Search results for "PYUSD"

Eric Trump Shares BTC Holdings of American Bitcoin Corp Months After Nasdaq Debut

BTC holdings of American Bitcoin Corp are 5,843 as of January 25, 2026.

Bitcoin price has surged by 0.83% over the last 24 hours.

Eric Trump earlier shared that USD1 has outperformed PYUSD.

American Bitcoin Corp (ABTC) Advocate Eric Trump has shared the BTC holdings of the company. It holds over

TheNewsCrypto·01-28 06:42

Interactive Brokers Enables 24/7 USDC Deposits for Clients

Interactive Brokers enables 24/7 USDC deposits with instant USD conversion, bypassing bank hours and time zones.

ZeroHash powers wallet custody and conversion, charging a 0.30% fee while IBKR adds no deposit fees.

Support for RLUSD and PYUSD is coming, expanding stablecoin funding

CryptoFrontNews·01-18 10:31

Interactive Brokers taps USDC, RLUSD, PYUSD for 24/7 account funding

Interactive Brokers adds 24/7 USDC deposits, with Ripple USD and PYUSD next, auto‑converting to USD and cutting cross‑border wire delays from days to minutes.

Summary

Stablecoin funding lets eligible clients deposit USDC now, with RLUSD and PYUSD coming soon, settling near‑instantly into USD

Cryptonews·01-16 14:06

Stablecoin rails give Interactive Brokers 24/7 funding edge with USDC, RLUSD, PYUSD

Interactive Brokers now enables eligible clients to fund accounts 24/7 using stablecoins like USDC, with support for RLUSD and PYUSD coming soon. This service, powered by ZeroHash, allows near-instant conversions to USD, bypassing costly bank wires.

Cryptonews·01-16 10:24

Interactive Brokers Stablecoin Funding Explained: USDC, Ripple RLUSD, and the Future of 24/7 Trading

Interactive Brokers now supports 24/7 account funding with USDC, with Ripple RLUSD and PayPal PYUSD coming soon. Here’s how stablecoins are reshaping brokerage trading.

CryptopulseElite·01-16 08:29

Interactive Brokers will charge a 0.3% fee plus Gas Fee for stablecoin deposits. Support for PYUSD and RLUSD will be available next week.

Interactive Brokers (IBKR) in the US has launched a stablecoin deposit feature, supporting USDC and planning to add PYUSD and RLUSD next week. Deposits will incur a 0.3% fee plus Gas fees, which may be more cost-effective for large deposits. This move indicates that stablecoins could become the standard tool for future settlements.

動區BlockTempo·01-16 03:15

Interactive Brokers launches USDC 24/7 deposit and trading! Next week, RLUSD and PYUSD stablecoins will be added.

Interactive Brokers announces support for 24/7 USDC deposits via Circle, enabling 24/7 trading. This feature is powered by Zerohash, allowing users to send USDC from networks like Ethereum to a secure wallet, with tokens automatically converted to USD and deposited into the account. CEO Milan Galic stated that RLUSD and PYUSD options are planned to be added next week.

MarketWhisper·01-16 00:45

The biggest trap of stablecoins: 99% of companies issuing tokens are just "self-congratulating"

Written by: Mario Stefanidis

Compiled and edited by: BitpushNews

Stablecoins are penetrating the traditional financial sector in a patchy yet undeniable way.

Klarna has just launched KlarnaUSD on Stripe's first-layer network Tempo, built specifically for payments; PayPal's issued PYUSD on Ethereum has doubled in market value within three months, with stablecoins surpassing a 1% market share and a supply approaching $4 billion; Stripe has now started using USDC to pay merchants; Cash

TechubNews·01-08 07:52

The biggest trap of stablecoins: 99% of companies issuing tokens are just "self-entertaining"

Stablecoin issuance seems to be the next growth engine for fintech companies, but in reality, it could be a money-burning trap for the vast majority of enterprises. This article delves into PayPal's PYUSD, Klarna's strategic shift, and Stripe's acquisition of Bridge, revealing why "issuing your own coin" is not a wise choice for 99% of companies—the true value lies in infrastructure, not in token issuance itself. This article is based on Mario Stefanidis, compiled, translated, and written by BitpushNews.

(Previous context: Stripe's acquisition of stablecoin platform Bridge sparks a new chapter in the integration of fintech and blockchain)

(Additional background: PayPal launches PYUSD stablecoin rewards program with an annual yield of up to 3.7%)

This article is for...

動區BlockTempo·01-08 07:35

PayPal launches PYUSD savings wallet on Spark to encourage deposits

PayPal launched PYUSD Savings Vault on the decentralized lending platform Spark, offering a 4.25% annual yield for the stablecoin PYUSD. This yield is linked to the Sky Savings Rate and derives from revenue from over-collateralized loans and liquidity activities.

TapChiBitcoin·2025-12-23 08:30

Ripple USD Soars with Record Trading Volume, Outpacing PYUSD

Ripple USD (RLUSD) has surged in trading volume by 94.27%, reaching $84.66 million, outperforming PayPal USD (PYUSD). The increased interest reflects a strong demand for stablecoins, aided by Ripple's acquisition of Rail, which enhances its market position.

BTC-1,46%

CryptoDaily·2025-12-20 10:55

PayPal partners with USD.AI, using PYUSD as the payment layer for AI infrastructure

PayPal and Permian Labs, the developer and provider of core services for the USD.AI Foundation, have announced a partnership to support financing and payments for AI infrastructure using the stablecoin PayPal USD (PYUSD). Under the agreement, PYUSD will be integrated and compatible with USDai, enabling AI companies to

TapChiBitcoin·2025-12-20 00:04

Ripple USD Soars with Record Trading Volume, Outpacing PYUSD

Ripple USD (RLUSD) has experienced a significant leap in the past 24 hours, showcasing an impressive surge in trading volume. According to CoinMarketCap, the volume for Ripple’s stablecoin skyrocketed by 94.27%, reaching a total of $84.66 million. This uptick highlights growing interest and active e

CryptoDaily·2025-12-19 10:50

How YouTube’s Stablecoin Payments Revolutionize Creator Earnings

Introduction

In December 2025, YouTube introduced a new payout feature allowing eligible U.S. creators to receive earnings in PayPal USD (PYUSD), a dollar-backed stablecoin. This development signals an increasing integration of stablecoins into mainstream financial infrastructures, providing creato

CryptoDaily·2025-12-19 01:22

PayPal launches PYUSD Savings Vault on Spark, bringing DeFi yields

PayPal launched PYUSD Savings Vault on Spark's decentralized lending platform, offering a yield of about 4.25% annually. This vault allocates 90% of deposits to yield strategies while 10% ensures liquidity for instant withdrawals, enhancing growth for PYUSD in DeFi.

TapChiBitcoin·2025-12-16 00:39

YouTube supports creators receiving payments with PYUSD, is the era of Big Tech's stablecoins here?

The world's largest video platform, YouTube, has recently officially launched a new option for American creators to receive income using PayPal's stablecoin PYUSD, marking a significant step for mainstream tech giants in the application of crypto payments. This collaboration was confirmed by PayPal's head of crypto business, and its cleverness lies in the fact that YouTube itself does not need to handle cryptocurrencies directly; all complexities are managed by PayPal. Currently, PYUSD, with a market cap of nearly $4 billion, is moving from payment backend to consumer-facing cash flow through such high-profile use cases, indicating that stablecoins are becoming the infrastructure that Big Tech is eager to deploy.

MarketWhisper·2025-12-15 01:27

Youtube Expands Creator Monetization Using Paypal USD Stablecoin

Youtube has reportedly begun letting U.S. creators receive payouts in Paypal’s dollar-pegged stablecoin, Paypal USD (PYUSD), signaling a shift toward regulated digital currencies as mainstream payment tools and deepening stablecoins’ role in creator monetization.

Youtube Expands Creator Payouts

BTC-1,46%

Coinpedia·2025-12-13 05:36

YouTube Enables PYUSD Stablecoin Payouts for US Creators

YouTube has launched PYUSD stablecoin payouts for U.S. creators via PayPal, enhancing payment efficiency. This initiative, supported by the GENIUS Act's regulatory clarity, aims to boost adoption of stablecoins and expand on-chain financial opportunities, despite existing skepticism.

US-0,68%

CryptoFrontNews·2025-12-12 19:18

Interactive Brokers officially launches "stablecoin deposits," allowing USDC to be instantly credited to stock accounts

Major US online broker Interactive Brokers (IBKR) has officially launched a stablecoin deposit feature, allowing global retail investors to fund their securities accounts directly from their crypto wallets using stablecoins. Funds can arrive in the account within seconds, enabling 24/7 real-time deposits.

(Background: YouTube has enabled stablecoin payments, allowing US creators to receive PYUSD as revenue)

(Additional context: Interactive Brokers plans to issue a US dollar stablecoin: the technical foundation is ready, is the broker's settlement revolution coming?)

According to Bloomberg today (12), the major US online broker Interactive Brokers (IBKR) has officially launched a stablecoin deposit feature, allowing global retail investors to fund their securities accounts directly from their crypto wallets using stablecoins, with funds arriving within minutes.

動區BlockTempo·2025-12-12 16:00

YouTube Now Lets US Creators Take Earnings in PayPal's Stablecoin: Report

In brief

YouTube enabled U.S. creators to receive earnings in PYUSD, according to a Fortune exclusive.

Big Tech only adopts new payment rails when they're "operationally mature and low-friction," an expert told Decrypt.

The update follows Trump's signing of the GENIUS Act, giving stablecoins a

Decrypt·2025-12-12 05:39

YouTube has allowed creators in the United States to receive payments using PYUSD stablecoin.

YouTube has enabled American creators to accept PayPal's stablecoin PYUSD payments. Mae Zabane, PayPal's Crypto executive, stated that the feature is live but currently limited to US users. PYUSD was launched in mid-2023, with its market cap soaring from approximately $50 million at the beginning of the year to $3.9 billion now, an almost 8-fold growth.

MarketWhisper·2025-12-12 05:35

YouTube adds PayPal’s PYUSD as creator payout option

YouTube has begun allowing U.S. creators to receive payouts in PayPal's PYUSD stablecoin, enhancing the crypto earnings landscape for content creators. This system, which utilizes PayPal for settlement, offers faster access to funds and avoids the volatility of traditional cryptocurrencies.

Cryptonews·2025-12-12 05:24

YouTube partners with PayPal to enable creators to receive payments in stablecoins, as tech giants step into the crypto payments era

The world's largest online video platform, YouTube, has officially enabled US creators to receive payments using PayPal's stablecoin PYUSD, becoming one of the latest tech giants to adopt cryptocurrency payment technology. This feature is now live within PayPal's business payment system, symbolizing how major tech platforms are accelerating their embrace of stablecoin payments following the passage of the GENIUS Act, and highlighting PayPal's rapid expansion in the crypto ecosystem.

YouTube Opens PYUSD Withdrawals: Creators Can Directly Receive "Stablecoin Salaries"

Forbes reports that YouTube has now enabled US creators to choose whether to receive platform earnings or other payments in PayPal's stablecoin PYUSD.

PayPal's crypto business head May Zabaneh confirmed that this feature is now officially active, and

ETH-5,51%

ChainNewsAbmedia·2025-12-12 04:24

YouTube now accepts stablecoin payments, allowing US creators to receive revenue in PYUSD.

YouTube and PayPal team up to enable PYUSD settlements, demonstrating how major tech platforms are incorporating stablecoins under clear regulations.

(Previous context: Stripe announces acquisition of crypto wallet Valora, aiming to promote the stablecoin network Tempo)

(Additional background: The "Tether parent" Stable stablecoin chain experienced a crash at launch, dropping 60% at its peak, raising trust issues with market makers)

Key signals emerged on Thursday in the United States: YouTube and PayPal completed renewal agreements, officially allowing American creators to receive earnings in PYUSD. This decision signifies traditional internet giants shifting from observation to action, activating on-chain stablecoin settlement.

Seamless "Hands-Off" Architecture

YouTube adopts a "clean layering" design to avoid directly holding crypto assets. The platform still relies on Pa

動區BlockTempo·2025-12-12 04:10

Stablecoins Take Another Step Forward: YouTube Allows Creators to Receive Revenue in PYUSD

Source: Fortune; Translation: Golden Finance

Large tech companies continue to cautiously explore the cryptocurrency space.

The latest example is video platform YouTube allowing content creators to choose to receive revenue shares in PayPal's stablecoin PYUSD. PayPal's head of cryptocurrency, May Zabaneh, confirmed this arrangement to Fortune magazine and added that the feature is now live, but currently only available to users in the United States.

A Google spokesperson, which owns YouTube, confirmed that the platform has started using PayPal's stablecoin PYUSD to pay creators but declined to comment further.

YouTube is already an existing customer of PayPal and uses the fintech giant’s payment services, which help large enterprises pay gig workers and contractors.

金色财经_·2025-12-12 03:10

State Street, Galaxy to Launch Solana Tokenized Fund

SWEEP becomes the first Solana-issued product from a global bank, with PYUSD powering 24/7 subscription and redemption flows.

The fund targets institutions seeking cash-like liquidity onchain, with Galaxy handling issuance and State Street acting as custodian.

Ondo commits approximately $200M to s

CryptoFrontNews·2025-12-11 08:33

SWEEP Tokenized Fund Launch Set for Early 2026 on Solana

State Street and Galaxy Digital are launching SWEEP, a tokenized private liquidity fund using PYUSD stablecoin on Solana. SWEEP allows 24/7 trading of private assets, enhancing accessibility, speed, and transparency in private markets, expected to debut in early 2026.

Coinfomania·2025-12-11 07:53

State Street invests 200 million to land on Solana, partnering with Galaxy to launch a tokenized fund

State Street, with a global asset size of $4.1 trillion, and Galaxy Asset Management announced plans to launch the tokenized fund SWEEP in early 2026, utilizing Paxos stablecoin PYUSD on Solana to achieve around-the-clock investor capital flow. Ondo Finance commits to investing $200 million as seed funding.

MarketWhisper·2025-12-11 03:36

Asset management giant enters the scene! State Street partners with Galaxy to launch the first tokenized liquidity fund on Solana, with Ondo providing $200 million in seed funding.

The fusion of traditional financial giants and crypto-native institutions is making a milestone step forward. The world's leading custodian bank State Street and well-known crypto asset management company Galaxy Asset Management jointly announced plans to launch a tokenized liquidity fund called SWEEP in early 2026. The fund will be initially launched on the Solana blockchain, utilizing PayPal's issued PYUSD stablecoin to enable 24/7 subscription and redemption, and Ondo Finance has committed to provide approximately $200 million in seed funding. This move marks a systematic migration of traditional cash management tools to public blockchain networks on an unprecedented scale and in an unprecedented form.

MarketWhisper·2025-12-11 02:05

Stellar XLM Targets $0.34 as Rebound Strengthens Amid PYUSD Expansion Talks

XLM maintains momentum above the $0.24 support level as analysts monitor the chart structure for a continued rebound toward the $0.34 resistance zone.

PYUSD grows its presence across various blockchains, increasing attention on Stellar due to its speed, efficiency, and suitability for stablecoin se

XLM-2,63%

CryptoFrontNews·2025-12-04 10:32

Gate Research: Kalshi and Polymarket Reach Record Monthly Trading Volume | Policy Shift Opens Room for Mid-term BTC Upside

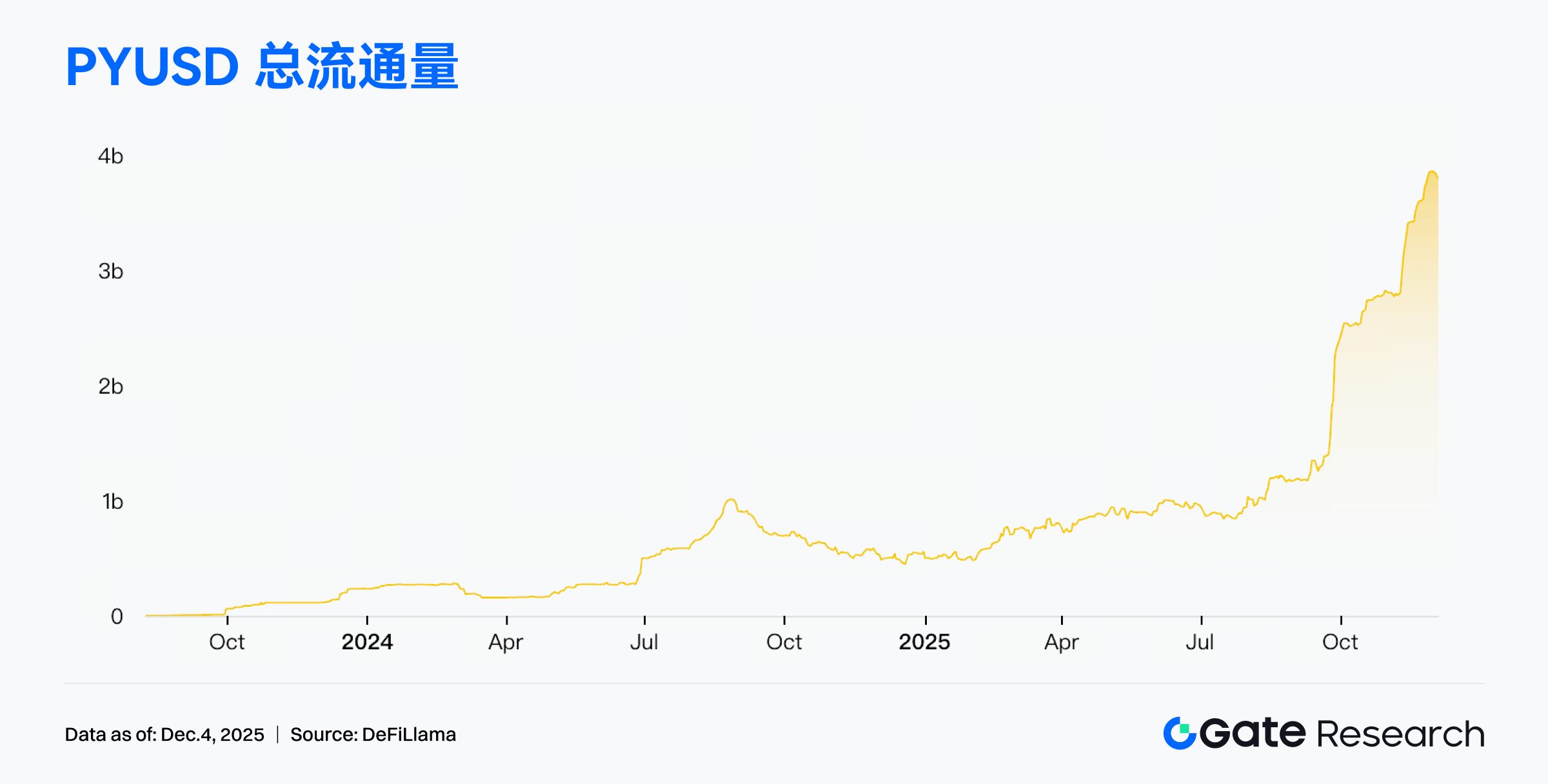

Summary

SEC regulatory improvements and renewed expectations of interest rate cuts have spurred a V-shaped market rebound, with ETH leading strongly. Capital is expected to flow into DeFi, Layer2, and other Ethereum-related ecosystems.

The Ethereum Fusaka upgrade proceeded smoothly; Web3 project registrations in the Cayman Islands have surged; PayPal stablecoin PYUSD has grown significantly.

Kalshi and Polymarket saw nearly $10 billion in trading volume in November, setting a record for the strongest month.

The current market situation is not due to a real deterioration of fundamentals. The 401(k) pension plan guidelines to be released next year may allow allocation of cryptocurrencies in retirement markets.

ENA, LINEA and

BTC-1,46%

GateResearch·2025-12-04 07:50

Ethena’s synthetic USDe contracts sharply as dollar-backed stablecoins expand

Ethena’s synthetic-dollar stablecoin USDe saw one of its sharpest monthly contractions yet, while fiat-backed stablecoins like USDT, USDC and PYUSD attracted billions in inflows

CoinGecko data showed that Ethena’s USDe stablecoin fell from a market capitalization of $9.3 billion on Nov. 1 to a

Cointelegraph·2025-12-03 10:07

PayPal's PYUSD supply surges, market cap exceeds $3.8 billion in just a few months

PYUSD, the stablecoin issued by PayPal, has experienced explosive growth in recent months, with its market cap increasing from $1.2 billion to over $3.8 billion since September. This surge reflects rising adoption by users and organizations in the digital finance ecosystem, positioning PYUSD as the sixth-largest stablecoin globally, with a notable 36% growth in the last 30 days.

TapChiBitcoin·2025-12-03 05:48

Orbital Partners With Stable To Expand Cost-Efficient Stablecoin Payment Solutions

In Brief

Orbital has partnered with Stable to integrate a stablecoin-native layer 1 blockchain, enabling cost-efficient USDT and PYUSD payment processing for its customers.

Global payments solutions provider Orbital announced a partnership with Stable, a layer 1 blockchain network developed to

MpostMediaGroup·2025-11-20 07:15

Ethereum tokenization ecosystem explodes: PayPal and BlackRock lead the push into a new era of $18.6 billion on-chain finance

As of November 2025, the on-chain financial ecosystem of Ethereum has reached a milestone. The quarterly transfer volume of PayPal's stablecoin PYUSD soared to $18.6 billion, a 260% increase year-over-year, while tokenized fund assets driven by BlackRock and Fidelity surged by 2000%. This trend indicates that traditional financial capital is systematically migrating to the Ethereum network. Although the ETH price remains constrained by the $3,500 resistance level, on-chain data and institutional deployments suggest that Ethereum is accelerating its evolution into the core infrastructure for tokenizing "real-world assets" (RWA).

ETH-5,51%

MarketWhisper·2025-11-10 08:14

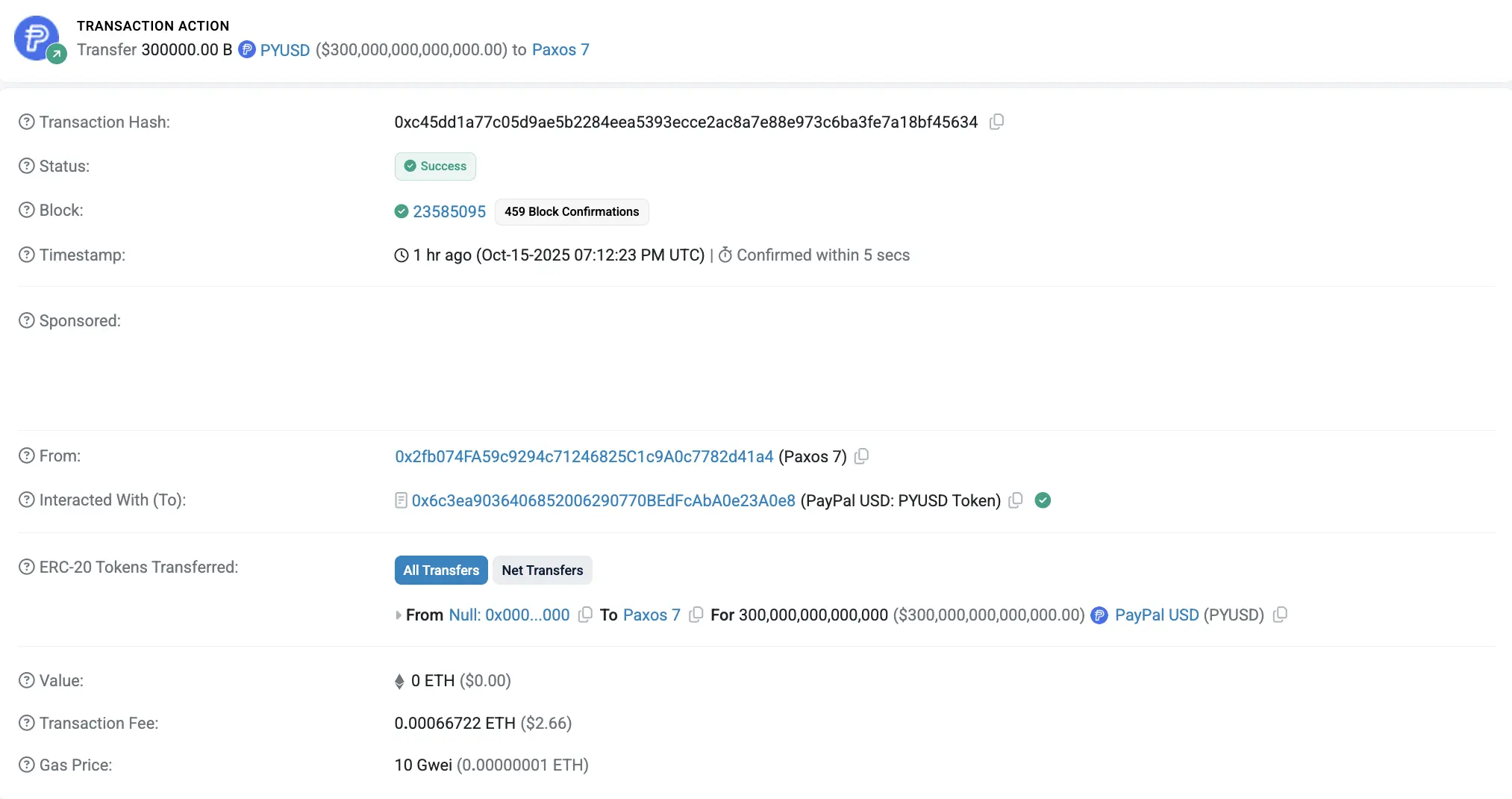

PYUSD: The encryption journey of payment giant PayPal

300 trillion dollars of misunderstanding

In the early hours of October 10, 2025, a dramatic scene unfolded in the crypto market as stablecoin issuer Paxos unexpectedly minted and destroyed 300 trillion PayPal USD (PYUSD). According to CoinMarketCap, the current market value of PYUSD is only about $2.6 billion, and the amount of erroneous minting is equivalent to 113,250 times the circulating supply. If priced at $1, the total amount of erroneous minting of PYUSD is more than twice the global GDP, far exceeding the entire market value of the U.S. crypto market.

This means that, even if Paxos has sufficient reserves, when faced with a supply of 300 trillion, its asset collateral ratio will instantly drop to zero, and the PYUSD held by users will also become worthless, leading to a collapse of market confidence and triggering a chain reaction; secondly, if this massive amount of PYUSD is used for on-chain transactions, it could be exploited by arbitrage bots or market makers.

金色财经_·2025-10-31 09:28

PYUSD verification report, total circulation exceeds 2.6 billion coins, continuing to set a new high, an approximate rise of 125.5% compared to August.

Paxos released a PYUSD stablecoin attestation report issued by KPMG, showing that as of October 15, the total circulating supply reached 2,638,336,904 coins, setting a new historical record, with redeemable collateral value exceeding the circulating supply. This represents an increase of approximately 125.5% compared to August.

MarsBitNews·2025-10-25 10:38

Epic Oolong: Paxos accidentally issued 300 trillion PYUSD, CEO argues it is a "Blockchain transparency proof"?

Last week, stablecoin issuer Paxos accidentally minted $3 trillion worth of PYUSD tokens due to an "internal technical error," and quickly destroyed them 24 minutes later. This "blunder," which exceeded the global GDP by more than double, did not leave its internal systems, but coincided with Paxos seeking a national trust license from the OCC, raising market concerns about Paxos' operational standards and systemic risks. Paxos CEO Charles Cascarilla characterized the incident at Wednesday's Fed encryption roundtable as a testament to the transparency of Blockchain rather than a system failure.

ETH-5,51%

MarketWhisper·2025-10-23 06:23

The Democratic Party criticizes the "GENIUS Act" for being too lenient in regulation, warning that the USD1 and Paxos incident could trigger financial risks.

U.S. Democratic Senator Elizabeth Warren criticized cryptocurrency policy again on 10/21 and wrote to Treasury Secretary Scott Bessent (, condemning the stablecoin bill "GENIUS Act" signed by Trump as too lenient. She cited the Trump stablecoin USD1 and the Paxos misissue of PYUSD as examples that could trigger financial risks, and demanded that the Treasury address the loopholes in the bill to eliminate conflicts of interest and protect consumer rights.

Trump signs the GENIUS Act, setting a precedent for stablecoin legislation.

The "GENIUS Act" was signed into law by Trump in July this year, and passed through both houses of Congress, becoming the first official bill in the United States aimed at stablecoins. The main contents include:

Stablecoins must be 100% backed by USD or equivalent liquid assets.

Market capitalization exceeds 50 billion USD

USD10,1%

ChainNewsAbmedia·2025-10-22 06:44

PayPal's PYUSD on Solana surpasses 1 billion USD — Fintech giants enter the blockchain era

The circulating supply of PayPal's PYUSD stablecoin on the Solana blockchain has surpassed $1 billion, indicating significant adoption by fintech firms. PYUSD enables fast, low-cost transactions, highlighting high demand for blockchain-based payment systems. Its integration marks PayPal's expansion into decentralized finance ( DeFi ) and reflects a trend of public fintech companies migrating to Solana for improved performance and transparency.

TapChiBitcoin·2025-10-19 02:15

Paxos Accidentally Mints $300 Trillion in PayPal USD and Burns It All Within 22 Minutes

A technical glitch at Paxos briefly minted $300 trillion in PYUSD, quickly corrected within 22 minutes. This incident showcased blockchain's transparency and accountability compared to traditional financial systems, highlighting the technology's capability for rapid error resolution.

CryptoFrontNews·2025-10-17 02:01

Daily Market Wrap | Oct. 16

France's Lise is set to launch Europe's first tokenized stock exchange by 2026, aiming to streamline SME IPOs. Meanwhile, Visa plans to create onchain finance infrastructure and Bitfarms announces a $300M offering amidst a surge in shares. Paxos reversed a minting error of PayPal's PYUSD, and Monad opened an airdrop portal for token eligibility checks.

TokenInsight·2025-10-16 11:24

Gate on-chain observation ( on October 16, ): The US government seized another $2.4 billion in Bitcoin; Paxos quickly destroyed 300 trillion PYUSD after mistakenly issuing them.

In the past 24 hours, the crypto market has witnessed significant events on both macro and micro levels. The U.S. government has launched a new round of Bitcoin seizures worth $2.4 billion related to the Prince Group case, which, along with Whale LuBian's transfer of $1.34 billion BTC, has created immense selling pressure expectations on a macro level. Within the market, the Bull vs Bear Battle has intensified: on one hand, top short positions represented by Abraxas Capital are partially taking profit, indicating a release of short-term risks; on the other hand, several institutional whales are re-accumulating ETH around $4,000, while precise short-term traders are frequently capturing swing trading opportunities, resulting in substantial profits for the day. Overall market sentiment is cautious, with funds rapidly rotating between mainstream assets and high-risk alts, and investors need to closely monitor the defense of key support levels.

MarketWhisper·2025-10-16 09:29

PYUSD's $300 Million Mint Sparks Stablecoin Trust Crisis in 2025 DeFi Landscape

In the volatile world of decentralized finance (DeFi), PayPal's stablecoin PYUSD has triggered alarm bells with a sudden $300 million minting event, amplifying concerns over transparency and reserve backing amid a broader $19 billion crypto liquidation cascade.

ETH-5,51%

CryptopulseElite·2025-10-16 09:24

Paxos' $300 Trillion PYUSD Minting Error: A Wake-Up Call for Stablecoin Security in 2025 DeFi

In a shocking blunder that exposed the fragility of stablecoin operations, Paxos accidentally minted $300 trillion in unbacked PayPal USD (PYUSD) tokens on October 15, 2025, dwarfing the entire $310 billion stablecoin market cap.

CryptopulseElite·2025-10-16 09:17

Paxos accidentally minted 300 million USD stablecoin PYUSD, printing three times the global GDP in one click.

Stablecoin issuer Paxos unexpectedly minted 300 trillion PayPal USD (PYUSD) stablecoins this morning, amounting to three times the global GDP (GDP), causing an uproar in the market. Even though all were destroyed within 22 minutes, it still raised concerns about the transparency of stablecoin issuance.

Serious blunder: Paxos accidentally pressed the wrong button, turning 30 billion into 300 trillion.

Blockchain data shows that Paxos mistakenly minted 300 trillion PYUSD on Ethereum this morning, which was subsequently urgently sent to a black hole address for destruction, and then 30 billion PYUSD was re-minted, clearly indicating a serious error by the operator who added 6 extra zeros.

It is reported that 300 trillion USD is approximately three times the total global GDP of 111 trillion USD in 2024, printed out overnight.

BTC-1,46%

ChainNewsAbmedia·2025-10-16 04:24

Paxos burned PYUSD 300 trillion! The largest minting blunder in history, unfolding a 30-minute horror.

Paxos's destruction of PYUSD created the largest blunder in encryption history, minting and destroying 300 trillion PayPal USD stablecoins in just 30 minutes on October 15, an astronomical figure equivalent to twice the global GDP.

MarketWhisper·2025-10-16 02:07

Stablecoin scare! Paxos accidentally minted 300 trillion PYUSD, exposing a fatal flaw in the industry.

Paxos unexpectedly minted up to 3 trillion USD worth of PYUSD stablecoins today, which instantly ignited the community. Although the company quickly destroyed this batch of Tokens and re-minted 300 million USD, claiming it was a user input error, this incident exposed a serious core issue in the stablecoin industry: these protocols lack a hard-coded reserve proof mechanism that can mint Tokens without sufficient Collateral. This incident may undermine the confidence of traditional finance (TradFi) in stablecoin investments and highlights the fatal flaws in the industry regarding transparency and regulatory safeguards.

MarketWhisper·2025-10-16 02:06

Load More