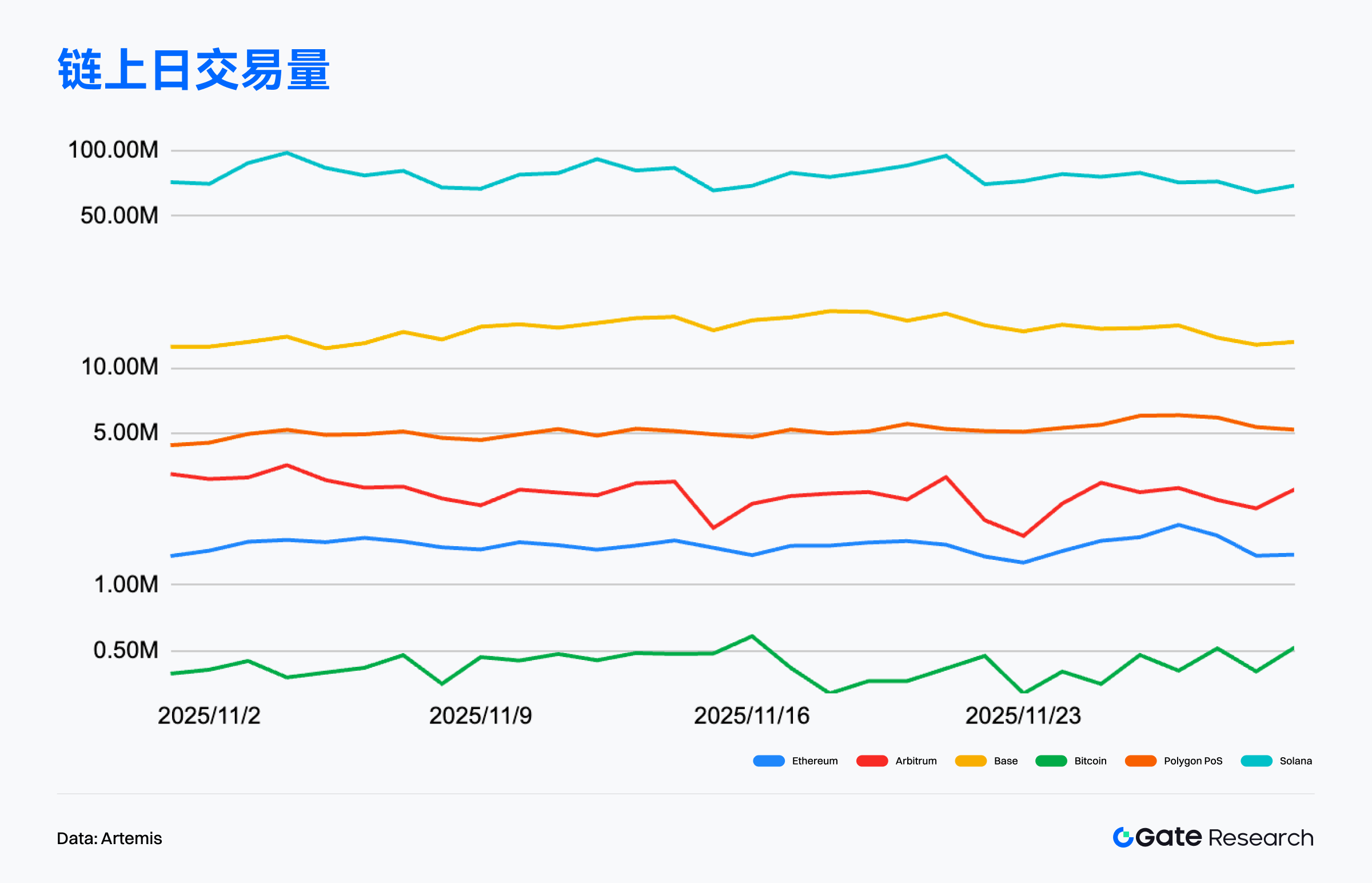

Gate Research Institute: BTCFi Diffusion Drives Starknet Advancement, High-Performance L1 and On-Chain Finance Narratives Heat Up | November 2025 Web3 On-Chain Data Analysis

On-Chain Data Summary

Overview of On-Chain Activity and Capital Flows

To accurately assess the true usage of the blockchain ecosystem, this section examines several key on-chain activity indicators, including daily transaction volume, Gas fees, active addresses, and net cross-chain bridge flows. These metrics cover user behavior, network usage intensity, and asset liquidity. Compared to simply observing capital inflows and outflows, these native on-chain data provide a more comprehensive reflection of the fundamental changes in the public chain ecosystem, helping to determine whether capital flows are accompanied by actual usage demand and user growth, thereby identifying networks with sustainable development potential.

Transaction Volume Analysis: Solana remains high, mainstream public chains maintain steady activity

According to Artemis data, in November, the on-chain transaction activity of multiple mainstream public chains generally maintained a moderate upward trend, showing a structural pattern dominated by high-performance public chains and a gradual recovery of Layer2 solutions. From

GateResearch·2025-12-11 07:37

XRP targets SWIFT, not Ethereum! Retail investors are chasing the wrong trading volume direction

XRP is transitioning from an L1 competitor to a settlement infrastructure. Ripple has launched a compliant RLUSD stablecoin, forming a "dual-asset pipeline" with XRP positioned near SWIFT. The US spot XRP ETF has attracted nearly $1 billion in institutional funds, but most retail investors still focus on price speculation rather than settlement adoption, completely ignoring this valuation logic revolution.

MarketWhisper·2025-12-11 07:24

From Fusaka to Based Rollup: How Much Further Is ETH Value Capture?

After the Ethereum Fusaka upgrade, although the EIP-7918 mechanism was introduced, the ETH value capture issue remains unresolved, and L2 still accounts for the majority of profits. Using Based Rollup can alleviate liquidity fragmentation and ETH value capture issues, allowing L2 to inherit L1 security. However, L2s are generally reluctant to give up profits and reforms need to be promoted. Reya Chain uses ZK proofs to ensure finality and buy back ETH, which can bring positive impacts to the Ethereum ecosystem.

ETH-3,67%

金色财经_·2025-12-11 03:53

From Fusaka to Based Rollup: How Much Further is the Road to ETH Value Capture?

After the Ethereum Fusaka upgrade, although the EIP-7918 mechanism was introduced, the ETH value capture issue remains unresolved, and L2 still accounts for the majority of profits. Using Based Rollup can alleviate liquidity fragmentation and ETH value capture issues, allowing L2 to inherit L1 security. However, L2s are generally reluctant to give up profits and reforms need to be promoted. Reya Chain uses ZK proofs to ensure finality and buy back ETH, which can bring positive impacts to the Ethereum ecosystem.

ETH-3,67%

PANews·2025-12-11 00:02

Tempo Turns on Public Testnet, Setting Its Sights on Instant Settlement

Tempo flipped the switch on its public testnet today, giving developers their earliest hands-on access to the payments-optimized layer one (L1) blockchain.

Tempo Rolls out Public Testnet

Tempo’s development team opened the project’s public testnet to anyone willing to build on it, marking the

Coinpedia·2025-12-10 05:32

Fogo, an SVM L1 public chain, announced that it will launch a FOGO token presale event on December 17th

According to Shenchao TechFlow news, on December 10, according to the official announcement, the SVM Layer1 public chain project Fogo announced that it will launch the FOGO token presale event on December 17, which will provide 2% of the total supply of FOGO genesis.

DeepFlowTech·2025-12-10 04:56

HYPE Joins BCH, BNB, TRX as Only L1 Tokens Gainers in 2025

HYPE joins BCH, BNB, and TRX as 2025’s only rising L1 tokens, driven by strong liquidity, stable supply structures, and improving network activity.

Four L1 Tokens Sustain Gains Amid Wider Market Declines

Market observers said there were similar increases in the value of BNB, HYPE, and TRX,

LiveBTCNews·2025-12-07 14:51

Bitcoin Cash becomes the best-performing L1 of the year after rising nearly 40%

Bitcoin Cash (BCH) has emerged as the best-performing Layer-1 asset this year, rising nearly 40%, outperforming major blockchains like Ethereum and BNB. This success is attributed to its strong supply dynamics and lack of selling pressure. Meanwhile, Bitcoin may briefly drop to $87,000 before rising towards $100,000, depending on macroeconomic conditions.

TapChiBitcoin·2025-12-07 13:07

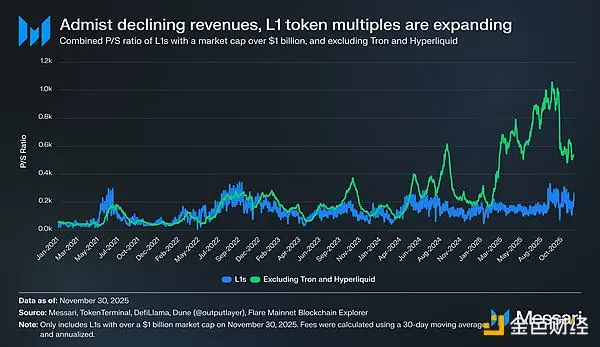

From ETH to SOL: Why Can't L1s Still Match Bitcoin's Depth of Consensus?

The valuation of the crypto market is mainly driven by "monetary premium," with BTC firmly holding its dominant position. Although alternative L1s rely on this narrative to maintain high valuations, due to a lack of substantial revenue and long-term underperformance compared to BTC, market confidence is waning; in the future, L1 valuations may continue to compress, and market share will flow toward Bitcoin. This article is sourced from Messari, compiled, translated, and written by BlockTempo.

(Previous context: US September core PCE lower than expected, "inflation under control"! Bitcoin rebounds and breaks above $91,000, Ethereum stands at $3100 )

(Background supplement: Is a rate cut in December certain? Fed mouthpiece: inflation data rising moderately)

Refocusing the conversation on why "cryptocurrency" itself is important is because this is the position that most capital in the industry is trying to acquire. The current total cryptocurrency market cap is $3.26 trillion. Among this, BTC accounts for

動區BlockTempo·2025-12-06 10:11

Hotstuff Labs Launches Hotstuff, a DeFi Native Layer 1 Connecting On-Chain Trading With Global Fi...

Singapore, Singapore, December 5th, 2025, Chainwire

Hotstuff Labs today announced the public testnet for Hotstuff L1, a DeFi Layer 1 blockchain powered by DracoBFT, a custom-built consensus protocol. Hotstuff L1 is a purpose-built chain that pairs a highly performant on-chain order book with a

CaptainAltcoin·2025-12-05 14:35

Ethereum $380 Billion Bubble? Top Venture Capitalists Debate Intensely: L1 Valuations at Risk of Being Overestimated

Inversion founder Santiago Santos and Dragonfly managing partner Haseeb Qureshi engaged in a heated debate over L1 valuations. Santiago claimed that L1s are overvalued, noting that Ethereum's market cap of $380 billion is far less impressive than Amazon's during the dotcom bubble of the 1990s. Haseeb countered that Ethereum is not a company, but rather a nation-level infrastructure.

MarketWhisper·2025-12-05 07:32

Can L1 tokens compete with Bitcoin in the cryptocurrency space?

Author: AJC, Research Manager at Messari; Source: X, @AvgJoesCrypto; Translated by: Shaw, Jinse Finance

Cryptocurrency Drives Industry Development

Refocusing on cryptocurrency is crucial because it remains the ultimate target where most of the industry’s capital is trying to invest. The total market capitalization of cryptocurrencies has reached $3.26 trillion. Of this, Bitcoin accounts for $1.80 trillion, or 55%. Of the remaining $1.45 trillion, about $0.83 trillion is concentrated in other Layer-1 protocol (L1) tokens. In total, approximately $2.63 trillion (about 81% of all crypto capital) is allocated to assets that the market already considers money or believes may acquire a monetary premium.

Given this, whether you are a trader, investor, capital allocator, or developer, it is critical to understand how the market allocates and withdraws monetary premiums. In the cryptocurrency sector,

金色财经_·2025-12-05 05:58

Aster DEX Burns $80M in $ASTER & Reveals 2026 Roadmap: L1 Chain, Staking, Smart Money Incoming

Aster, a decentralized exchange, launched its H1 2026 roadmap, focusing on scalability and community growth, alongside a major token burn of 77.8 million $ASTER tokens. Key initiatives include a new blockchain, staking, and governance features to enhance user engagement and strategies in DeFi.

CoinsProbe·2025-12-05 04:48

What are the benefits of the Fusaka upgrade for Ethereum?

The focus of Ethereum's Fusaka upgrade is on engineering optimization, aiming to improve network efficiency and activity through measures such as reducing L2 costs, normalizing blob fees, increasing the gas limit, and lowering the threshold for decentralized validators. This series of improvements is designed to create favorable conditions for high-frequency application activation, enhance institutional participation, promote parallel development of L1 and L2, and restore Ethereum's deflationary expectations, signifying Ethereum's maturity and stability.

金色财经_·2025-12-05 03:46

Former Binance.US CEO launches stablecoin platform ahead of L1 network

1Money has launched a stablecoin orchestration platform with zero platform fees, prioritizing usage-based fees for stablecoin and fiat transactions. Co-founded by former Binance.US CEO Brian Shroder, the initiative aims to disrupt legacy providers and enhance stablecoin adoption amid regulatory advancements.

L1-5,83%

Cointelegraph·2025-12-04 21:37

Is it difficult for Ethereum to reach new highs again? Analyzing the debate between Santiago and Haseeb: Are L1s seriously overvalued?

Inversion founder Santiago Santos and Dragonfly managing partner Haseeb Qureshi recently got into a heated argument on X regarding L1 valuations. The former bluntly claimed, "Most L1s are severely overvalued, and ETH may never return to its ATH," while the latter fired back, "These aren't companies, they're nation-level infrastructure—you are underestimating long-term exponential growth."

Now, the two have participated in a live debate lasting over an hour, moderated by crypto KOL Threadguy, delivering an intense and in-depth exchange on the topic of "How should L1s actually be priced?"

L1 Value Bubble? Santiago: Valuations are out of touch with reality, demand isn't there

Before the debate even began, Santiago got straight to the point: "In the past ten years, over a hundred

ChainNewsAbmedia·2025-12-04 09:24

Ethereum Breaks $3,200 as Fusaka Goes Live: $4,262 Now in Sight If History Repeats

Ethereum surged 7.38% in the past 24 hours to reclaim $3,210, decisively breaking a multi-week consolidation range just hours after the successful activation of the Fusaka hard fork on December 5, 2025. The long-awaited upgrade, powered by PeerDAS and complementary EIPs, instantly unlocked up to 8× higher data throughput for Layer 2 rollups while laying the groundwork for future L1 gas limit increases — giving traders the exact fundamental catalyst the market had been waiting for.

CryptopulseElite·2025-12-04 06:08

Ethereum mainnet upgrade! Fusaka data throughput surges 8x, lower user fees

Ethereum has successfully activated the Fusaka upgrade at epoch 411392. This Ethereum upgrade introduces the PeerDAS mechanism, increasing rollup data throughput to 8 times its previous capacity, providing lower user fees. At the same time, it optimizes user experience through the R1 curve and pre-confirmation mechanism, and prepares for future scalability upgrades such as raising the L1 gas limit.

ETH-3,67%

MarketWhisper·2025-12-04 00:47

Load More